In 2026, Affirm generated approximately $2.4 billion in annual revenue, proving that Buy Now, Pay Later (BNPL) isn’t just a checkout feature—it’s a full-scale financial infrastructure business built on data, risk modeling, and merchant economics.

Most founders think fintech growth comes from charging users. Affirm flips the model. Its success is driven by monetizing merchants, optimizing transaction flow, and using credit risk as a revenue lever rather than a cost center.

In this breakdown, you’ll learn how Affirm turns everyday purchases into recurring platform revenue, how its unit economics stay profitable at scale, and what entrepreneurs can replicate when building their own embedded finance platforms.

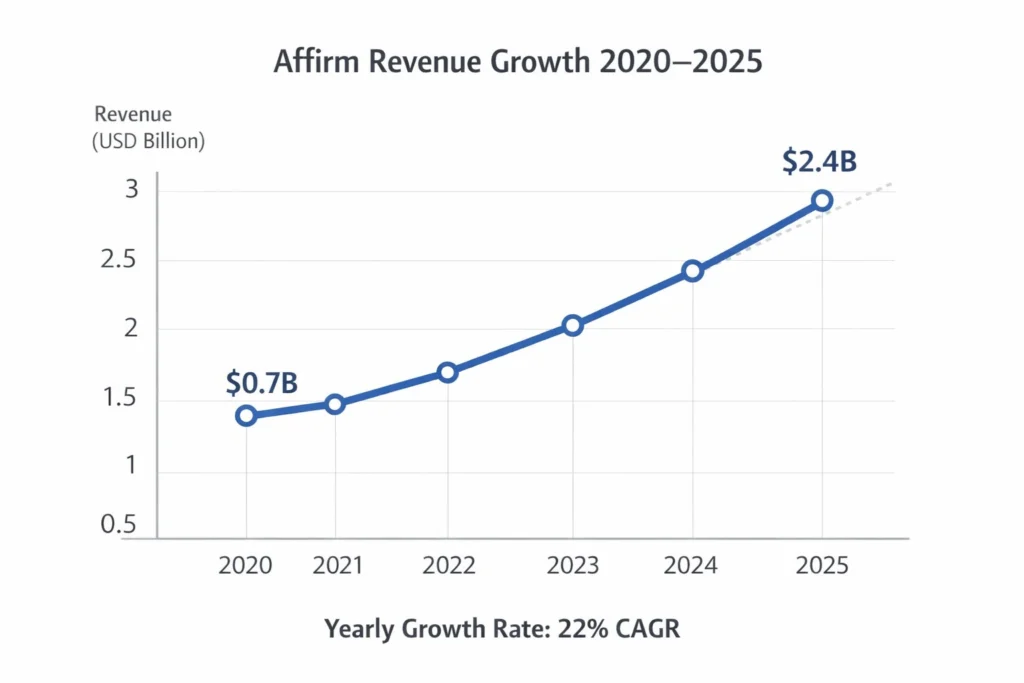

Affirm Revenue Overview – The Big Picture

2025 Revenue:

- Affirm total revenue (2025): ~$2.4B

Valuation:

- Market valuation (2025): ~$16B–$18B

YoY Growth:

- Year-over-year growth: ~22%

Revenue by Region:

- North America: ~85%

- Europe: ~10%

- Other Markets: ~5%

Profit Margins:

- Gross margin: ~40–45%

- Operating margin (improving, near breakeven for core BNPL operations)

Competition Benchmark:

