Behind every late-night Amazon delivery and just-in-time retail shelf refill lies a complex web of freight movement. Convoy emerged to rewrite this invisible infrastructure by replacing phone-driven freight brokerage with a fully digital, algorithm-powered logistics marketplace.

Founded by a former Amazon executive, Convoy designed its platform to remove inefficiencies that had plagued freight for decades—empty miles, opaque pricing, slow payments, and manual load matching. By 2025, Convoy represents one of the most advanced freight-tech business models, blending marketplace dynamics with AI-driven logistics intelligence.

Studying the business model of Convoy is critical for modern founders building B2B marketplaces, two-sided platforms, on-demand logistics ecosystems, and enterprise SaaS + marketplace hybrid solutions Convoy demonstrates how data, automation, and network effects can disrupt even the oldest industrial sectors—the same category where Miracuves builds scalable logistics and marketplace platforms for entrepreneurs worldwide.

How the Convoy Business Model Works

Convoy operates on a digital freight marketplace + logistics intelligence platform model. At its core, it connects shippers who need to move freight with carriers who have available trucking capacity—all through real-time automation instead of traditional phone-based brokerage.

Unlike legacy freight brokers that rely on manual coordination, Convoy functions as a software-first logistics network, where pricing, matching, routing, and payments are handled algorithmically.

Type of Business Model

- Primary Model: Two-sided marketplace (Shippers ↔ Carriers)

- Extended Model: Hybrid of Marketplace + SaaS + Data Intelligence Platform

- Revenue Logic: Transaction-based with enterprise logistics layering

Value Proposition (By User Segment)

For Shippers (Enterprises & Retailers):

- Instant digital freight booking

- Real-time price transparency

- Guaranteed capacity access

- Automated documentation & billing

For Carriers (Truck Owners & Fleets):

- Consistent load access

- Faster payments

- Reduced deadhead miles

- Smart route optimization

For Enterprise Partners:

- Logistics data intelligence

- Network visibility

- API-driven freight orchestration

Key Stakeholders in the Convoy Ecosystem

- Shippers (Demand creators)

- Carriers & Fleet Operators (Supply providers)

- Technology & Data Partners

- Payment & Compliance Entities

- Regulatory Bodies

Each stakeholder strengthens liquidity, trust, and transaction velocity within the network.

Why the Model Works in 2025

- Explosion of eCommerce & rapid fulfillment

- Demand for real-time supply chain visibility

- Rising fuel costs forcing efficiency optimization

- Tight regulatory compliance in transportation

- Data-driven decision-making in enterprise logistics

Convoy thrives because it doesn’t just match loads—it optimizes the entire freight economy using software.

Read more : What Is Convoy and How Does It Work?

Target Market & Customer Segmentation Strategy

Convoy operates in a high-value B2B logistics market, serving both enterprise shippers and independent-to-large fleet carriers. Its segmentation strategy is designed to maximize network liquidity while optimizing lifetime value on both sides of the marketplace.

Instead of targeting a single logistics niche, Convoy built a horizontal freight infrastructure layer that supports retail, manufacturing, CPG, eCommerce, and industrial supply chains.

Primary & Secondary Customer Segments

Primary Segment – Shippers (Demand Side):

- Large enterprises (Retail, eCommerce, Manufacturing, CPG)

- Mid-sized logistics-heavy businesses

- 3PLs and supply chain operators

Behavior Traits: - High shipment frequency

- Cost + speed sensitivity

- Demand real-time visibility and compliance

Secondary Segment – Carriers (Supply Side):

- Independent owner-operators

- Small to mid-sized trucking fleets

- Regional and national carriers

Behavior Traits: - Income stability driven

- Preference for fast payouts

- Route efficiency and reduced empty miles matter most

Tertiary Segment – Enterprise Integrators:

- TMS providers

- Warehouse & fulfillment platforms

- Enterprise logistics software vendors

Customer Journey: Discovery → Conversion → Retention

For Shippers:

- Discovery via enterprise sales, referrals, industry events

- Conversion through demo-driven onboarding

- Retention through:

- Reliable capacity

- Cost predictability

- Deep analytics & reporting

For Carriers:

