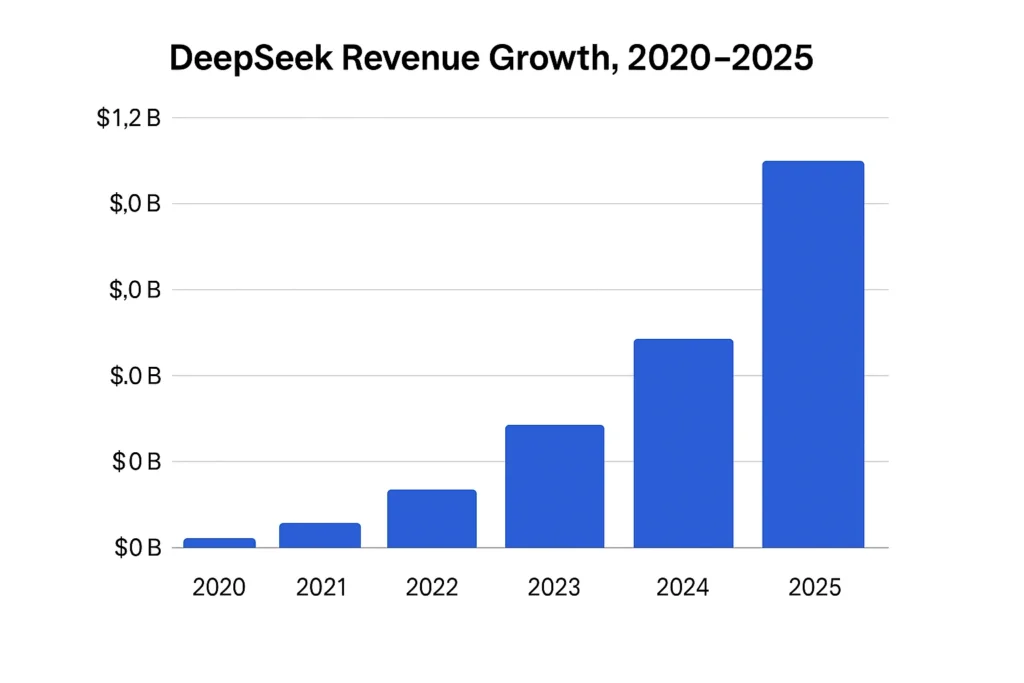

DeepSeek’s growth has stunned the AI world, crossing $1.1B in revenue in 2025 and emerging as a serious challenger to OpenAI, Anthropic, and Google. What makes DeepSeek exceptional is not just its advanced language models—but its ability to deliver enterprise-grade AI at a fraction of traditional costs. This cost-efficiency has fueled massive adoption across startups, SaaS platforms, Fortune 500 enterprises, and developers worldwide.

For entrepreneurs, DeepSeek’s business model offers a rare opportunity: a playbook for building a profitable AI platform even without billion-dollar infrastructure. By understanding how DeepSeek monetizes APIs, enterprise licenses, GPU cloud services, and specialized AI tools, founders can replicate the same multi-revenue system in a DeepSeek Clone—unlocking fast monetization, scalable growth, and long-term retention.

DeepSeek Revenue Overview – The Big Picture

DeepSeek’s 2025 valuation is estimated between $8–10B, driven by explosive global adoption and low-cost AI capabilities. The company saw 140% YoY revenue growth from 2024 to 2025 as enterprises, startups, and developers migrated from costlier Western AI providers.

Revenue by region: Asia ~45%, North America ~30%, Europe ~20%, Others ~5%.

Estimated net profit margin: 28–32%—significantly higher than early-stage AI labs due to DeepSeek’s low training cost and efficient inference architecture.

DeepSeek is positioned as a leading “affordable enterprise AI alternative” competing against OpenAI, Anthropic, and Google.

Read More: What is DeepSeek and How Does It Work?

Primary Revenue Streams Deep Dive

1. API Usage Revenue (≈ 55%)

Developers pay per-token or per-request API usage. Lower prices (40–60% cheaper) result in massive adoption. Many SaaS apps reduced AI costs by half after switching.

2. Enterprise Licensing (≈ 20%)

Private, on-premise, or VPC-based LLM deployments. Licensing cost ranges $250k–$2M annually, depending on scale.

3. Custom Fine-Tuning & Model Adaptation (≈ 10%)

DeepSeek monetizes industry-specific AI models—legal, medical, finance, logistics. Contracts range from $30k–$500k.

