Adyen didn’t become one of the world’s most trusted payment infrastructure companies by chasing hype—it scaled by quietly becoming the backbone of modern commerce. The business model of Adyen is built around one powerful idea: give global businesses one unified platform to accept payments anywhere, manage risk, and optimize checkout performance across every channel.

In 2026, Adyen stands out because it doesn’t operate like a typical payment gateway. It runs a full-stack model where payment processing, acquiring, fraud tools, and data insights work together inside a single system. This creates higher reliability, better authorization rates, and smoother customer experiences

For entrepreneurs and founders, studying how Adyen works is valuable because it shows how infrastructure-led platforms win long-term. Instead of depending on ads or subscriptions, Adyen scales with transaction volume and customer growth. And for businesses building fintech, marketplace, or enterprise-grade platforms, Miracuves helps turn these proven models into scalable real-world products with secure architecture and growth-ready design.

How the Adyen Business Model Works

Adyen is not just a “payment gateway.” It is a global payments infrastructure platform that helps businesses accept, process, and optimize payments across online, in-app, and in-store channels—through one unified system. In simple terms, Adyen makes money when merchants successfully process transactions, but its real strength is how it improves payment success rates and reduces complexity for large-scale brands.

Core Framework of the Adyen Business Model

1) Type of Business Model

Adyen follows a B2B payments infrastructure + enterprise fintech platform model, often categorized as:

- Payments-as-a-Service (PaaS)

- Full-stack payment processing

- Unified commerce model (online + offline payments)

- Hybrid model: Payment processing + risk + data optimization tools

Unlike many players that rely on multiple third parties, Adyen controls more layers of the payment flow, which helps it deliver better performance and consistency.

2) Value Proposition (Who Gets What Value?)

Adyen creates value for different user segments in the ecosystem:

For Merchants (Brands & Businesses):

- Higher payment success rate (better authorization)

- Faster, smoother checkout experience

- One integration for global payments

- Reduced payment failures and fraud

- Unified reporting for online + offline sales

For Customers (End Users):

- Faster payments with fewer errors

- More payment options (cards, wallets, local methods)

- Secure transactions with less friction

For Partners (Platforms & Tech Ecosystem):

- Strong APIs for integration

- Payment tools that scale across markets

- Support for marketplace payouts and complex payment routing

3) Key Stakeholders in the Ecosystem

Adyen’s ecosystem works because it balances multiple stakeholders:

- Merchants: Enterprise businesses processing high volumes

- Consumers: People paying via cards, wallets, BNPL, etc.

- Banks / Card Networks: Visa, Mastercard, issuing banks, acquiring relationships

- Regulators: Compliance, KYC/AML, regional payment rules

- Technology partners: POS systems, ecommerce platforms, fraud tools, reporting layers

Adyen’s job is to make the whole system feel “simple” for merchants while handling the complexity behind the scenes.

4) Evolution of the Model (How It Changed Over Time)

Adyen started as a payment processor focused on simplifying fragmented payment systems. Over time, it evolved into a full-stack unified commerce platform by adding:

- Global acquiring capabilities

- Risk management and fraud prevention

- In-person payments (POS + terminals)

- Marketplace payout infrastructure

- Data-driven payment optimization

- Enterprise-level reliability and compliance

This evolution made Adyen stronger in 2026 because businesses want fewer vendors and more control.

Read more : What is Adyen App and How Does It Work?

Target Market & Customer Segmentation Strategy

Adyen’s growth is powered by one clear focus: it targets businesses where payments are not just a “feature,” but a revenue-critical system. Instead of trying to serve everyone, Adyen scales by working with brands that process high transaction volumes, operate globally, and care deeply about checkout performance, fraud control, and payment reliability. This focus makes the Adyen business model highly efficient, because the platform grows naturally as its merchants grow.

Who Uses Adyen? (Primary + Secondary Segments)

Primary Customer Segments (Core Buyers)

Adyen mainly serves mid-market to enterprise companies, such as:

- Global ecommerce brands

- Digital-first marketplaces

- Subscription platforms and SaaS businesses

- Large retail chains with omnichannel operations

- On-demand service platforms with high transaction frequency

These businesses usually have high payment volumes and need multi-country coverage with strong compliance.

Secondary Customer Segments (Growth Layer)

Adyen also attracts:

- High-growth startups scaling internationally

- Platform businesses needing payouts and split payments

- Retailers upgrading from legacy payment providers

- Companies looking to consolidate multiple PSPs into one system

These segments are important because they become enterprise-level clients over time.

