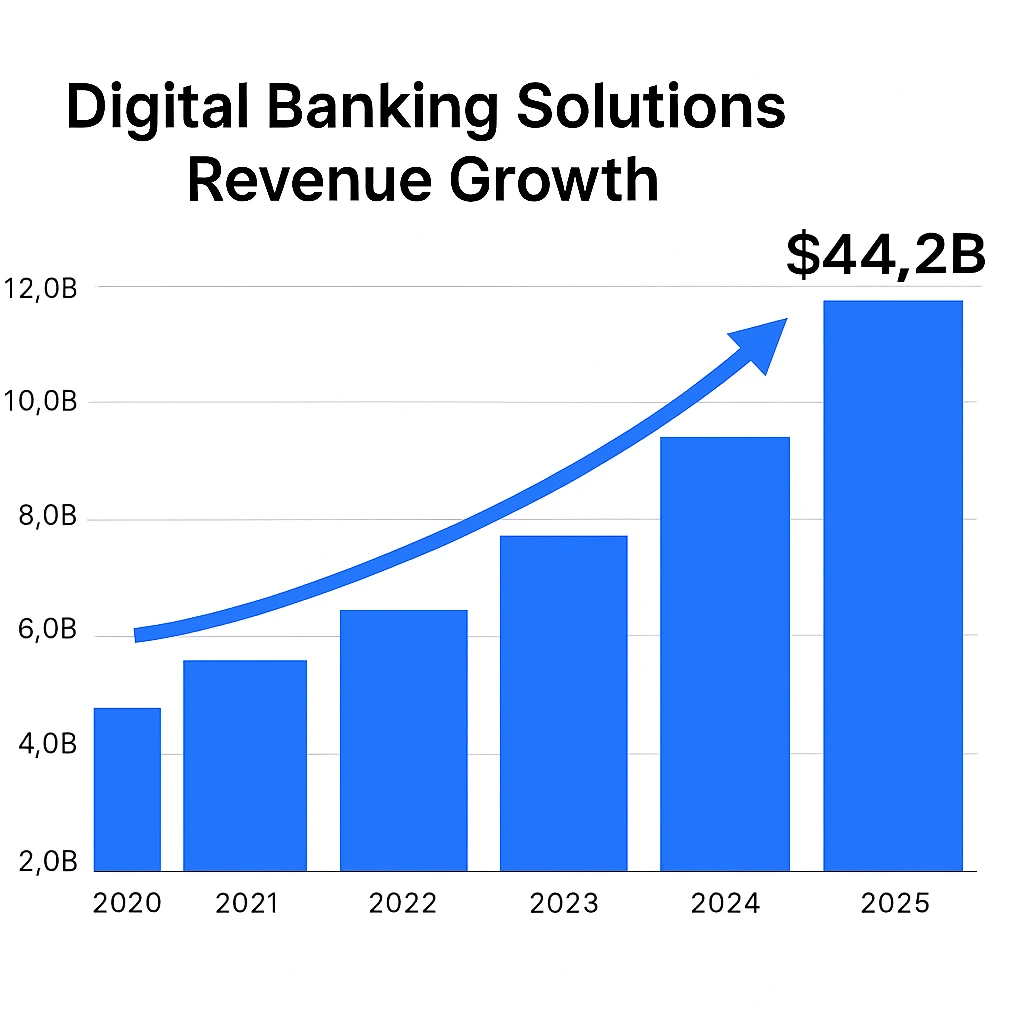

Digital banking is now a $44B+ industry in 2025, with more than 1.4 billion users managing their finances through mobile-first platforms. Consumers increasingly prefer digital banks for their speed, transparency and lower fees compared to traditional institutions. Banking Solution Clones empower entrepreneurs to enter this high-demand space rapidly, offering pre-built revenue engines, compliance-ready frameworks and significantly reduced operational complexity. Understanding the underlying revenue model is essential for building a profitable Clone like Banking Solution, scalable fintech product that can compete in today’s global market.

