Brex began as a simple corporate card solution for startups but quickly evolved into a multi-billion-dollar finance platform combining smart credit, expense automation, budgeting, and cash management. By 2025, Brex was serving thousands of high-growth companies and processing billions in corporate spend every month — proving that modern businesses prefer intelligent, software-driven financial tools over traditional banking systems.

In 2026, the global corporate spend management market crossed $35 billion, fueled by remote teams, SaaS-driven operations, and the need for real-time financial control. Entrepreneurs now have a massive opportunity to launch niche corporate finance platforms targeting startups, SMEs, agencies, logistics firms, and global teams.

Understanding the Brex Clone model is vital because it combines credit underwriting, virtual cards, spend tracking, approvals, automated accounting, multi-currency support, and team-level controls — features essential for modern business finance ecosystems.

A powerful Brex Clone Script accelerates your entry into this market, enabling you to launch a secure, intelligent, and scalable corporate finance platform. With Miracuves Clone Solutions, founders get a 2026-ready architecture optimized for spend management, risk scoring, corporate credit workflows, and real-time analytics.

What Makes a Great Brex Clone?

A great Brex Clone in 2026 is far more than a digital corporate card system. It must function as an end-to-end corporate finance stack, combining credit, spend controls, accounting automation, approval workflows, virtual cards, and real-time insights. Modern companies rely on financial clarity and speed — which means your Brex-style platform must be engineered for accuracy, stability, and enterprise-level security.

Founders entering this space must understand that corporate spend management involves rapid transactions, multi-user access, dynamic budgets, and continuous syncing with accounting systems like QuickBooks, Xero, Zoho Books, and NetSuite. Any delay or miscalculation can disrupt a company’s workflow. A well-built Brex Clone handles all of this through sub-300ms response times, 99.9 percent uptime, and multi-layer security across users, teams, cards, and transactions.

In 2026, companies expect features like AI-based spend categorization, smart approvals, multi-currency support, fraud detection, audit trails, and global virtual cards — all delivered through a simple, well-designed interface. This makes performance, scalability, and compliance the foundation of a high-quality Brex Clone.

Key Elements of a Great Brex Clone (2026)

- AI-powered spend categorization and anomaly detection

- Virtual and physical corporate cards (with custom controls)

- Real-time dashboards for budgets, teams, and departments

- Automated accounting sync (QuickBooks, Xero, NetSuite, Zoho Books)

- Multi-currency support for global teams

- Approval workflows with tiered permissions

- Credit underwriting engine for corporate limits

- Travel and expense automation

- Advanced reporting, audit logs, and compliance tools

- Microservices architecture for instant scalability

Comparison Table: Modern Brex Clones and Their Differentiators

| Feature Category | Basic Spend Tool | Advanced 2026 Spend Tool | Miracuves Brex Clone Script |

|---|---|---|---|

| Virtual Cards | Limited | Yes | Unlimited virtual cards with controls |

| Credit & Underwriting | Basic | Semi-automated | AI-based underwriting engine |

| Spend Controls | Basic limits | Custom rules | Department-, team-, and project-level controls |

| Performance | 500–800ms | 350–450ms | Under 300ms optimized |

| Accounting Integrations | Partial | Full | Real-time sync with major accounting systems |

| Fraud Detection | Limited | Rules-based | AI-powered anomaly detection |

| Scalability | Up to 100K users | Up to 500K | Multi-million user support |

| Security | Basic | AES-256 | Multi-layer enterprise-grade security |

Essential Features Every Brex Clone Must Have

A Brex-style platform is built on three powerful layers — the company layer (admin), the employee layer (users), and the financial engine (core system). Each must work flawlessly to deliver instant spending control, intelligent expense management, automated accounting, and real-time visibility. Unlike traditional banking systems, a Brex Clone must behave like intelligent software — proactive, automated, and deeply integrated with business workflows.

Corporate spend is fast, high-volume, and multi-directional. Teams generate expenses from travel, SaaS tools, subscriptions, office operations, marketing, logistics, and remote tasks. A modern Brex Clone must therefore automate classification, detect anomalies, enforce budgets, and sync transactions instantly across all systems. In 2026, businesses expect financial tools that eliminate spreadsheets, reduce fraud, and simplify payment operations across distributed teams.

