DHgate is one of the world’s largest B2B cross-border eCommerce marketplaces, connecting Chinese manufacturers directly with global wholesale buyers across categories such as electronics, apparel, accessories, and industrial goods. By removing traditional intermediaries and enabling smaller order quantities, DHgate made international sourcing accessible to SMEs, resellers, and dropshippers worldwide.

In 2025, DHgate operates as a mature trade platform focused on repeat buyers, tighter logistics control, and value-added merchant services that go beyond simple transactions. The platform emphasizes escrow-based payments, reliable cross-border shipping, supplier verification, and data-driven matchmaking to increase trust, efficiency, and long-term engagement on both sides of the marketplace.

For founders, DHgate offers a strong blueprint for building high-volume, commission-driven B2B marketplaces with predictable margins and recurring revenue. Its model shows how combining transaction fees with logistics, advertising, and premium seller services can create a scalable, defensible business with clearer unit economics than most B2C platforms.

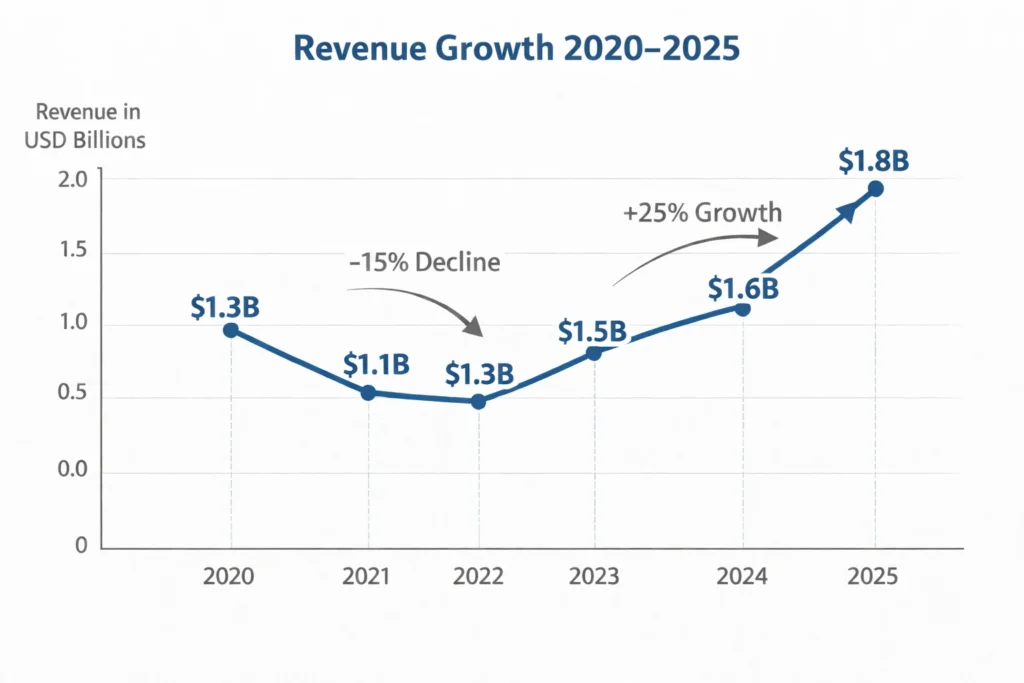

DHgate Revenue Overview – The Big Picture

- 2025 Revenue: ~$1.8 billion

- Valuation (private estimate): ~$6–7 billion

- YoY Growth (2024–2025): ~15%

- Primary Markets: US, Europe, Middle East, LATAM

- Average Gross Margin: 42–48%

- Competition Benchmark: Alibaba.com, Global Sources, Made-in-China

DHgate’s advantage lies in servicing SME buyers who order frequently but in smaller wholesale volumes.

Read More: What is DHgate and How Does It Work?

Primary Revenue Streams Deep Dive

Revenue Stream #1: Transaction Commissions

DHgate earns a commission on every completed wholesale transaction.

- How it works: Percentage fee per order

- Commission range: 3%–10%

- Revenue share: ~50%

- 2025 contribution: ~$900M

Revenue Stream #2: Cross-Border Logistics Services

DHgate provides shipping, customs, and tracking via partner carriers.

