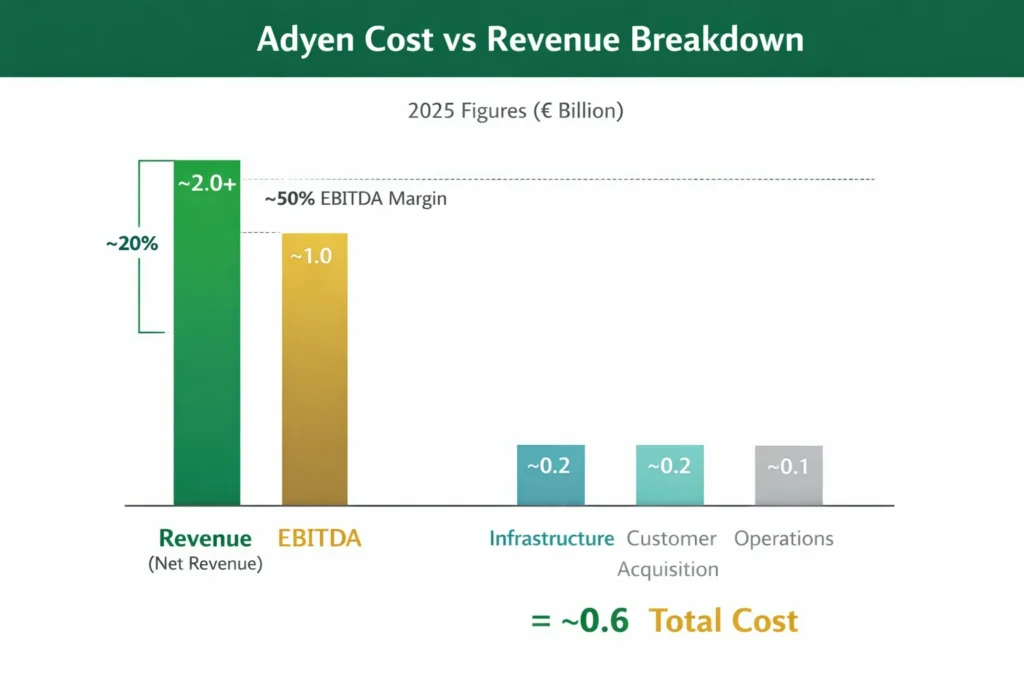

Adyen stands among the most profitable payment infrastructure companies globally, generating approximately €2B+ annual revenue with industry-leading margins close to 50% EBITDA. What makes Adyen unique is not just scale, but how efficiently it monetizes every payment transaction through its unified payment stack.

Unlike traditional gateways that depend on third-party processors, Adyen built an end-to-end infrastructure combining payment processing, issuing, risk management, and data analytics. This creates multiple monetization layers from a single merchant relationship.

For founders, Adyen represents the evolution of fintech — where payments are no longer standalone services but deeply embedded financial ecosystems driving recurring revenue and high retention.

Additional founder insights:

