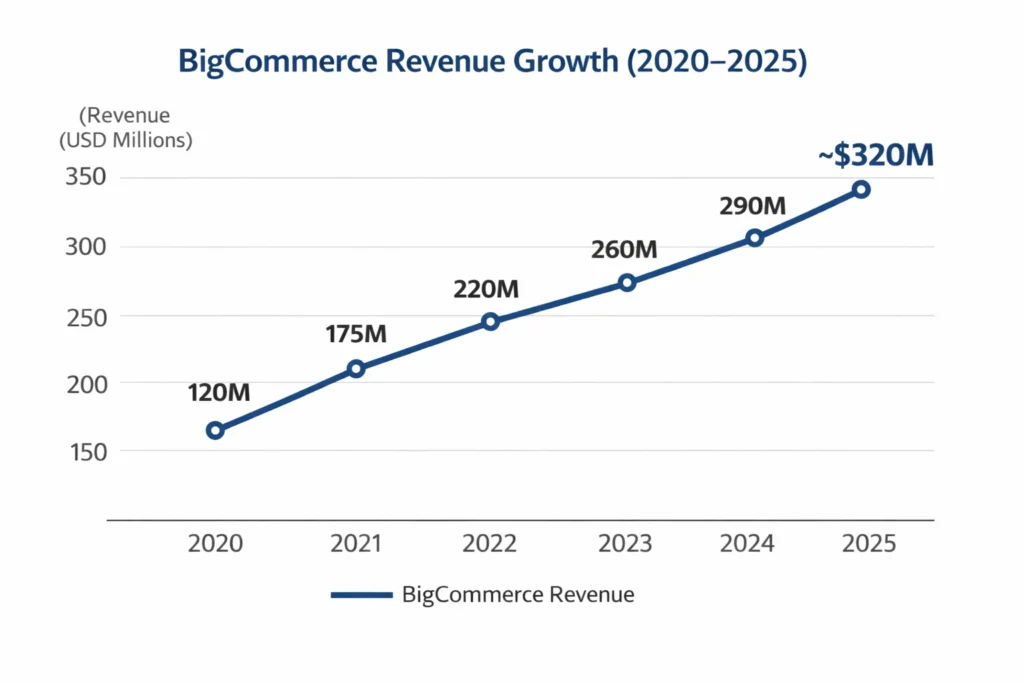

BigCommerce crossed approximately $320 million in revenue in 2025, proving that enterprise-focused SaaS commerce platforms can scale profitably even in a crowded market. Its growth is driven by recurring subscriptions, strong enterprise adoption, and a focus on flexible integrations rather than heavy transaction fees. This approach allows BigCommerce to compete effectively against larger players while maintaining healthy gross margins.

For founders, BigCommerce is a masterclass in subscription-first monetization layered with ecosystem revenue. The platform combines predictable SaaS plans with enterprise contracts, app marketplace commissions, and partner integrations. This layered model increases average revenue per merchant without relying on aggressive pricing or transactional dependency.

Understanding how BigCommerce earns, retains, and expands revenue helps entrepreneurs design predictable, scalable commerce platforms. Built-in upsells, revenue-based plan upgrades, and long-term enterprise relationships create compounding lifetime value. Founders can apply these principles to build platforms that grow alongside their customers rather than extracting value upfront.

BigCommerce Revenue Overview – The Big Picture

| Metric | 2025 Data |

|---|---|

| Total Revenue (2025) | ~$320 million |

| Valuation | ~$1.2–1.4 billion (market-driven) |

| YoY Growth | ~9–11% |

| Primary Markets | North America (65%), Europe (20%), APAC (15%) |

| Gross Margin | ~77–79% |

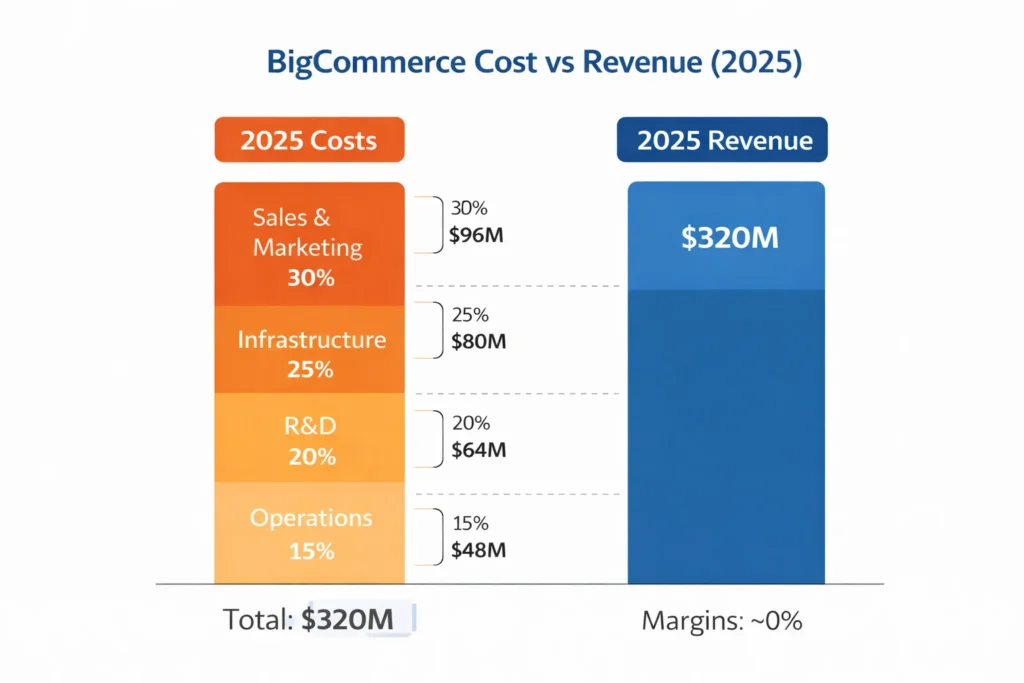

| Net Margin | Near break-even (SaaS reinvestment phase) |

| Core Competitors | Shopify, Magento (Adobe), WooCommerce |

Read More: What is BigCommerce and How Does It Work?

