If you’ve ever stared at your screen, wondering how crypto projects manage to raise millions before even launching a product — you’re not alone. The Initial DEX Offering (IDO) space has exploded, and decentralized IDO launchpads are the magic carpet rides for many blockchain startups. But here’s the kicker — while everyone’s buzzing about tokens and fundraising, hardly anyone talks about how these launchpads themselves make money. Weird, right?

As a creator, founder, or startup enthusiast, it’s natural to dream about launching the next Moj of the blockchain world. But dreams need fuel — aka revenue. You can’t just ride the DeFi wave and hope to stay afloat. You need a solid, scalable, and creative revenue model. This blog isn’t another “What is an IDO” yawner. We’re diving into the heart of how decentralized IDO launchpads actually sustain and thrive.

At Miracuves, we help bold thinkers turn brilliant ideas into launch-ready platforms — complete with business logic, scalability, and monetization strategies. So if you’re ready to uncover the cashflows behind IDO platforms, let’s roll.

What is a Decentralized IDO Launchpad, Really?

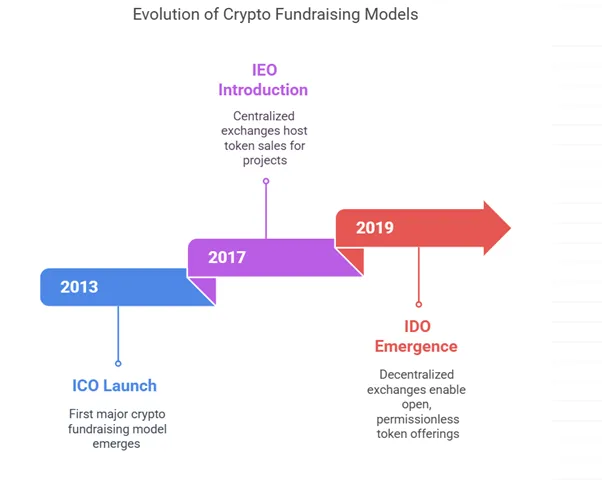

An IDO launchpad is a platform that allows crypto projects to launch tokens and raise funds from the public in a decentralized way — usually via a DEX (Decentralized Exchange). These platforms are often hosted on blockchains like Ethereum, Binance Smart Chain, Solana, or Polygon.

But this isn’t just crowdfunding with a Web3 twist. It’s a full-stack fundraising protocol with tokenomics, smart contracts, KYC (in some cases), wallet integrations, staking, and liquidity pools. Examples? Think of platforms like Polkastarter, DAO Maker, or TrustPad. These aren’t hobby projects — they’re million-dollar platforms with powerful business engines humming underneath.

Why Monetization Matters in a Decentralized Setup

Let’s kill the myth: “If it’s decentralized, it can’t generate revenue.” Nope. Decentralization just means no single party owns all the power — but value can (and should) still flow.

Without revenue, you’re just hosting a flashy token faucet for broke founders. You need strategies that reward liquidity providers, incentivize governance participants, and keep the lights on — all while respecting decentralization.

Breakdown: Top Revenue Streams for Decentralized IDO Launchpads

1. Token Listing Fees

Startups pay a listing fee in native tokens or stablecoins to get launched. Depending on platform reputation, this can range from $10K to $500K+. These fees often include advisory services, smart contract audits, marketing shoutouts, and liquidity setup.

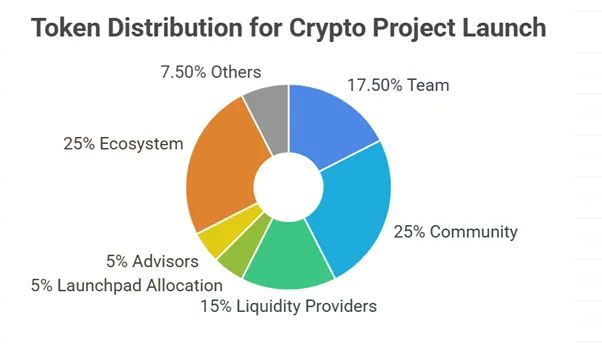

2. Token Allocation & Vesting

Launchpads often keep a % of the project tokens — think 1-5%. These tokens are vested over months or years, aligning platform incentives with long-term success. When the token moons, so does your wallet.