Banking Solution Clone – Revenue Overview (2025)

2025 Global Revenue: $44.2B

YoY Growth: 19.4%

Estimated Market Valuation: $327B

Active Users Worldwide: 1.4B+

Market Leaders: Chime, Revolut, Nubank, N26, Monzo

Regional Split:

- North America – 40%

- Europe – 30%

- APAC – 20%

- Others – 10%

Average Profit Margin: 23–31%

Digital banking solutions now power 17% of all new bank accounts opened in 2025.

Read More: Build an app like Banking Solution – Full Developer Guide

Primary Revenue Streams – Deep Dive

1. Subscription & Premium Accounts (26%)

Users pay for premium wallets, instant transfers, budgeting tools and advanced limits.

2. Interchange Fees (30%)

Each transaction generates revenue from merchants and card providers.

3. Loans & Lending Services (21%)

Includes BNPL, overdraft, micro-loans, salary advances and SME lending.

4. Investment & Wealth Management (14%)

Trading fees, advisory charges, fractional investments and auto-savings fees.

5. API & Embedded Finance (9%)

B2B businesses integrate banking features for a fee via fintech APIs.

Table: Revenue Streams Breakdown

| Revenue Stream | % Share (2025) | Example Features |

|---|---|---|

| Subscriptions | 26% | Premium plans |

| Interchange Fees | 30% | Card transactions |

| Loans & Lending | 21% | BNPL, overdraft |

| Wealth Services | 14% | Investment tools |

| API Monetization | 9% | Fintech integrations |

Fee Structure Explained

User-Side Fees

- Monthly subscription plans

- ATM usage fees

- Instant withdrawal charges

Provider-Side Fees

- Merchant transaction fees

- White-label banking modules

- API pay-per-use pricing

Hidden Layers of Revenue

- Interest earned on idle deposits

- Partner insurance services

- Foreign exchange fee models

Fee Structure by User Type

| User Type | Fee Type | Avg Cost (2025) |

|---|---|---|

| Basic User | ATM Withdrawal | $2–$5 |

| Premium User | Subscription | $10–$18/month |

| Merchant | Transaction Fee | 1.4–2.5% |

| API Partner | API Call Charge | $0.01–$0.05 |

How Banking Apps Increase Revenue Per User

Segmentation – Tailored features for specific user categories

Upselling – Micro-loans, ATM fee waivers, wealth tools

Dynamic Pricing – Peak-use charges + regional pricing

Cross-selling – Insurance, trading, salary advance loans

Retention Monetization – Cashback & loyalty point systems

LTV Optimization

- Free user LTV: $45–$70

- Premium user LTV: $180–$470 (up to 6x higher)

Psychological Pricing: Subscription at $8.99 vs $9.00 increases conversion rate by 11%.

