Behind every fast-moving supply chain today lies a quiet digital revolution. Direct Freight represents a new generation of B2B logistics platforms that remove friction between shippers and carriers by replacing traditional broker-heavy processes with real-time digital freight matching. By positioning itself as a direct marketplace between freight demand and transport capacity, Direct Freight has built a model that prioritizes speed, transparency, and network-driven efficiency—making it a powerful case study for founders building B2B marketplaces, SaaS logistics tools

Studying the business model of Direct Freight is crucial for modern entrepreneurs because it demonstrates how : Direct Freight proves how digital infrastructure replaces legacy middlemen, transforms data into a monetizable asset, and builds long-term competitive moats through powerful B2B network effects. This model is especially relevant today for founders exploring freight tech, logistics marketplaces, aggregation platforms, and real-time SaaS ecosystems—the same category where Miracuves builds scalable, ready-to-launch platforms for rapid market entry.

How the Direct Freight Business Model Works

At its core, Direct Freight operates as a digital B2B freight marketplace combined with a real-time logistics data platform. It connects shippers who need to move goods directly with carriers and fleet operators who provide transport capacity, eliminating the delays, opacity, and cost inefficiencies of traditional freight brokerage.

Instead of relying on phone calls, intermediaries, and fragmented systems, Direct Freight enables transactions through a centralized, tech-driven platform where pricing, availability, compliance, and execution happen in near real time.

This is not just a marketplace—it is a coordination engine for physical movement of goods at scale.

Type of Business Model

- Primary Model: B2B Digital Marketplace

- Supporting Model: SaaS + Data Intelligence Platform

- Hybrid Layer: Transaction-based + Subscription-based monetization

Direct Freight blends marketplace liquidity with software-as-a-service stability, ensuring both recurring revenue and transactional upside.

Value Proposition by User Segment

For Shippers (Manufacturers, Retailers, Distributors):

- Instant access to verified carrier capacity

- Transparent, competitive pricing

- Faster shipment booking and reduced delays

- Real-time shipment tracking and data visibility

For Carriers & Fleet Operators:

- Consistent access to paying loads

- Reduced empty miles and higher asset utilization

- Faster payments and automated documentation

- Demand visibility across regions

For Enterprise & Logistics Partners:

- API-driven freight data access

- Performance analytics and route optimization

- Integration with TMS, ERP, and warehouse systems

Key Stakeholders & Their Roles

- Shippers: Generate freight demand and transaction volume

- Carriers & Fleets: Supply transport capacity and execution

- Direct Freight Platform: Orchestrates matching, pricing, compliance, payments, and data

- Technology Partners: Power cloud infrastructure, mapping, APIs, and payments

- Regulatory Bodies: Influence compliance, safety, and operational standards

Each stakeholder is economically interdependent, creating a balanced multi-sided ecosystem where liquidity and trust reinforce each other.

Why the Model Works in 2025

The Direct Freight business model aligns perfectly with current market conditions:

- Supply chain volatility demands real-time decision-making

- Driver shortages make capacity optimization mission-critical

- Fuel cost fluctuations increase the need for dynamic pricing

- Enterprise digitization is accelerating post-pandemic

In 2025, companies no longer want freight “brokers”—they want infrastructure partners that offer speed, data, and reliability. Direct Freight delivers exactly that.

Read more : What Is Direct Freight Service and How Does It Work?

Target Market & Customer Segmentation Strategy

Who Uses Direct Freight — And Why They Stay

Direct Freight serves a purely execution-driven B2B audience where time, reliability, and cost efficiency directly impact profitability. Unlike consumer apps driven by convenience and brand emotion, adoption here is driven by economic outcomes and operational performance.The platform’s growth is anchored in two core demand–supply segments, with additional enterprise layers built on top.

Primary Customer Segments

1. Shippers (Freight Demand Side)

Includes:

- Manufacturers

- Retail chains

- Wholesalers & distributors

- E-commerce fulfillment companies

- 3PL providers

Key Characteristics (2025):

- High shipment frequency

- Cost-sensitive but reliability-focused

- Need real-time visibility and compliance assurance

- Operate across national and cross-border lanes

Why They Choose Direct Freight:

- Faster load booking vs traditional brokers

- Transparent, competitive pricing

- Reduced dependency on middlemen

- Live tracking and digital documentation

2. Carriers & Fleet Operators (Supply Side)

Includes:

- Independent owner-operators

- Small to mid-sized fleets

- Large enterprise trucking companies

Key Characteristics:

- Asset-heavy businesses (trucks, drivers)

- Revenue depends on utilization rate

- Sensitive to fuel prices and deadhead miles

- Seek predictable cash flow

Why They Stay on the Platform:

- Steady flow of verified loads

- Reduced idle time and empty miles

- Faster digital settlements

- Broader market access without sales overhead

Secondary Customer Segments

- Logistics Tech Companies: API access for freight data

- Enterprise Supply Chain Teams: Data dashboards and forecasting tools

- Financial Institutions & Insurers: Risk assessment and cargo insurance integrations

- Warehouse & Fulfillment Networks: Coordinated pickup–drop automation

These secondary segments enhance ecosystem depth and unlock non-transactional revenue streams.

