If you’re diving into the world of crypto fundraising in 2025, chances are you’re either already obsessed with launchpads or at least crypto-curious. And for good reason. Platforms like Bscpad have completely shaken up how blockchain startups raise capital. But here’s the kicker—copying Bscpad isn’t a guaranteed ticket to success. In fact, many startups end up shooting themselves in the foot before they ever get their platform off the ground.

I still remember working with a founder who was so sure his Bscpad alternative would go viral. He threw money at development, hyped it up in Telegram groups, and even got a few influencers to give it a shoutout. But fast-forward three months… crickets. The problem? He ignored some brutal but basic truths about how launchpads actually work—and what it really takes to compete in this space.

That’s why we’re here. This blog is your cheat sheet. Whether you’re a founder, startup junkie, or investor eyeing the launchpad scene, I’m laying down the top 5 blunders you’ll want to dodge like a rug-pull. We’ll talk tech, tokenomics, community (yes, that chaotic beast), monetization, and more. Oh, and don’t worry—we’ll keep the jargon in check and the advice practical.

So if you’re serious about building a Bscpad-style platform—or already halfway through—don’t make these rookie mistakes. Save yourself the headache. Let’s get into it.

What’s Fueling the Bscpad Clone Craze?

Let’s face it—Bscpad cracked the code. It gave early-stage crypto projects a runway to raise funds in a decentralized, permissionless way. The draw? Lower entry barriers, democratized token sales, and a killer incentive for everyday investors.

As centralized exchanges tighten their listing criteria and regulatory scrutiny increases, many projects are turning to launchpads like Bscpad, Polkastarter, and TrustPad. That’s why we’re seeing a surge in Bscpad clones—everyone wants a slice of the IDO (Initial DEX Offering) pie.

But just like everyone who bought a drone didn’t become a filmmaker, everyone who builds a launchpad clone doesn’t become the next Bscpad. Execution is everything.

Top 5 Mistakes Startups Make When Building a Bscpad Clone

1. Ignoring Token Utility and Poor Tokenomics

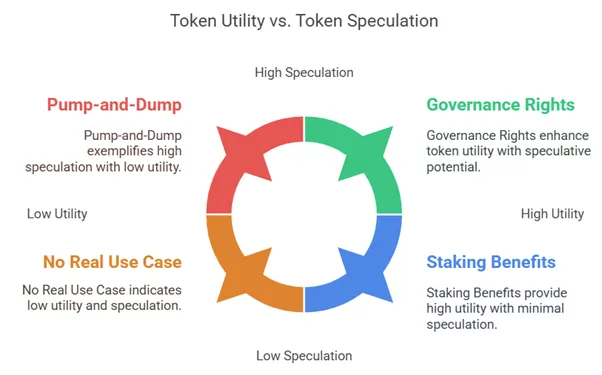

Let’s start with the holy grail—your token. You’d be amazed how many startups launch a Bscpad clone with a token that has… zero real use. If users are only buying your token to speculate or access tiered sales, you’re in trouble.

Why it’s a problem:

- Weak utility leads to weak community interest.

- No real reason to hold = sell pressure.

- No sustainability = crash and burn.

Fix it:

Design a robust tokenomics model. Give users reasons to hold—staking rewards, governance rights, loyalty bonuses, maybe even access to exclusive tools or NFT drops. And for the love of crypto, don’t inflate your supply thinking more = better.

2. Overbuilding the Tech, Underbuilding the Community

Here’s the trap: founders sink months into coding the perfect platform—clean UI, slick UX, gas-efficient smart contracts. But nobody’s talking about it. There’s no hype, no community vibe, no loyal followers to participate in IDOs.

Why it hurts:

- A ghost town platform, no matter how polished, doesn’t launch successful projects.

- IDOs rely on crowd participation—no crowd, no sale.

- Community is your marketing engine. Period.

Fix it:

Start building community before your code is even complete. Use Twitter, Discord, Reddit, and yes, Telegram. Host AMAs, drop sneak peeks, share roadmaps, and reward early believers. People need to feel like they’re part of something early.

3. Copy-Pasting Features Without Market Fit

Just because Bscpad has tiered staking, doesn’t mean your clone should blindly adopt it. Some startups clone features wholesale without understanding why they exist or if they’ll work for their target audience.

The issue:

- Copying without context = misalignment.

- Features that worked for Bscpad might flop in a new market.

- Your users might need something different.

Fix it:

Study your region, audience, and niche. For example, if you’re targeting smaller investors in Tier 2 cities or emerging markets, maybe flexible participation or low-barrier entry would work better than complex staking tiers.