- Discovery via driver communities, mobile app stores, word-of-mouth

- Conversion through frictionless KYC + instant load access

- Retention through:

- Fast payments

- Consistent load availability

- Route optimization incentives

Acquisition Channels & LTV Optimization

Shipper Acquisition:

- Direct enterprise sales

- Strategic partnerships

- Industry conferences

- Supply chain consulting channels

Carrier Acquisition:

- Mobile app onboarding

- Referral bonuses

- Fleet partnerships

- Regional trucking associations

Lifetime Value Optimization:

- Multi-load contracts

- Subscription-based freight programs

- Data-driven upsells (analytics, compliance, optimization tools)

- Long-term enterprise logistics integration

Market Positioning & Competitive Differentiation

Convoy is positioned as a technology-first freight infrastructure company, not a traditional broker.

Competitive Edge:

- AI-driven pricing and routing

- Deep marketplace liquidity

- Enterprise-grade compliance

- Transparency in freight economics

Market Differentiation Strategy:

- Software replaces manual brokerage labor

- Data becomes a monetizable logistics asset

- Platform trust compounds with network scale

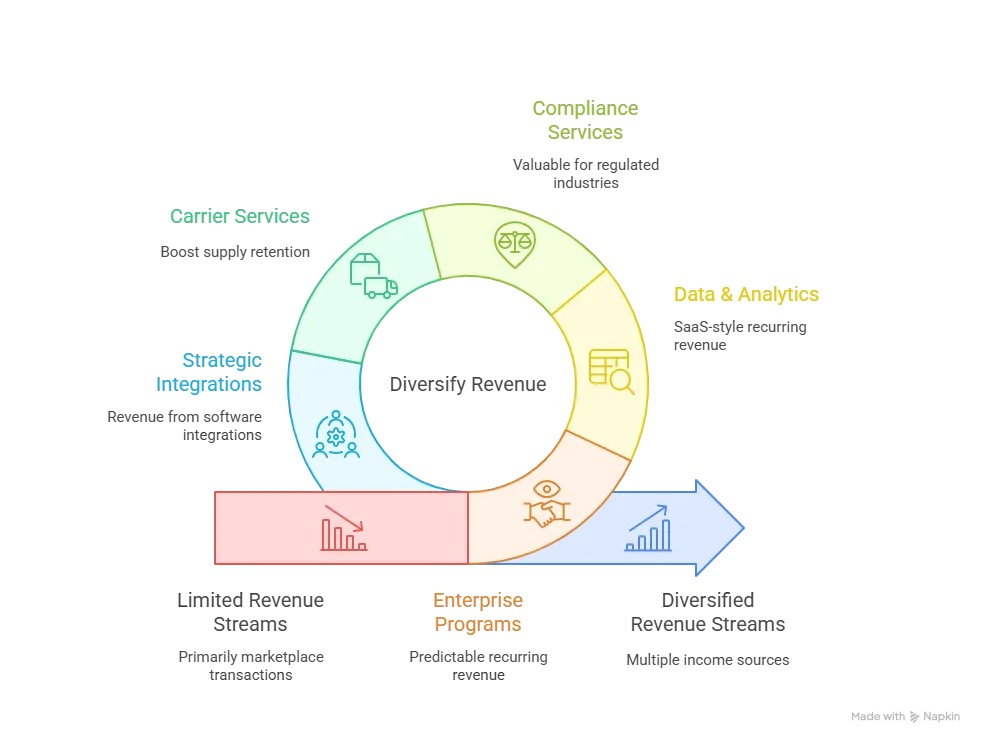

Revenue Streams & Monetization Design

Once Convoy engineered liquidity on both sides of its marketplace, the next layer of its business model focused on how money flows efficiently through the platform. Convoy’s monetization design is built around transaction efficiency, value-based pricing, and enterprise logistics automation rather than simple brokerage margins.

At a high level, Convoy earns by orchestrating freight movement digitally and taking a margin for the value it creates through speed, pricing accuracy, and operational reliability.

Primary Revenue Stream: Freight Transaction Commissions

This is Convoy’s core monetization engine.

- Mechanism: Convoy takes a margin between what shippers pay and what carriers earn.

