Chewy has quietly become one of the most powerful eCommerce businesses in the pet industry, serving millions of pet parents across the United States with a category-focused, digital-first model. By specializing exclusively in pet products and care, Chewy has built deep expertise in customer behavior, repeat purchasing patterns, and supply chain efficiency that generalist marketplaces struggle to match.

What looks like a simple online pet store is actually a highly optimized, recurring-revenue machine built on logistics, subscriptions, and customer loyalty. Chewy’s Autoship program drives predictable demand, reduces churn, and lowers acquisition costs, while its nationwide fulfillment network ensures fast, reliable delivery for bulky and time-sensitive pet supplies. This combination turns everyday consumables into long-term customer relationships.

For entrepreneurs building vertical marketplaces or subscription-driven platforms, Chewy’s revenue model offers some of the most practical lessons in modern eCommerce. It shows how focusing on consumables, emotional customer connection, and frictionless reordering can dramatically increase lifetime value. More importantly, Chewy demonstrates that niche dominance and retention-first design can outperform broader, price-only competition.

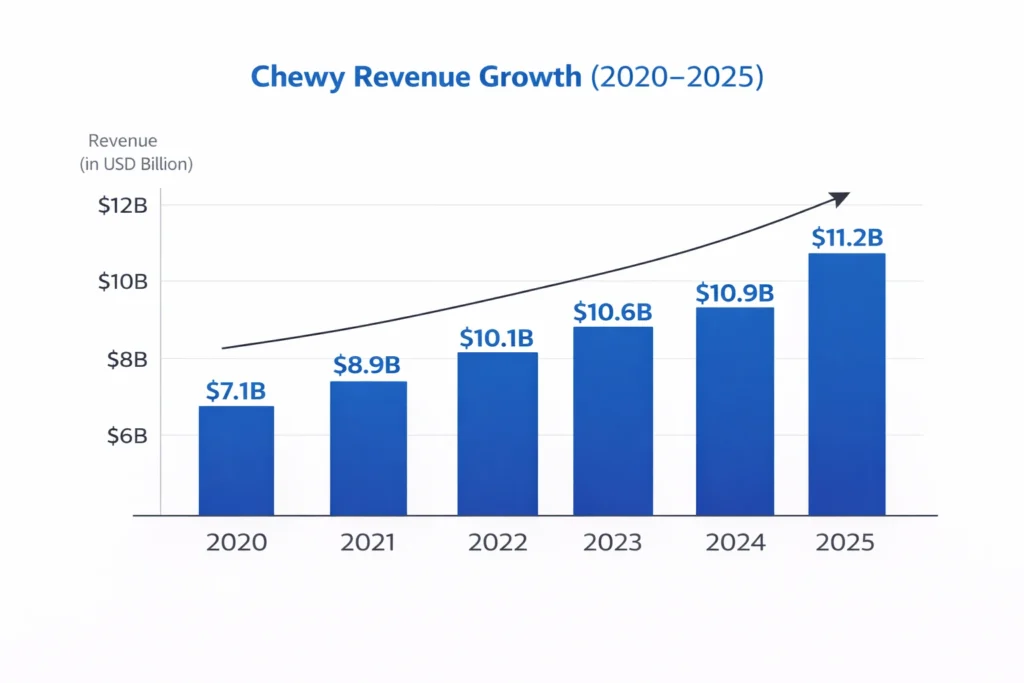

Chewy Revenue Overview – The Big Picture

Chewy operates as a direct-to-consumer pet commerce platform with deep supplier integration and strong customer retention.

Key Financial Highlights (2025):

- 2025 Revenue: ~$11.2 billion

- Valuation: ~$15–16 billion

- YoY Growth: ~8–9%

- Primary Markets: United States (dominant), limited international exposure

- Gross Margin: ~28–29%

- Net Margin: ~1–2% (improving profitability trend)

Competition Benchmark:

- Amazon Pets: Broader catalog, weaker loyalty

- Petco / PetSmart: Physical-first, lower digital efficiency

- Walmart Pets: Price-driven, low personalization

Read More: What is Chewy and How Does It Work?

Primary Revenue Streams Deep Dive

Chewy’s monetization is designed around lifetime value rather than one-time purchases.