Below is a breakdown of the essential features across all three layers, followed by advanced capabilities and technical requirements.

Employee-Side Features

Employees need simple tools that allow payments while maintaining accountability.

- Virtual and physical corporate cards

- Employee dashboards showing limits, spend history, and reimbursements

- Real-time notifications for transactions

- Mobile receipt upload and OCR-based extraction

- Travel and expense (T&E) workflows

- Subscription and SaaS expense tracking

- Auto-categorization of expenses

- Multi-currency support for international payments

Company/Admin Features

Administrators need total control, visibility, and compliance.

- Create, edit, and manage unlimited virtual cards

- Set department-, team-, project-, or vendor-specific spending limits

- Real-time budget dashboards

- Custom approval workflows

- Role-based access control

- Settlement and payout configuration

- Fraud detection and anomaly alerts

- Automated reimbursement cycles

- Vendor management and recurring payment tracking

- Comprehensive audit logs

Financial Engine (Core System)

This is the heart of the Brex Clone — it drives automation, accuracy, and compliance.

- AI-powered categorization of expenses

- Auto-sync with accounting systems (QuickBooks, Xero, NetSuite, Zoho Books)

- Rule-based approval triggers

- Credit underwriting engine for corporate limits

- Advanced reporting, financial statements, and export options

- API integrations for banks, FX providers, and payment gateways

- Ledger system for multi-currency management

Advanced Features for 2026

- AI anomaly detection for suspicious transactions

- Smart insights on team overspending or recurring waste

- Real-time FX conversion for global teams

- Automated travel reporting (flights, hotels, per diem)

- Policy-based spending recommendations

- Global virtual card issuance

- OTP or biometric-based high-value transaction verification

- Carbon footprint dashboard for sustainability reporting

Technical Architecture Requirements

To support real-time corporate-level expense flows, the architecture must be robust.

- Microservices for scalability across teams and departments

- High-speed APIs ensuring sub-300ms transaction processing

- Auto-scaling cloud infra for large expense volumes

- AES-256 encryption and tokenized card transactions

- 99.9% uptime with multi-zone redundancy

- PCI-compliant architecture for card operations

- Real-time synchronization with accounting systems

- Event-driven backend for instant notifications and approvals

Feature Comparison Table: Basic vs Professional vs Enterprise

| Feature Set | Basic | Professional | Enterprise |

|---|---|---|---|

| Virtual Cards | Yes | Yes | Unlimited + advanced rules |

| Expense Categorization | Manual | Automated | AI-powered with anomaly detection |

| Accounting Sync | Limited | Full sync | Advanced multi-system sync |

| Spend Controls | Basic limits | Team-level | Department-, vendor-, and rule-based |

| Underwriting | Not included | Basic | AI underwriting engine |

| Travel & Expense | Limited | Standard | Full T&E suite |

| Fraud Detection | Basic | Moderate | Intelligent AI-driven detection |

| Scalability | Up to 50K users | Up to 500K | Multi-million enterprise |

How Miracuves Implements These Features

Miracuves builds Brex Clone platforms with:

- A modular microservices-based architecture

- AI-powered spend intelligence

- Full card issuance & virtual card workflows

- Cloud-native scaling for high-volume spend

- Real-time accounting sync engines

- Enterprise-grade security and encryption

- End-to-end customization options

- Delivery timelines within 30–90 days

Cost Factors & Pricing Breakdown

Brex-Like Corporate Cards & Spend Management Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Core Corporate Spend MVP | Business onboarding, virtual corporate cards, spend limits, transaction tracking, and a simple admin panel. | $80,000 |

| 2. Mid-Level Spend Management Platform | Expense categorization, approval workflows, budgeting controls, real-time notifications, reimbursements, and analytics dashboards. | $180,000 |

| 3. Advanced Brex-Level Platform | Credit underwriting logic, physical & virtual cards, policy automation, accounting integrations, compliance workflows, fraud controls, and enterprise-grade scalability. | $350,000+ |

These figures represent the typical global investment required to build a modern corporate cards and spend-management platform similar to Brex, focused on control, automation, and finance-team efficiency.