Primary Revenue Streams Deep Dive

Revenue Stream #1: Subscription Plans

- How it works: Monthly or annual SaaS plans based on merchant scale

- Pricing logic: Revenue caps tied to GMV

- Revenue share: ~70%

- 2025 impact: ~$224M

Revenue Stream #2: Enterprise (BigCommerce Enterprise)

- High-GMV merchants with custom contracts

- Annual commitments + support SLAs

- Revenue share: ~15%

- 2025 impact: ~$48M

Revenue Stream #3: App Marketplace Revenue

- Revenue share from third-party apps

- Developer commissions + listing exposure

- Revenue share: ~7%

- 2025 impact: ~$22M

Revenue Stream #4: Payment & Integration Partnerships

- Referral fees from payment gateways, logistics, and SaaS tools

- Revenue share: ~5%

- 2025 impact: ~$16M

Revenue Stream #5: Professional Services

- Migration, onboarding, consulting

- Revenue share: ~3%

- 2025 impact: ~$10M

Revenue Streams Breakdown Table

| Revenue Stream | % Share | 2025 Revenue |

|---|---|---|

| Subscriptions | 70% | ~$224M |

| Enterprise Plans | 15% | ~$48M |

| App Marketplace | 7% | ~$22M |

| Partnerships | 5% | ~$16M |

| Services | 3% | ~$10M |

The Fee Structure Explained

User-Side Fees

- Monthly SaaS subscription

- Revenue cap-based upgrades

- Annual discounts

Merchant-Side Fees

- Platform access fee

- Optional paid apps

- Enterprise contract fees

Hidden Revenue Layers

- App developer commissions

- Partner referral payouts

- Feature-gated upgrades

Regional Pricing Variation

- Higher ARPU in North America

- Discounted tiers for emerging markets

Fee Structure Table

| User Type | Fees Paid | Notes |

|---|---|---|

| Small Merchants | Monthly SaaS fee | Revenue cap enforced |

| Mid-Market | Higher tier subscription | Advanced features |

| Enterprise | Custom annual contract | SLAs + integrations |

| App Developers | Revenue share | Marketplace access |

How BigCommerce Maximizes Revenue Per User

- Segmentation: SMB → Mid-market → Enterprise

- Upselling: Automatic plan upgrades based on GMV

- Cross-selling: Apps, integrations, themes

- Dynamic pricing: Revenue-based plan thresholds

- Retention monetization: Long-term contracts

- LTV optimization: Multi-year enterprise deals

- Psychological pricing: Annual savings incentives

Example: Merchants exceeding revenue limits are nudged to upgrade, increasing ARPU without churn.

Cost Structure & Profit Margins

Key Cost Components

- Infrastructure: Cloud hosting & scaling (~25%)

- Sales & Marketing: CAC-heavy enterprise sales (~30%)

- Operations: Support, compliance (~15%)

- R&D: Platform innovation (~20%)

Unit Economics

- High upfront CAC

- Strong LTV due to long merchant lifecycles

- Margins expand as merchants scale

Read More: Best BigCommerce Clone Scripts 2025 | Scalable Ecommerce SaaS

Future Revenue Opportunities & Innovations

- AI-driven storefront personalization

- Commerce analytics subscriptions

- Headless commerce APIs

- International merchant expansion

- Vertical-specific commerce solutions

Risks:

- Shopify ecosystem dominance

- Open-source competition

Opportunities:

- Enterprise merchants seeking flexibility

- SaaS platforms targeting B2B commerce

Lessons for Entrepreneurs & Your Opportunity

What works

- Subscription-first revenue

- GMV-linked pricing

- Ecosystem-driven monetization

What to replicate

- Revenue caps

- App marketplaces

- Enterprise upsells

Market gaps

- Vertical-specific commerce platforms

- Localized SaaS commerce for emerging markets

Want to build a platform with BigCommerce’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our BigCommerce-style clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

BigCommerce proves that predictable SaaS revenue beats transactional dependency.By relying on subscriptions instead of per-transaction cuts, BigCommerce stabilizes cash flow, reduces revenue volatility, and avoids penalizing merchants as they scale. This predictability makes forecasting easier and supports long-term platform investments.

Its model favors long-term merchant success over short-term fees.Revenue caps, flexible integrations, and enterprise-grade tooling encourage merchants to grow without fear of margin erosion. As merchants succeed, BigCommerce benefits through plan upgrades and enterprise contracts rather than transactional friction.

FAQs

1. How much does BigCommerce make per transaction?

BigCommerce doesn’t charge per transaction; revenue comes from subscriptions.

2. What’s BigCommerce’s most profitable revenue stream?

Recurring SaaS subscriptions.

3. How does BigCommerce’s pricing compare to competitors?

More flexible and enterprise-friendly than most.

4. What percentage does BigCommerce take from providers?

None directly; it uses subscription pricing instead.

5. How has BigCommerce’s revenue model evolved?

Shifted from SMB focus to enterprise-led growth.

6. Can small platforms use similar models?

Yes, especially with tiered subscriptions.

7. What’s the minimum scale for profitability?

Several thousand active merchants.

8. How to implement similar revenue models?

Use GMV-linked plans and ecosystem add-ons.

9. What are alternatives to this model?

Transaction-fee-based or marketplace commissions.

10. How quickly can similar platforms monetize?

Often within the first 30–60 days post-launch.