The year is 2025, and let’s face it—cryptocurrencies aren’t just digital coins anymore; they’re cultural icons, financial tools, and political hot potatoes. Among all crypto applications, peer-to-peer (P2P) Bitcoin trading apps are exploding in popularity, especially in regions where centralized exchanges are getting tangled in red tape or simply don’t exist. Whether you’re a startup founder eyeing your next move or an investor sniffing out high-margin ideas, understanding how a P2P Bitcoin marketplace app makes money is more than relevant—it’s essential. When I switched to a P2P platform, it felt like switching from a public bus to your own motorbike—freedom, speed, and a little bit of risk. But from a business standpoint? That’s where the magic lies. You get decentralization without losing the monetization potential. That’s gold—literally and figuratively.

In this post, we’re diving deep into monetization mechanics for P2P Bitcoin apps. Think listing fees, escrow fees, premium perks, and even token-based ecosystems. We’ll talk about who’s paying, why they’re willing to, and how you can build a system that grows your revenue without pushing away your users. Plus, you’ll get comparisons, real-world examples, and a roadmap to choose the right mix of revenue streams for your business model. Whether you’re building your own LocalBitcoins clone or strategizing a crypto pivot, you’ll find this guide packed with practical insights, nuanced discussions, and no-nonsense breakdowns of what works. Ready to crack the code on sustainable crypto revenues? Let’s go.

What Sparked the Rise of P2P Bitcoin Apps?

Centralized exchanges were all the rage—until they weren’t. From regulatory crackdowns to frozen accounts, users began losing trust. That’s where P2P trading stepped in, offering a decentralized alternative where buyers and sellers connect directly. Apps like Paxful, Binance P2P, and LocalBitcoins created easy-to-use platforms that cut out the middleman—at least in theory.

In practice, though, these platforms still need to earn. The difference is, they do it in subtle, user-focused ways that prioritize freedom and flexibility over forced loyalty.

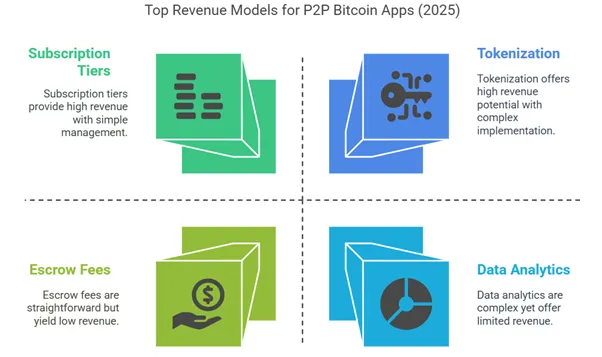

Top Revenue Models for a P2P Bitcoin Trading App

1. Escrow Service Fees

The Backbone of Monetization

Every P2P trade typically involves an escrow mechanism. When a buyer initiates a transaction, the app locks the seller’s Bitcoin in escrow. For offering this trust-based service, you can charge a percentage-based fee (e.g., 1%) per transaction.

Pros:

- Steady revenue stream

- Easy to scale with volume

Cons:

- Margin pressure from competitors who offer 0% fees

2. Trading Commission

Some platforms split fees into maker (ad creator) and taker (order fulfiller) charges. This allows you to incentivize one side of the marketplace and balance liquidity.

Example: Paxful charges only the seller (maker) a 1% fee.

3. Premium Listing Fees

Just like on eBay or Craigslist, premium visibility sells. Let users pay to list their ad at the top, highlight it, or feature it on the homepage.

Bonus Tip: Use dynamic pricing models based on demand and region.

4. Subscription Tiers for Power Users

For professional traders and businesses, offer monthly or yearly plans with benefits like:

- Lower escrow fees

- Faster dispute resolution

- Priority support

- Custom dashboards or APIs

Pro Tip: Bundle fiat payment integrations or fiat-on-ramp APIs into premium tiers.

5. In-App Wallet Services

Let users store and transfer their crypto directly within the app—then monetize that.

- Charge withdrawal fees

- Offer instant swap features for a fee

- Enable cross-wallet transfers

Monetization Insight: Partner with payment gateways for commissions per transaction.

6. KYC & Compliance-as-a-Service (For B2B)

Sell your compliance layer to white-label clients or API consumers. If you’ve built a solid identity verification process, other fintech apps might pay to use it.