Customer Journey: From Discovery to Retention

1. Discovery:

- Industry referrals

- SEO and industry searches

- Partnerships with logistics networks

- Trade shows and B2B sales outreach

2. Onboarding:

- KYC and compliance verification

- Digital account creation

- API integrations for enterprise users

- Training and pilot shipment phase

3. Activation:

- First successful shipment executed

- Tracking and proof-of-delivery established

- Payment cycle completed

4. Retention:

- Performance analytics dashboards

- Predictable shipment flow

- Contract pricing & subscription upgrades

- Dedicated account management for enterprises

Retention in freight platforms is driven less by brand love and more by operational dependency. Once Direct Freight becomes embedded in daily logistics workflows, switching costs become structurally high.

Acquisition Channels & LTV Optimization

- Direct Sales for Enterprises: High ACV, long-term contracts

- Organic Inbound for SMEs: SEO, content, referrals

- Carrier Community Growth: Word-of-mouth among drivers

- Partnership Integrations: TMS, ERP, and warehouse systems

Lifetime Value is optimized through:

- Subscription upgrades

- Volume-based pricing

- Long-term shipper–carrier contracts

- Data and analytics add-ons

Revenue Streams and Monetization Design

Direct Freight’s monetization strategy is intentionally designed as a hybrid revenue engine, combining predictable recurring income with high-volume transactional upside. This structure allows the platform to remain financially resilient even during freight market cycles.

Instead of depending on a single revenue source, Direct Freight captures value at multiple moments of the logistics transaction lifecycle—from booking to execution to post-delivery analytics.

Primary Revenue Stream: Transaction Commissions

This is the core revenue driver of the Direct Freight business model.

How it Works:

- A commission is charged on every successfully completed shipment.

- The fee is typically calculated as a percentage of the freight value.

- Paid either by the shipper, the carrier, or split between both.

Why It Scales:

- Directly tied to platform volume

- Grows with marketplace liquidity

- Benefits from rising freight rates and shipment frequency

Strategic Importance:

- Creates alignment between platform success and user success

- Encourages Direct Freight to optimize matching speed, capacity utilization, and reliability

Secondary Revenue Stream 1: Subscription Plans

Targeted at:

- High-volume shippers

- Fleet operators

- Enterprise logistics teams

Subscription Tiers Unlock:

- Advanced analytics and reporting

- Contract pricing tools

- Priority load matching

- API and system integrations

- Dedicated account support

This stream provides stable, recurring monthly revenue independent of daily transaction volatility .

Secondary Revenue Stream 2: Enterprise SaaS & Data Licensing

Direct Freight monetizes freight intelligence as a standalone asset.

Includes:

- Lane pricing benchmarks

- Capacity forecasting

- Market demand heatmaps

- Risk scoring model .

These datasets are licensed to:

- 3PLs

- Supply chain consulting firms

- Financial institutions

- Insurance and underwriting firms

This transforms Direct Freight from a transport marketplace into a logistics intelligence company.

Operational Model & Key Activities

Behind the simple front-end experience of Direct Freight runs a high-availability, data-intensive operational engine. This layer is where reliability, trust, speed, and scalability are won or lost. In freight, even minor delays or data errors translate directly into financial loss for users—so daily execution becomes a core competitive moat.

Unlike consumer apps optimized for engagement, Direct Freight is optimized for precision, uptime, compliance, and transaction certainty.