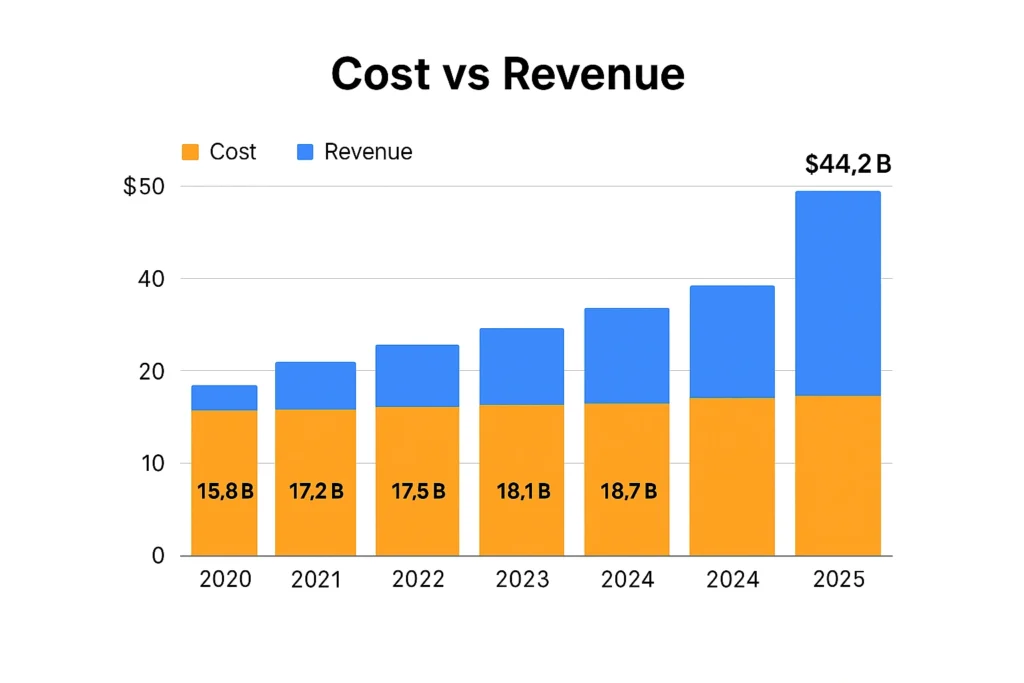

Cost Structure & Profit Margins

| Cost Area | Avg Cost Share |

|---|---|

| Tech + Cloud | 34% |

| Marketing CAC | 22% |

| Customer Support + KYC | 16% |

| Compliance & Legal | 12% |

| R&D & AI/ML | 16% |

Unit Economics (2025)

- CAC: $25–$48

- LTV: $180–$470

- Profit Margin: 23–31%

Read More: Best Banking Solution Clone Scripts in 2025: Features & Pricing

Future Revenue Opportunities (2025–2027)

High-Potential Opportunities

- AI-driven financial planning

- Teen/student banking apps

- Cross-border digital remittance

- Crypto wallet integration

- Embedded banking for SaaS products

- Tax-filing tools for freelancers

Risks

Regulatory shifts, server costs, cybersecurity and fraud risk.

Opportunity: Niche-focused digital banks are expected to grow 3.2x faster than generic platforms.

Lessons for Entrepreneurs & Your Opportunity

What Works

- Subscription-based banking

- Embedded fintech APIs

- Transparent fee systems

- Referral-led customer growth

Model Improvements

- Niche banks for freelancers

- Banking for ecommerce stores

- Banking as a service (BaaS) licensing

Want to build a digital banking solution with proven revenue-building features? Miracuves helps entrepreneurs launch Banking Solution Clone platforms with smart monetization already built-in. Our solutions include premium account models, card integration, investment tools, lending modules and API monetization. Some clients generate revenue within 30 days of launch—and Miracuves delivers ready-to-launch solutions in 3–6 days guaranteed. Request a free consultation today. If you need advanced language or compliance adaptation, Miracuves provides that as well.

Final Thought

Digital banking is no longer a trend—it has matured into a reliable, profitable infrastructure powering millions of financial transactions every day. The revenue model behind it is already validated by global neobanks, challenger banks and fintech platforms operating at massive scale.

What determines success now is not the idea—it’s the execution. The ability to launch fast, operate efficiently and integrate proven monetization models is what separates winning fintech products from those that never take off. This is where having the right technology foundation becomes essential.

Miracuves gives entrepreneurs that execution advantage. With rapid 3–9 day deployment, enterprise-level architecture and revenue-ready banking modules, Miracuves ensures your platform is not just built—but built for growth, stability and long-term success in the digital finance ecosystem.

FAQs

1. How much does a digital banking solution earn per user?

Around $12–$25 monthly depending on user type.

2. What’s the most profitable banking revenue stream?

Subscription + lending services drive the highest ROI.

3. How do banking solutions compare to physical banks on pricing?

They offer up to 40% cheaper services with faster onboarding.

4. How much commission is charged to merchants?

Ranging between 1.4% to 2.5% per transaction.

5. Can small startups use this banking model?

Yes, niche-focused banking apps are the fastest growing in fintech.

6. What’s the minimum scale for profitability?

Around 8,000 active users or 2,000 paid subscribers.

7. How to implement this model easily?

Using Banking Solution Clone scripts with pre-built modules.

8. Can AI increase revenue?

Yes—AI-based savings & investment tools improve LTV by 40%.

9. What are alternatives to this model?

Wallet-only, B2B API banking, or subscription-only models.

10. How quickly can these platforms monetize?

With Miracuves – revenue can start within weeks after launch, with a guaranteed delivery timeline of just 3–6 days.