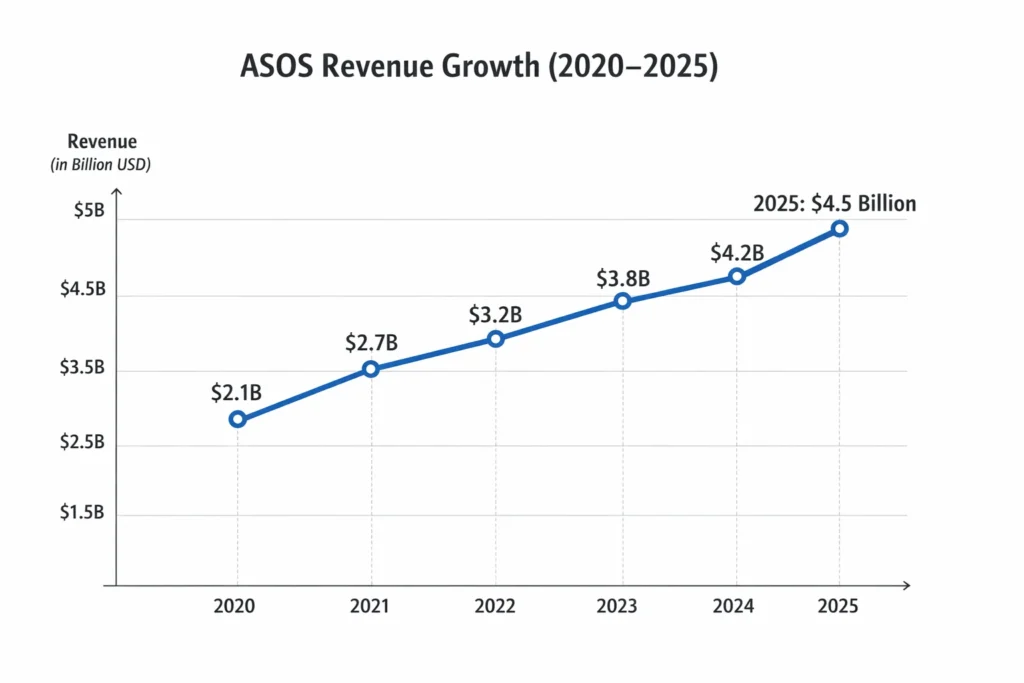

ASOS generated approximately $4.5 billion (≈£3.6 billion) in revenue in 2025, proving that digital-first fashion platforms can scale globally without relying on physical retail stores. Its success highlights the power of mobile-first commerce, fast inventory turnover, and a strong global logistics network. By operating entirely online, ASOS minimizes real estate costs while maximizing reach across more than 200 markets, making it a benchmark for modern fashion eCommerce.

What makes ASOS especially interesting is not just its sales volume, but how efficiently it monetizes trend cycles, private-label brands, and customer data. The company uses real-time demand signals, AI-driven merchandising, and rapid design-to-shelf workflows to capitalize on emerging fashion trends faster than traditional retailers. Its private labels deliver higher margins, while data-driven personalization improves conversion rates, repeat purchases, and average order value.

For founders building fashion marketplaces or D2C platforms, ASOS offers one of the most practical and replicable revenue models in eCommerce today. The blend of direct product sales, subscriptions, marketplace commissions, and advertising creates diversified income streams with predictable cash flow. More importantly, ASOS demonstrates how technology, analytics, and brand control can be combined to build a scalable, profitable fashion platform without heavy inventory risk.

ASOS Revenue Overview – The Big Picture

ASOS operates as a global online fashion retailer serving more than 200 markets with a mobile-first strategy.

2025 Snapshot

- Annual revenue: ~$4.5 billion

- Valuation: ~$3.2 billion (public market adjusted)

- YoY growth: ~6%

- Gross margin: ~45%

- Net profit margin: 3–5%

- Active customers: ~25 million

Revenue by Region

- UK & Europe: ~45%

- US: ~30%

- Rest of World (APAC + Middle East): ~25%

Competition Benchmark

- Zara (Inditex): Higher margins, offline dominance

- Shein: Faster supply chain, lower margins

- Boohoo: Similar model, lower AOV

Read More: What is ASOS and How Does It Work?

