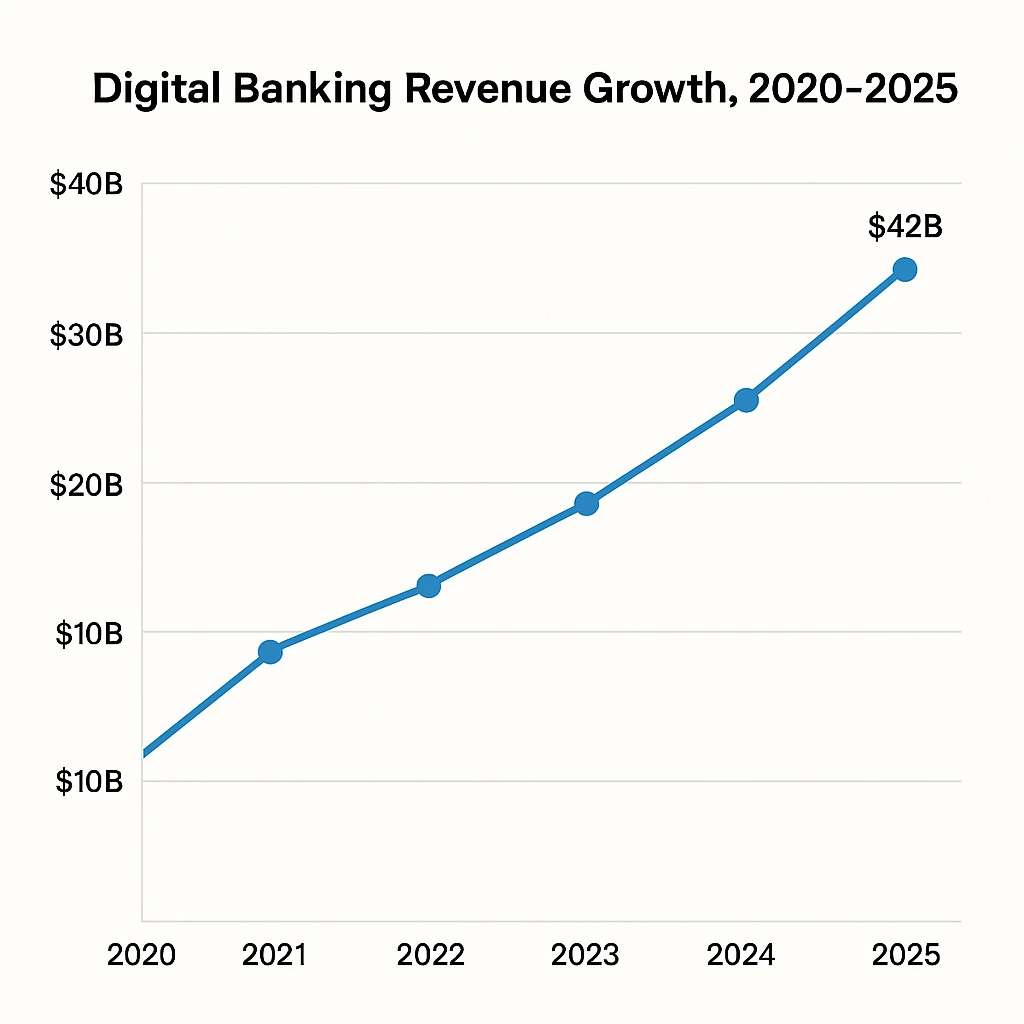

In 2025, digital banking apps collectively generated over $42 billion in revenue, proving that modern finance has fully shifted to mobile-first experiences. This explosive growth is driven by user demand for faster onboarding, transparent fees and smarter financial tools powered by automation and AI. Understanding how these platforms generate revenue helps entrepreneurs tap into the same proven model—without needing banking licenses or massive infrastructure. Banking script clones make this transition seamless by providing ready-made systems with built-in monetization, allowing startups to enter the fintech market faster and with far lower risk.

Banking Script Clone Revenue Overview – The Big Picture

2025 Global Revenue: $42B+

YoY Growth: 18.6%

Current Market Valuation: $310B

Leading Regions: North America (38%), Europe (32%), APAC (22%)

Average Profit Margin: 22–28% annually

Top Competitors: Revolut, N26, Monzo, Chime, Nubank

Market Position: Digital banks now hold 13% of all new customer bank accounts globally.

Primary Revenue Streams – Deep Dive

1. Interchange Fees (32%)

Banks earn a percentage every time a user makes a transaction using debit/credit cards.