Miracuves Pricing for a Brex-Like Platform

Miracuves Price: Starts at $15,999

This package includes a complete corporate spend foundation with business onboarding, card-ready architecture, expense and approval workflows, budgeting controls, compliance-oriented logic, and a centralized admin dashboard — built for scalable B2B finance operations.

Note:

Includes full non-encrypted source code, backend/API setup, admin configuration, frontend dashboard integration, and deployment assistance — allowing you to launch a fully branded Brex-style spend platform under your own ownership.

Launch Your Brex-Style Corporate Spend Platform — Contact Us Today

Delivery Timeline for a Brex-Like Platform with Miracuves

Delivery depends on scope and configuration, including:

- Card issuing and credit logic depth

- Expense rules and approval hierarchies

- Accounting and ERP integrations

- Compliance, KYC, and regulatory requirements

- Reporting and admin control depth

- Branding and UI/UX customization

Tech Stack

Built using a JS-based architecture, ideal for corporate finance and spend-management platforms that require secure transaction handling, scalable APIs, real-time controls, and enterprise-level reliability.

Customization & White-Label Option

Building a Brex-style corporate card + spend-management + financial-operations platform isn’t just about issuing cards — it’s about creating a complete financial OS for businesses. A platform inspired by Brex must combine corporate credit, automated expense workflows, multi-team controls, real-time tracking, budgeting tools, reimbursements, and compliance — all wrapped in a clean, modern UX designed for founders, CFOs, and finance teams.

Miracuves delivers a fully white-label Brex-style solution that can be customized for neobanks, fintech startups, B2B finance platforms, SME tools, ERP-integrated expense systems, or corporate card providers. Every module — from card management to multi-entity finance — can be shaped around your business model and regulatory region.

Why Customization Matters

Corporate finance platforms vary widely based on:

- Regulatory zones (card issuing rules differ by country)

- Business segments (startups, SMEs, mid-market, enterprises)

- Credit rules & underwriting

- Accounting standards

- Multi-entity or remote-team financial operations

- Integrations required (ERP, HRMS, payroll, banks)

Customization ensures your Brex-style platform fits your customers, your compliance scope, and your financial product strategy — not a rigid template.

What You Can Customize

1. UI/UX & Corporate Dashboards

- Multi-level dashboards (Admin, Finance Team, Employee)

- Modern business-grade UI in your brand identity

- Insights: spend trends, budgets, team analytics

- Navigation optimized for finance workflows

2. Corporate Cards & Controls

- Virtual & physical card issuance rules

- Spend limits (daily, monthly, per-merchant)

- Category restrictions

- One-time cards or subscription-linked cards

- Freeze/unfreeze, pin management, replace card

- Multi-currency support (region-dependent)

3. Expense Management System

- Automated receipt capture

- Auto-matching expenses to transactions

- Team budgets

- Custom approval workflows

- Reimbursements

- Tagging, notes, department mapping

- Policy engine for compliance

4. Credit, Risk & Underwriting Logic

- Cash-flow–based underwriting (Brex style)

- Bank-balance logic

- Revenue-based scoring

- Risk tiers and dynamic spending limits

- Fraud detection and anomaly checks

- Suspension/velocity rules

5. Multi-Entity & Team Structure

- Parent account → subsidiaries → departments → employees

- Separate cards, budgets, and reporting structures

- Multi-country entity support

- Consolidated finance reports

6. Accounting & ERP Integrations

- QuickBooks, Xero, NetSuite, Zoho

- Export mappings for journal entries

- Automated ledger entries

- Receipts & expense categorizations

- Tax/GST/VAT mapping

7. Payments & Banking Layer

- Bill pay module

- Vendor management

- ACH/SEPA/UPI/bank transfers (region-dependent)

- Approval flows for vendor payouts

8. Rewards & Benefits Engine

- Cashback rules

- Merchant partnerships

- Tier-based membership

- Category-wise reward optimization

9. Security, Compliance & Admin

- Role-based access

- Audit trails

- KYC/KYB onboarding

- AML screening

- Device security & encryption

10. Extensions & Integrations

- CRM tools

- HRMS for employee sync

- Travel systems

- Analytics platforms

- Custom API layer for partners

How Miracuves Handles Customization

- Requirement Mapping

We define your target business segment, regulatory region, card model, and spend-management depth. - Architecture Planning

Modular framework: onboarding → cards → expense engine → budgets → payouts → reporting. - Design & Development

UI branding, card logic, approval workflows, integrations, and custom finance operations built to spec. - Testing & Quality Assurance

Compliance checks, transaction simulations, budget rule validation, ERP sync testing, and security audits. - Deployment

Fully white-labeled corporate spending platform rolled out with your domain, branding, and operational setup.