4. GPU Cloud & High-Performance Inferencing (≈ 10%)

DeepSeek leases compute power optimized for LLM inference during global GPU shortages.

5. AI SaaS Products & Agents (≈ 5%)

Autonomous agents, workflow automation suites, lightweight enterprise AI tools priced $20–$99/month.

Revenue Streams Breakdown Table

| Revenue Stream | Share % | 2025 Estimated Contribution | How It Works |

|---|---|---|---|

| API Usage | 55% | ~$605M | Token-based usage billing |

| Enterprise Licensing | 20% | ~$220M | Annual licensing for private AI |

| Custom Fine-Tuning | 10% | ~$110M | Tailored model training |

| GPU Cloud Services | 10% | ~$110M | Compute rental & inference |

| AI SaaS & Agents | 5% | ~$55M | Subscription AI tools |

The Fee Structure Explained

User-side fees

Token-based pricing for developers; tiered usage plans for startups; volume-based discounts for large deployments.

Provider-side fees

Partners hosting DeepSeek’s models on marketplaces may pay 10–20% commissions.

Hidden revenue layers

Data annotation partnerships

On-demand fine-tuning

Model upgrade bundles

Regional pricing differences

Asia remains the cheapest region; US/EU have higher regulatory compliance overhead.

Read More: Business Model of DeepSeek : Complete Strategy Breakdown 2025

Fee Structure Table

| User Type | Fees Paid | Notes |

|---|---|---|

| Developers | Per-token API fees | Lower entry tier pricing |

| Startups | Monthly usage bundles | Discounted scaling plans |

| Enterprises | Annual licensing ($250k–$2M) | Includes private deployment |

| Marketplace Providers | 10–20% commissions | Applies to model resale |

How DeepSeek Maximizes Revenue Per User

Segmentation

Different pricing tiers for startups, indie developers, and large enterprises.

Upselling

Move API users into enterprise or dedicated cluster plans.

Cross-selling

Add-ons like vector DBs, agents, model monitoring, and workflow automation.

Dynamic pricing

Token pricing varies based on concurrency and compute availability.

Retention monetization

Long-term contracts, annual commitments, and usage-based loyalty discounts.

LTV optimization

Enterprises renew at high rates due to deep integration of models.

Psychological pricing

Ultra-low starter pricing encourages mass adoption, increasing long-term usage.

Real Example

A mid-size platform paying $8k/month for Western APIs pays $3.5k/month with DeepSeek but increases usage over time due to affordability—driving long-term revenue.

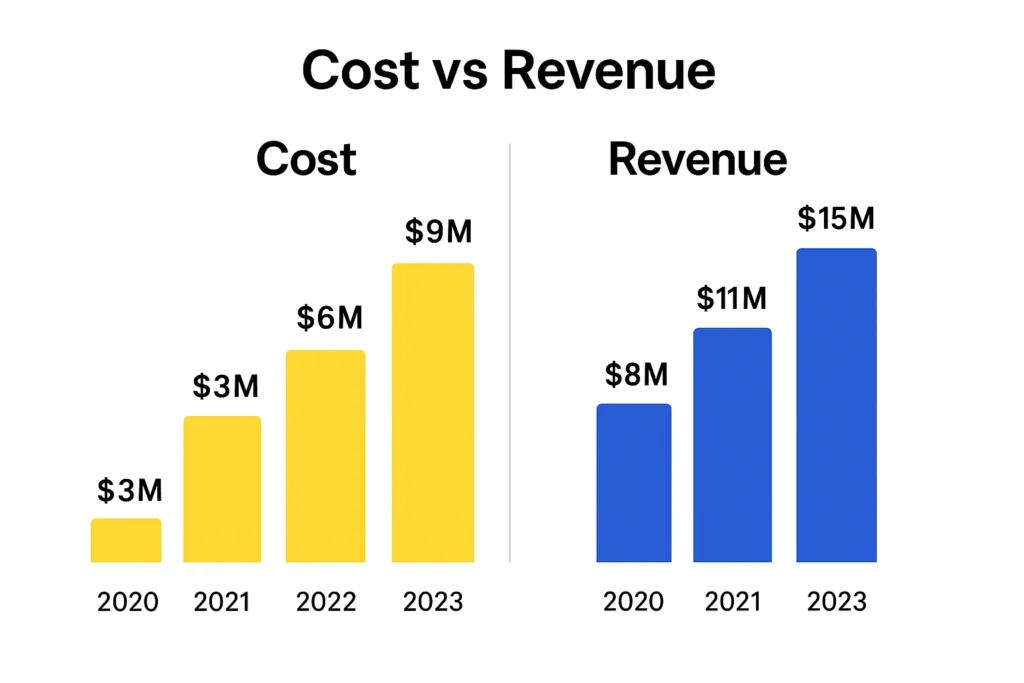

Cost Structure & Profit Margins

Tech infrastructure cost

GPU clusters, cloud hosting, distributed training, and inference optimization.

