Dream Yacht Charter recorded an estimated annual revenue of about $128.7 million in 2025, making it one of the largest global yacht-charter brands. Its scalable and flexible revenue engine—built on fleet ownership, franchise partnerships, and diversified charter types—offers deep lessons for entrepreneurs. Understanding this model helps founders replicate the same success with ready-made Dream Yacht Charter Clone solutions from Miracuves.

Dream Yacht Charter Revenue Overview – The Big Picture

Dream Yacht Charter operates across 45+ destinations worldwide with a fleet exceeding 1,000 yachts. Its annual revenue hovers around $120–130 million, driven by both direct bookings and franchise arrangements.

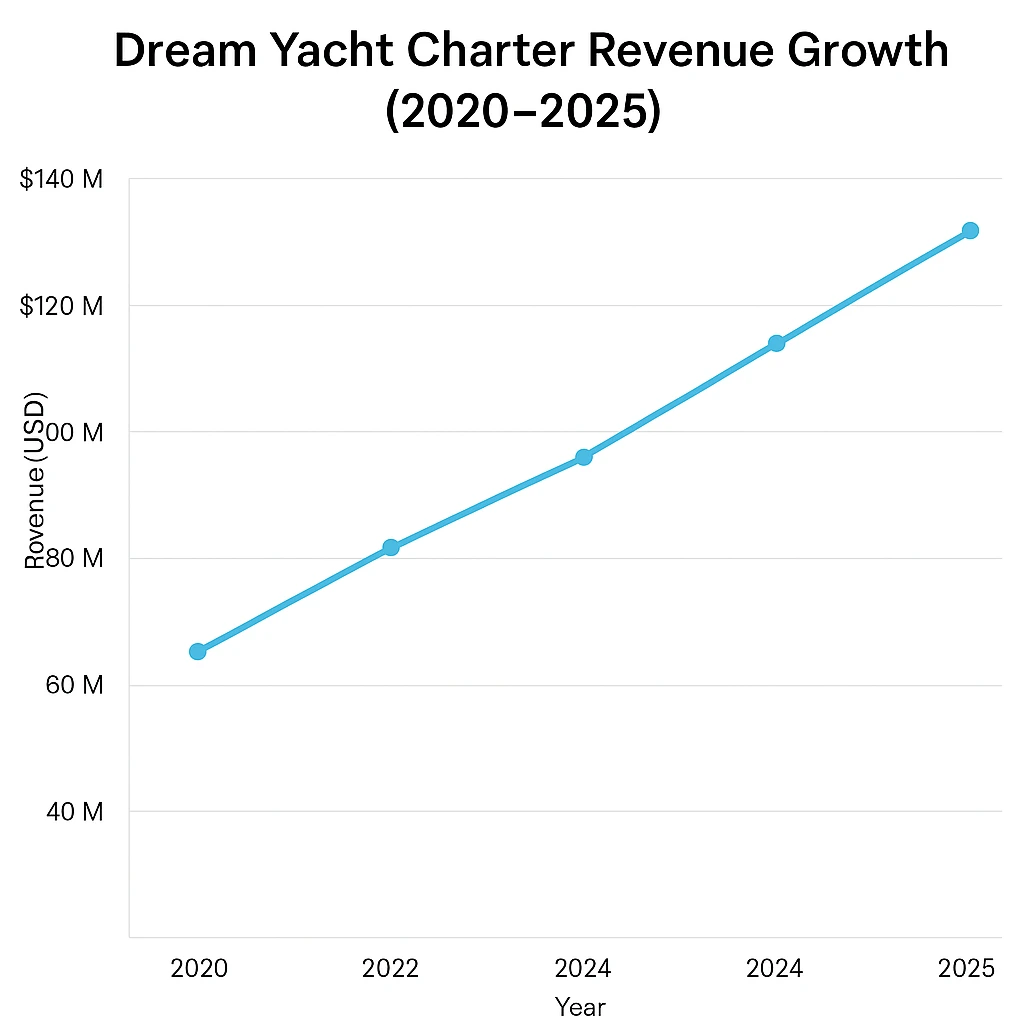

Year-over-year growth: 8 – 10 % over the last three years, supported by post-pandemic demand for private marine vacations.

Regional breakdown: Europe (45 %), Caribbean (30 %), Asia-Pacific (15 %), and Others (10 %).

Profit margins: Operating margins average 15 – 18 %, improving due to fractional ownership and partner fleet models.

Market position: Among global charter operators, Dream Yacht Charter ranks in the top three by fleet size and revenue, ahead of many regional competitors.

Read More: Dream Yacht Charter Review : What It Is & How Yacht Rentals Work

Primary Revenue Streams Deep Dive

| Revenue Source | Description | Share of Revenue (%) |

|---|---|---|

| Bareboat Charters | Yacht rentals without crew; clients self-sail | 45 % |

| Crewed Charters | Luxury packages with crew and catering | 25 % |

| Cabin Cruises | Shared voyages sold per cabin | 10 % |

| Fractional Ownership | Customers buy shares of a yacht for seasonal use | 8 % |

| Franchise & Partner Programs | Local operators pay fees to run under the brand | 7 % |

| Ancillary Services | Insurance, fuel, provisioning, equipment rentals | 5 % |

How it works:

The platform earns through both direct bookings and B2B agreements with owners or franchise partners. Bareboat and crewed charters form the backbone, while cabin cruises and fractional ownership programs provide recurring income.

Growth trends: Crewed charters and fractional ownership grew over 20 % year-on-year as travelers sought premium yet flexible experiences.

Pricing example: Bareboat charters average $3,000 – $8,000 per week, while crewed charters can exceed $20,000 for luxury vessels.