Real Examples from the Miracuves Portfolio

Miracuves has delivered 600+ fintech and business-finance systems, including:

- Corporate expense & card-management products

- ERP-integrated finance automation tools

- Multi-entity budgeting & approval platforms

- Digital banking tools for SMEs & enterprises

- White-label business finance dashboards

These successes show how a Brex-style concept can be transformed into a powerful, enterprise-ready financial operations platform fully aligned with your brand and product strategy.

Launch Strategy and Market Entry

Launching a Brex-style corporate finance platform requires more than strong technology — it requires precision, compliance readiness, and a strategic rollout. Corporate spend platforms impact daily operations, so your product must build trust from day one. A well-planned launch reduces onboarding friction, increases adoption among finance teams, and positions your platform as a reliable financial partner rather than a simple tool.

A Brex Clone must therefore go through structured phases: pre-launch setup, controlled onboarding, public launch, and scale-up. Each stage validates your system under real usage conditions and ensures stability before expanding.

Pre-Launch Checklist

Before onboarding your first company, the platform must be production-ready, secure, and compliant.

- Complete end-to-end testing across employee, admin, and accounting flows

- Validate card issuance and virtual card provisioning workflows

- Configure KYC/KYB flows for companies and employees

- Test approval chains, spend rules, and policy automation

- Confirm accounting integrations (QuickBooks, Xero, NetSuite, Zoho Books)

- Set up FX, multi-currency, and reconciliation logic

- Prepare KPI dashboards for finance teams and founders

- Build App Store and Play Store versions for mobile expense submission

- Train internal support and finance teams on admin-level controls

Regional Entry Strategies

Corporate finance behavior varies by geography. Tailoring your approach gives faster adoption.

Asia (India, Singapore, Indonesia)

- Target startups, agencies, IT firms, SMEs with large SaaS and travel spend

- Offer strong subscription and vendor management tools

- Highlight virtual cards for recurring SaaS expenses

MENA (UAE, Saudi Arabia, Qatar)

- Focus on mid-market companies and high-spend sectors

- Highlight multi-currency features for global payments

- Offer compliance-focused reporting and approval flows

Europe

- Integrate strong compliance, VAT handling, and multi-entity structures

- Offer open banking-linked data for smoother underwriting

- Highlight sustainability dashboards and audit trails

United States

- Focus on SaaS-heavy startups, agencies, logistics, and eCommerce brands

- Promote advanced underwriting models inspired by Brex-style credit

- Integrate payroll and HRMS tools for expense-related automation

User Acquisition & Growth Frameworks

Corporate finance platforms scale through trust, value, and operational benefit.

- Offer free onboarding audits to help companies clean up existing spend flows

- Implement referral incentives for founders and finance teams

- Partner with coworking spaces, accelerators, and startup communities

- Use case studies demonstrating cost savings and operational efficiency

- Add loyalty and reward programs tied to card usage

- Promote virtual card workflows for SaaS tools and subscriptions

- Use targeted LinkedIn campaigns for finance leaders and founders

Proven Monetization Models for 2026

Corporate spend platforms generate recurring and transactional revenue.

- Interchange revenue from card transactions

- Subscription fees for advanced analytics, multi-entity control, or AI modules

- FX conversion margins for international transactions

- Vendor cashback or partner offers

- Custom corporate card programs with tailored credit lines

- Premium onboarding and consulting services

With strong usage, interchange plus subscriptions can create highly predictable monthly revenue.

Miracuves End-to-End Launch Support

Miracuves ensures your Brex-style platform reaches market smoothly through structured support.