- Klarna: ~$2.8B revenue

- Afterpay (Block): ~$2.6B revenue

- PayPal Pay Later: Integrated into PayPal’s $30B+ ecosystem

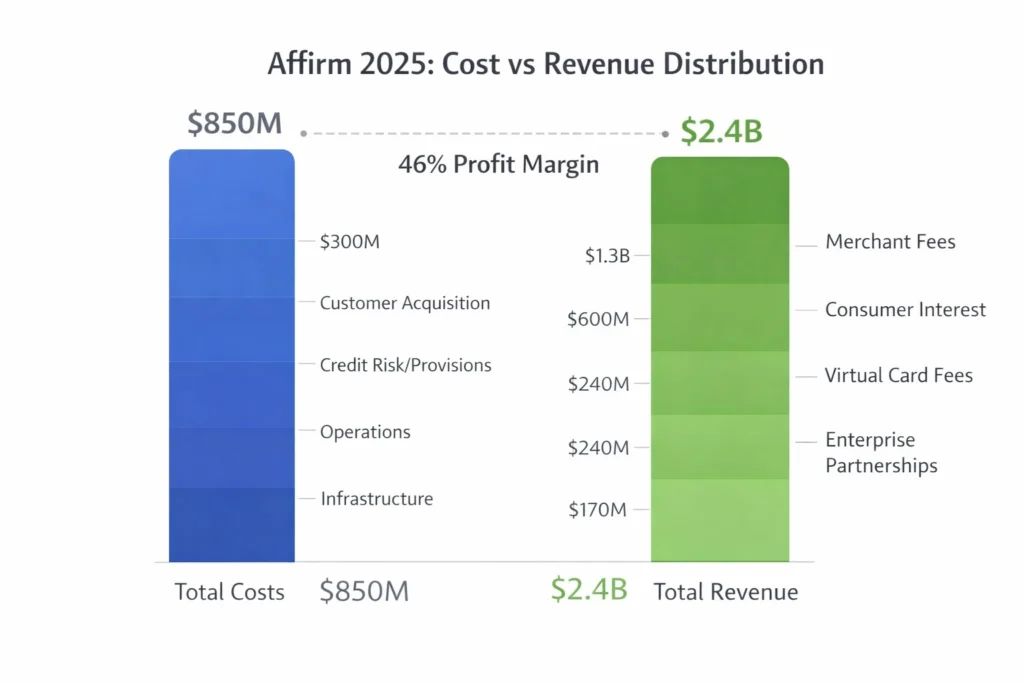

Primary Revenue Streams Deep Dive

Revenue Stream #1: Merchant Transaction Fees (55%)

Affirm charges merchants a percentage of each completed transaction for enabling BNPL at checkout. Higher conversion rates and larger average order values justify premium fees.

- Pricing: 2%–6% per transaction

- 2025 Impact: ~$1.3B

Revenue Stream #2: Consumer Interest Revenue (25%)

For longer-term financing plans, Affirm earns interest directly from consumers, especially on higher-ticket purchases.

- Pricing: 0%–36% APR depending on plan

- 2025 Impact: ~$600M

Revenue Stream #3: Virtual Card Usage (10%)

Affirm-issued virtual cards allow consumers to use BNPL anywhere, expanding transaction volume outside partner merchants.

- Pricing: Merchant-side fees + interest

- 2025 Impact: ~$240M

Revenue Stream #4: Enterprise Partnerships (7%)

Custom financing solutions for large brands and platforms.

- Pricing: Annual contracts and revenue-sharing models

- 2025 Impact: ~$170M

Revenue Stream #5: Data & Risk Services (3%)

Credit modeling insights and fraud-prevention services for merchants.

- Pricing: Subscription or usage-based

- 2025 Impact: ~$70M

Revenue Streams Percentage Breakdown

| Revenue Stream | % Share | Pricing Model | 2025 Revenue Impact |

|---|---|---|---|

| Merchant Transaction Fees | 55% | % per transaction | ~$1.3B |

| Consumer Interest Revenue | 25% | APR-based interest | ~$600M |

| Virtual Card Usage | 10% | Merchant + interest | ~$240M |

| Enterprise Partnerships | 7% | Annual contracts | ~$170M |

| Data & Risk Services | 3% | Subscription/Usage | ~$70M |

The Fee Structure Explained

User-Side Fees

- Interest on longer-term plans (up to 36% APR)

- Late fees (limited or capped depending on region)

Provider-Side Fees (Merchants)