Customer Journey: Discovery → Conversion → Retention

Adyen’s customer journey is very “enterprise-style,” meaning it is relationship-driven and long-term.

1) Discovery

Businesses typically discover Adyen through:

- Enterprise fintech research

- Industry referrals and case studies

- Partner ecosystems (commerce platforms, POS vendors)

- CTO/CFO-led vendor comparisons

2) Conversion

Adyen converts customers by proving measurable outcomes such as:

- Higher authorization rates

- Lower payment failures

- Better fraud performance

- Faster global expansion with fewer integrations

- Unified reporting and settlement control

3) Retention

Retention is strong because payments are deeply integrated into the business workflow. Adyen increases lifetime value by:

- Expanding payment methods by region

- Adding risk tools and checkout optimization

- Supporting in-store terminals + unified commerce

- Providing data insights that improve conversion

Once Adyen becomes the payment backbone, switching becomes expensive and operationally risky.

Acquisition Channels + LTV Optimization

Adyen grows through channels that fit its premium enterprise positioning:

- Direct enterprise sales (high-touch onboarding)

- Long-term account management

- Performance-based proof (conversion lift, fraud reduction)

- Expansion strategy (start with one region, then scale globally)

LTV increases because customers don’t just “use payments”—they expand usage into more products, more geographies, and more channels.

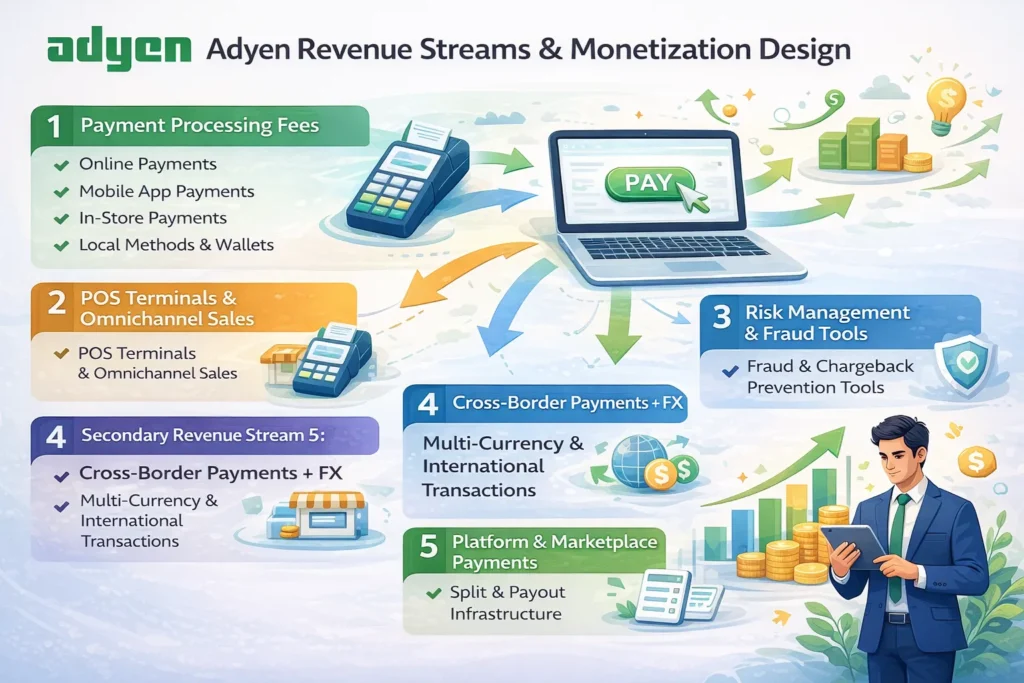

Revenue Streams and Monetization Design

Once you understand who Adyen serves, the next question becomes clear: how does Adyen actually make money?

In 2026, the Adyen revenue model works like a transaction-powered engine. The company earns primarily when payments are processed successfully, but its real advantage is that it increases revenue per merchant by improving authorization performance, enabling global payment methods, and expanding into unified commerce (online + in-store). This creates compounding growth because Adyen’s revenue rises automatically as its customers scale.

