Let’s be real—crypto isn’t just the new kid on the fintech block anymore. It’s hosting the party. From Bitcoin pizza stories to NFTs of pixelated monkeys selling for millions, we’ve seen it all. But behind the flash and memes, there’s a rock-solid question serious entrepreneurs are asking: “How exactly do crypto exchanges make money?”

It’s not just about flashy charts and Elon tweets. Crypto exchanges are pulling in billions annually by monetizing every trade, deposit, and digital sigh a user makes. The secret? They’ve built a fintech machine that works 24/7, across borders, and thrives on both bull and bear markets.

If you’re planning to launch your own crypto exchange According to Statista —or clone an existing powerhouse—you need more than hype. You need a smart business model, and the right tech partner to build it. That’s where Miracuves enters the picture.

Understanding the Crypto Exchange Ecosystem

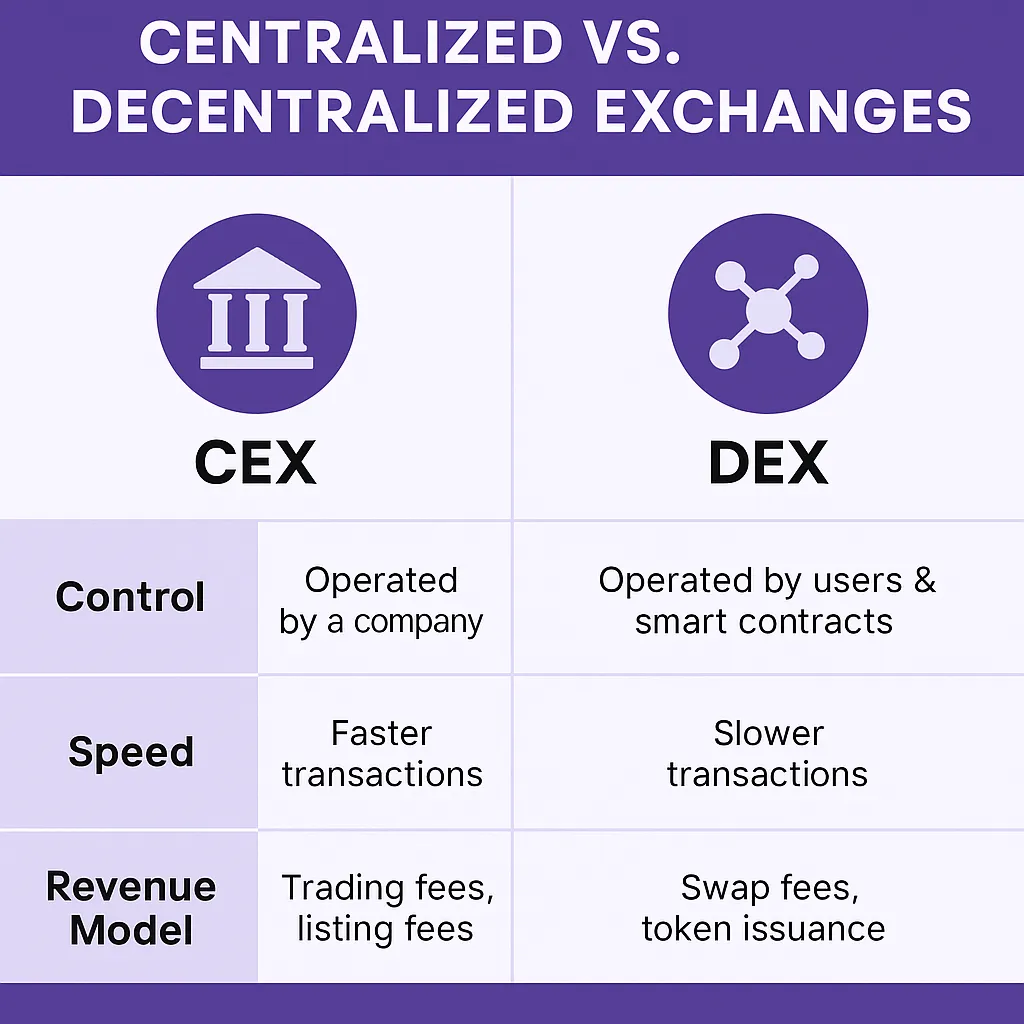

Crypto exchanges act as digital marketplaces for buying, selling, and trading cryptocurrencies. They’re part stock exchange, part payment processor, and part vault. There are two main types of platforms you can launch:

- Centralized Exchanges (CEX) – run like traditional brokerages (e.g., Binance, Coinbase)

- Decentralized Exchanges (DEX) – run on smart contracts with no central authority (e.g., Uniswap)

Each model comes with its own money mechanics, but both rely on volume, liquidity, and user retention to stay profitable.