Primary Revenue Streams Deep Dive

Revenue Stream #1: Direct Product Sales (Core Revenue)

ASOS primarily earns by selling fashion products directly to consumers.

- Contribution: ~75% of total revenue

- Pricing: Mid-range ($15–$150 per item)

- 2025 insight: Private-label brands drive higher margins than third-party brands

Revenue Stream #2: ASOS Marketplace Commissions

Independent boutiques sell via ASOS Marketplace.

- Contribution: ~10%

- Commission: 15–20% per sale

- Benefit: Zero inventory risk for ASOS

Revenue Stream #3: ASOS Premier Subscription

Annual paid membership offering free express delivery.

- Contribution: ~5%

- Price: ~$24/year

- Impact: Increases purchase frequency by ~2.3×

Revenue Stream #4: Brand Advertising & Promotions

Fashion brands pay for visibility on the platform.

- Contribution: ~6%

- Formats: Sponsored listings, featured collections, emails

Revenue Stream #5: Data-Driven Merchandising & Insights

Trend forecasting and inventory optimization powered by customer data.

- Contribution: ~4% (indirect but margin-rich)

- Value: Reduces unsold inventory by ~20%

Revenue Streams Breakdown Table

| Revenue Stream | Percentage Share |

|---|---|

| Direct Product Sales | 75% |

| Marketplace Commissions | 10% |

| Premier Subscription | 5% |

| Advertising & Promotions | 6% |

| Data & Optimization | 4% |

The Fee Structure Explained

User-Side Fees

- Product price

- Shipping (waived for Premier users)

- Optional returns beyond policy limits

Seller-Side Fees (Marketplace)

- Commission per sale

- Featured listing fees

- Optional promotional placements

Hidden Revenue Layers

- Vendor margin negotiations

- Currency conversion margins

- Logistics partnerships

Regional Pricing Variation

- Higher AOV in US & EU

- Dynamic pricing based on demand and season

Fee Structure Table by User Type

| User Type | Fees Applied |

|---|---|

| Regular Shoppers | Product price + shipping |

| Premier Members | Subscription fee only |

| Marketplace Sellers | 15–20% commission |

| Brand Advertisers | CPM / CPC pricing |

| International Buyers | FX + logistics margin |

How ASOS Maximizes Revenue Per User

ASOS focuses heavily on increasing Lifetime Value (LTV) rather than single purchases.