- Pricing Model: Dynamic, algorithm-driven pricing based on:

- Lane demand & supply

- Fuel prices

- Seasonal freight volatility

- Carrier availability

- Revenue Share: Historically, this accounts for the majority of Convoy’s total revenue.

- Growth Trajectory: Scales directly with:

- Number of loads moved

- Average order value

- Enterprise contract volume

This model allows Convoy to grow revenue without owning trucks or warehouses, keeping the platform asset-light and highly scalable.

Secondary Revenue Streams

1. Enterprise Logistics Programs

- Long-term digital freight management contracts

- Custom pricing, guaranteed capacity, and volume-based incentives

- Predictable recurring revenue from large shippers

2. Premium Data & Analytics Tools

- Freight demand forecasting

- Lane performance analytics

- Network efficiency benchmarks

- Used by large enterprises for supply chain planning

3. Compliance & Automation Services

- Automated documentation, invoicing, and regulatory workflows

- Audit-ready logistics records

- Especially valuable for regulated industries

4. Carrier-Focused Service Tools

- Fast payment programs

- Route optimization insights

- Fleet performance dashboards

5. Strategic Integrations & API Access

- Revenue from logistics software integrations

- TMS, ERP, and warehouse system connectivity

Overall Monetization Strategy (How It All Connects)

Convoy’s revenue design follows a layered monetization architecture:

- Marketplace transactions generate volume-driven income

- Enterprise programs lock in predictable contracts

- Data and compliance tools create SaaS-style recurring revenue

- Carrier services boost supply retention and transaction frequency

Psychology Behind Convoy’s Pricing Strategy

- Dynamic pricing creates perceived market fairness

- Bundled enterprise services increase switching costs

- Value-based pricing aligns Convoy’s earnings with customer success

- Tiered service levels encourage natural upselling

Convoy doesn’t compete on being the cheapest broker—it competes on being the most efficient digital logistics operating system.

Operational Model & Key Activities

Behind Convoy’s clean digital interface runs a high-availability, data-intensive logistics operating machine. Every day, the platform coordinates thousands of moving assets in real time—where even a few minutes of delay can translate into massive financial impact for shippers and carriers. Operations, therefore, are not just support functions at Convoy—they are the core competitive moat.

Convoy’s operational design blends software automation, marketplace governance, and enterprise-grade reliability into one unified execution engine.

Core Operations

1. Platform & Marketplace Management

- Real-time load ingestion and verification

- Automated carrier–shipper matching

- Dynamic pricing and load optimization

- Fraud detection and duplicate load filtering

- Continuous uptime and performance monitoring

2. Technology Infrastructure

- Cloud-based, highly scalable architecture

- AI/ML pricing and demand forecasting engines

- Real-time GPS and telematics integrations

- Secure API layers for TMS, ERP, and WMS systems

- Data pipelines for nationwide freight visibility

3. Quality Control & Trust Systems

- Carrier vetting and compliance verification

- Shipments audit trails and digital documentation

- Performance scoring for both carriers and shippers

- Community-based issue reporting and escalation

4. Customer Support & Success Operations

- Dedicated enterprise account managers

- 24/7 operations support for shipment exceptions

- Carrier onboarding and payout management

- Dispute resolution and compliance assistance

5. Marketing, Growth & Network Liquidity

- Enterprise sales enablement

- Carrier acquisition campaigns

- Regional market activation strategies

- Referral and incentive program execution

Resource Allocation & Strategic Investment Focus

Technology & Infrastructure (Largest Share of Budget)

- Continuous AI optimization

- Platform security and regulatory compliance

- Data engineering and analytics

Sales & Enterprise Growth

- High-touch B2B sales teams

- Long-cycle enterprise deal structuring

Carrier Network Expansion

- Incentives, payment acceleration programs

- Fleet technology adoption programs

R&D & Product Innovation

- Autonomous freight intelligence

- Predictive supply chain optimization

- Network simulation modeling

Regional Expansion Strategy

- Focused lane-by-lane market entry

- Density-first expansion instead of broad geographic sprawl

Why Operations Are Convoy’s True Moat

Unlike consumer apps where marketing often leads growth, Convoy’s defense is operational excellence at scale. Each successfully executed shipment:

- Increases network trust

- Improves pricing intelligence

- Strengthens data accuracy

- Compounds marketplace liquidity

This creates a self-reinforcing operational flywheel where better execution directly improves monetization and market share.

