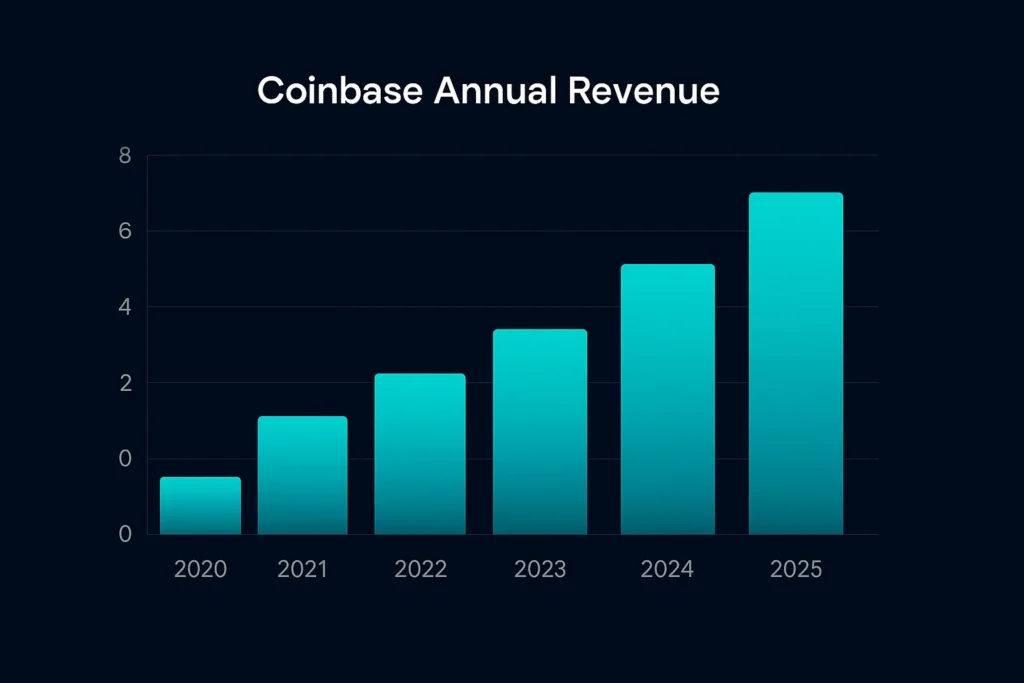

Coinbase earned $5.2 billion in 2024 and is projected to cross $6.5 billion in 2025 — making it one of the most profitable fintech businesses worldwide without storing or owning crypto assets. Instead of depending on investments, Coinbase built a transaction-driven financial engine that monetizes user activity, liquidity flow and institutional demand — not crypto speculation.

What makes Coinbase stand out is its regulation-first approach, which helped it become the leading compliance-friendly exchange in the United States and a trusted gateway for new investors entering the blockchain economy. While many platforms faced regulatory pressure, Coinbase leveraged it to build credibility — converting transparency into profitability.

Why it matters:

Coinbase’s revenue model is structured, scalable, regulation-ready, and replicable — especially for entrepreneurs who want to launch their own crypto exchange platforms without creating a native token or running liquidity pools. With the right blueprint, a Coinbase-style platform can be launched as a profitable SaaS + fintech hybrid — even at a micro-market scale.

This breakdown explores how Coinbase makes money, how it secures user trust, how it continues to expand, and how similar platforms can replicate this model with a smart architecture — not just big investment.

Coinbase Revenue Overview – The Big Picture

- Estimated Revenue (2025): $6.5 Billion (projected)

- 2024 Revenue: $5.2 Billion

- Current Valuation (2025): $60–70 Billion

- User Base: Over 120 million verified users

- Active Monthly Users: 11.5 million+

- Year-over-Year Growth: ~20%

- Revenue by Region:

- North America – 45%

- Europe – 22%

- Asia – 17%

- Others – 16%

Profit Margin: 45–50%

Market Position: Largest regulated crypto exchange in the USA — ahead of Kraken, Gemini, and Robinhood Crypto.