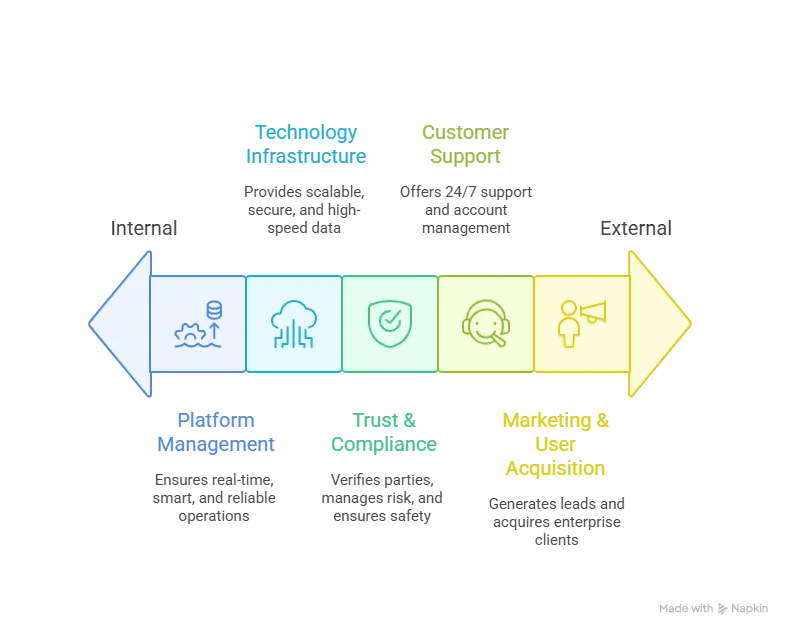

Core Operations

1. Platform Management

- Real-time load ingestion and updates

- Smart matching between shipper demand and carrier capacity

- Duplicate load detection and fraud filtering

- Continuous uptime and performance monitoring

2. Technology Infrastructure

- Cloud-based scalable architecture

- High-speed data pipelines for pricing and availability

- Location-based search, geofencing, and alert engines

- Secure API layers for TMS, ERP, and warehouse integrations

3. Trust, Compliance & Quality Control

- Carrier and shipper verification

- KYC, insurance validation, and safety compliance checks

- Risk scoring for loads and counterparties

- Community reporting and dispute resolution mechanisms

4. Customer Support & Account Operations

- Subscription onboarding and training

- 24/7 technical and transaction support

- Enterprise account management

- SLA monitoring for premium clients

5. Marketing & User Acquisition Operations

- SEO and inbound lead generation

- B2B outbound sales teams

- Industry events and logistics expos

- Fleet referral programs and shipper partnerships

Resource Allocation Strategy (2025 Model)

Direct Freight’s internal resource deployment reflects its identity as a technology-first logistics company, not a brokerage firm.

- Technology & Product Development: High share of total budget

- Platform security

- AI-driven matching algorithms

- Data science and predictive analytics

- Sales & Marketing: Focused more on enterprise acquisition than mass advertising

- Field sales for large shippers

- Account-based marketing for fleets

- Operations & Support: Built for 24/7 reliability

- Shift-based support teams

- Regional compliance and safety monitoring

- R&D & Regional Expansion:

- Lane density optimization

- Cross-border compliance models

- Integration with new logistics standards and government systems

Strategic Partnerships & Ecosystem Development

Direct Freight’s growth has not been driven by the platform alone—it has been amplified through a carefully constructed ecosystem of strategic partnerships. In large-scale logistics, no single company can control the entire value chain. Success depends on how effectively a platform orchestrates collaboration across technology, finance, compliance, and physical movement.

Rather than operating as a closed system, Direct Freight follows an open-integration philosophy, allowing partners to plug directly into its freight, data, and payment infrastructure.

Key Partnership Categories

1. Technology & API Partners

These partners strengthen the digital backbone of the platform:

- Transportation Management Systems (TMS)

- Enterprise Resource Planning (ERP) software providers

- GPS and telematics vendors

- Cloud infrastructure and cybersecurity firms

Strategic Impact:

- Deep workflow automation for enterprises

- Reduced friction in load creation and tracking

- Faster adoption by large logistics player .

2. Payment & Financial Services Partners

- Digital payment gateways

- Carrier financing providers

- Fuel card networks

- Cargo insurance firms

Value Created:

- Faster carrier settlements

- Embedded financial tools inside freight workflows

- New revenue layers via fintech integrations

3. Logistics & Fulfillment Alliances

- Warehousing and distribution centers

- Cross-dock operators

- 3PL and 4PL providers

These partnerships allow Direct Freight to expand from pure transport coordination into full supply-chain orchestration.

4. Marketing & Distribution Partners

- Industry associations

- Fleet management communities

- Trade publications and logistics media

- Regional logistics networks

These channels accelerate trust-based adoption, which is critical in conservative B2B markets.

Growth Strategy & Scaling Mechanisms

Direct Freight’s growth is not driven by consumer-style virality but by structured, network-led B2B expansion. Its strategy focuses on building deep liquidity in freight lanes first, then scaling geographically and vertically once density is achieved. This approach ensures that every new market launch is economically viable from the start.