3. Staking & Locking Rewards

Many launchpads require users to stake native tokens (like POLS, DAO, or TRUST) to access sales. These tokens are locked, reducing circulating supply — which helps price and increases demand. Some platforms also take staking fees or use it as liquidity for farming.

4. Swap & Liquidity Fees

By integrating their own DEX or through partnerships (like PancakeSwap or Uniswap), launchpads can earn swap fees when users trade the launched token. Sometimes, they act as LPs (liquidity providers) and rake in additional yield.

5. Launch Tiers & Premium Access

Want early access to that hyped AI project’s presale? Better be a “Gold” or “Diamond” tier user. Platforms create tiered systems based on staking amounts or holding durations — and often charge membership or access fees.

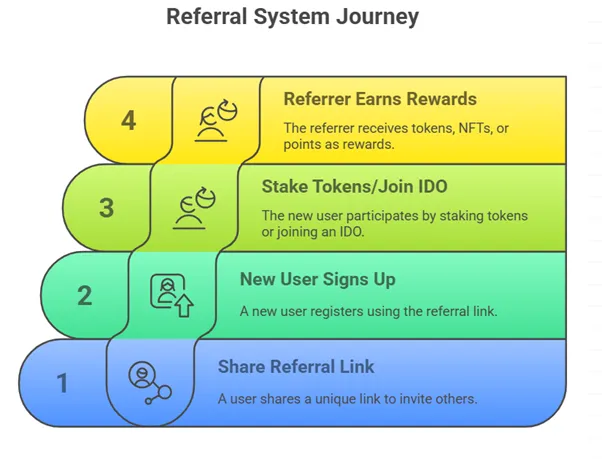

6. Affiliate & Referral Bonuses

Savvy platforms turn users into marketers with affiliate rewards. Every new wallet that signs up through a referral link could earn the referrer a % of fees, tokens, or even NFTs.

7. Governance Proposal Fees

Some launchpads charge a fee for submitting governance proposals — especially on DAOs. This discourages spam while creating a subtle monetization channel that aligns with community curation.

Examples of Launchpads Nailing Monetization

| Platform | Revenue Sources | Unique Twist |

|---|---|---|

| Polkastarter | Listing fees, token allocation, KYC tiers | Strict vetting → high trust |

| DAO Maker | Social mining, token allocations | Community-driven incentives |

| TrustPad | Multi-chain support, affiliate fees | Flexible staking model |

| Seedify | NFT & GameFi focus | Incubation + Launchpad hybrid |

Future-Proofing the Revenue Engine

Let’s talk trends. As Web3 matures, users demand more utility and trust.

- Cross-chain Compatibility: The more chains you support (Solana, Arbitrum, Base), the more projects you attract.

- AI Project Launches: AI x Web3 is heating up. Launchpads that cater to these niches can charge more.

- Regulatory-Compliant Launches: Platforms offering light KYC/AML filters gain trust — and get premium clients.

Monetization Mistakes to Avoid

- Overcharging Early-Stage Projects: Kills long-term pipeline.

- Underpricing Premium Services: Leaves revenue on the table.

- Ignoring Community Incentives: Your biggest marketers are users — empower them.

- Neglecting Token Utility: No one wants deadweight tokens.

Read More : How to Develop a Revenue Model for a Decentralized IDO Launchpad

Conclusion

Building a decentralized IDO launchpad isn’t just about tech — it’s about economy design. The revenue model is the engine, not an afterthought. From token allocations and staking to premium access and referral programs — each lever can help create sustainable growth.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

1.What is the most common way IDO launchpads make money?

Through listing fees, token allocations, and staking rewards. These ensure both upfront and long-term revenue.

2.Do decentralized launchpads charge for listing?

Yes, most charge a fixed or dynamic fee based on services offered and project size.

3.Can launchpads earn from token trading?

Absolutely! Platforms often earn via liquidity provision or swap fees through integrated DEXs.

4.Are staking tokens required for users?

In many launchpads, staking is essential to access token sales and achieve higher allocation tiers.

5.How do affiliate systems work in IDO launchpads?

Users refer others using custom links and earn rewards based on referrals’ activity — like participation or purchases.

Related Articles :