Read More: Inside the Coinbase App: What It Does, Who Uses It & How It Makes Money

Primary Revenue Streams – Deep Dive

| Revenue Stream | % Share (2025 est.) | Description |

|---|---|---|

| Transaction Fees | 48% | Trading, swaps & conversions |

| Subscription & Services | 22% | Coinbase One, API access |

| Blockchain Rewards (Staking) | 10% | Yield & staking services |

| Institutional Services | 8% | Prime services & custody |

| USDC Yield | 6% | Interest revenue from stablecoin |

| NFT Marketplace & Commerce | 3% | Low but growing |

| Others | 3% | Card, remittances, ads |

Revenue Stream #1 – Transaction Fees

- Core engine of Coinbase’s revenue

- Fees 0.5%–4% depending on trade size

- Generated $2.9B+ in 2024 alone

Revenue Stream #2 – Subscription Services (Coinbase One)

- $29.99/mo per user

- Priority support, 0% fees, tax tools

- Solid recurring revenue stream

Revenue Stream #3 – Staking & Blockchain Rewards

- 1.5%–3% fees on staking assets

- Earned over $500M+ in 2024

Revenue Stream #4 – Institutional Custody (Prime)

- Coinbase handles custody for large funds

- Custodies over $180B in assets today

Revenue Stream #5 – USDC Stablecoin Yield

- Generates interest via treasury investments

- Low-risk & regulation-compliant revenue stream

The Fee Structure Explained

| User Type | Fee Type | Range |

|---|---|---|

| Retail Traders | Transaction Fee | 0.5–4% |

| Institutional | Prime Service | Custom pricing |

| Staking Users | Staking Fee | 1.5–3% |

| API Users | Subscription | $30–$300/mo |

| NFT Sellers | Commission | 1–2.5% |

User-side Fees – Trading, network fee, instant buy/sell fee

Provider-side Fees – API access, custody fees, enterprise security

Hidden Layers – Spread pricing & maker/taker models

Regional Pricing: US & EU impose higher compliance fees

Read More: Coinbase Marketing Strategy: Ride the Crypto Wave

How Coinbase Maximizes Revenue Per User

- Segmentation — Retail vs Institutional

- Upselling — Tax reports, staking, subscriptions

- Cross-selling — NFT, API, and cloud security

- Dynamic pricing — High-frequency traders get reduced fees

- Retention monetization — Coinbase Earn & educational rewards

- Psychological pricing — Small fee feels negligible per trade

- LTV optimization — Educational onboarding → Active trader flow

Real Example (2024):

An average retail user generated $65/year, while institutional traders generated $2,700+ each in revenue.