Primary Revenue Stream 1: Payment Processing Fees (Core Engine)

Mechanism

Adyen charges merchants a fee for every successful transaction processed through its platform. This includes:

- Online payments (web checkout)

- Mobile app payments

- In-store payments (POS terminals)

- Local payment methods and wallets

Pricing Model

Adyen typically earns through a combination of:

- Interchange + scheme fees (pass-through)

- Adyen processing margin

- Pricing varies by:

- payment method (cards vs local rails)

- region/country

- risk level and chargeback exposure

- transaction volume commitments

- payment method (cards vs local rails)

Revenue Contribution

This is Adyen’s largest revenue driver, because every payment event directly generates income.

Growth Trajectory

This stream grows due to:

- Higher global ecommerce volume

- Strong omnichannel retail demand

- Growth in subscription billing and recurring payments

- Expansion of digital payments in emerging markets

Secondary Revenue Stream 2: Unified Commerce + In-Store Payments

Adyen earns more when businesses adopt its in-store payment solutions, including:

- POS terminals

- Unified reporting across store + online

- Centralized settlement and reconciliation

Why this matters: retail payments are high-volume and sticky, which improves long-term revenue stability.

Secondary Revenue Stream 3: Risk Management & Fraud Tools

Adyen monetizes payment safety and fraud reduction through built-in tools that help merchants:

- reduce chargebacks

- detect suspicious activity

- block fraud without harming conversions

For merchants, this is valuable because fraud control directly impacts profitability, not just security.

Secondary Revenue Stream 4: Cross-Border Payments + FX

When merchants process international payments, Adyen benefits from:

- cross-border routing

- multi-currency settlement

- currency conversion layers (where applicable)

- regional payment optimization

This becomes a major growth lever in 2026 as brands expand globally and sell across borders.

Secondary Revenue Stream 5: Platform & Marketplace Payments

Adyen supports complex payment flows for platforms such as marketplaces and on-demand ecosystems, including:

- split payments (platform + seller)

- payouts to multiple parties

- compliance-ready onboarding support

- controlled fund flows

This is a premium use case because platforms create repeated transactions and long-term payment dependency.

Read more : Best Adyen Clone Scripts 2025: Launch a Global Payment Gateway That Scales Fast

Operational Model & Key Activities

Adyen’s business model works because its operations are designed like a high-performance infrastructure company, not a typical consumer app. Behind the simple checkout experience is a complex machine that manages payment routing, authorization, compliance, fraud risk, and settlement across multiple countries. In 2026, Adyen’s operational strength is its ability to deliver reliability at scale while continuously optimizing payment success rates for enterprise merchants.

Core Operations (What Adyen Does Daily)

Adyen’s day-to-day operations focus on keeping the platform stable, secure, and conversion-friendly.

1) Platform Management & Payment Processing

- Handling millions of transactions across regions and payment methods

- Smart routing to improve approval rates

- Maintaining uptime and processing stability during peak traffic

2) Technology Infrastructure

- Running global payment rails and acquiring connections

- API performance monitoring and optimization

- Real-time transaction tracking and analytics

3) Risk, Fraud & Compliance Operations

- Fraud detection and chargeback management

- AML/KYC compliance processes

- Regulatory updates across different countries

4) Merchant Support & Account Management

- Enterprise onboarding and integration support

- Dedicated technical support for high-volume clients

- Ongoing performance reviews and optimization recommendations

5) Growth + Market Expansion Operations

- Launching local payment methods in new regions

- Managing banking relationships and acquiring licenses

- Supporting merchants entering new countries

Key Activities That Keep the Model Scalable

Adyen stays scalable because it prioritizes operations that reduce complexity for merchants:

- One unified integration instead of multiple vendors

- Centralized reporting and reconciliation

- Automation in fraud screening and payment optimization

- Consistent payment experience across online + offline channels

This is why large brands choose Adyen when scaling globally

Strategic Partnerships & Ecosystem Development

Adyen’s growth is not built only on technology—it is built on the strength of its ecosystem. In payments, no company wins alone because every transaction depends on a network of banks, card schemes, regulators, payment methods, and commerce platforms. In 2026, the Adyen business model stays competitive because Adyen builds partnerships that increase payment reach, improve approval rates, and make global expansion easier for merchants.

At a strategic level, Adyen’s partnership philosophy is simple: reduce friction for merchants by handling complexity behind the scenes. The more partnerships Adyen builds, the more “plug-and-play” its platform becomes across countries and industries.

