Behind the seamless movement of goods across continents lies a powerful digital engine—and Navisphere is one of the most critical yet least visible platforms driving this global flow. Built as the proprietary technology backbone of C.H. Robinson, Navisphere is not just a logistics management tool.In 2025, as global supply chains face rising volatility, regulatory pressure,Navisphere stands as a textbook example of how enterprise SaaS meets marketplace economics at scale.

For modern founders and logistics entrepreneurs, studying the business model of Navisphere is crucial because it demonstrates how : Proprietary platforms outperform generic SaaS in mission-critical industries , Data becomes the core monetization engine ,Network effects silently compound in B2B ecosystems

This is especially relevant for entrepreneurs building freight marketplaces, enterprise SaaS tools, AI-driven logistics platforms, and B2B digital ecosystems—the same categories where Miracuves builds ready-to-launch, scalable logistics and marketplace infrastructure for founders worldwide.

How the Navisphere Business Model Works

Navisphere operates as a hybrid enterprise logistics platform that blends SaaS infrastructure, managed services, data intelligence, and brokerage-driven marketplace dynamics into a single connected ecosystem. Unlike consumer freight apps or open load boards, Navisphere is designed as a closed-loop enterprise-grade orchestration system that powers the entire global operations of C.H. Robinson and its enterprise clients.

At its core, Navisphere doesn’t simply match loads—it digitizes, optimizes, automates, and monetizes global trade flows across every transportation mode.

Type of Business Model

Navisphere follows a Hybrid Enterprise SaaS + Managed Marketplace + Data Intelligence Platform model:

- Enterprise SaaS Platform: Transportation Management System (TMS) for large shippers

- Managed Brokerage Marketplace: Carrier and freight matching inside C.H. Robinson’s ecosystem

- Data & AI Platform: Predictive analytics, routing optimization, pricing intelligence

- Supply Chain Control Tower: End-to-end visibility across global freight operations

This hybrid design allows Navisphere to avoid the thin margins of open marketplaces while capturing high-value enterprise contract revenue plus transaction-based brokerage income.

Value Proposition by User Segment

For Shippers & Enterprises

- End-to-end shipment visibility across all modes (road, rail, air, ocean)

- AI-driven routing, ETAs, and cost optimization

- Real-time supply chain risk monitoring

- Automated booking, invoicing, and compliance

For Carriers & Transport Partners

- Consistent freight volume via C.H. Robinson network

- Predictable payments and reduced deadhead miles

- Digital tendering and automated load management

- Access to enterprise-grade customers

For C.H. Robinson (Platform Owner)

- Full control over pricing, contracts, and routing flows

- Massive proprietary logistics data generation

- Operational cost automation at global scale

- Deep customer lock-in and switching barriers

Key Stakeholders & Their Roles

- Global Shippers: Demand generators and long-term contract holders

- Carriers & Fleets: Capacity providers across transportation modes

- Customs, Ports & Regulatory Bodies: Compliance enforcement

- Technology & Data Partners: AI, EDI, tracking, and API integrations

- C.H. Robinson Operations Teams: Brokerage execution, compliance, risk, and customer success

Each stakeholder feeds data back into the system—creating a self-reinforcing intelligence loop that continuously strengthens the platform.

Evolution of the Navisphere Model

- Phase 1: Internal operational TMS for C.H. Robinson brokers

- Phase 2: Digital carrier onboarding + shipment visibility tools

- Phase 3: Global multimodal integration (air, ocean, rail)

- Phase 4 (2023–2025): AI-driven predictive analytics, control-tower dashboards, sustainability tracking, and real-time risk modeling

This evolution transformed Navisphere from a cost-center operational tool into a profit-generating strategic asset.

Target Market & Customer Segmentation Strategy

Navisphere is built for high-volume, high-complexity B2B logistics users rather than casual freight buyers. Its entire design reflects enterprise-grade decision-making, compliance, and global scale execution. Unlike open marketplaces that optimize for mass adoption, Navisphere optimizes for long-term contracts, operational depth, and lifetime enterprise value.