Instead of chasing mass adoption, Direct Freight prioritizes high-value enterprise shippers and active carrier networks, which automatically pull in surrounding demand and supply.

Core Growth Engines

1. Network-Led Organic Growth

- Shippers attract carriers to specific routes

- Carriers attract more shippers due to capacity availability

- Lane-level liquidity creates self-reinforcing adoption

- Word-of-mouth spreads rapidly in driver and dispatcher communities

This creates a flywheel effect, where every successful shipment strengthens the platform’s relevance in that corridor.

2. Enterprise Sales & Strategic Accounts

- Dedicated B2B sales teams onboard large manufacturers, retailers, and 3PLs

- Once a large shipper onboarded, thousands of loads flow through the system

- These anchor clients seed new regional markets efficiently

Enterprise contracts act as growth multipliers, not just revenue sources.

3. Product-Led Expansion

- Simple entry-level plans for SMEs

- Advanced automation and analytics for enterprises

- Data and financial tools layered in later

As customers grow, they naturally upgrade inside the ecosystem instead of switching platforms.

4. Geographic & Corridor-Based Expansion

Direct Freight scales through:

- High-density trade lanes first

- Hub-and-spoke regional rollouts

- Cross-border expansion once compliance infrastructure is ready

This avoids the mistake of spreading capacity too thin across low-volume regions.

New Market & Product Line Expansion (2025 Focus)

- Cross-border freight coordination

- Temperature-controlled and high-value cargo lanes

- Integrated warehousing + line-haul orchestration

- Predictive analytics for enterprise demand planning

Each new module increases revenue per customer without requiring new user acquisition.

Competitive Strategy & Market Defense

Direct Freight operates in one of the most competitive and margin-sensitive digital ecosystems—freight logistics. Its long-term survival depends not just on acquiring users, but on defending market position against brokers, legacy software vendors, and emerging tech startups. The platform’s competitive strategy is built around structural advantages rather than short-term pricing wars.

Core Competitive Advantages

1. Network Effects & Switching Barriers

As more shippers and carriers transact on Direct Freight:

- Load availability increases

- Carrier utilization improves

- Pricing accuracy becomes more precise

- Trust in counterparties strengthens

This creates a self-reinforcing loop where the value of the platform grows with every additional user. Once a shipper or fleet embeds Direct Freight into daily workflows, switching platforms would disrupt operations, not just software.

2. Brand Trust in a High-Risk Industry

Freight involves:

- High-value cargo

- Strict delivery timelines

- Legal and insurance exposure

Direct Freight protects its brand through:

- Verified participants

- Compliance automation

- Transparent digital documentation

In B2B logistics, trust is a brand moat, not a marketing slogan.

3. Technology & Automation Leadership

Direct Freight continuously invests in:

- Real-time matching algorithms

- Predictive demand and capacity modeling

- Automated documentation and settlements

- AI-based risk and fraud detection

Competitors that rely on manual processes or outdated systems cannot match the platform’s speed, accuracy, or scale.

4. Data-Driven Personalization

Every shipment strengthens Direct Freight’s intelligence layer:

- Lane pricing models improve

- Carrier reliability scoring becomes more accurate

- Shipper behavior optimization increases

- Predictive alerts reduce failures

This data advantage compounds over time and becomes increasingly difficult for new entrants to replicate.

Market Defense Tactics

1. Handling New Entrants & Price Undercutting

Instead of fighting on price alone, Direct Freight defends on:

- Reliability and uptime

- Verified network quality

- Enterprise-grade integrations

- Performance analytics

Low-cost competitors struggle to retain users once operational complexity increases.

2. Feature Timing & Selective Innovation

Direct Freight avoids feature overload. Instead, it:

- Rolls out automation selectively based on usage data

- Prioritizes enterprise pain points over experimental tools

- Launches new modules only when ecosystem readiness is proven

This disciplined innovation prevents technical debt and protects user experience.

3. Partnership & Consolidation Defense

Rather than blocking competitors outright, Direct Freight:

- Partners where possible

- Integrates complementary tools

- Acquires niche capabilities strategically

This allows it to absorb innovation rather than be disrupted by it .

Lessons for Entrepreneurs & Implementation

The Direct Freight business model offers powerful, real-world lessons for founders building marketplaces, SaaS platforms, and infrastructure-driven digital ecosystems. Its success was not built on viral marketing or aggressive discounting—but on deep operational relevance, trust, and data-driven execution.