Key Partnership Types in Adyen’s Ecosystem

1) Technology and API Partners

These partnerships strengthen integrations and platform usability:

- Ecommerce platforms and commerce tools

- POS and retail system integrations

- CRM, analytics, and customer data platforms

- Fraud and identity verification ecosystems

Purpose: faster merchant onboarding and smoother technical implementation.

2) Payment Networks and Banking Alliances

These are the most critical partnerships because they directly impact transaction success.

- Card networks (Visa, Mastercard, etc.)

- Local acquiring banks

- Issuing bank relationships (approval behavior)

- Alternative payment method providers

Purpose: better authorization rates, wider payment coverage, and stable settlement infrastructure.

3) Payment Methods + Wallet Partnerships

In 2026, consumers expect local payment options. Adyen expands merchant reach by supporting:

- Digital wallets

- Buy Now Pay Later options

- Local bank transfer systems

- Region-specific payment rails

Purpose: higher conversion rates and fewer drop-offs at checkout.

4) Marketplace & Platform Ecosystem Alliances

Adyen supports platforms that need complex money movement, such as:

- Split payments (platform + sellers)

- Payouts to multiple parties

- Compliance-friendly onboarding

- Multi-region settlement controls

Purpose: enable marketplace business models that depend on reliable payouts and fund control.

5) Regulatory and Expansion Alliances

Payments are regulated heavily, so Adyen builds relationships that support:

- Licensing and compliance readiness

- Regional regulatory approvals

- Data protection alignment

- Secure transaction monitoring

Purpose: expand globally without legal disruption or operational shutdown risks.

Competitive Strategy & Market Defense

Payments is one of the most competitive markets in tech because every business needs it, margins are constantly pressured, and switching costs vary by customer type. Yet Adyen continues to defend its position in 2026 because it competes like an infrastructure company, not a feature-based fintech. The Adyen business model stays strong by combining performance, enterprise trust, and deep platform integration—creating long-term customer retention and strong market defense.

Adyen’s Core Competitive Advantages

1) Network Effects + Switching Barriers

Adyen becomes harder to replace over time because payments are deeply embedded into:

- checkout flow and conversion logic

- fraud and risk rules

- settlement and reconciliation processes

- reporting, dashboards, and finance workflows

- omnichannel systems (online + in-store)

Once Adyen is integrated across regions and channels, switching becomes expensive, risky, and operationally disruptive.

2) Enterprise Trust + Brand Equity

Adyen’s strongest competitive advantage is trust.

Enterprise businesses care about:

- uptime reliability

- regulatory compliance

- fraud protection

- stable settlements and reporting

- long-term support

Adyen’s brand is positioned around being the “safe choice” for high-volume global commerce.

3) Full-Stack Infrastructure Control

Many competitors rely on third-party acquiring partners or fragmented systems.

Adyen’s advantage is its ability to manage more of the payment stack, which leads to:

- better authorization rates

- more consistent performance across markets

- faster rollout of payment improvements

- stronger data feedback loops

This infrastructure control creates a performance moat.

4) Data-Driven Payment Optimization

Adyen uses transaction data to improve:

- routing decisions

- fraud filtering without conversion loss

- payment method prioritization

- checkout personalization by region

In 2026, this is a major differentiator because payment success is now a conversion strategy, not just a backend process.

5) Compliance Strength as a Competitive Weapon

As regulations tighten globally, compliance becomes a moat.

Adyen builds systems that support:

- AML/KYC requirements

- regional regulatory rules

- secure transaction monitoring

- data privacy compliance

This allows Adyen to expand into regulated markets faster than weaker competitors.

Lessons for Entrepreneurs & Implementation

Adyen’s story is a masterclass in how modern platform businesses win in 2026—not by chasing consumer hype, but by building the infrastructure that other businesses depend on. The Adyen business model proves that when you solve a painful operational problem at scale (payments complexity, low approval rates, fraud, fragmented systems), you can build a compounding enterprise business with strong retention and long-term revenue growth.

Below are the most practical lessons founders can take from Adyen—and how to apply them when building their own fintech, marketplace, or transaction-driven platform.

Key Factors Behind Adyen’s Success

Adyen didn’t win because it had “more features.” It won because it made payments simpler and more reliable for high-growth businesses.

Adyen’s success drivers include:

- Unified platform thinking: one system for online, in-store, and global payments

- Enterprise trust: reliability and compliance-first operations

- Performance advantage: higher authorization rates and conversion improvements

- Scalable architecture: built to handle high transaction volume without breaking

- Expansion-ready ecosystem: strong bank, network, and payment method coverage

Replicable Principles for Startups

Even if you are not building a global payment company, Adyen’s strategy is highly replicable.

