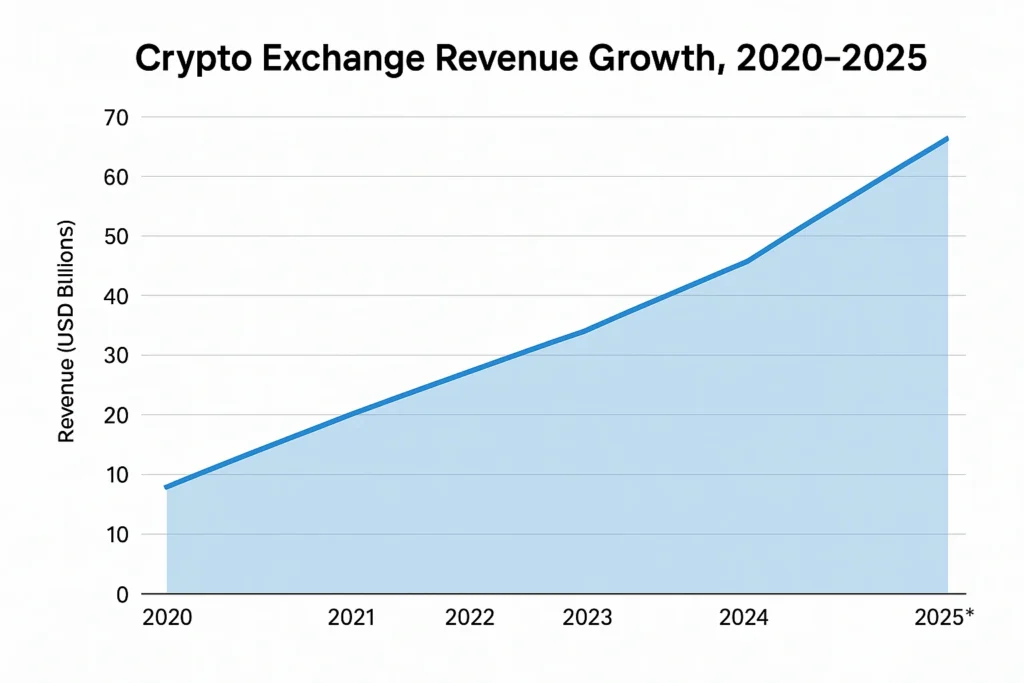

Did you know global crypto exchanges generated over $50 billion in 2024 — and analysts expect the market to cross $65 billion in 2025?

Why it matters:

Crypto exchanges have evolved from simple trading platforms into multi-layer fintech ecosystems with built-in monetization, AI-driven tools, institutional services, futures trading, staking, lending, and premium subscription models. For entrepreneurs, this is not just a trend — it’s a scalable business opportunity with high margins, predictable revenue, and global demand.

In 2025, the rise of P2P trading, compliant exchanges, and regional micro-exchanges means you don’t need to compete with Binance or Coinbase. Even a niche exchange with 50K active users can become profitable if its revenue layers are structured well. That’s exactly what this model reveals — how to build a crypto exchange that earns from day one.

Crypto Exchange Revenue Overview – The Big Picture

• Global revenue (2025 forecast): $65B+

• Current market valuation: $2.1 trillion (crypto market cap)

• Year-over-year growth: 23%

• Fastest growing region: Asia-Pacific, followed by Middle East

• Profit margins: 35%–60% depending on model

• Top competitors: Binance, Coinbase, Kraken, Bybit, OKX

| Year | Global Exchange Revenue (USD Bn) |

|---|---|

| 2020 | 18 |

| 2021 | 32 |

| 2022 | 41 |

| 2023 | 47 |

| 2024 | 50 |

| 2025* | 65+ (projected) |

Primary Revenue Streams Deep Dive

1. Trading Fees (40%–60% share)

Users pay a fixed or dynamic fee on every trade. Example: Binance earns $20M+ daily via trading fees alone.

2. Withdrawal & Deposit Fees (10%–15%)

Fixed fees for fiat/crypto withdrawals & deposits.

