AI image generation crossed a major inflection point in 2025. Platforms inspired by DALL·E are no longer experimental tools—they are serious revenue engines.

They now sit at the center of content production, product design, advertising creatives, UI mockups, and brand assets, shifting from “creative experiments” to mission-critical business software with daily active usage and predictable demand.

The global AI image generation market now exceeds $1.2 billion in annual platform revenue, driven by developers, enterprises, creators, and agencies embedding visuals directly into workflows.

Growth is fueled by API integrations, automation tools, e-commerce catalogs, social media content scaling, and enterprise marketing operations, where speed and cost efficiency matter more than manual design.

For founders, studying the DALL·E-style revenue model is essential because it combines usage-based monetization, SaaS subscriptions, and enterprise licensing into one scalable system.

This hybrid model balances high compute costs with recurring revenue, strong cash flow visibility, and expanding lifetime value, making it one of the most durable monetization frameworks in the AI economy.

DALL·E-Style Revenue Overview – The Big Picture

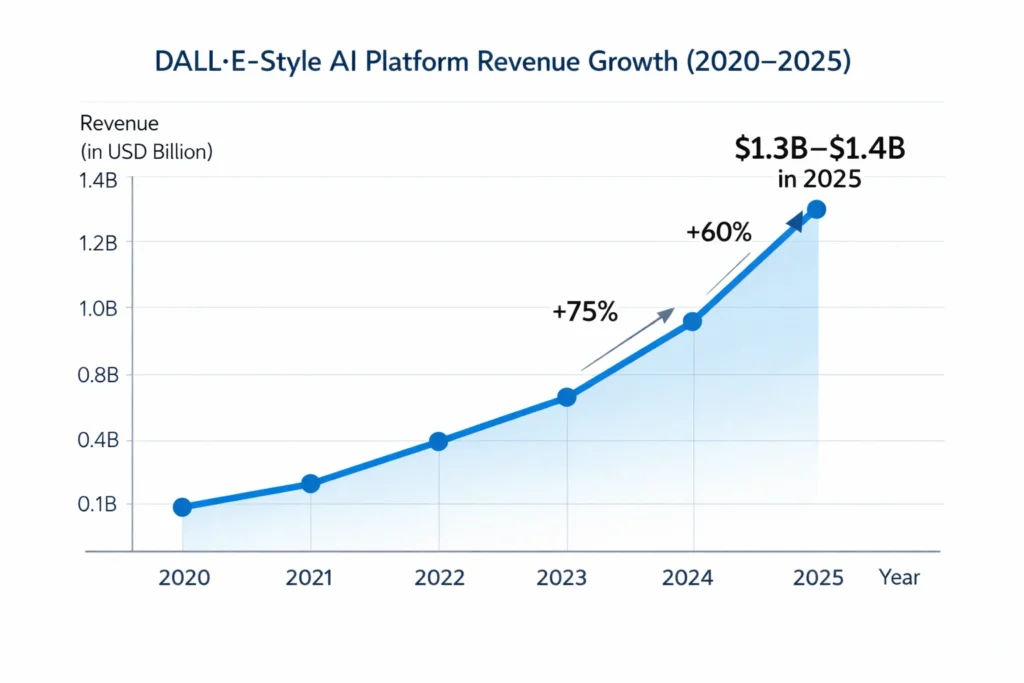

- 2025 Revenue (global DALL·E-style platforms): ~$1.2–1.4 billion

- Implied valuation of leading platforms: $25–35 billion (based on AI SaaS multiples)

- YoY growth (2024–2025): ~55–65%

- Revenue by region:

- North America: 46%

- Europe: 28%

- Asia-Pacific: 21%

- Rest of World: 5%

- Average profit margins: 28–35% at scale

- Competition benchmark: Midjourney-style subscriptions, Stable Diffusion enterprise licensing, Canva AI integrations

Read More: What Is DALL·E? A Simple Guide to AI Image Generation

Primary Revenue Streams Deep Dive

Revenue Stream #1: API Usage (Pay-Per-Image / Tokens)

- How it works: Developers and businesses pay per generated image or per compute token