- Transaction fee (2%–6%)

- Platform integration fees for enterprise setups

Hidden Revenue Layers

- Revenue-sharing partnerships

- Virtual card interchange revenue

- Risk-based pricing optimization

Regional Pricing Variation

- US: Higher merchant fees, broader interest options

- EU: Lower interest caps, compliance-driven pricing

Complete Fee Structure by User Type

| User Type | Fees Paid | Monetization Method | Revenue Driver |

|---|---|---|---|

| Consumers | Interest (APR) | Financing charges | Volume Scale |

| SMB Merchants | 2%–6% per sale | Transaction fees | Core Revenue |

| Enterprise Merchants | Custom pricing | Revenue sharing | High Margin |

| Partners | API/Integration fees | Platform access | Growth Levers |

How Affirm Maximizes Revenue Per User

- Segmentation: Low-risk vs high-value consumers

- Upselling: Longer-term financing options

- Cross-Selling: Virtual cards, partner offers

- Dynamic Pricing: Risk-based APR models

- Retention Monetization: Repeat checkout integration

- LTV Optimization: Merchant loyalty programs

- Psychological Pricing: “0% APR” short-term plans trigger higher AOV

- Real Example: Merchants report 20–30% AOV increase with BNPL enabled.

Cost Structure & Profit Margins

- Infrastructure Cost: Payment processing & cloud services

- CAC & Marketing: Merchant acquisition programs

- Operations: Compliance, underwriting, customer support

- R&D: Risk models, fraud prevention systems

- Unit Economics: ~$0.40–$0.70 per transaction

- Margin Optimization: Automation in credit decisions

- Profitability Path: Scale transaction volume faster than risk losses

Read More: Best Affirm Clone Scripts 2025 – Build a BNPL App with Miracuves

Future Revenue Opportunities & Innovations

- AI-driven credit personalization

- Embedded finance APIs for SaaS platforms

- Global BNPL expansion

- 2025–2027 Risks: Regulation, interest rate volatility

- Opportunities: SME-focused lending platforms, subscription BNPL

Lessons for Entrepreneurs & Your Opportunity

What Works:

- Merchant-first monetization

- Risk-based pricing

- Platform partnerships

What to Replicate:

- BNPL checkout integrations

- Virtual cards

- API-based financing

Market Gaps:

- Emerging markets BNPL platforms

- Industry-specific financing tools

Want to build a platform with Affirm’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Affirm clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it, we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Affirm proves that fintech platforms don’t win by lending more—they win by embedding themselves into commerce itself. By becoming part of the checkout experience, it turns every purchase into a potential revenue event.

For founders, the real insight is that data and risk modeling are monetization tools, not just compliance requirements. The better you price risk, the more confidently you can scale revenue without sacrificing margins.

If you’re entering the embedded finance space, focus on trust, transparency, and merchant economics first. Do that well, and your platform won’t just process payments—it will become a financial backbone for entire industries.

FAQs

1. How much does Affirm make per transaction?

Typically 2%–6% from merchants, plus interest on longer-term consumer plans.

2. What’s Affirm’s most profitable revenue stream?

Merchant transaction fees at high-volume partners.

3. How does Affirm’s pricing compare to competitors?

It charges higher merchant fees but offers better conversion and transparency.

4. What percentage does Affirm take from providers?

Merchants usually pay between 2% and 6% per completed sale.

5. How has Affirm’s revenue model evolved?

From consumer interest-driven to merchant-first monetization.

6. Can small platforms use similar models?

Yes, with API-based BNPL and niche merchant partnerships.

7. What’s the minimum scale for profitability?

Around 10,000+ monthly transactions for stable unit economics.

8. How to implement similar revenue models?

Integrate BNPL APIs, automate risk scoring, and build merchant dashboards.

9. What are alternatives to Affirm’s model?

Subscription lending, marketplace financing, or revenue-based financing.

10. How quickly can similar platforms monetize?

With proper integrations, revenue can start within 30–60 days of launch.