3. Listing Fees (10%–20%)

New tokens/projects pay $50K–$1M+ to get listed.

4. Margin Trading & Futures (15%–25%)

High-profit segment with leveraged trading & liquidation revenue.

5. Premium Features & Subscriptions (5%–8%)

API access, pro trading tools, advanced charting, research reports.

Read More: Best Crypto Exchange Script 2025 – Secure Trading Platform

| Revenue Source | Share (%) | Avg 2025 Global Revenue |

|---|---|---|

| Trading Fees | 40–60% | $30B+ |

| Listing Fees | 10–20% | $8B+ |

| Futures/Margin | 15–25% | $12B+ |

| Withdrawal Fees | 10–15% | $7B+ |

| Premium Tools | 5–8% | $4B+ |

The Fee Structure Explained

| User Type | Fee Type | Typical Rate |

|---|---|---|

| Trader | Trading fee | 0.1% – 0.5% |

| Trader | Withdrawal fee | Fixed or dynamic |

| Token Provider | Listing fee | $50K – $1M |

| Premium User | Subscription | $10 – $100/mo |

| Institutional Client | API access | $500+/mo |

Hidden Revenue Layers:

• Liquidation charges in futures trading

• Spread-based earnings

• Order book manipulation prevention via maker/taker fees

• Lending & staking revenue

• Proof-of-reserve service charges

How Crypto Exchanges Maximize Revenue Per User

• User Segmentation: Retail traders, whales, institutions

• Upselling: Pro accounts, analytics tools

• Cross-selling: Derivatives, staking, lending

• Dynamic pricing: Based on trading volume & loyalty

• Retention monetization: VIP tiers, fee discounts, referral income

• Psychological pricing: 0.09% fee feels “almost free”

• LTV optimization: Exchange users have avg. LTV $2,500–$7,000

Real example: Coinbase increased ARPU from $58 (2022) to $112 per user in 2024 via staking + premium accounts.