- Infrastructure and server optimization for heavy spend traffic

- API configuration for card issuance, banking, accounting, and KYC

- Support with App Store / Play Store submission

- Assistance with credit workflows and underwriting configuration

- Early-stage monitoring of spend, approvals, and fraud signals

- Optimization based on initial user behavior

- Guidance on segmentation, positioning, and early merchant partnerships

With a Miracuves-powered Brex Clone and a well-executed launch strategy, founders can go from concept to live corporate finance platform within 30–90 days, positioned to scale confidently.

Why Choose Miracuves for Your Brex Clone

In corporate finance, your technology platform becomes the heartbeat of a company’s daily operations. If a card gets declined without reason, an approval flow breaks, or an expense fails to sync into accounting, it is not just an inconvenience — it affects payroll, vendor relationships, and leadership trust. That is why choosing a development partner for your Brex-style platform is more than a technical choice. It is a strategic decision about reliability, speed, and scale.

Miracuves is built specifically for founders who want to enter the spend management and corporate card space with confidence. Instead of experimenting with untested architectures, you get a platform framework that has already been proven across multiple fintech categories — lending, BNPL, neobanking, and card-based products. The Miracuves Brex Clone foundation is engineered to handle real-world load, multi-team usage, and high transaction volumes without compromising performance or user experience.

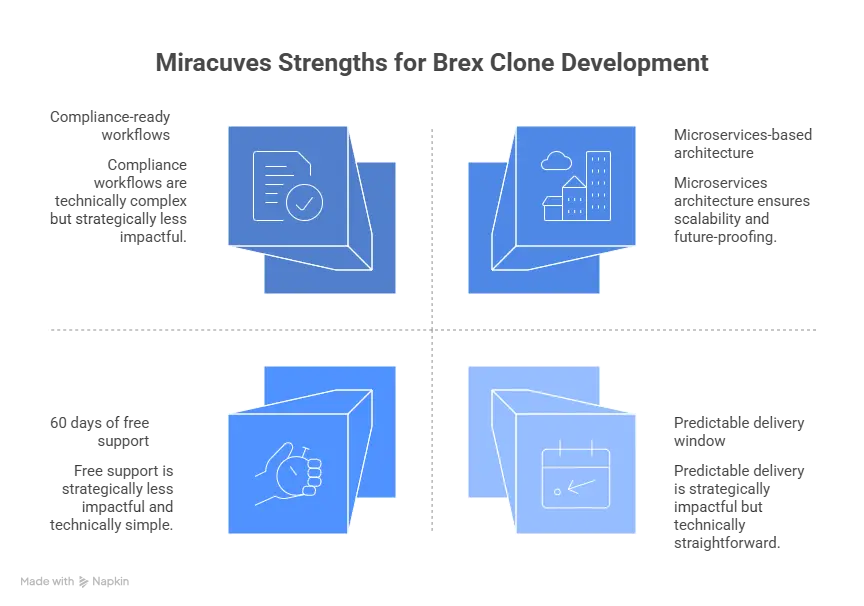

Key Strengths of Miracuves for Brex Clone Development

- 600 plus successful deployments across fintech, card, lending, and neobank ecosystems

- Predictable 30–90 day delivery window for a complete, production-ready Brex-style platform in 2026

- Full source-code ownership so you are not locked into a SaaS or vendor-dependent model

- 60 days of free post-launch support for stabilization, optimization, and feature fine-tuning

- Microservices-based, future-proof architecture designed to support global scaling and multi-entity structures

- Performance engineered for sub-300ms response times and 99.9 percent uptime even under high transaction loads

- Compliance-ready workflows that can align with your regional regulations, card partners, and banking relationships

Short Success Stories and Transformations

A startup-focused corporate card platform

A founder targeting early-stage startups wanted a Brex-style solution with strong SaaS and marketing spend tracking. Miracuves customized its Brex Clone engine to include project-level budgets, virtual cards for individual SaaS tools, and real-time subscription analytics. Within the first six months, the platform onboarded dozens of startup clients and became their primary spend control tool.

An agency and services spend platform

A digital agency group needed a way to separate spending by client, campaign, and project while still using centralized company credit. Miracuves implemented client-level virtual cards, project tags, and campaign-based reporting on top of its Brex-style architecture. Finance teams could finally see which clients and projects were driving the most spend, and optimize margins accordingly.

