Binance reportedly crossed $12.1 billion in annual revenue, despite regulatory challenges — proving that crypto platforms can be among the most profitable fintech businesses in the world when structured with the right revenue model.

What makes this even more inspiring? Binance doesn’t own crypto — it facilitates it. Its exchange operates as a revenue engine powered by trading fees, futures, staking, listings, liquidity services and ecosystem products — turning digital transactions into large-scale recurring income.

Why it matters:

Entrepreneurs entering the blockchain space must understand Binance’s business model — because its revenue strategy can be replicated without holding crypto reserves, without mining, and even without a major user base at the beginning. With the right model, even niche exchanges can scale into multi-million-dollar businesses within a year.

This report breaks down how Binance makes money, its revenue streams, cost structure, profit margins, and the exact logic you can use to create your own high-profit crypto exchange — even at a smaller scale.

Binance Revenue Overview – The Big Picture

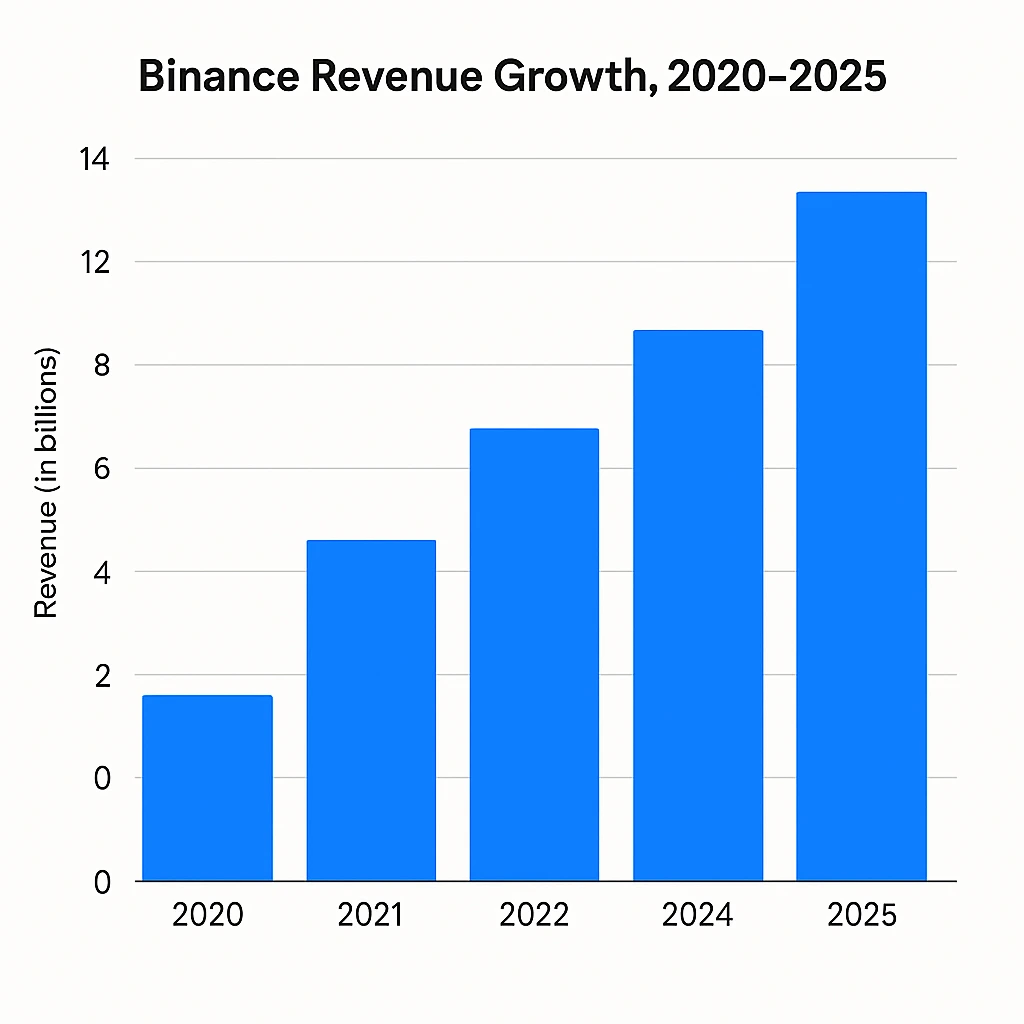

- Estimated Revenue (2025): $13.7 Billion (projected)

- 2024 Revenue: ~$12.1 Billion

- Current Valuation (2025): $78–85 Billion

- User Base: 190+ million registered users

- Year-over-Year Growth: ~14%

- Revenue by Region:

- Asia – 48%

- Europe – 25%

- North America – 18%

- LATAM & Africa – 9%

Profit Margin: ~52–60% (one of the highest in fintech)

Market Position: Largest crypto exchange in terms of volume & liquidity – ahead of Coinbase, Kraken, OKX & Bybit.