Revenue Stream #1: Pet Product Sales (Core Revenue)

Chewy earns margins on food, toys, accessories, and health products.

- Share: ~70% of total revenue

- Pricing: Competitive, low-friction pricing

- 2025 Insight: Consumables drive repeat behavior

Revenue Stream #2: Autoship Subscriptions

Recurring scheduled deliveries for food, treats, and medicines.

- Share: ~55% of total sales volume (overlapping with product sales)

- Pricing: 5–10% discount for subscribers

- 2025 Data: Over 70% of active customers use Autoship

Revenue Stream #3: Private Label Brands

Chewy-owned brands across food, supplements, and accessories.

- Share: ~8%

- Advantage: Higher margins, brand control

Revenue Stream #4: Pharmacy & Pet Healthcare

Prescription meds and health products via Chewy Pharmacy.

- Share: ~7%

- Benefit: High retention, regulatory moat

Revenue Stream #5: Services & Partnerships

Vet partnerships, insurance referrals, and brand collaborations.

- Share: ~2–3%

- Growth Area: Still early-stage monetization

Revenue Streams Percentage Breakdown

| Revenue Stream | Share (%) |

|---|---|

| Product Sales | 70% |

| Autoship Subscriptions | Embedded |

| Private Labels | 8% |

| Pharmacy & Health | 7% |

| Services & Partnerships | 3% |

The Fee Structure Explained

Chewy does not monetize users with platform fees. All revenue is embedded in product economics.

User-Side Fees

- No subscription fee

- No membership cost

- Free shipping above minimum order value

Supplier-Side Economics

- Wholesale pricing agreements

- Volume-based rebates

- Inventory commitments

Hidden Revenue Layers

- Subscription-driven predictability

- Reduced churn costs

- Data-backed inventory optimization

Regional Pricing Variation

- US pricing optimized for retention

- Aggressive discounts in competitive categories

Complete Fee Structure by User Type

| User Type | Fees Applied |

|---|---|

| Pet Owners | None |

| Autoship Users | Discounted pricing |

| Suppliers | Wholesale margin sharing |

| Private Brands | Internal margins |

| Partners | Revenue-share agreements |

How Chewy Maximizes Revenue Per User

Chewy focuses relentlessly on lifetime value.

- Segmentation: Pet type, size, lifecycle stage

- Upselling: Supplements, treats, grooming products

- Cross-Selling: Toys and accessories post-food purchase

- Dynamic Pricing: Subscription incentives

- Retention Monetization: Personalized reminders

- LTV Optimization: Multi-pet household targeting

- Psychological Pricing: Convenience-first framing

Real Data Example:

Autoship customers spend nearly 2× more annually than non-subscribers.