Primary & Secondary Customer Segments

1. Large & Mid-Sized Enterprises (Primary Segment)

These are manufacturers, retailers, and global brands managing complex supply chains.

- Industries: FMCG, retail, automotive, pharmaceuticals, industrial manufacturing, e-commerce

- Needs: Multimodal freight, compliance automation, global visibility, cost predictability

- Decision Drivers: Reliability, risk mitigation, data transparency, long-term stability

2. Freight Carriers & Fleet Operators (Primary Supply Segment)

These provide transport capacity across trucking, air, ocean, and rail.

- Segments: Owner-operators, regional fleets, national carriers, 3PL partners

- Needs: Consistent freight flow, fast payment cycles, route optimization

- Retention Trigger: Predictable income + digital automation

3. Brokers, Customs & Trade Partners (Secondary Segment)

These operate within the extended execution layer.

- Customs agents, port authorities, warehouse operators, compliance services

- Value: Integrated workflow + reduced paperwork + real-time coordination

4. Enterprise Supply Chain Teams & Executives (Decision Stakeholders)

- Roles: Logistics managers, procurement heads, CFOs, operations VPs

- Concern: Cost control, SLA performance, geopolitical risk, ESG compliance

Customer Journey: Discovery → Conversion → Retention

1. Discovery

- Enterprise sales outreach by C.H. Robinson

- Industry conferences, trade logistics expos

- Direct referrals from global shipping partners

- Integration-driven leads via ERP/TMS ecosystems (SAP, Oracle, Netsuite)

2. Conversion

- Custom platform demonstrations of Navisphere

- Pilot shipments and controlled test lanes

- SLA-based onboarding with dedicated account managers

- API & EDI integration with client ERP systems

3. Retention

- Long-term multi-year freight contracts

- Embedded dashboards into daily operations

- Predictive alerts and cost optimization tools

- Continuous performance benchmarking and reporting

Once embedded into daily operations, switching costs become extremely high, locking customers into the ecosystem.

Acquisition Channels & LTV Optimization

- Direct enterprise sales teams (high-ticket acquisition)

- Global strategic partnerships with ports, airlines, shipping alliances

- Data-driven upselling (predictive optimization modules, expanded regions)

- Cross-selling across modalities (OTR → Ocean → Air → Rail)

Lifetime Value Optimization Levers

- Contract renewals tied to operational performance

- Volume-based pricing incentives

- Platform extensions into new geographies

- Advanced analytics add-ons for enterprise decision makers

Revenue Streams & Monetization Design

Navisphere’s monetization engine is architected to extract value at multiple points of the global freight lifecycle—not from a single transaction. It blends contract-based enterprise revenue, brokerage commissions, and data-driven service layers into a tightly integrated revenue architecture. This multi-stream design ensures predictable cash flow, high margins on intelligence services, and long-term account expansion.

Primary Revenue Stream: Freight Brokerage & Managed Transportation (Core Engine)

This is the largest revenue pillar of Navisphere, directly tied to C.H. Robinson’s global brokerage operations.

Mechanism

- Enterprises book freight through Navisphere

- C.H. Robinson executes the shipment via its carrier network

- Margin is generated between shipper contract rates and carrier payouts

Pricing Model

- Contract-based pricing

- Lane-wise negotiated rates

- Volume-driven discounts

- Long-term enterprise SLAs

Revenue Contribution (Estimated 2025)

- ~70–75% of total Navisphere-linked revenue

- Driven by multimodal volume: OTR, ocean, air, rail

Growth Trajectory

- Fueled by:

- Global e-commerce expansion

- Supply chain reshoring

- Increased cross-border trade digitization

- Enterprise shift from brokers to platform-managed logistics

This stream scales with global trade velocity, making Navisphere directly tied to macroeconomic freight flows.

Secondary Revenue Stream 1: Enterprise SaaS & Platform Subscriptions

Large enterprises pay for direct access to Navisphere’s control tower features.