• Owning infrastructure dramatically increases margins

• Enterprise merchants create predictable transaction volume

• Unified data across channels increases upsell potential

• Platform payments create network effects

• Embedded finance unlocks hidden revenue streams

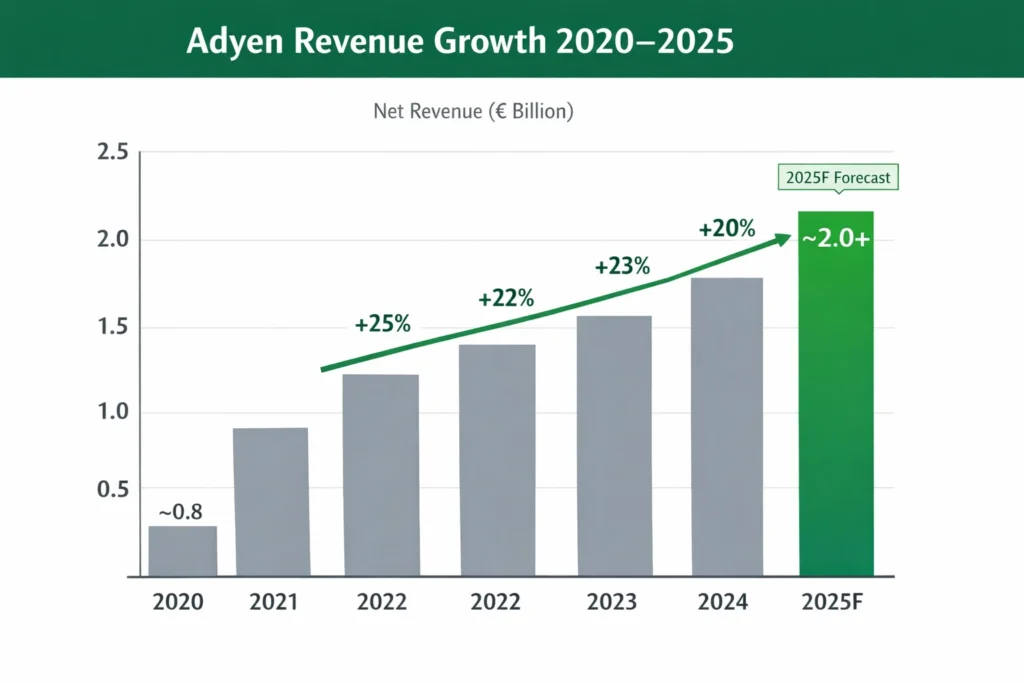

Adyen Revenue Overview – The Big Picture

2025 Estimated Revenue: ~€2B+

Valuation Range: ~$45B–$55B market cap range (fluctuates with market cycles)

YoY Growth: ~20–25% range

Revenue by Region:

• Europe: ~45%

• North America: ~35%

• Asia Pacific + Others: ~20%

Profit Margins:

• Gross Margin: Very high due to software-led infra

• EBITDA Margin: ~45–50%

Competition Benchmark:

• Higher margins than most payment processors

• Competes with Stripe, Checkout.com, Worldpay, PayPal enterprise

Primary Revenue Streams Deep Dive

Revenue Stream #1 — Payment Processing Fees

Core revenue driver. Charges merchants per transaction processed across cards, wallets, and local payment methods.

Share: ~60–65%

Revenue Stream #2 — Settlement & FX Revenue

Cross-border transaction currency conversion and settlement services.

Share: ~10–15%

Revenue Stream #3 — Issuing (Cards & Banking Services)

Virtual cards, expense cards, embedded banking infrastructure.

Share: ~8–12%

Revenue Stream #4 — Risk & Fraud Prevention Tools

AI-driven fraud scoring and transaction risk intelligence.

Share: ~5–8%

Revenue Stream #5 — Platform & Marketplace Payments

Revenue from SaaS platforms using Adyen to power sub-merchant payments.

Share: ~5–10%

Read More: Business Model of Adyen: Revenue, Strategy & Growth 2026

Revenue Streams Breakdown

| Revenue Stream | Revenue Share | Pricing Model | 2025 Trend |

|---|---|---|---|

| Payment Processing | 60–65% | Per transaction fee | Stable high growth |

| FX & Settlement | 10–15% | FX spread + settlement fee | Growing with cross-border |

| Issuing | 8–12% | Card usage + program fees | Fast growth segment |

| Risk & Fraud | 5–8% | SaaS + per transaction | AI expansion driving growth |

| Platform Payments | 5–10% | Volume-based platform fee | Marketplace boom driver |

The Fee Structure Explained

User-Side Fees

Typically invisible. Fees are embedded into merchant pricing.

Merchant / Provider Fees

• Transaction processing fee

• Payment method fee

• Authorization fee

• Cross-border fee

Hidden Revenue Layers

• FX margin

• Risk scoring usage

• Data analytics services

Regional Pricing Variation

• EU lower card fees

• US higher interchange environment

• APAC fast growing digital wallet fees

Fee Structure by User Type

| User Type | Fee Type | Typical Range | Revenue Impact |

|---|---|---|---|

| Enterprise Merchants | Processing Fee | 0.6% – 1.2% | Core revenue driver |

| Platforms / Marketplaces | Volume + Platform Fee | Custom contract | High long-term value |

| Cross-Border Merchants | FX + Cross-border Fee | 1% – 3% total | High margin |

| Issuing Clients | Card + Program Fee | Per card + usage | Recurring revenue |

| SaaS / Embedded Finance | API + Usage Fee | Volume tier pricing | Fastest growth segment |

How Adyen Maximizes Revenue Per User

Segmentation

Enterprise vs mid-market vs platform merchants.