Strategic Partnerships & Ecosystem Development

Convoy’s growth has never depended on operating in isolation. Instead, it deliberately built a collaboration-first ecosystem strategy, positioning itself as a connective digital layer inside the broader supply chain stack. Its partnerships are designed to expand reach, deepen product utility, and strengthen network effects across logistics workflows.

Rather than viewing partners as vendors, Convoy treats them as co-creators of supply chain intelligence and infrastructure.

Key Partnership Types

1. Technology & API Partners

- Transportation Management Systems (TMS)

- Enterprise Resource Planning (ERP) platforms

- Warehouse Management Systems (WMS)

- Telematics and GPS tracking providers

Strategic Outcome: Seamless data flow across shipper operations and Convoy’s freight network.

2. Payment & Financial Infrastructure Partners

- Digital payment processors

- Fast-pay and working capital partners

- Carrier financing and fuel card providers

Strategic Outcome: Faster carrier payouts, reduced cash-flow friction, higher carrier retention.

3. Logistics & Capacity Alliances

- Regional and national carrier networks

- Dedicated fleet operators

- Cold-chain and specialized freight providers

Strategic Outcome: Guaranteed capacity across diverse freight categories and lanes.

4. Marketing & Distribution Partnerships

- Enterprise logistics consultancies

- Retail and manufacturing associations

- Industry events and trade groups

Strategic Outcome: Faster shipper acquisition and brand trust in regulated B2B markets.

5. Regulatory & Expansion Alliances

- Cross-border compliance partners

- Regulatory advisory firms

- Regional transportation authorities

Strategic Outcome: Smoother geographic expansion and compliance scalability.

Ecosystem Strategy: How Partnerships Create Moats

Convoy’s ecosystem design is built around network amplification:

- Each partner increases platform data accuracy

- Data accuracy improves pricing and routing intelligence

- Better intelligence attracts more enterprise shippers

- More shippers attract more carriers

- More carriers deepen capacity reliability

This creates multi-layered network effects:

- Operational network effects (capacity density)

- Data network effects (better predictions with scale)

- Financial network effects (faster payment loops)

Monetization Within the Ecosystem

- Revenue from premium integrations

- Enterprise SaaS-style contracts bundled with partners

- Volume-based incentives through carrier alliances

- Data-driven upsells via enterprise platforms

Instead of extracting value from partners, Convoy’s model ensures partners grow as the platform grows, which is why its ecosystem remains stable and defensible.

Growth Strategy & Scaling Mechanisms

Convoy’s growth engine is built on a density-first scaling philosophy—instead of expanding everywhere at once, it strengthens liquidity on specific freight lanes, then compounds growth through network effects, data intelligence, and enterprise adoption. This allows Convoy to scale efficiently, defensibly, and profitably across regions and verticals.

Core Growth Engines

1. Organic Network Effects

- More shippers → more load volume

- More loads → higher carrier earnings

- Higher carrier earnings → more carrier supply

- More supply → better pricing & reliability for shippers

This self-reinforcing loop drives organic growth without heavy consumer-style advertising.

2. Enterprise Sales-Led Growth

- Long-cycle B2B contracts with Fortune 1000 shippers

- Dedicated sales engineers + logistics consultants

- Multi-year digital freight transformation deals

This creates large, predictable revenue blocks instead of volatile per-load dependence.

3. Product-Led Growth Through Automation

- Automated booking reduces procurement friction

- API-driven workflows embed Convoy into daily shipper operations

- Once embedded, switching costs rise sharply

4. New Product & Capability Expansion

- Predictive freight intelligence

- Sustainability & carbon tracking tools

- Network optimization dashboards

Each new layer increases revenue per shipper without extra acquisition cost.