Includes

- Transportation Management System (TMS)

- Control-tower dashboards

- Real-time tracking and compliance tools

- API and ERP integrations

Pricing Model

- Annual SaaS contracts

- Per-user or per-location licensing

- Tiered feature access for analytics, compliance, and automation

Why It’s Powerful

- High-margin, recurring revenue

- Deep platform lock-in

- Independent of daily freight volume volatility

Secondary Revenue Stream 2: Data Intelligence & Predictive Analytics Services

Navisphere monetizes its proprietary logistics dataset through intelligence layers.

Monetized Data Products

- Dynamic lane pricing

- Predictive ETAs and risk scoring

- Capacity forecasting

- Disruption and geopolitical risk modeling

- Carbon and sustainability analytics

Who Pays

- Global manufacturers

- Retail giants

- Procurement and finance teams

- Supply chain risk managers

Strategic Impact

Data services carry software-level margins while using physical freight data as raw input, creating one of Navisphere’s highest ROI monetization layers.

Secondary Revenue Stream 3: Carrier Services & Financial Products

Carriers generate additional monetization through:

- Fast-pay and factoring services

- Insurance facilitation

- Trailer leasing and fleet support programs

- Fuel and route optimization programs

These products stabilize the supply-side loyalty while opening ancillary fintech-style revenue channels.

Secondary Revenue Stream 4: Compliance & Trade Services

Navisphere also earns from:

- Customs brokerage

- Trade document automation

- Regulatory advisory services

- Cross-border compliance management

These revenues grow in high-regulation trade corridors and emerging markets.

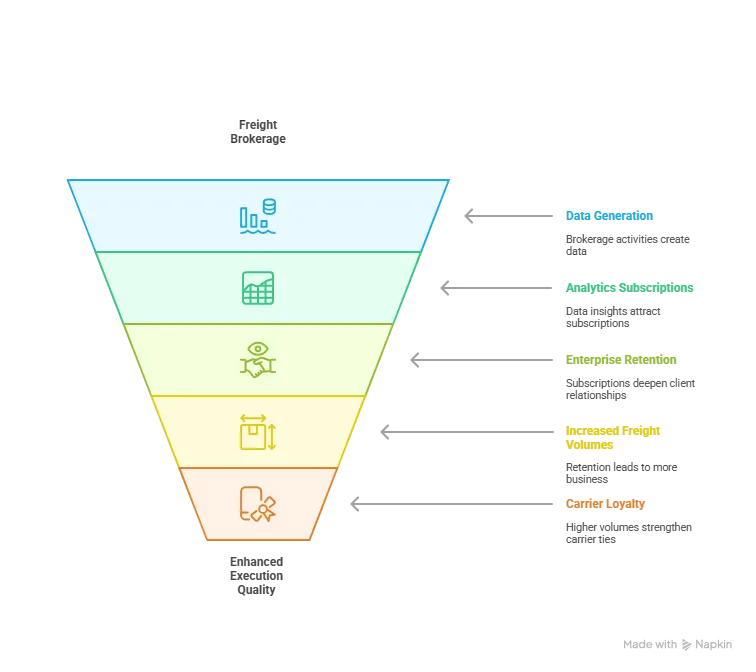

Overall Monetization Strategy (Connected Architecture)

Navisphere’s revenue streams are not isolated—they reinforce each other:

- Brokerage drives data generation

- Data drives analytics subscriptions

- Analytics deepen enterprise retention

- Retention expands freight volumes

- Higher volumes strengthen carrier loyalty

- Carrier loyalty improves execution quality

- Execution quality increases enterprise contracts

This creates a closed revenue flywheel where transactional, subscription, and intelligence revenues compound together.

Operational Model & Key Activities

Navisphere’s true strength lies in its operational execution engine—the invisible machine that processes millions of logistics decisions daily with precision, automation, and global coordination. Unlike consumer platforms that optimize primarily for engagement, Navisphere optimizes for uptime, accuracy, regulatory compliance, and execution speed, because in enterprise logistics, even minutes of delay can translate into millions in losses.