Upselling

Fraud tools, issuing, data insights.

Cross-Selling

Payments → issuing → embedded finance → working capital.

Dynamic Pricing

Custom pricing based on merchant volume.

Retention Monetization

High switching cost keeps merchants long term.

LTV Optimization

Once integrated deeply, merchants rarely switch.

Psychological Pricing

Bundled enterprise pricing reduces visible fee sensitivity.

Real Data Insight

Enterprise merchants often generate 10× revenue vs SMB merchants.

Cost Structure & Profit Margins

Infrastructure Cost

Cloud + data centers + compliance infra.

Customer Acquisition Cost

Low due to enterprise sales model.

Operations Cost

Risk teams + compliance + regulatory ops.

R&D Cost

Heavy investment into fraud AI + payment routing.

Unit Economics

High margin per transaction after scale.

Profitability Path

Scale transaction volume → Fixed infra cost spread → Margin expansion.

Future Revenue Opportunities & Innovations

New Streams

• Banking-as-a-Service expansion

• Lending products for merchants

• Subscription commerce payments

AI/ML Monetization

• Predictive fraud models

• Payment routing optimization

• Revenue forecasting tools

Market Expansion

• Southeast Asia

• Latin America

• Middle East digital commerce growth

Predicted Trends 2025–2027

• Embedded finance inside SaaS platforms will dominate

• Unified commerce will replace multi-vendor stacks

• Real-time payment rails monetization

Risks & Threats

• Interchange regulation pressure

• Enterprise client concentration risk

• Competition from full-stack fintechs

Founder Opportunity

• Niche payment infrastructure

• Vertical SaaS embedded payments

• Regional payment aggregation

Lessons for Entrepreneurs & Your Opportunity

What Works

• Full-stack ownership

• Enterprise merchant focus

• Deep integrations

• Platform ecosystem strategy

What To Replicate

• Multi-layer monetization

• Embedded finance modules

• Data-driven pricing

Market Gaps

• SME embedded payment solutions

• Local payment infra in emerging markets

• Vertical fintech stacks

Founder Improvements

• Faster onboarding UX

• Vertical-specific payment optimization

• AI-driven pricing automation

Want to build a platform with Adyen’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Adyen clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it, Miracuves can arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Adyen proves that payment infrastructure can be one of the most profitable fintech business models when built with full-stack ownership. The company’s success comes from controlling the payment flow, data intelligence, and merchant experience inside one ecosystem.

For new founders, the biggest lesson is clear — the real money is not in payment gateways anymore. It is in owning financial infrastructure layers and monetizing them through multiple channels.

The next generation of payment startups will likely focus on verticalized embedded finance rather than generic payment processing. Those who move early into niche embedded finance segments will see the highest margins.

FAQs

1. How much does Adyen make per transaction?

Typically fractions of a percent depending on region, payment method, and merchant volume.

2. What’s Adyen’s most profitable revenue stream?

Payment processing combined with value-added services like fraud and FX.

3. How does Adyen’s pricing compare to competitors?

Usually competitive at enterprise scale but premium due to full-stack value.

4. What percentage does Adyen take from providers?

Varies widely based on contract structure and volume tiers.

5. How has Adyen’s revenue model evolved?

From payment processing to full financial infrastructure monetization.

6. Can small platforms use similar models?

Yes, especially via embedded payment infrastructure.

7. What’s the minimum scale for profitability?

Usually requires consistent transaction volume across multiple merchants.

8. How to implement similar revenue models?

Start with payments → add fraud → add issuing → add financial services.

9. What are alternatives to Adyen’s model?

Payment orchestration, marketplace payment models, vertical fintech payment stacks.

10. How quickly can similar platforms monetize?

Some platforms begin generating transaction revenue within weeks after merchant onboarding.