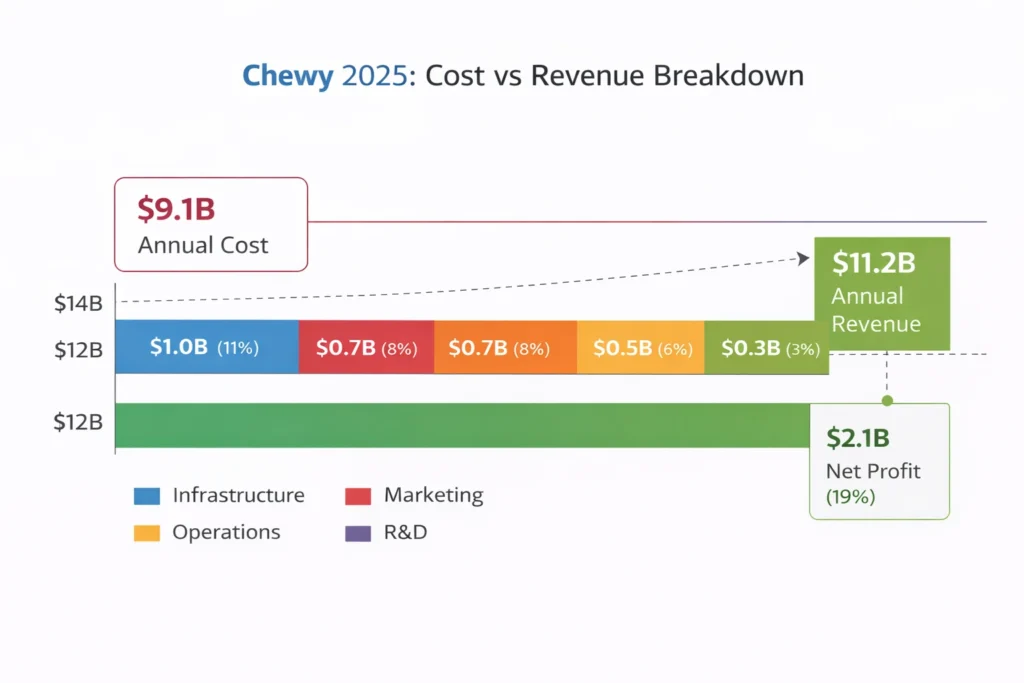

Cost Structure & Profit Margins

Chewy’s margins depend on logistics efficiency and retention.

- Infrastructure: Warehouses, fulfillment (~11%)

- Marketing & CAC: Paid ads, onboarding (~7–8%)

- Operations: Support, returns (~6%)

- R&D: Personalization, logistics tech (~4%)

Unit Economics Insight:

Each retained Autoship customer reduces CAC impact by over 35% within 12 months.

Read More: Best Chewy Clone Script 2025 –Build a Pet-Care Ecommerce Platform

Future Revenue Opportunities & Innovations

Chewy’s growth is shifting toward services and intelligence.

- Subscription expansion into healthcare

- AI-driven pet health recommendations

- Insurance and wellness bundles

- International expansion

- Private-label nutrition

Predicted Trends (2025–2027):

- Higher healthcare monetization

- Deeper personalization via AI

- Increased private-label penetration

Risks:

- Shipping cost inflation

- Margin pressure from Amazon

- Regulatory changes in pet healthcare

Opportunities for Founders:

- Regional pet marketplaces

- Niche pet verticals

- Faster local delivery models

Lessons for Entrepreneurs & Your Opportunity

What Works:

- Subscription-first design

- Consumable-driven retention

- Emotional brand loyalty

What to Replicate:

- Autoship-style recurring orders

- Predictable demand modeling

- Personalized lifecycle targeting

Market Gaps:

- Emerging markets

- Pet services aggregation

- Local fulfillment optimization

Founder Improvements:

- Lower logistics overhead

- Faster onboarding

- Smarter subscription UX

Want to build a platform with Chewy’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Chewy clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, andif you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Chewy proves that loyalty beats discounts in modern eCommerce. Rather than competing solely on price, the company invests heavily in customer experience, reliable delivery, and emotional brand connection with pet owners. This loyalty-driven strategy reduces churn, increases repeat purchases, and creates long-term value that short-term discounts cannot sustain.

Its subscription-led approach turns everyday purchases into predictable revenue. Programs like Autoship smooth demand cycles, improve inventory planning, and significantly increase customer lifetime value by locking in repeat orders. As a result, Chewy benefits from stable cash flows and lower marketing costs over time, even in competitive product categories.

For founders, Chewy is a masterclass in building defensible, recurring commerce. It demonstrates how subscriptions, consumable products, and trust-based branding can form strong competitive moats that are difficult for new entrants to break. Entrepreneurs who apply these principles can create scalable platforms that monetize consistently while maintaining high customer satisfaction.

FAQs

1. How much does Chewy make per transaction?

Margins average 25–30% depending on category.

2. What’s Chewy’s most profitable revenue stream?

Autoship subscriptions combined with private labels.

3. How does Chewy’s pricing compare to competitors?

More competitive than Petco, more loyal than Amazon.

4. What percentage does Chewy earn from products?

Typically 20–35% gross margin.

5. How has Chewy’s revenue model evolved?

Shifted from growth-first to retention-first after 2022.

6. Can small platforms use similar models?

Yes, especially in niche pet categories.

7. What’s the minimum scale for profitability?

Around 30k–50k active subscribers.

8. How to implement similar revenue models?

Start with subscriptions, then layer private labels.

9. What are alternatives to Chewy’s model?

Marketplace commissions or membership fees.

10. How quickly can similar platforms monetize?

Many businesses begin generating revenue soon after launch.