Core Operations

1. Platform Management

- 24/7 global platform uptime and disaster recovery systems

- High-availability cloud infrastructure with regional redundancy

- Continuous software deployment, patching, and security hardening

- Real-time performance monitoring across all transportation modes

2. Technology Infrastructure

- AI-powered routing, tendering, and ETA prediction engines

- Massive EDI and API message processing across shippers and carriers

- High-throughput data pipelines for real-time freight visibility

- Cybersecurity systems for contract, payment, and trade data

3. Quality Control & Trust Systems

- Carrier identity verification and compliance screening

- Fraud detection in tendering, billing, and documentation

- Load duplication and anomaly filtering

- SLA adherence tracking and performance scoring

4. Customer Support & Success

- Dedicated enterprise account managers

- Proactive disruption management (weather, port strikes, geopolitical events)

- Real-time exception handling and contingency routing

- Continuous reporting for finance and procurement teams

5. Marketing & Enterprise Growth Operations

- Fortune-500 level sales operations

- Vertical-specific industry marketing (retail, pharma, automotive, FMCG)

- Strategic logistics consulting backed by platform insights

- Internal revenue optimization teams for lane and contract performance

Resource Allocation Strategy (Enterprise-Scale View)

Although exact internal budgets are proprietary, industry benchmarks and public disclosures suggest the following approximate allocations:

- Technology & Platform Development: 20–25%

(AI, data science, infrastructure, cybersecurity, APIs) - Operations & Brokerage Execution: 35–40%

(Global teams, compliance, load monitoring, customer success) - Sales & Marketing: 15–20%

(Enterprise sales force, industry partnerships) - Data & R&D Innovation: 8–12%

(Predictive analytics, automation, sustainability tracking) - Geographic Expansion & Compliance: 5–8%

(New trade corridors, regulatory onboarding, port integrations)

This heavy investment into technology + execution is what allows Navisphere to operate at global scale with enterprise reliability.

Strategic Partnerships & Ecosystem Development

Navisphere’s ecosystem is not built on open, uncontrolled integrations—it is engineered through high-trust, enterprise-grade strategic alliances that directly enhance execution quality, global reach, and compliance depth. Every partnership within the Navisphere ecosystem is designed to reduce friction, increase data velocity, and strengthen its global logistics moat.

At its core, Navisphere follows a “platform + execution + intelligence” partnership philosophy—it doesn’t just connect systems; it aligns incentives across the entire freight value chain.

Key Types of Strategic Partnerships

1. Technology & API Partners

These power Navisphere’s digital backbone:

- ERP & enterprise software (SAP, Oracle, Microsoft Dynamics)

- Telematics & IoT tracking providers

- AI, machine learning, and predictive analytics vendors

- EDI and API integration partners

Strategic Benefit:

Deep system-to-system integration makes Navisphere operationally inseparable from enterprise workflows.

2. Payment, Fintech & Financial Services Alliances

- Global banking and payment networks

- Carrier factoring and fast-payment partners

- Insurance and risk underwriting providers

- FX and cross-border financial settlement services

Strategic Benefit:

These alliances transform Navisphere from a logistics platform into a financial operating layer for global trade.

3. Port, Terminal & Logistics Infrastructure Partners

- Seaports and airport authorities

- Rail operators and intermodal hubs

- Large warehouse and distribution center networks

- Cold-chain and pharma-certified transport operators

Strategic Benefit:

Direct infrastructure ties enable priority access, faster clearances, and real-time congestion intelligence.

4. Carrier Network & Fleet Partnerships

- National and regional trucking fleets

- Ocean carriers and freight forwarders

- Air cargo providers

- Specialized capacity providers (hazmat, temperature-controlled, oversized)

Strategic Benefit:

Ensures capacity stability, price predictability, and service-level consistency across global trade lanes.

5. Regulatory, Compliance & Trade Alliances

- Customs authorities

- Trade law consultants

- ESG and sustainability certification bodies

- Government export/import promotion agencies

Strategic Benefit:

Turns regulatory complexity into a competitive advantage rather than a barrier.