A logistics and fleet expense management system

A logistics operator wanted to control fuel, toll, and maintenance expenses across hundreds of vehicles. Using the Miracuves Brex Clone foundation, the platform was tailored to include driver-level cards, route-based spend rules, and real-time alerts for out-of-policy transactions. The result was a measurable reduction in leakages and significantly improved visibility for operations and finance.

Final Thought

The corporate finance ecosystem is transforming rapidly. Companies now expect real-time visibility, intelligent card controls, automated accounting, and a unified system that eliminates financial friction. The Brex model has already proven that when software meets financial infrastructure, businesses gain unmatched clarity and control — and founders gain a massive opportunity to build platforms that become central to daily operations.

In 2026, launching a Brex-style platform is not just about building a product. It is about creating a financial backbone for modern teams — remote, global, fast-moving, and increasingly digital. A well-engineered Brex Clone accelerates your ability to enter this market without the typical multi-year development cycle or the heavy cost of building financial infrastructure from scratch. With Miracuves, you gain a platform that is secure, scalable, compliant, and optimized for real-world usage. From underwriting to virtual cards, spend controls to accounting sync, your product is built to function like a mature, enterprise-grade finance system — even on day one. And with a predictable 30–90 day launch timeline, you can move faster than most competitors while staying in full control through complete source-code ownership.

The next generation of corporate finance leaders will be those who combine strong product thinking with reliable technology execution. Miracuves empowers you to do exactly that — launch faster, scale smarter, and build a long-term financial platform that companies trust.

Ready to launch your Brex Clone and build a serious corporate finance and spend management platform in 2026? Get a free consultation and detailed project roadmap from Miracuves — trusted by 200 plus entrepreneurs worldwide for high-performance fintech and corporate card solutions.

FAQs

How quickly can Miracuves deploy my Brex Clone?

Miracuves can deploy a complete, production-ready Brex-style platform within a 30–90 day window, including setup, customization, integrations, compliance workflows, and go-live preparation.

What’s included in the Miracuves Brex Clone package?

You receive employee and admin dashboards, virtual card workflows, spend controls, underwriting engine, accounting sync, approval rules, backend system, APIs, documentation, and deployment support.

Do I get full source-code ownership?

Yes. Miracuves provides 100% full source-code ownership, ensuring long-term independence with no recurring licensing or vendor lock-ins.

How does Miracuves ensure scalability for corporate finance platforms?

Miracuves uses microservices architecture, auto-scaling cloud servers, sub-300ms API performance, and enterprise-grade security, supporting multi-million-user ecosystems effortlessly.

Does Miracuves help with app store approval?

Yes. Miracuves assists with Play Store and App Store submissions, build checks, guideline compliance, and deployment readiness for mobile expense apps.

Is post-launch support included?

Yes. Miracuves includes 60 days of free post-launch support for monitoring, optimization, debugging, and ensuring stable operations during the early usage phase.

Can Miracuves integrate custom payment gateways or card issuers?

Absolutely. Miracuves supports integrations with banking APIs, virtual card issuers, payment gateways like Stripe, Razorpay, PayPal, and region-specific providers.

What is the upgrade and update policy?

Miracuves offers optional upgrades for new features, enhanced analytics, AI engines, multi-currency modules, deeper accounting sync, and extended administrator tools.

How does white-labeling work for the Brex Clone?

Your platform is fully branded with your logo, colors, domain, messaging, and identity — including dashboards, emails, notifications, and mobile apps — with no external branding.

What ongoing support can I expect after launch?

You receive optional ongoing maintenance, server monitoring, security updates, feature enhancements, API adjustments, AI upgrades, and dedicated developer assistance as needed.

Related Articles

- Best Nubank Clone Scripts 2025: Build the Future of Digital Banking

- Best Razorpay Clone Scripts 2025: Build Your Own Payment Gateway Platform

- Best Betterment Clone Scripts 2026 for Automated Investing Platforms

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Groww Clone Scripts 2026: Launch a Powerful Investment & Trading Platform Fast

- Best Acorns Clone Scripts 2025 – Launch Your Micro-Investing App Fast