Read More: What Is Binance & Want to Know How It Works? Here’s the Breakdown

Primary Revenue Streams – Deep Dive

| Revenue Stream | % Share (2025 est.) | Description |

|---|---|---|

| Trading Fees | 42% | Spot, margin & futures trading fees |

| Futures & Derivatives | 20% | Contract trading, leverage system |

| Listings & IEOs | 12% | Token listing fees & launchpad services |

| Binance Earn / Staking | 10% | Yield products & managed funds |

| Subscription & VIP Services | 6% | API access, advanced tools |

| NFT Marketplace | 3% | NFT trading & creator fees |

| Others (Loans, Card, Ads) | 7% | Binance card, loans, ads, etc. |

Revenue Stream #1 – Trading Fees

- Core revenue engine – spot, futures, margin trading

- Fees range 0.02%–0.1% per trade

- Estimated $5B+ annually in 2025

Revenue Stream #2 – Futures & Derivatives

- Advanced traders = higher fees & leverage trades

- $2.3B+ revenue in 2024

Revenue Stream #3 – Listings & IEOs

- Tokens pay for listing/onboarding

- Fees from $100K to $2M+ per listing

Revenue Stream #4 – Binance Earn

- Staking, lending, savings accounts

- Approx. $1.3B+ annual revenue

Revenue Stream #5 – NFT & Misc Services

- NFT marketplace, cloud infrastructure, ads

- Growing rapidly post-2023 rebound

The Fee Structure Explained

| User Type | Fee Type | Range |

|---|---|---|

| Trader | Spot/Margin Trading | 0.02%–0.1% |

| Futures Trader | Funding & Contract Fee | 0.03%–0.5% |

| Token Creators | Listing Fee | $100k–$2M+ |

| Institutions | API/VIP Services | $400–$3,000 monthly |

| Staking Users | Earn Fee | 1%–3% |

| NFT Sellers | Commission | 1%–2.5% |

User-side Fees – Trading, withdrawal & network fees

Provider-side Fees – Token listing, staking fee, launchpad model

Hidden Layers – Spread pricing, liquidity pool earnings

Regional Pricing – EU/US regulations push premium fees

Read More: Powering Your Startup | A Breakdown of Key Binance Features

How Binance Maximizes Revenue Per User

- Segmentation – Retail vs Institutional traders

- Upselling – Futures, leverage & VIP tiers

- Dynamic Pricing – Volume-based fee reductions

- Cross-Selling – NFT, staking, launchpad

- Retention Tools – Earn, Launchpool, Card

- Price Psychology – Micro-fee model feels negligible

- LTV Optimization – Every user gets monetized uniquely

Real Example (2024):

An average retail trader generated ~$54/year, while advanced traders & institutions generated $1800+ each.