This is exactly the type of model that scales sustainably in B2B environments.

Key Factors Behind Direct Freight’s Success

- Marketplace Liquidity First, Features Second

Direct Freight focused on ensuring that real loads and real carriers existed on the platform before over-engineering the product. Liquidity created adoption faster than feature hype. - Trust as a Core Product Feature

Verification, compliance, documentation, and dispute resolution were treated as core product layers, not add-ons. - Hybrid Monetization Model

Combining transaction fees + subscriptions + data + financial services protected revenue during freight market cycles. - Data as a Compounding Asset

Every shipment strengthened pricing models, demand forecasting, and carrier scoring—turning operations into long-term intellectual capital. - Enterprise Workflow Integration

By embedding into TMS and ERP systems, Direct Freight became infrastructure—not just a tool.

Replicable Principles for Startups

Entrepreneurs can directly adapt these patterns across industries:

- Build two-sided liquidity before scaling features

- Use automation to replace manual intermediaries

- Create high switching costs through workflow integration

- Monetize usage, not just sign-ups

- Treat data as a revenue product, not just a byproduct

These principles translate extremely well into:

- Logistics

- Food delivery

- Mobility

- Healthcare platforms

- Fintech marketplaces

- B2B SaaS ecosystems

Common Mistakes to Avoid

- Launching without sufficient supply–demand balance

- Focusing on UI design before backend operations

- Underestimating compliance and verification costs

- Competing only on price instead of reliability

- Monetizing too late or with a single revenue stream

Most marketplace failures occur due to operational fragility, not lack of demand.

Ready to implement the Direct Freight business model for your market?

Miracuves builds scalable logistics, marketplace, and B2B SaaS platforms with proven business logic and growth mechanics. We’ve helped 200+ entrepreneurs launch profitable digital platforms across logistics, mobility, and on-demand services. Get your free business model consultation today.

Conclusion :

The business model of Direct Freight proves a powerful truth about modern digital platforms: real innovation isn’t only about new apps—it’s about rebuilding invisible infrastructure with precision, data, and trust. While consumer tech grabs headlines, companies like Direct Freight quietly reshape trillion-dollar industries by turning chaos into coordinated digital systems.

In 2025 and beyond, the biggest opportunities for founders will not come from entertainment or social apps alone—but from digitizing legacy industries where inefficiency is still the norm. Freight and logistics are just one example of how execution, not hype, creates durable value.

Direct Freight demonstrates that when technology, operations, data, and trust align, a platform doesn’t just participate in a market—it becomes the market’s backbone.

In the future of platform economies, ownership of workflows will matter more than ownership of users—and Direct Freight is already ahead on that curve.

FAQs

1. What type of business model does Direct Freight use?

Direct Freight uses a hybrid B2B marketplace and SaaS business model, combining transaction-based freight matching with subscription tools and logistics intelligence services.

2. How does the Direct Freight business model create value?

It creates value by directly connecting shippers and carriers, reducing empty miles, speeding up load matching, improving price transparency, and automating documentation and payments.

3. What are the key success factors of Direct Freight?

Direct Freight’s success is driven by high marketplace liquidity, strong trust and verification systems, and deep enterprise workflow integrations. Its hybrid monetization model and data-driven automation further strengthen scalability and profitability.

4. How scalable is the Direct Freight business model?

The model is highly scalable because software, automation, and data allow expansion across regions without proportional growth in physical infrastructure or manpower.

5. What are the biggest challenges in this model?

Major challenges include achieving early supply–demand balance, managing regulatory compliance, maintaining data accuracy at scale, and building trust in a traditionally conservative logistics industry.

6. How can entrepreneurs adapt the Direct Freight model to their region?

Entrepreneurs can localize this model by first dominating one high-volume corridor, partnering with regional fleet operators, and aligning with local transport laws before scaling automation.

7. What resources and timeframe are needed to launch a similar platform?

A scalable logistics marketplace requires strong backend development, compliance systems, payment and tracking integrations, and dedicated operations teams. With Miracuves, a Direct-Freight-style platform can launch in 3–9 days, with pricing starting at $12999 .

8. What are the main alternatives to the Direct Freight model?

Alternatives include traditional freight brokers, load boards, enterprise-only TMS platforms, and full-stack logistics providers. However, most lack Direct Freight’s real-time automation and data intelligence layer.

9. How has the Direct Freight business model evolved over time?

Direct Freight evolved from a basic load-matching platform into a fully automated, data-driven logistics ecosystem with predictive pricing, compliance automation, fintech services .

Related Article :