2. Subscription & Premium Accounts (22%)

Users pay monthly for features like higher withdrawal limits, savings automation & investment tools.

3. Loan Interest & Lending Services (19%)

Including BNPL, personal loans, micro-financing, and working capital loans.

4. Wealth Management & Investments (15%)

Commission-based investments, trading fees & advisory charges.

5. Partnerships & API Monetization (12%)

Businesses pay to integrate banking features via embedded finance APIs.

Revenue Streams Breakdown

| Revenue Stream | % Share (2025) | Example Features |

|---|---|---|

| Interchange Fees | 32% | Card payments |

| Subscriptions | 22% | Premium accounts |

| Loans & Lending | 19% | BNPL, micro-loans |

| Wealth Management | 15% | Trading, advisory |

| API Monetization | 12% | B2B integrations |

Fee Structure Explained

User-Side Fees

- Monthly subscriptions

- ATM withdrawal fees

- Instant transfer fees

Provider-Side Fees

- Merchant transaction fees

- API usage fees

- Insurance & financial product commission

Hidden Revenue Layers

- Interest on parked funds

- White-label fintech services

- Cross-border exchange fees

Fee Structure by User Type

| User Type | Fee Type | Average Cost |

|---|---|---|

| Basic User | ATM Withdrawal | $2–$4 |

| Premium User | Monthly Subscription | $8–$15 |

| Merchant | Per Transaction | 1.2%–2.5% |

| API Partner | API Calls | $0.01 per call |

How Banking Apps Maximize Revenue Per User

Segmentation – Free vs. Premium users

Upselling – Investment tools & insurance offers

Cross-Selling – BNPL + savings + debit cards

Dynamic Pricing – Surge fees during high usage

Retention Monetization – Cashback, rewards, loyalty

LTV Optimization – Automated savings & recurring fees

Psychological Pricing – $4.99 → $5 feels expensive

Real Insight: On average, a premium user generates 3.5x higher LTV than a free user.