Ecosystem Strategy: Why Partnerships Power Navisphere’s Moat

Navisphere’s ecosystem strategy creates three compounding advantages:

- Network Effects

- More enterprises → more freight volume

- More freight → more carriers engaged

- More carriers → better pricing & reliability

- Better pricing & reliability → more enterprises

- Monetization Inside the Ecosystem

- Financial services revenue from payments and factoring

- Compliance and consulting revenue from trade services

- Data monetization via risk, pricing, and sustainability analytics

- Competitive Moats via Strategic Tie-Ups

- Long-term exclusive enterprise contracts

- Embedded integrations with ERP and infrastructure systems

- Regulatory partnerships that are difficult to replicate

The result is an ecosystem where every additional partner increases the switching cost for every other participant—a textbook example of B2B platform defensibility.

Growth Strategy & Scaling Mechanisms

Navisphere’s growth has never been driven by consumer virality or mass-user adoption. Instead, it scales through enterprise infrastructure expansion, data leverage, and global execution depth. Its growth strategy mirrors how large-scale industrial platforms expand—contract by contract, corridor by corridor, and region by region.

Rather than chasing user volume, Navisphere focuses on freight density, data density, and operational dominance.

Primary Growth Engines

1. Organic Enterprise Expansion

Growth begins with large shippers embedding Navisphere into their core supply chain operations.

- Multi-year global shipping contracts

- Platform-wide deployment across all business units

- Expansion from domestic to cross-border logistics

- Growth in shipment volume per enterprise account

Once embedded, Navisphere grows inside the customer, not just by adding new customers.

2. Cross-Sell Across Transportation Modes

Navisphere rarely enters with all services at once:

- Start with Over-The-Road (OTR) freight

- Expand into Ocean & Air

- Extend into Rail & Intermodal

- Add customs, compliance, and analytics

Each added mode multiplies account value without re-acquisition cost.

3. Data-Driven Growth & AI Monetization

As freight volumes increase:

- Routing intelligence improves

- Pricing algorithms become more accurate

- Risk forecasting strengthens

- Sustainability analytics grow in precision

This allows Navisphere to:

- Launch premium AI modules

- Upsell predictive and optimization tools

- Monetize insights beyond physical shipments

Data itself becomes an independent growth lever.

4. Global Geographic Expansion

Navisphere scales geographically through:

- Trade corridor prioritization (Asia–US, EU–Asia, LatAm–US)

- Port and customs onboarding in new regions

- Regulatory framework setup market-by-market

- Local carrier network activation

Expansion is systematic, compliance-first—not speculative.

5. Strategic Acquisition-Led Scaling (Via C.H. Robinson)

Growth is also accelerated through:

- Acquisitions of specialized logistics tech firms

- Purchase of regional brokers for instant market share

- Integration of niche compliance and analytics providers

These acquisitions are subsequently absorbed into the Navisphere ecosystem, strengthening its core platform.

Competitive Strategy & Market Defense

Navisphere operates in one of the most competitive and capital-intensive digital arenas—global logistics technology—where rivals range from fast-moving logistics startups to enterprise-grade SaaS giants. Yet Navisphere sustains its leadership through a multi-layered competitive defense strategy built on network control, data dominance, execution depth, and institutional trust.

Unlike platforms that rely on brand alone, Navisphere’s defense is structural and systemic, making it extremely difficult to displace.

Core Competitive Advantages

1. Network Effects & High Switching Barriers

- Every new shipper increases freight density

- Higher freight density attracts more carrier capacity

- More carriers improve price stability and service quality

- Improved service deepens enterprise dependency

Once Navisphere is integrated into:

- ERP systems

- Procurement workflows

- Financial reconciliation

- Compliance operations

Switching becomes operationally and financially disruptive, not just technically difficult.

2. Brand Equity & Institutional Trust

Navisphere benefits directly from:

- C.H. Robinson’s decades-long enterprise reputation

- Fortune-500 client trust

- Proven execution during global disruptions (COVID, Red Sea crisis, port strikes, wars, climate disruptions)

In B2B logistics, trust outweighs feature novelty, and Navisphere wins on reliability.