Founders can copy these principles:

- Build a product that becomes a core business dependency, not a “nice-to-have”

- Solve one painful workflow end-to-end instead of creating a partial solution

- Focus on outcomes that impact revenue directly (conversion, approval, retention)

- Create a system that improves as usage increases (data feedback loops)

- Design for long-term retention, not short-term acquisition

Common Mistakes to Avoid

Many startups fail in infrastructure-like markets because they focus on surface-level features.

Avoid these mistakes:

- Competing only on price (you will lose margin and positioning)

- Scaling too fast without operational reliability

- Ignoring compliance until it becomes a business blocker

- Building fragmented systems that can’t expand globally

- Treating payments/risk as “add-ons” instead of core product architecture

How to Adapt the Adyen Model for Local or Niche Markets

You don’t need to be “Adyen-sized” to apply this model. You can adapt it in a smaller, smarter way.

Examples of niche adaptations:

- A payment + invoicing platform for one industry (healthcare, logistics, education)

- A marketplace payout system for local service platforms

- A subscription billing + fraud control solution for SaaS startups

- A unified commerce system for regional retail chains

- A fintech layer for cross-border payments in a specific corridor

The winning move is specialization: pick one niche where payment flow is broken, then own that workflow completely.

Implementation Timeline + Investment Priorities

If you want to build a platform inspired by Adyen’s model, here’s a realistic execution roadmap:

Phase 1 : Foundation

- Define your payment flow, user roles, and compliance needs

- Choose the right tech stack and architecture

- Build core transaction workflow + admin controls

Phase 2 : Monetization + Reliability

- Add reporting, reconciliation, and settlement logic

- Build risk rules and fraud controls

- Optimize UX for payment success + fewer failures

Phase 3 : Scaling

- Add multi-region support and local payment methods

- Introduce partner integrations (APIs, payouts, onboarding tools)

Improve performance, analytics, and operational automation

Ready to implement Adyen’s proven business model for your market? Miracuves builds scalable platforms with tested business models and growth mechanisms. We’ve helped 200+ entrepreneurs launch profitable apps. Get your free business model consultation today.

Conclusion

The Adyen business model proves a simple but powerful truth about platform economies in 2026: the biggest winners are often the companies that build the infrastructure others rely on. Adyen didn’t grow by chasing attention—it grew by mastering execution, performance, and trust at scale. By simplifying global payments, improving conversion outcomes, and building a unified system for modern commerce, Adyen became deeply embedded into how digital businesses operate every day.

For entrepreneurs, the bigger lesson is not just “build payments.” It is to build a platform that removes friction from high-value workflows, delivers measurable business impact, and becomes harder to replace over time. In 2026 and beyond, the future of digital ecosystems will belong to businesses that combine innovation with operational excellence—because in a

FAQs

What type of business model does Adyen use?

Adyen follows a B2B payments infrastructure platform model. It powers online, in-store, and global payment processing through one unified system.

How does the Adyen business model create value?

It helps businesses accept payments faster with higher success rates and fewer failures. It also simplifies global expansion, fraud control, and payment operations in one platform.

What are Adyen’s key success factors?

Adyen wins through enterprise trust, reliability, and full-stack payment control. Its unified commerce and performance optimization create long-term merchant retention.

How scalable is Adyen’s business model?

It scales automatically as merchant transaction volume grows. More payments, more regions, and more channels directly increase Adyen’s revenue.

What are the biggest challenges in Adyen’s model?

Major challenges include global compliance complexity and fraud/chargeback risks. It must also maintain high uptime and performance under massive transaction loads.

How can entrepreneurs adapt Adyen’s model to their region?

Start with one niche like marketplaces, subscriptions, or retail payments in your market . Then expand with local payment methods, risk tools, and multi-region support.

What resources and timeframe are needed to launch a platform like this?

A strong MVP usually 30-90 days depending on payment and compliance scope. You’ll need backend engineering, payment integrations, risk controls, and reporting.

What are alternatives to this model?

Alternatives include subscription fintech SaaS or marketplace commission + payout models. You can also use a bank-led gateway model or payment aggregator + service bundle approach.

How has Adyen’s business model evolved over time?

It evolved from basic processing into unified commerce with global acquiring and terminals. Now it includes fraud tools, marketplace payouts, and data-driven payment optimization.

Related Article :