Read More: Build an app like Banking Solution – Full Developer Guide

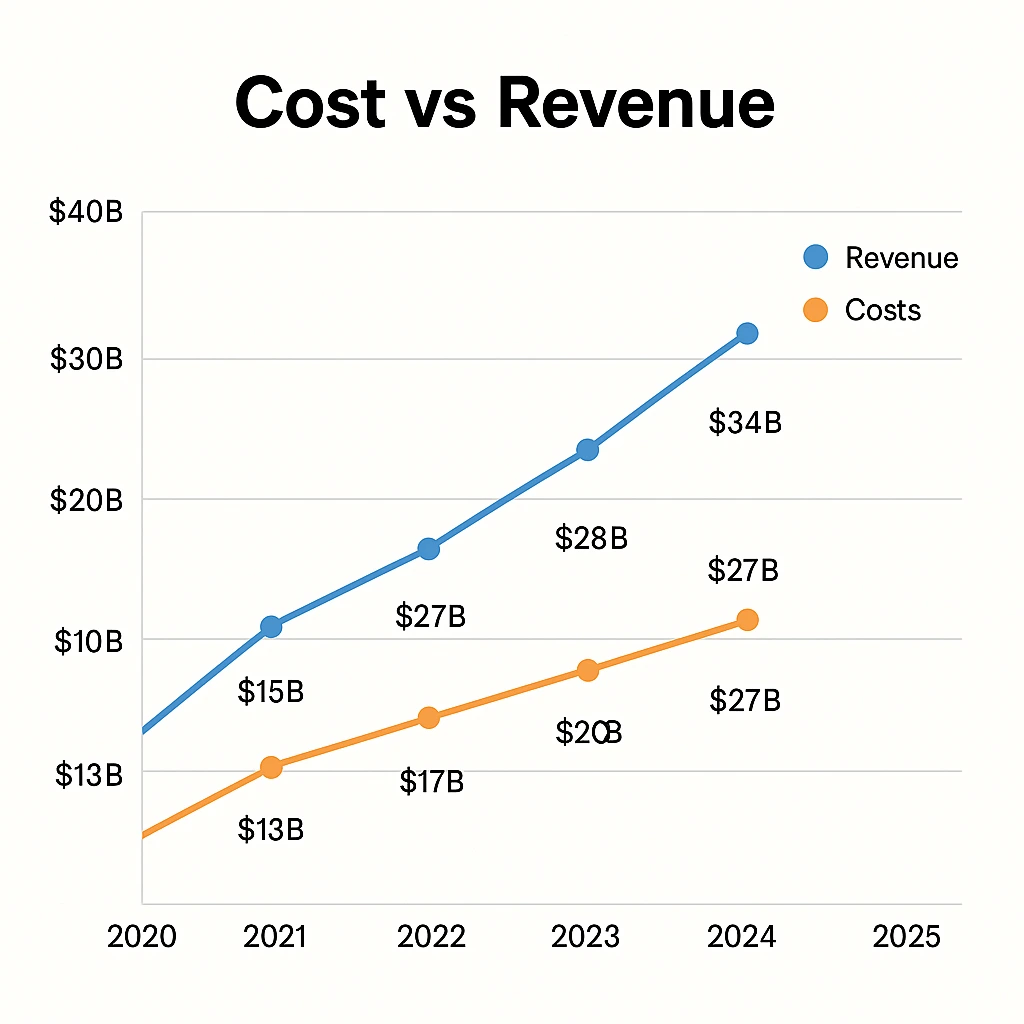

Cost Structure & Profit Margins

Major Cost Areas

- Tech infrastructure & cloud hosting

- Marketing & CAC

- Customer support & KYC verification

- Compliance & legal

- R&D & AI-driven automation

Unit Economics (2025)

- CAC (average): $22–$45

- LTV: $180–$450

- Profit Margin: 22–28%

Read More: Best Banking Solution Clone Scripts in 2025: Features & Pricing

Future Revenue Opportunities & Innovations

New Streams Emerging in 2025–2027:

- AI-based robo-advisory banking

- Crypto wallets & digital assets

- Embedded finance for SaaS businesses

- Prediction-based financial planning

- BNPL for small purchases

- Banking APIs for eCommerce

Risks: Regulation, fraud, rising server costs

Opportunity: Niche-focused digital banks are expected to grow 3x faster than generic ones.

Lessons for Entrepreneurs & Your Opportunity

What Works

- Low CAC via referral programs

- Automated money flows

- Higher LTV from premium segments

What Entrepreneurs Can Replicate

- Subscription banking

- Wealth management integrations

- Instant digital onboarding

Market Gaps

- Regional micro-loans

- Teen/student banking

- Banking for freelancers

Want to build a platform with this proven revenue model? Miracuves helps entrepreneurs launch revenue-generating digital banking solutions with built-in monetization features. Our Banking Script Clone comes with ready revenue channels like subscriptions, cards, lending, trading modules, and API monetization. In fact, some clients see revenue within 30 days of launch — and Miracuves delivers ready-to-launch solutions in 30–90 days guaranteed. Get a free consultation to map out your revenue strategy. If you need an advanced banking script in a different tech stack or region-based compliance system, Miracuves will provide that too.

Final Thought

The digital finance model has already proven itself globally, with neobanks and fintech platforms scaling faster than traditional institutions. Banking scripts make it simple for new entrepreneurs to enter this high-growth market without the heavy infrastructure or long development cycles.

Miracuves elevates this opportunity by providing fast deployment, enterprise-grade architecture and built-in monetization channels from the very start. Every module—from onboarding to transactions—is optimized to help you launch confidently and scale smoothly.

With Miracuves, your fintech platform can go live within 3–9 days, fully equipped for real users, real transactions and real revenue. It’s the fastest, most efficient way to turn a validated digital banking model into a fully operational business.

FAQs

1. How much does a digital bank make per transaction?

Usually between 1%–2.5% via interchange and merchant fees.

2. What’s the most profitable revenue stream?

Lending & subscription-based accounts deliver the highest margins.

3. How does pricing compare to traditional banks?

Digital banks are 30–40% cheaper yet deliver more features.

4. What percentage is taken from providers?

Typically 1.2%–2.5% per merchant transaction.

5. How has the revenue model evolved?

It expanded from card fees to loans, AI-advisory, and SaaS-style APIs.

6. Can small platforms replicate this model?

Yes. Niche digital banks are the fastest-growing segment in fintech.

7. What’s the minimum scale for profitability?

Around 10,000 active users—or 2,000 premium subscribers.

8. How to implement similar revenue models?

Use plug-and-play modules built in Banking Script Clones.

9. What are alternatives to this model?

Commission-only, subscription-only, and API-only banking models.

10. How quickly can new platforms monetize?

Within weeks using pre-built solutions like Miracuves banking scripts, with a guaranteed delivery timeline of just 30–90 days.