- Segmentation: Gender, age, style preferences

- Upselling: Complete-the-look recommendations

- Cross-selling: Accessories + apparel bundles

- Dynamic pricing: Flash sales driven by inventory levels

- Retention monetization: Premier subscriptions

- Psychological pricing: Limited-time discounts

- Real example: Premier users spend ~£110 more annually than non-members

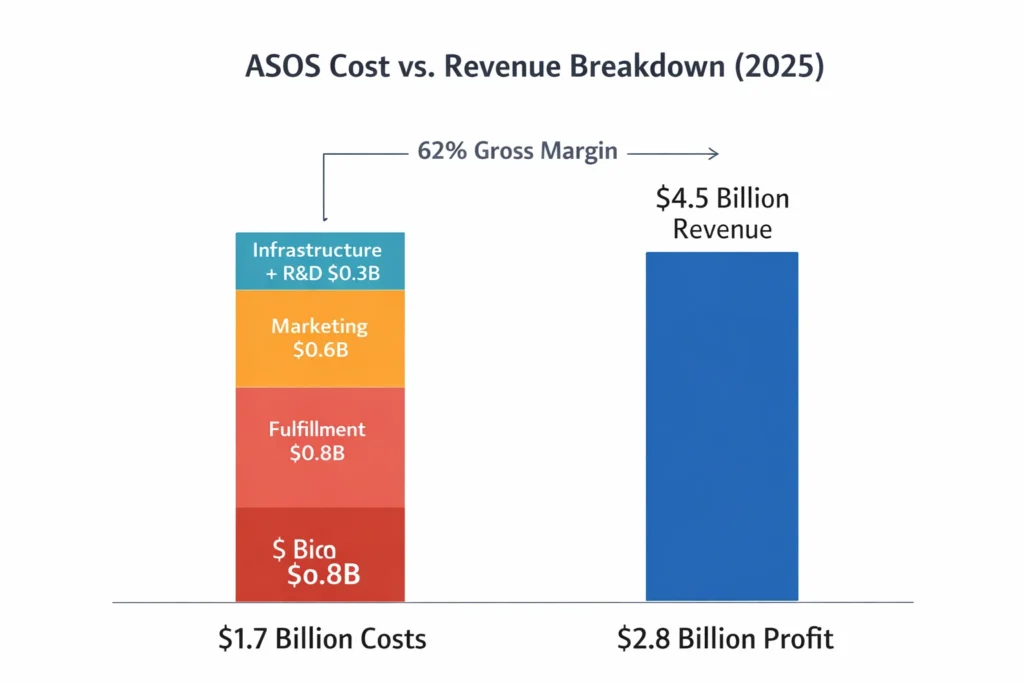

Cost Structure & Profit Margins

Running a global fashion platform comes with heavy operational costs.

Key Cost Areas

- Infrastructure: Cloud, app development, data systems

- Marketing & CAC: Influencers, paid ads, loyalty programs

- Operations: Warehousing, fulfillment, returns

- R&D: AI sizing, personalization engines

Unit Economics

- Average Order Value (AOV): ~$85

- Fulfillment cost per order: ~$12

- Contribution margin per order: ~$18–22

Read More: Best ASOS Clone Script 2025 – Launch Your Fashion Marketplace

Future Revenue Opportunities & Innovations

Looking ahead, ASOS is expanding beyond traditional retail.

- AI-driven styling subscriptions

- On-demand manufacturing

- Creator-led fashion drops

- Social commerce integrations

- Emerging market expansion (India, SEA)

Risks

- Fast-fashion regulation

- Rising return rates

- Competition from ultra-fast supply chains

Founder Opportunity

Niche fashion platforms with better personalization and faster launches.

Lessons for Entrepreneurs & Your Opportunity

What Works

- Private labels = higher margins

- Subscriptions stabilize revenue

- Data reduces inventory risk

What to Replicate

- Marketplace + D2C hybrid model

- Membership-based retention

- AI-driven merchandising

Market Gaps

- Sustainable fashion platforms

- Regional fashion marketplaces

- Creator-driven brands

Want to build a platform with ASOS’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our ASOS clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

ASOS proves that fashion eCommerce success isn’t about being the cheapest — it’s about owning customer data, understanding demand patterns, and building long-term loyalty. By tracking browsing behavior, purchase frequency, and style preferences, ASOS predicts trends before they peak and reduces overstock risks. This data-first approach allows the brand to move faster than traditional retailers while maintaining healthier margins.

Its revenue model balances massive scale with deep personalization, making it ideal for founders to study and adapt. ASOS serves millions of customers globally while still delivering curated experiences through AI-driven recommendations, segmented marketing, and subscription-based benefits. This balance enables consistent revenue growth without sacrificing customer experience or operational efficiency.

With the right execution, similar platforms can achieve profitability faster than traditional retail by avoiding physical store costs, optimizing supply chains, and diversifying monetization streams. By combining private labels, marketplace commissions, and recurring revenue models, digital-first fashion businesses can reach break-even sooner and scale sustainably in competitive markets.

FAQs

1. How much does ASOS make per transaction?

Around $18–22 in contribution margin per order.

2. What’s ASOS’s most profitable revenue stream?

Private-label product sales.

3. How does ASOS’s pricing compare to competitors?

Mid-range pricing with higher perceived value.

4. What percentage does ASOS take from providers?

Marketplace sellers pay 15–20% commission.

5. How has ASOS’s revenue model evolved?

Shifted from pure retail to subscriptions and data-driven monetization.

6. Can small platforms use similar models?

Yes, especially niche or regional platforms.

7. What’s the minimum scale for profitability?

Typically 50k–100k active users with repeat buyers.

8. How to implement similar revenue models?

Combine D2C sales, subscriptions, and marketplace commissions.

9. What are alternatives to ASOS’s model?

Dropshipping, print-on-demand, or creator-led commerce.

10. How quickly can similar platforms monetize?

Many businesses begin generating revenue soon after launch.