4. No KYC or Compliance Planning

Sure, crypto’s all about decentralization. But if you’re running a launchpad and handling user funds, ignoring KYC (Know Your Customer) and AML (Anti-Money Laundering) is like begging regulators to shut you down.

What can go wrong:

- Legal issues

- Payment processor problems

- Partnerships fall through

- Bad PR (and bad actors)

Fix it:

Build compliance from day one. Integrate with third-party KYC providers like Sumsub, Persona, or Shufti Pro. Offer regional compliance toggles. And consult a crypto-savvy lawyer before things get serious.

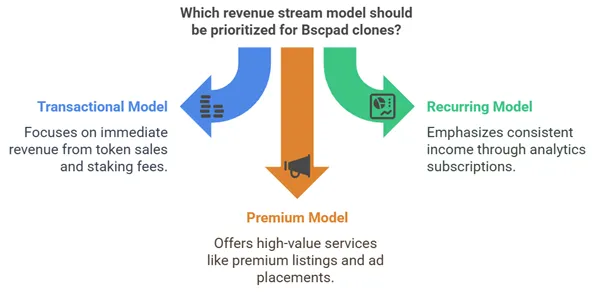

5. Failing to Create a Monetization Plan

This one’s subtle but deadly. A lot of founders assume transaction fees and token value will cover the bills. Spoiler alert: they often don’t.

Why it’s fatal:

- You burn runway without revenue.

- You rely too much on token price = volatility.

- No long-term business model = no long-term survival.

Fix it:

Diversify revenue streams. Think launch fees for IDO projects, subscription models for premium tools, priority listings, or ad placements. Even a freemium analytics dashboard can generate income.

How to Pick the Right Model for Your Bscpad Clone

Different Goals, Different Tools

- Casual crypto users want simplicity. Focus on UI/UX, low buy-ins, and mobile access.

- Active investors look for tier benefits, portfolio tracking, and staking dashboards.

- Influencers and creators want affiliate programs, promo tools, and analytics to track conversions.

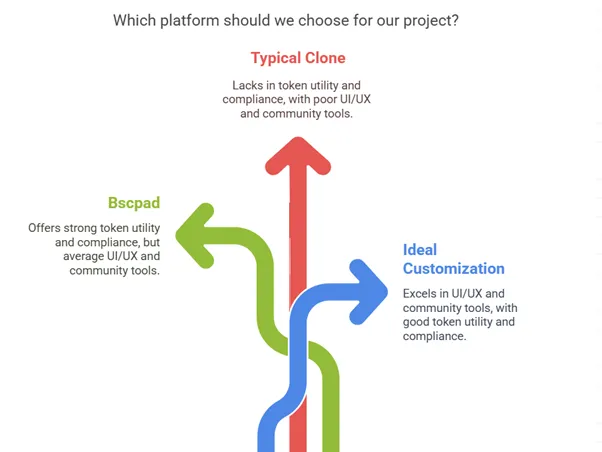

App Comparison Cheat Sheet

| Feature | Bscpad | Typical Clone | Ideal Customization |

|---|---|---|---|

| Token Utility | High | Low to Medium | Medium to High |

| Community Tools | Moderate | Low | High |

| Compliance | Region-Based | Often Missing | Built-In KYC |

| UI/UX | Good | Inconsistent | User-Driven |

| Monetization | Token Fees | Sparse | Multi-stream |

Challenges to Watch Out For

- Data Privacy: Collect only what you need. Use encryption.

- Content Moderation: Telegram groups can turn toxic—hire mods.

- Transparency: Show how projects are vetted. List partners and advisors.

- Market Saturation: Everyone’s building a launchpad. What’s your edge?

Conclusion

To wrap it up—building a Bscpad clone isn’t about copy-pasting. It’s about learning from what works and adapting it with nuance. Token utility, community engagement, and compliance aren’t just buzzwords—they’re your foundation.

As we move deeper into 2025, expect hybrid models that blend launchpads with social-fi, DAO governance, and even AI-curated project scoring. The winners? Startups who build with intention, not imitation.

FAQs

1. What is a Bscpad Clone?

It’s a launchpad platform modeled after Bscpad, allowing crypto projects to raise funds via token sales while offering users access to IDOs.

2. Do I need a native token to run a launchpad?

Yes. It’s key for access tiers, staking, rewards, and aligning user incentives.

3. Can I run a Bscpad-style platform without KYC?

Technically yes, but it’s risky. Without compliance, you’re exposed to legal issues and reputational damage.

4. What’s the biggest challenge when cloning Bscpad?

Getting user trust. The space is flooded with scams—transparency and utility matter.