3. Technology & Algorithmic Execution

- AI-driven route optimization

- Predictive ETAs and real-time disruption modeling

- Automated tendering and exception handling

- Machine-learning-based pricing intelligence

Competitors often offer visibility software—Navisphere offers visibility + execution + risk mitigation in one loop.

4. Data-Driven Personalization & Compliance Strength

- Lane-specific, account-specific pricing predictions

- Personalized carrier recommendations

- ESG and carbon tracking per shipment

- Automated regulatory adaptation across regions

Data is not only used for optimization—it becomes a compliance and personalization weapon.

Market Defense Tactics

1. Handling New Entrants & Price Competition

- New freight tech startups compete on lower pricing

- Navisphere counters with:

- SLA guarantees

- Execution reliability

- Compliance shields

- Predictive cost stability

Price wars collapse when execution risk rises—Navisphere wins on risk control, not cheapest rates.

2. Strategic Feature Rollouts & Timing

Navisphere times major upgrades around:

- Regulatory changes (customs automation, ESG mandates)

- Port disruptions and geopolitical shifts

- Carrier capacity cycles

This ensures that new features are urgency-driven, not cosmetic.

3. Partnership & Acquisition as Market Defense

- Strategic acquisitions remove emerging niche threats

- Infrastructure partnerships make displacement impractical

- Regulatory-aligned alliances restrict competitive entry in key corridors

Rather than outspending competitors on advertising, Navisphere out-integrates and out-locks them institutionally.

Lessons for Entrepreneurs & Implementation

Navisphere’s journey offers a powerful blueprint for founders who want to build high-moat, enterprise-grade digital platforms rather than surface-level apps. Its success is not based on virality or branding—it is rooted in deep infrastructure, data compounding, and execution reliability. For entrepreneurs, this is a masterclass in how platform control beats marketplace chaos in complex industries.

Let’s translate Navisphere’s success into practical, actionable lessons.

Key Factors Behind Navisphere’s Success

- Platform Ownership Over Dependency

Navisphere is not built on third-party systems—it is the system. Ownership of core infrastructure creates pricing power and strategic freedom. - Data as a Strategic Asset, Not a Byproduct

Every shipment generates intelligence. Over time, this data becomes more valuable than the transaction itself. - Execution Over Feature Volume

In enterprise markets, reliability, compliance, and risk control outperform UI innovation. - Embedded Ecosystem Lock-In

Once integrated into ERP, compliance, payments, and procurement, Navisphere becomes operationally irreplaceable. - Network Effects in B2B, Not Just B2C

Freight density creates pricing power, capacity stability, and service quality—compounding at scale.

Replicable Principles for Startups

Entrepreneurs building marketplaces, logistics platforms, or enterprise SaaS can replicate Navisphere’s core mechanics by:

- Building vertical-focused platforms instead of horizontal tools

- Designing for long-term contracts, not one-time transactions

- Integrating payments, compliance, and analytics from day one

- Using data feedback loops to improve pricing, matching, and forecasting

- Prioritizing workflow embedding instead of surface-level usage

These principles apply beyond logistics—to fintech, healthcare, proptech, procurement, and industrial SaaS.

Common Mistakes to Avoid

- Chasing user growth without building execution infrastructure

- Treating data as reporting only, not as a monetizable asset

- Launching without compliance automation in regulated industries

- Relying on external platforms for core workflows

- Underestimating enterprise sales cycles and integration complexity

Navisphere proves that slow, deep integration wins over fast, shallow expansion.