- Pricing: Per-kg and per-order logistics fees

- Revenue share: ~25%

- 2025 contribution: ~$450M

Revenue Stream #3: Seller Advertising & Promotions

Suppliers pay to boost product visibility and search ranking.

- Pricing model: CPC + placement packages

- Revenue share: ~15%

- 2025 contribution: ~$270M

Revenue Stream #4: Value-Added Seller Services

Includes storefront upgrades, analytics, certifications, and faster payouts.

- Revenue share: ~7%

- 2025 contribution: ~$126M

Revenue Stream #5: Payment & FX Margins

Margins from currency conversion and escrow-based payments.

- Revenue share: ~3%

- 2025 contribution: ~$54M

Revenue Streams Breakdown Table

| Revenue Stream | % Share | 2025 Revenue |

|---|---|---|

| Transaction Commissions | 50% | $900M |

| Logistics Services | 25% | $450M |

| Advertising | 15% | $270M |

| Seller Services | 7% | $126M |

| Payments & FX | 3% | $54M |

The Fee Structure Explained

DHgate monetizes primarily from suppliers, while keeping buyer entry friction extremely low.

User-Side Fees (Buyers)

- No signup fees

- Shipping & customs charges

- Optional inspection and insurance fees

Provider-Side Fees (Suppliers)

- Sales commissions

- Advertising spend

- Logistics service charges

Hidden Revenue Layers

- Shipping consolidation margins

- Priority escrow release

- Data-driven ad pricing

Regional Pricing Variation

- Higher logistics margins in North America

- Discounted commissions for high-volume sellers

Fee Structure Table

| User Type | Fee Category | Typical Range |

|---|---|---|

| Buyer | Shipping & customs | $20–$200+ |

| Supplier | Transaction commission | 3%–10% |

| Supplier | Logistics | Variable by weight |

| Supplier | Advertising | CPC-based |

| Supplier | Premium tools | Subscription-based |

How DHgate Maximizes Revenue Per User

DHgate focuses on long-term buyer-seller relationships.

- Segmentation: SME buyers, resellers, dropshippers

- Upselling: Faster shipping, quality inspections

- Cross-selling: Packaging, labeling, compliance services

- Dynamic pricing: Volume-based discounts

- Retention monetization: Repeat wholesale contracts

- LTV optimization: Subscription seller tools

- Psychological pricing: Tiered supplier plans

On average, active buyers place 8–12 bulk orders per year, creating stable recurring revenue.