Core Revenue Streams for Crypto Exchanges

1. Trading estate

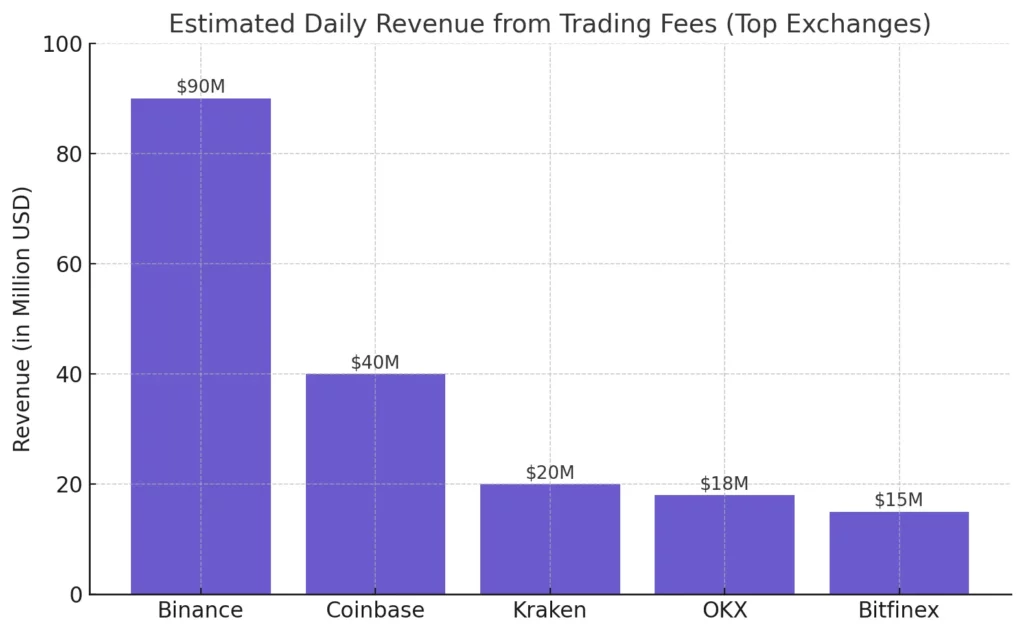

This is the bread and butter. Every time a user trades, the exchange takes a cut.

CEXs typically charge 0.1%–0.5% per trade. That might seem small—until millions of trades start rolling in.

DEXs use liquidity pool fees, shared with token holders or liquidity providers. Either way, every transaction is a moneymaker.

2. Withdrawal & Deposit Fees

Some platforms charge fixed or percentage-based fees for crypto or fiat withdrawals.

Example: Coinbase charges 1% on crypto withdrawals, while many charge $10–$30 for fiat bank withdrawals.

3. Listing Fees

New crypto projects pay to get listed. This can range from $50,000 to over $1 million, depending on the exchange’s popularity.

It’s like shelf space in a supermarket—but for coins.

4. Spread Margin

Some platforms (especially beginner-friendly ones) offer simple buy/sell options with higher spreads.

They quietly profit by selling at a slightly higher price than they bought at. It’s invisible profit—and very scalable.

5. Staking-as-a-Service

Exchanges let users stake their tokens to earn interest. In return, the exchange takes a cut of the staking rewards.

This passive income model is growing rapidly—especially with proof-of-stake chains like Ethereum 2.0.

6. Margin & Futures Trading

For experienced traders, exchanges offer leveraged trading.

Users borrow to trade bigger amounts, and the platform earns interest + higher fees from leveraged trades.

High risk for users. High reward for exchanges.

7. Subscription-Based Features

Some platforms offer pro memberships with advanced tools, API access, lower fees, or early access to ICOs.

Recurring revenue in a volatile world? Smart move.

8. NFT & Token Launchpads

Many crypto exchanges are now launching NFT marketplaces and IEO/IDO launchpads.

They take a cut of every launch, sale, or auction hosted on their platform.

Learn More: Proven Revenue Models for Your Decentralized Crypto Exchange

Trust & Security: The Real Cost and Features

Crypto is volatile. Scams are rampant. One security breach can bankrupt a platform overnight.

That’s why successful exchanges invest heavily in:

- Cold wallet storage

- 2FA & biometric security

- Regulatory compliance (KYC/AML)

- Insurance for stored assets

Learn More: Cost vs Features in P2P Crypto App Development

How to Make Your Crypto Exchange Stand Out

- UI/UX Matters: Most users are not DeFi nerds. Keep it clean and intuitive.

- Lcalize It: Offer region-specific fiat integrations and languages.

- Gamify It: Add badges, referral programs, and loyalty points.

- Offer Education: Build trust with explainers, simulators, and newsletters.

Choosing the Right Tech Stack

A high-performance crypto exchange needs a robust backend, real-time trading engine, and bank-level security. Popular tech choices include:

- Node.js / Python for real-time ops

- React / Flutter for cross-platform UI

- PostgreSQL / MongoDB for data

- Blockchain integrations (e.g., Ethereum, BNB, Solana)

Miracuves delivers pre-built crypto exchange clones with customizable tech, wallet APIs, KYC modules, and more—cutting your launch time from months to weeks.

Conclusion

Crypto exchanges are powerful platforms that can generate revenue 24/7—if built right. From trading fees to staking services, the business model is diverse, scalable, and future-ready.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQ’s

1) What is the main revenue source for crypto exchanges?

Trading fees! These small cuts per transaction generate millions in daily revenue.

2) Are crypto exchanges legal to operate?

Depends on the country. Many require KYC/AML compliance and licensing from financial authorities.

3) What’s the difference between CEX and DEX?

CEXs are centralized and user-friendly. DEXs are decentralized, require wallets, and offer more privacy.

4) How much does it cost to build a crypto exchange?

With Miracuves, you can launch a fully functional clone starting around $15K–$25K depending on features.

5) How do exchanges protect user funds?

Cold storage, 2FA, encrypted wallets, smart contract audits, and sometimes insurance policies.

6) Can I monetize my exchange with NFTs too?

Absolutely. You can integrate NFT marketplaces or token launchpads for additional revenue streams.