7. Loyalty & Tokenization Programs

Integrate your own token for in-app rewards, staking, fee discounts, or premium access. Platforms like Binance and Crypto.com use this to drive stickiness and user engagement.

8. Dispute Resolution Services

In tricky regions, offer paid arbitration or faster settlement for a small fee. Think of it as a crypto-based legal service baked into your app.

9. Affiliate & Referral Program

Let users earn commissions by referring new users. You’ll gain more traffic while paying only for successful conversions.

10. Analytics & Insights Dashboard (B2B or Pro Users)

Offer tools for market monitoring, trade analytics, and fraud detection. Power users love data. Charge for it.

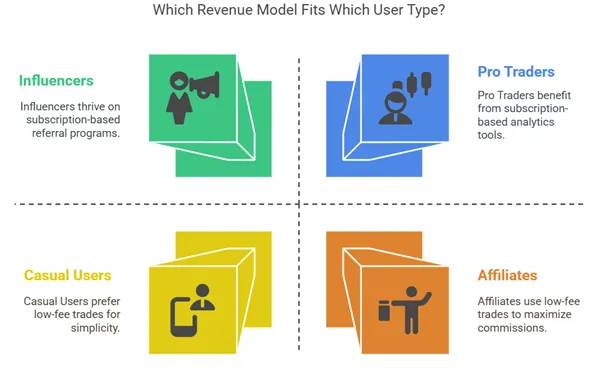

How to Choose the Right Revenue Model

Every audience is different. Here’s how to segment:

Casual Users:

- Prefer free or low-cost trading

- Avoid aggressive upselling

- Monetize via withdrawal fees or occasional premium listings

Creators/Pro Traders:

- Subscription plans with performance metrics, alerts, and arbitrage tools

- Escrow discounts

Influencers & Affiliates:

- Focus on multi-level referral programs

- Bonus rewards in native tokens

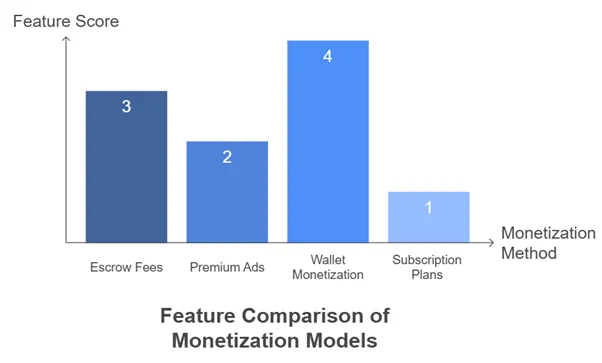

Feature Comparison Table

| Feature | Escrow Fees | Premium Ads | Wallet Monetization | Subscription Plans |

|---|---|---|---|---|

| Revenue Predictability | High | Medium | High | Medium |

| User Tolerance | High | Medium | Low (requires trust) | High (if benefits clear) |

| Integration Complexity | Low | Low | Medium-High | Medium |

| Scales With User Growth? | Yes | Yes | Yes | Yes |

Current Challenges in Monetizing P2P Crypto Apps

- Data Privacy & Regulations

Balancing KYC/AML with user anonymity is tricky. - Fake Listings & Scams

High-volume platforms often attract bad actors. You’ll need a mix of automation + human moderation. - Fee Pressure from Competitors

Many rivals offer 0% fees. You’ll need to stand out with value-added services. - Monetization Transparency

Users hate hidden charges. Be clear, upfront, and fair—or risk churn.

Conclusion: Final Thoughts

To succeed in this fast-moving market, you need more than an app—you need a system. A monetization strategy that fits your audience, builds trust, and keeps the engine running. And don’t forget—your revenue model is a living organism. It will evolve as crypto norms, regulations, and tech shift. Start lean, test fast, and scale what works.

FAQ

1. Why do users pay fees on P2P platforms if they’re decentralized?

Decentralized doesn’t mean free. Platforms charge for services like escrow, security, and support—think of it like Airbnb for Bitcoin trades.

2. Which model is best for new startups?

Start with escrow fees and premium listings. They’re easy to implement and don’t scare away users.

3. Can I use my own token for fees?

Yes! In fact, many platforms reward users with discounts when they pay in native tokens.

4. What’s the average fee percentage in 2025?

Still ranges from 0.5% to 1%, depending on region and transaction size.