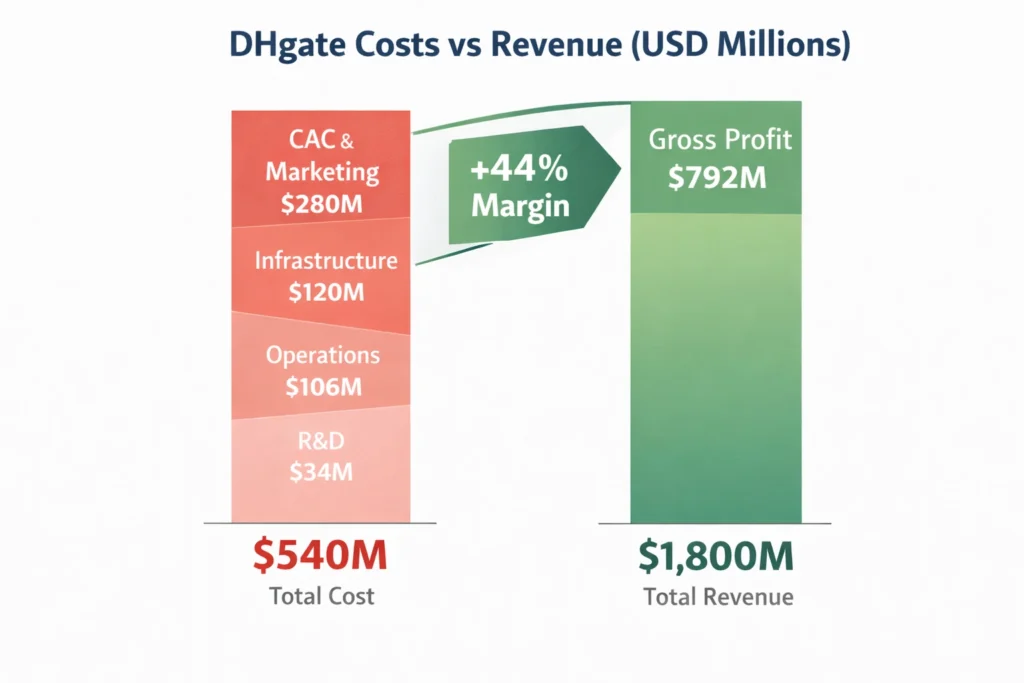

Cost Structure & Profit Margins

Major Cost Buckets

- Infrastructure: Platform, payments, data security

- CAC & Marketing: Global buyer acquisition

- Operations: Dispute resolution, logistics coordination

- R&D: Search, fraud prevention, AI matching

Unit Economics

- Avg order value: $420

- Avg platform revenue per order: $32–38

- Contribution margin: ~45%

DHgate maintains profitability through scale, repeat usage, and logistics density.

Read More: Best DHgate Clone Scripts 2025 | Global B2B Wholesale Marketplace

Future Revenue Opportunities & Innovations

New Revenue Streams

- Supplier financing & credit

- AI-driven demand forecasting

- Subscription-based buyer sourcing

AI/ML Monetization

- Smart supplier matching

- Fraud detection & dispute reduction

- Predictive inventory demand

Market Expansion

- Africa & Southeast Asia

- Regional fulfillment hubs

Predicted Trends (2025–2027)

- B2B marketplaces becoming SaaS-like

- Embedded finance growth

- Fewer suppliers, higher trust

Risks & Threats

- Alibaba pricing pressure

- Trade regulations and tariffs

Opportunities for New Founders

- Vertical-specific B2B marketplaces

- Region-focused wholesale platforms

Lessons for Entrepreneurs & Your Opportunity

What Works

- Commission-led monetization

- Logistics as a profit center

What to Replicate

- Escrow-based trust systems

- Seller subscription layering

Market Gaps

- Faster delivery for SMEs

- Transparent supplier verification

Founder Improvements

- Better buyer analytics

- Simplified onboarding

Want to build a platform with DHgate’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our DHgate clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

DHgate proves that B2B marketplaces can be more predictable and profitable than B2C by relying on higher order values, repeat purchasing cycles, and long-term buyer–supplier relationships. Unlike consumer platforms driven by impulse demand, B2B trade benefits from planned procurement, stable volumes, and clearer unit economics.

Its strong focus on repeat buyers and supplier services creates durable, recurring revenue streams that are less sensitive to seasonality and marketing spend. By monetizing logistics, escrow payments, analytics, and premium seller tools, DHgate turns operational infrastructure into consistent profit centers.

For founders, the real opportunity lies in building specialized, trust-driven wholesale platforms that serve specific industries, regions, or buyer segments. Marketplaces that emphasize verification, transparency, and value-added services can achieve faster profitability, stronger retention, and long-term defensibility.

FAQs

1. How much does DHgate make per transaction?

Roughly $32–38 per wholesale order.

2. What’s DHgate’s most profitable revenue stream?

Transaction commissions combined with logistics services.

3. How does DHgate’s pricing compare to competitors?

Lower commissions than Alibaba, but higher logistics usage.

4. What percentage does DHgate take from suppliers?

Between 3% and 10%.

5. How has DHgate’s revenue model evolved?

Shifted toward seller subscriptions and logistics monetization.

6. Can small platforms use similar models?

Yes, especially in niche B2B verticals.

7. What’s the minimum scale for profitability?

Around 50K–70K active buyers.

8. How to implement similar revenue models?

Combine escrow, commissions, and logistics services.

9. What are alternatives to DHgate’s model?

Vertical B2B SaaS marketplaces or private trade networks.

10. How quickly can similar platforms monetize?

Many businesses begin generating revenue soon after launch.