5. Geographic & Lane-Based Expansion

- Entry city-by-city, not country-by-country

- Focus on high-volume freight corridors first

- Density before diversity strategy ensures route profitability

Scaling Challenges & How Convoy Addressed Them

Operational Complexity

- Challenge: Managing millions of real-time freight variables

- Solution: Heavy investment in AI-based dispatching and automation

Carrier Liquidity Imbalance

- Challenge: Demand spikes without matching supply

- Solution: Guaranteed volume programs + carrier incentives

Margin Pressure in Brokerage

- Challenge: Traditional brokerage margins are thin

- Solution: Multi-layer monetization via enterprise SaaS + data services

Regulatory & Compliance Barriers

- Challenge: Multi-state transportation laws and audits

- Solution: Centralized compliance automation + audit-ready documentation

Technology Infrastructure Limits

- Challenge: Latency and uptime at national scale

- Solution: Cloud-native microservice architecture with redundancy

Why Convoy’s Scaling Model Is Structurally Strong

- Growth is tied to network density, not just marketing spend

- Data quality improves automatically with scale

- Enterprise workflows create long-term customer lock-in

- Expansion follows demand heatmaps, not geographic vanity metrics

This makes Convoy’s scaling approach capital-efficient and defensible, especially in a low-margin industry like freight.

Competitive Strategy & Market Defense

Convoy operates in one of the most competitive and margin-sensitive industries in the world—freight and logistics. Its survival and leadership are not driven by branding alone, but by structural competitive advantages embedded deep into its platform design, data systems, and network behavior.

Rather than fighting brokers on price alone, Convoy competes by re-architecting how freight itself is discovered, priced, and executed.

Core Competitive Advantages

1. Network Effects & Switching Barriers

- As Convoy’s shipper volume increases, carrier earnings potential rises.

- As carrier density increases, shipper pricing accuracy and reliability improve.

- Integrated APIs, contracts, and workflows make switching operationally expensive.

This creates economic and technical lock-in on both sides of the marketplace.

2. Brand Trust in a Trust-Deficient Industry

- Freight is historically plagued by payment delays and fraud.

- Convoy built brand equity around:

- Transparent pricing

- Fast, reliable payouts

- Verified carrier networks

Trust becomes a competitive weapon in B2B logistics.

3. Technology & Algorithmic Differentiation

- AI-based dynamic pricing

- Predictive capacity forecasting

- Automated exception handling

- GPS and telematics-driven real-time tracking

These capabilities allow Convoy to act as a freight decision engine, not just a booking platform.

4. Data as a Strategic Asset

- Lane-level pricing intelligence

- Network utilization analytics

- Carrier performance benchmarks

- Seasonal freight volatility modeling

Data compounds daily and becomes nearly impossible for new entrants to replicate quickly.

5. Enterprise-Grade Compliance & Security

- Automated audit trails

- Digital documentation

- Regulatory reporting readiness

This makes Convoy enterprise-friendly, while many startups stay stuck at SMB scale.

Market Defense Tactics

Handling New Entrants

- Competes on network density, not discounting

- Continuously expands carrier liquidity before new players can reach minimum viable scale

Pricing Wars

- Avoids race-to-the-bottom pricing

- Uses value-based enterprise contracts instead of transactional undercutting

Feature Rollouts & Timing

- Rolls out automation first where operational ROI is highest

- Uses controlled pilot markets before national releases

Strategic M&A & Partnerships (Defensive Growth)

- Expands capabilities faster than organic R&D alone

- Absorbs competitive threats through integration rather than confrontation

Regulatory Defense

- Proactive compliance investments act as a barrier to entry

- Many fast-moving competitors struggle under audit and labor regulations

Why Convoy’s Market Defense Is Structurally Powerful

- It defends on five layers simultaneously: network, technology, data, trust, and compliance.

- Even well-funded competitors struggle without:

- Carrier density

- Enterprise trust

- Deep logistics data

- As the platform scales, each defensive layer strengthens the other.

Convoy’s true advantage is not just being early—it is being embedded into the operating fabric of enterprise logistics.

Lessons for Entrepreneurs & Implementation

Convoy’s journey offers a powerful playbook for founders building B2B marketplaces, logistics platforms, and data-driven ecosystems. Its success was not driven by flashy consumer branding—but by deep operational discipline, platform thinking, and long-term network design.

Let’s translate Convoy’s strategy into actionable lessons for entrepreneurs.

Key Success Factors Behind Convoy’s Growth

- Technology as the Core Product: Convoy didn’t “digitize brokers”—it replaced them with algorithms.