- Pricing: $0.02–$0.12 per image depending on resolution and model

- 2025 share: ~38% of total revenue

- Why it scales: Embedded directly into apps, websites, and automation tools

Revenue Stream #2: Individual Subscriptions

- How it works: Monthly plans for creators, marketers, designers

- Pricing: $15–$60/month

- 2025 share: ~27%

- Key advantage: Predictable recurring revenue

Revenue Stream #3: Enterprise & Team Licensing

- How it works: Custom plans with SLA, security, private models

- Pricing: $5,000–$250,000/year contracts

- 2025 share: ~22%

- Highest margin stream

Revenue Stream #4: Credits & Add-Ons

- How it works: Users buy extra image credits, higher resolution, faster queues

- Pricing: $10–$500 top-ups

- 2025 share: ~9%

Revenue Stream #5: Marketplace & IP Extensions

- How it works: Style packs, fine-tuned models, brand-safe libraries

- 2025 share: ~4%

Revenue streams percentage breakdown

| Revenue Stream | How It Works | Pricing Model (2025) | Revenue Share (%) | Notes |

|---|---|---|---|---|

| API Usage | Developers pay per image or compute token via API | $0.02–$0.12 per image | 38% | Highest scalability; embedded into SaaS, apps, workflows |

| Individual Subscriptions | Monthly plans for creators & professionals | $15–$60 per month | 27% | Strong recurring revenue base |

| Enterprise & Team Licensing | Custom contracts with SLA, security & private models | $5,000–$250,000/year | 22% | Highest margins and LTV |

| Credits & Add-Ons | Extra image credits, faster queues, high-res exports | $10–$500 per top-up | 9% | Impulse-driven upsell revenue |

| Marketplace & IP Extensions | Style packs, fine-tuned models, brand-safe libraries | Variable | 4% | Emerging but strategic |

The Fee Structure Explained

User-Side Fees

- Subscription plans

- Pay-as-you-go image credits

- Premium exports (4K, vector, batch generation)

Provider-Side Fees

- Enterprise onboarding fees

- Custom model training charges

- Priority compute access

Hidden Revenue Layers

- Data usage insights (anonymized)

- White-label licensing

- API overage fees

Regional Pricing Variation

- Lower subscription pricing in Asia & LATAM

- Enterprise pricing standardized globally

Complete fee structure by user type

| User Type | Fees Paid | Typical Cost Range | Monetization Logic |

|---|---|---|---|

| Free Users | Limited credits, watermark, slower generation | $0 | Conversion funnel |

| Individual Creators | Subscription + optional credit top-ups | $15–$60/month | Predictable MRR |

| Power Users | Subscription + frequent credit purchases | $80–$300/month | High ARPU segment |

| Developers | API usage fees (per image / token) | $50–$5,000+/month | Scales with usage |

| Teams | Per-seat pricing + shared credits | $500–$5,000/month | Collaboration lock-in |

| Enterprises | Licensing + custom models + SLA | $5k–$250k/year | Highest profitability |

| White-Label Clients | Platform licensing + branding | Custom | Expansion revenue |

How DALL·E-Style Platforms Maximize Revenue Per User

- Segmentation: Hobbyists, professionals, enterprises

- Upselling: Resolution upgrades, faster inference, private generations

- Cross-selling: APIs + dashboards + collaboration tools

- Dynamic pricing: Surge pricing during high GPU demand

- Retention monetization: Daily credit limits that encourage upgrades

- LTV optimization: Teams convert 4.6× higher than solo users

- Psychological pricing: Credits feel cheaper than subscriptions

- Real data example: Power users generate 18× more images monthly than free users