Cost Structure & Profit Margins

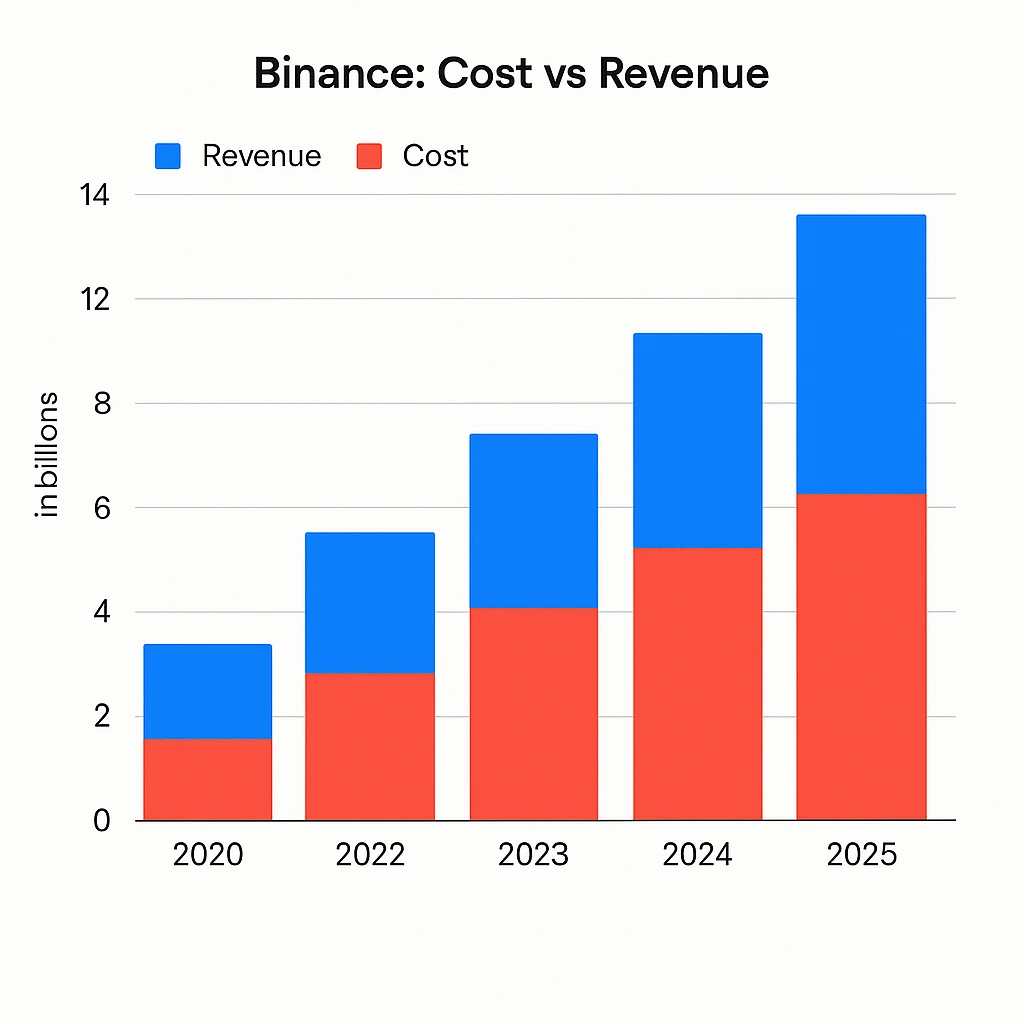

| Cost Component | Estimated Annual Cost (2025) |

|---|---|

| Tech Infrastructure | $1.1B |

| Legal & Compliance | $900M |

| Marketing/CAC | $750M |

| Operations & Support | $300M |

| R&D | $650M |

| Total Cost | ~$3.7B |

Estimated Profit (2025): $10B+

Profit Margin: ~58% – extremely scalable model

Unit Economics: Costs reduce as transaction volume increases

Future Revenue Opportunities – 2025 to 2027

- AI-based trading & robo-advisors

- Tokenized stocks & real-world assets

- Blockchain-based remittances

- CBDC adoption collaboration

- DeFi-integrated services

- Crypto insurance & regulated banking

- API-as-a-service for startups

Risks: Regulation & decentralised alternatives

Opportunity: Web3 finance is still in early phase — new players can dominate micro-niche markets.

Read More: Build an App Like Binance – Full-Stack Guide for Development

Lessons for Entrepreneurs & Your Opportunity

What Worked for Binance

- Low fees, high liquidity

- Trust-building through transparency

- Ecosystem approach (not just trading)

- Easy onboarding & global reach

What You Can Replicate

- Launchpad + Trading combo

- Staking products for retention

- Dynamic pricing & VIP tiers

- Multi-layer revenue generation

Your Opportunity – Build Your Own Binance-Style Platform

Want to build a platform with Binance’s proven revenue model?Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization features. Our Binance clone scripts come with flexible revenue models you can customize. Some clients even see revenue within 30 days of launch — and Miracuves delivers ready-to-launch solutions in 3–9 days guaranteed. If you want it in advanced language script, Miracuves will provide that also. Get a free consultation to map out your revenue strategy.

Final Thought

Crypto exchanges succeed when they understand user behavior, manage liquidity, and scale globally with a strong monetization model. The opportunity is still open — but how you structure the platform determines whether it becomes profitable or just another tech launch.

That’s where Miracuves becomes a strategic advantage, not just a development partner. Instead of starting from zero, you get a proven Binance-style revenue architecture, modular fee systems, staking modules, liquidity features, and a compliance-ready backend — all prebuilt.

If you want to launch fast, test revenue models early, and scale with confidence — Miracuves gives you a head start that competitors never get.

And remember: Miracuves delivers ready-to-launch solutions in just 3–9 days, meaning your market entry could be faster than fundraising.

FAQs

1. How much does Binance make per transaction?

Around 0.02%–0.1% depending on trade type & volume.

2. What’s Binance’s most profitable revenue stream?

Trading fees & derivatives trading (over 60% of total revenue).

3. How does Binance’s pricing compare to competitors?

It is lower than Coinbase, Kraken, and Gemini, which helps attract more global traders — and with Miracuves, you can build a similar crypto trading platform starting at just $2899.

4. What percentage does Binance take from providers?

1%–3% commission + listing fees + withdrawal spreads.

5. How has Binance’s model evolved over time?

From only trading to now staking, NFTs, API services & token launches.

6. Can small platforms use similar models?

Yes — micro-niche exchanges are growing fast in 2025.

7. What’s the minimum scale for profitability?

Around 100K active traders with a $20M monthly volume.

8. How to implement similar revenue models?

Start with trading + staking → then expand to derivatives & launchpads.

9. What are alternatives to Binance’s model?

DEX model, subscription-based trading, tokenized assets & AI trading.

10. How quickly can similar platforms monetize?

With Miracuves — within 3–9 days guaranteed, not months or years.