- Network Density Over Rapid Expansion: Strengthening a few lanes deeply beat shallow national sprawl.

- Trust Before Monetization: By prioritizing carrier payouts and shipper transparency, Convoy built long-term platform loyalty first.

- Data as a Monetizable Asset: Freight data evolved into forecasting, optimization, and enterprise intelligence.

- Enterprise-Ready From Day One: Compliance, audit trails, and security were built early—not as afterthoughts.

Replicable Principles for Startups

Founders can adapt Convoy’s model across industries by focusing on:

- Two-sided network design: Always ensure supply-side economics are as strong as demand-side value.

- Automation-first architecture: Manual operations don’t scale defensibly.

- Embedded workflows: The deeper your product sits inside daily operations, the higher your switching costs.

- Multi-layer monetization: Avoid dependence on one revenue stream.

- Operational moats over marketing hype: Execution beats advertisements in B2B platforms.

Common Mistakes to Avoid

- Scaling geography before achieving local liquidity

- Underestimating regulatory complexity

- Relying only on commission revenue

- Delaying data infrastructure investment

- Treating carriers or suppliers as vendors instead of ecosystem partners

Adapting the Convoy Model for Local or Niche Markets

Convoy’s framework works especially well for:

- Regional logistics marketplaces

- Construction material marketplaces

- Agricultural supply chain platforms

- Cold-chain and healthcare logistics

- Urban last-mile delivery networks

Ready to implement Convoy’s proven logistics marketplace business model for your market?

Miracuves builds scalable freight platforms with tested automation frameworks, AI-driven matching engines, and multi-layer monetization systems.

We’ve helped 200+ entrepreneurs launch profitable on-demand and marketplace platforms worldwide. Get your free business model consultation today.

Conclusion :

Convoy’s business model proves that even the most traditional, asset-heavy industries can be transformed by software, data, and network design. What began as a bold attempt to digitize freight brokerage evolved into a full-scale logistics intelligence platform—one that showed how automation can replace manual coordination, and how data can become as valuable as physical assets.

The deeper lesson for entrepreneurs is this: true disruption doesn’t come from changing the user interface alone—it comes from re-engineering the operating system of an entire industry. Convoy didn’t just move loads faster; it reshaped how freight is priced, trusted, and executed at scale.

As we move deeper into 2025 and beyond, platform economies will increasingly be defined not by who owns the assets, but by who controls the intelligence, trust, and network flows around those assets. Convoy stands as a living case study of that future.

FAQs :

1. What type of business model does Convoy use?

Convoy operates on a two-sided digital freight marketplace combined with an enterprise logistics intelligence platform. It connects shippers and carriers using automation, AI-driven pricing, and real-time capacity matching.

2. How does Convoy’s business model create value?

Convoy removes manual brokerage friction, cuts empty miles, improves pricing transparency, and speeds up carrier payments.This delivers enterprise-grade cost savings, faster fulfillment, and higher supply-chain reliability.

3. What are Convoy’s key success factors?

Its success comes from strong two-sided network effects, algorithmic pricing, and deep enterprise integrations. Fast payouts, compliance trust, and continuous data compounding strengthen its competitive moat.

4. How scalable is Convoy’s business model?

Convoy is asset-light, cloud-native, API-driven, and powered by repeatable software workflows. Scalability accelerates as freight volume, carrier density, and predictive data expand regionally.

5. What are the biggest challenges in Convoy’s model?

Key challenges include thin brokerage margins, carrier liquidity management, and regulatory complexity.Convoy counters these with automation-first operations and multi-layer monetization strategies.

6. How can entrepreneurs adapt Convoy’s model to their region?

They should start with one vertical, build density in a limited zone, and attract carriers via fast payouts. Compliance digitization comes first, while analytics layers follow after liquidity stabilizes.

7. What are alternatives to the Convoy business model?

Alternatives include traditional brokers, asset-heavy logistics firms, vertical load boards, and blockchain freight. However, most lack Convoy’s unified automation, AI intelligence, and enterprise integration depth.

8. How has Convoy’s business model evolved over time?

Convoy began as a digital freight brokerage replacing phone-based matching. By 2025, it evolved into an AI-driven freight intelligence and enterprise orchestration platform.

Related Article :