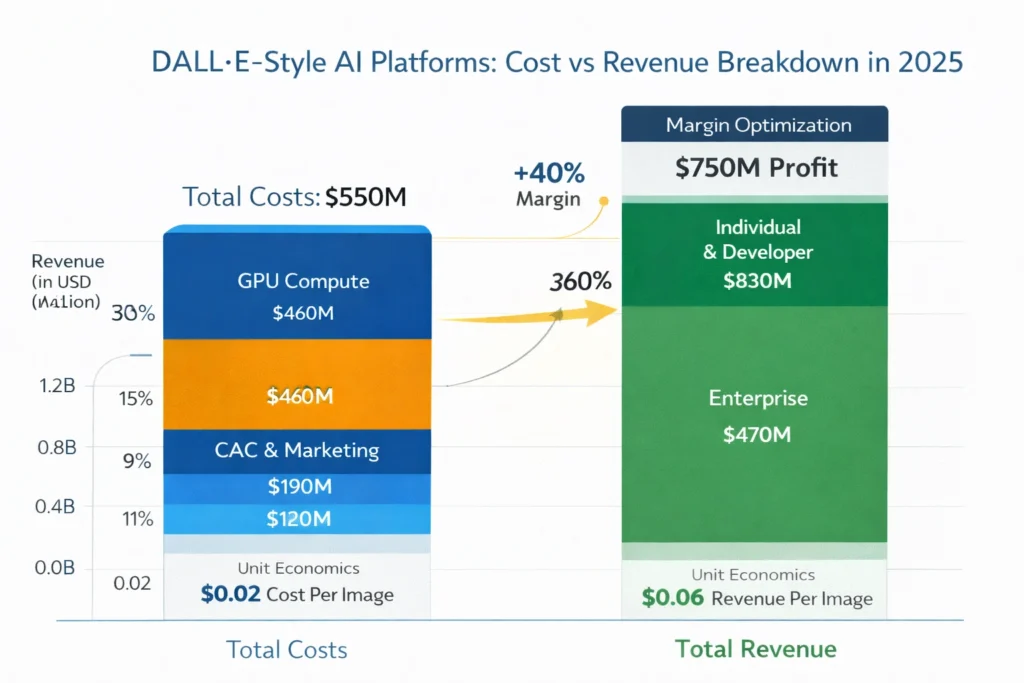

Cost Structure & Profit Margins

Infrastructure Cost

- GPU compute: 35–45% of revenue

- Storage & CDN: 6–9%

CAC & Marketing

- Paid ads, partnerships, freemium conversion

- ~12–16% of revenue

Operations

- Support, compliance, moderation

- ~8%

R&D

- Model improvements, safety layers

- ~10–14%

Unit Economics

- Cost per image: $0.01–$0.03

- Average revenue per image: $0.06

Profitability Path

- Breakeven at ~180k monthly active paying users

Future Revenue Opportunities & Innovations

- New streams: Brand-safe image licensing for enterprises

- AI/ML monetization: Custom fine-tuned models per company

- Market expansions: Education, e-commerce catalogs, gaming assets

- Predicted trends (2025–2027):

- Real-time image generation in workflows

- Multimodal pricing bundles

- Risks: GPU cost volatility, IP regulations

- Opportunities: Vertical-specific AI image platforms for founders

Lessons for Entrepreneurs & Your Opportunity

What Works

- Usage-based pricing beats flat subscriptions

- APIs unlock massive B2B scale

What to Replicate

- Credit systems

- Tiered subscriptions

- Enterprise licensing

Market Gaps

- Industry-specific image generators

- Affordable SME-focused platforms

Improvements Founders Can Use

- Faster inference

- Clearer commercial usage rights

Want to build a platform with DALL·E-style proven revenue models? Miracuves helps entrepreneurs launch revenue-generating AI platforms with built-in monetization systems. Our DALL·E clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

AI image generation is no longer about novelty—it’s about infrastructure.

It now powers marketing pipelines, e-commerce catalogs, gaming assets, social content, and internal design workflows. Platforms that position themselves as core creative infrastructure—not just tools—capture repeat usage, predictable demand, and long-term contracts.

DALL·E-style platforms show how compute-heavy products can still achieve strong margins with smart pricing.

By combining usage-based credits, tiered subscriptions, enterprise licensing, and API monetization, these platforms offset high GPU costs, smooth revenue volatility, and scale profitably as demand increases.

For founders, this is one of the clearest blueprints for building profitable AI businesses in 2025.

The opportunity lies in vertical-specific models, clearer commercial rights, faster inference, and tighter workflow integrations, where focused platforms can outpace generic AI tools and reach profitability faster.

FAQs

1. How much does a DALL·E-style platform make per transaction?

Typically $0.04–$0.10 per image depending on resolution and plan.

2. What’s the most profitable revenue stream?

Enterprise licensing and API usage.

3. How does pricing compare to competitors?

Usage-based pricing is more flexible than flat subscriptions.

4. What percentage do platforms take from providers?

Not applicable—most are fully platform-owned models.

5. How has the revenue model evolved?

From free demos to API-first SaaS monetization.

6. Can small platforms use similar models?

Yes, especially with niche or vertical focus.

7. What’s the minimum scale for profitability?

Roughly 150k–200k monthly active paying users.

8. How to implement similar revenue models?

Combine subscriptions, credits, and APIs from day one.

9. What are alternatives to this model?

Open-source licensing, white-label AI tools.

10. How quickly can similar platforms monetize?

Many begin monetizing within 30–60 days post-launch.