Adapting the Model for Local or Niche Markets

Founders don’t need global scale on Day 1. Navisphere’s model can be adapted regionally by:

- Focusing on one trade corridor or industry vertical

- Building a closed carrier network for quality control

- Offering localized compliance and payment automation

- Layering AI-driven pricing and tracking over time

- Expanding corridor-by-corridor, not country-by-country

This localized “micro-Navisphere” approach is ideal for:

- Regional trucking marketplaces

- Port logistics platforms

- Cross-border SME trade solutions

- Warehouse and last-mile orchestration systems

Implementation Timeline & Investment Priorities

To build a Navisphere-inspired platform, founders should prioritize:

- Phase 1: Core platform + carrier onboarding + shipment tracking

- Phase 2: Payments, invoicing, and compliance automation

- Phase 3: Predictive analytics, pricing intelligence, and risk modeling

- Phase 4: Ecosystem partnerships and geographic expansion

With Miracuves’ white-label logistics and marketplace infrastructure, entrepreneurs can dramatically shorten this curve.

With Miracuves, you can launch a scalable, Navisphere-style logistics or marketplace platform in just 3– 9 days, with pricing starting at $12999, instead of spending 12–18 months and massive custom development budgets. Ready to implement Navisphere’s proven business model for your market?

Miracuves builds scalable, ready-to-launch logistics and marketplace platforms with tested business models and built-in growth mechanisms. We’ve helped 200+ entrepreneurs launch profitable digital platforms across industries. Get your free business model consultation today at Miracuves.

Conclusion :

Navisphere proves a powerful truth that many founders overlook: the biggest digital revolutions don’t always happen in consumer apps—they happen quietly inside global infrastructure. By transforming logistics from a relationship-driven, manual industry into a real-time, AI-powered digital operating system, Navisphere shows how platform thinking can redefine even the most traditional sectors of the economy.

Its business model demonstrates that sustainable growth in 2025 is no longer built on surface-level features alone—it is built on deep integration, data compounding, execution reliability, and ecosystem control. Navisphere didn’t simply digitize freight; it restructured how global trade thinks, plans, and executes movement.

FAQs :

1. What type of business model does Navisphere use?

Navisphere operates on a hybrid enterprise SaaS + managed logistics marketplace + data intelligence platform model. It blends software licensing, freight brokerage, analytics, and compliance into one integrated ecosystem.

2. How does Navisphere’s model create value?

Navisphere creates value by digitizing end-to-end freight operations, automating routing, pricing, compliance, and payments, and converting logistics data into predictive intelligence. This significantly reduces risk, delays, and operational costs.

3. What are the key success factors behind Navisphere?

Its success is driven by deep enterprise integration, massive proprietary logistics data, strong carrier partnerships, and high switching costs, backed by consistent execution reliability across global trade corridors.

4. How scalable is Navisphere’s business model?

Navisphere is highly scalable because software and data layers grow with minimal marginal cost, freight volumes compound across regions, and new corridors can be activated through partnerships and regulatory onboarding.

5. What are the biggest challenges in Navisphere’s model?

Key challenges include real-time operational complexity, cross-border regulations, cybersecurity and data sovereignty risks, and managing carrier capacity during global disruptions.

6. How can entrepreneurs adapt this model to their region?

Entrepreneurs can localize the model by focusing on a single trade corridor or industry vertical, building a closed carrier ecosystem, and adding localized compliance and payments, then expanding city-by-city.

7. What resources and timeframe are needed to launch a similar platform?

Traditionally, such platforms require 12–18 months and $50,000–$250,000+ with large engineering teams. With Miracuves, a compliant platform can be launched in 3–9 days starting at $12999.

8. What are alternatives to Navisphere’s business model?

Alternatives include open freight marketplaces (DAT, Truckstop), visibility-only SaaS platforms (Project44, FourKites), digital freight forwarders (Flexport), and trade automation systems (Descartes).

9. How has the Navisphere business model evolved over time?

Navisphere evolved from an internal transportation management tool into a global multimodal enterprise control tower, and is now a fully AI-driven logistics intelligence and execution platform.

Related Article :

- Best Direct Freight Clone Scripts 2025 for Logistics Startups & Freight Marketplaces

- Best Truckstop Clone Scripts 2025 — Build a High-Revenue Freight & Load Board Marketplace

- Business Model of Uber Freight : Complete Strategy Breakdown 2025

- Best C.H. Robinson Clone Scripts 2025 – Build Your Own Smart Freight Network