Marketing/CAC

Developer-first, low-CAC strategy through open documentation and sample repos.

Operations

AI safety teams, dataset engineers, compliance teams.

R&D

Next-gen quantized models, cheaper training techniques, specialized models.

Unit economics

Low per-token inference cost gives DeepSeek a stronger profitability curve vs competitors.

Profitability path

Expected to maintain 28–32% net margins due to efficiency.

Cost vs Revenue Table (Estimated 2025)

| Category | Annual Cost | Notes |

|---|

| Infrastructure | ~$280M | GPUs, cloud, inference |

| R&D | ~$190M | Model training & upgrades |

| Operations | ~$120M | Staff & compliance |

| Marketing | ~$40M | Developer-focused |

| Total Costs | ~$630M | On $1.1B revenue |

| Net Profit | ~$470M | ~30% margin |

Future Revenue Opportunities & Innovations

AI agent marketplaces

Vertical-specific models (legal, medical, maritime, fintech)

Edge/on-device AI integrations

Expansion across Southeast Asia, Africa, GCC

AI-driven workflow automation

Risks: regulation, model commoditization, GPU constraints

Opportunities: low-cost AI demand, enterprise AI alternatives, sovereign AI partnerships

Lessons for Entrepreneurs & Your Opportunity

Build low-cost AI models users can adopt quickly

Offer fine-tuning services and enterprise deployments

Create AI agents that solve real industry workflows

Target regions underserved by US competitors

Design modular pricing to unlock multi-stream monetization

Read More: Best DeepSeek Clone Script 2025 | AI Research Engine

Want to build a platform with DeepSeek’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization features. Our DeepSeek clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and Miracuves delivers ready-to-launch solutions in 30–90 days guaranteed. Get a free consultation to map out your revenue strategy. If you want advanced language model scripts integrated, Miracuves will provide that also.

Final Thought

DeepSeek’s revenue model proves that affordable, scalable AI platforms can dominate fast, especially when built on multi-stream monetization and cost-efficient infrastructure. For entrepreneurs, the real opportunity lies in adopting this proven blueprint rather than starting from scratch. With the right architecture, pricing strategy, and go-to-market execution, a DeepSeek-style platform can begin generating revenue almost immediately.

Miracuves makes this pathway even simpler. Instead of spending months on development, infrastructure, and AI integrations, you can launch a fully customizable DeepSeek Clone that includes API billing, enterprise licensing, fine-tuning modules, agent systems, and GPU-ready scalability—all built to mirror successful industry leaders. Miracuves also ensures blazing-fast delivery, giving founders the ability to go live in 30–90 days, start onboarding users quickly, and begin monetizing in their first month. With Miracuves as your technology partner, entrepreneurs can confidently enter the AI space with a platform engineered for long-term growth, profitability, and enterprise adoption.

FAQs

1. How much does DeepSeek make per transaction?

It earns per-token or per-API request; enterprise plans use monthly commitments.

2. What’s DeepSeek’s most profitable revenue stream?

API usage remains the highest contributor.

3. How does DeepSeek’s pricing compare to competitors?

Generally 40–60% more affordable than Western AI labs, with pricing starting at $3299.

4. What percentage does DeepSeek take from providers?

Around 10–20% in marketplace commissions.

5. How has DeepSeek’s revenue model evolved?

Expanded from API-only to licensing, GPU cloud, and agents.

6. Can small platforms use similar models?

Yes—tiered pricing and modular revenue streams make it adaptable.

7. What’s the minimum scale for profitability?

Mid-size AI platforms can become profitable within 18–24 months.

8. How to implement similar revenue models?

Offer APIs, enterprise licensing, agent marketplaces, and fine-tuning.

9. What are alternatives to DeepSeek’s model?

Subscription SaaS, open-source monetization, hybrid AI marketplaces.

10. How quickly can similar platforms monetize?

With Miracuves setup, revenue can begin within weeks, backed by our fast 30–90 days guaranteed delivery for your complete launch.

Related Articles:

ChatGPT Clone Revenue Model: How AI Chat Platforms Make Money

Apple AI Realm Clone Revenue Model: How AI Ecosystems Make Money