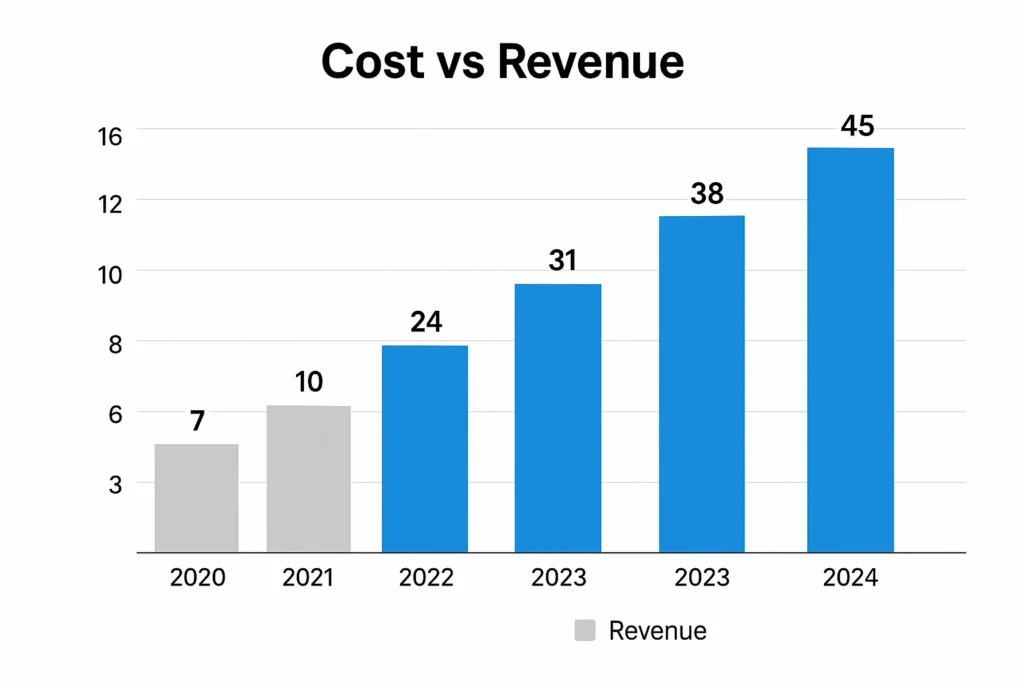

Cost Structure & Profit Margins

| Cost Type | Avg Share of Revenue |

|---|---|

| Tech Infrastructure | 25% |

| Marketing/CAC | 20% |

| Compliance & Legal | 15% |

| Operations | 15% |

| R&D | 10% |

| Other | 15% |

Profitability Path:

• Exchanges reach break-even after 50K–100K active traders

• Scalable via cloud-native infrastructure

• Global exchanges maintain 35%–60% profit margins

Future Revenue Opportunities & Innovations

• AI-powered trading bots

• Crypto tax & compliance tools

• NFT exchange integration

• Institutional trading desks

• Social trading (copy trading)

• Cross-chain liquidity aggregation

• AI/ML market prediction tools

• Embedded finance opportunities

2025–2027 forecast:

• Revenue to cross $90B+ globally

• Asia & Africa to be fastest adopters

• Gov-approved regulated exchanges will dominate

Read More: Most Profitable Crypto Exchange Apps to Launch in 2025

Lessons for Entrepreneurs & Your Opportunity

What works:

• Micro-fee-based high-volume model

• Multi-stream monetization

• API economy for institutions

What to replicate:

• Low trading fees to acquire traders

• Future-based revenue streams

• High retention via staking + rewards

Opportunity: Niche trading platforms – like sector-based exchanges (AI tokens, green tokens, gaming tokens).

Want to build a platform with crypto exchange’s proven revenue model?Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization features. Our Crypto Exchange Script Clone comes with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and Miracuves delivers ready-to-launch solutions in 30–90 days. Get a free consultation to map out your revenue strategy — and if you want in advanced language script, Miracuves will provide that also.

Final Thought

Crypto exchanges don’t just earn from trades — they control liquidity, digital assets, user data, and financial flow across the blockchain economy. In 2025, owning a crypto exchange doesn’t require massive funding — it requires a smart revenue model and the right tech foundation.

The market is wide open, especially for niche and regional exchanges, AI-powered trading tools, and P2P platforms built around trust, speed, and compliance. Those who launch early will capture users before regulations fully lock the space.

That’s where Miracuves comes in.

We don’t just develop apps — we build revenue engines. Our Crypto Exchange Script Clone is engineered to help entrepreneurs launch platforms with multiple income streams built in from day one — staking, futures, commissions, liquidity pool earnings, subscriptions, API tools, and more.

With real-time security frameworks, scalable architecture, advanced trading modules — Miracuves delivers ready-to-launch solutions in just 3–9 days, so you can focus on growth, not development.

FAQs

1. How much does a crypto exchange make per transaction?

Typically 0.1%–0.5% per trade, varying by trading volume and user tier.

2. What’s the most profitable revenue stream?

Margin trading and futures—high volume with liquidation fees.

3.How does pricing compare to competitors?

Low-fee exchanges focus on attracting mass users, while premium platforms charge more for advanced tools and analytics. With Miracuves, you still get premium features at an accessible starting price of $2,899.

4. What percentage does an exchange take from providers?

Listing fees range from $50K to $1M depending on project size.

5. How has the revenue model evolved?

Shifted from pure trading fees to staking, lending, futures, and institutional services.

6. Can small platforms use similar models?

Yes, niche or regional exchanges perform well with lean feature sets.

7. What’s the minimum scale for profitability?

Around 50K active traders with consistent volume.

8. How to implement similar revenue models?

Use prebuilt clone scripts with proven monetization layers.

9. What are alternatives to this model?

Subscription-based trading tools, Web3 wallets, NFT exchanges.

10. How quickly can similar platforms monetize?

With Miracuves clone scripts, revenue can start within 30 days, backed by our 30–90 days guaranteed delivery for full launch readiness.