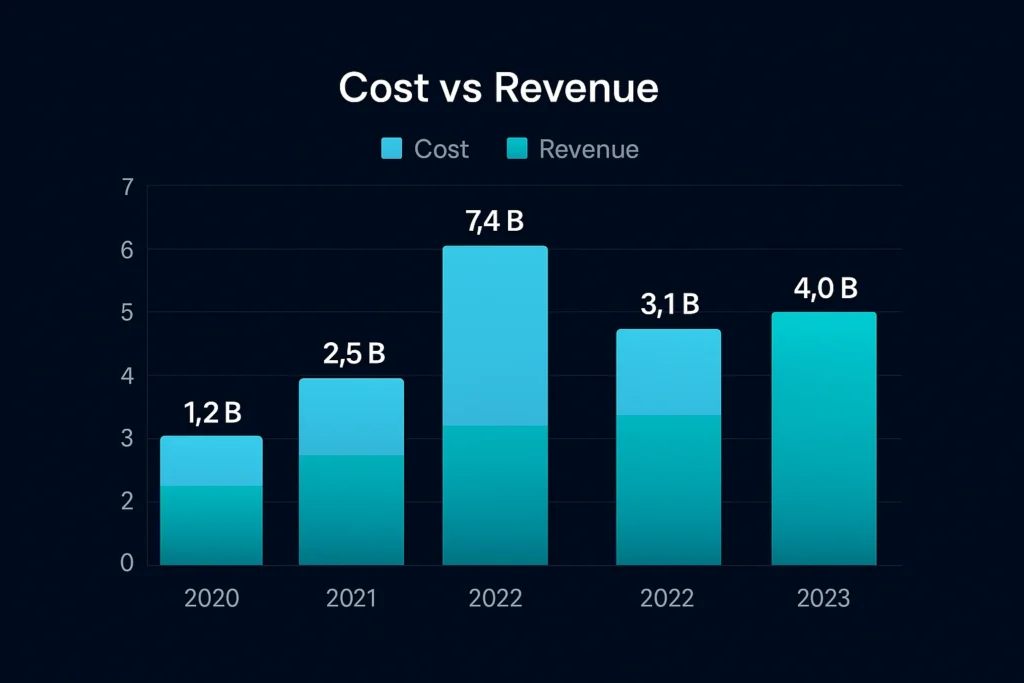

Cost Structure & Profit Margins

| Cost Component | Annual Cost (2025 est.) |

|---|---|

| Technology Infrastructure | $850M |

| Legal & Compliance | $700M |

| Marketing & CAC | $500M |

| Operations | $380M |

| R&D | $450M |

| Total Cost | ~$2.8B |

Estimated Profit 2025: ~$3.3B

Profit Margin: ~50%

Unit Economics: Strong CAC payback — under 5 months

Scalability: High upon regulation alignment

Read More: Build an App Like Coinbase – Full Stack Developer Guide

Future Revenue Opportunities – 2025 to 2027

- Tokenized asset trading

- Crypto tax-as-a-service

- AI-powered investment tools

- Web3 identity & user authentication

- Virtual asset banking (CBDCs)

- Decentralized credit systems

- Global remittance rails (low fee)

Risks: SEC regulations, on-chain finance, decentralized rival models

Opportunity: Regulated markets are still open — entrepreneurs can launch micro-niche Coinbase-style platforms in emerging sectors.

Lessons for Entrepreneurs & Your Opportunity

What Works for Coinbase

- High trust with strict regulation

- Easy onboarding for first-time investors

- Subscription-based recurring revenue

- Staking + custody → stable income layer

What You Can Replicate

- Fee layering

- Prime services for institutions

- Subscriptions + add-ons

- USDC / stablecoin yield model

Your Opportunity – Coinbase-Style Platform with Miracuves

Want to build a platform with Coinbase’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating crypto exchanges with built-in monetization systems. Our Coinbase clone scripts come with fully customizable revenue models, institutional APIs, staking, and subscription layers. Some clients see revenue within 30 days of launch, and Miracuves delivers ready-to-launch solutions in 3–9 days guaranteed. If you need an advanced scripting version — Miracuves provides that also. Get a free consultation to map out your revenue strategy and compliance model.

Final Thought

Fintech moves fast — but regulated, structured exchanges like Coinbase prove that profitability doesn’t depend on speculation, it depends on trust, compliance, and a scalable revenue model. With the right setup, even a new crypto exchange can start generating income from trading fees, subscriptions, staking, and institutional services — without ever holding crypto assets.

The next wave of crypto businesses won’t compete on features — they’ll compete on monetization efficiency. That means whoever builds smarter revenue layers will grow faster than those who only build trading platforms.

This is exactly where Miracuves gives entrepreneurs a major advantage. Instead of spending months building from scratch, you get a Coinbase-style architecture prebuilt — with fee systems, KYC/AML support, API layers, staking modules, and liquidity options already integrated. You can launch faster, test revenue earlier, and scale with confidence.

Miracuves delivers ready-to-launch solutions in just 3–9 days, making it one of the fastest go-to-market options for crypto exchange startups.

FAQs

1. How much does Coinbase make per transaction?

Between 0.5% to 4% depending on user type and trade value.

2. What’s Coinbase’s most profitable revenue stream?

Transaction fees + subscription services.

3. How does Coinbase compare to competitors?

It leads in regulation, security, and user trust — a major competitive advantage. With Miracuves, you can build a similar high-trust platform starting at just $2899.

4. What percentage does Coinbase take from staking providers?

Around 1.5–3% management fee.

5. Has Coinbase’s model changed over time?

Yes — it evolved from trading-only to subscription, custody & AI services.

6. Can entrepreneurs replicate this model?

Yes — especially by targeting niche regions & sectors.

7. What’s the minimum requirement for profitability?

150K+ active traders OR B2B subscription-based model.

8. How to implement this revenue model?

Begin with trading & staking → scale to API + subscription products.

9. What are alternatives to Coinbase’s model?

DEX model, tokenized assets, hybrid wallet-exchange architecture.

10. How fast can a Coinbase clone monetize?

With Miracuves — within 3–9 days guaranteed, not months or years.