Read More: Business Model of Dream Yacht Charter : Complete Strategy

The Fee Structure Explained

| User Type | Fee Type | Average Rate | Notes |

|---|---|---|---|

| Customer | Booking Service Fee | 5 – 8 % of charter cost | Applied per booking |

| Customer | Optional Add-ons (Food, Skipper, Insurance) | Varies | Premium upsells |

| Yacht Owner/Partner | Commission to Platform | 15 – 20 % of booking revenue | Based on fleet type |

| Yacht Owner | Listing & Maintenance Fees | Annual or per-use | Includes fleet management |

| Franchise Partner | Brand Royalty & Tech Licensing | 5 % of turnover | Applies to licensed bases |

Hidden tactics include dynamic seasonal pricing and bundling of premium services to maximize per-booking spend. Pricing varies by region—Caribbean packages are typically 15 % more expensive than Mediterranean routes.

How Dream Yacht Charter Maximizes Revenue Per User

Dream Yacht Charter relies on a multi-layered user segmentation strategy. High-net-worth clients are targeted with luxury crew experiences, while adventurous millennials opt for bareboat and cabin trips. The company employs upselling through add-ons such as onboard chefs, watersports gear, and destination packages. Cross-selling occurs through insurance partnerships and provisioning deals.

Dynamic pricing algorithms adjust charter rates based on season, demand, and fleet availability. Customer retention is driven by membership discounts and referral bonuses. Lifetime value optimization comes from repeat customers using different bases each year. Psychological pricing (e.g., $4,995 instead of $5,000) further enhances conversion rates.

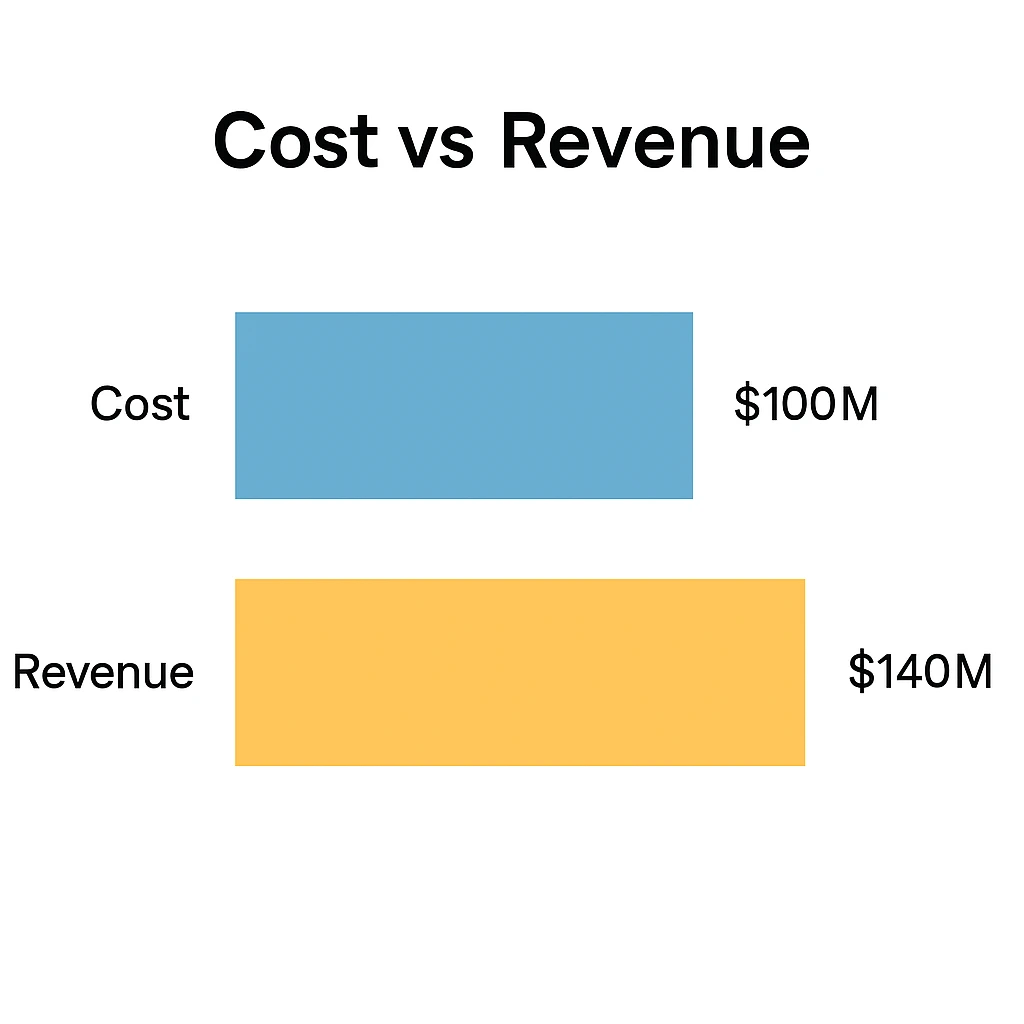

Cost Structure & Profit Margins

Major Cost Categories: Fleet leasing and maintenance (40 %), technology infrastructure (10 %), marketing and customer acquisition (20 %), operations (15 %), R&D and innovation (5 %), staff and administration (10 %).

Unit economics: Each yacht averages about 30–35 booked weeks per year; break-even occurs around 25 weeks.

Profitability: After COVID recovery, profit margins rebounded to around 15 %.

Improvement strategies: Asset-light partnership programs, digital booking automation, and dynamic pricing algorithms reduced operational overhead.

Read More: Build an App Like Dream Yacht Charter– Full-Stack Developer Guide

Future Revenue Opportunities & Innovations

Dream Yacht Charter is experimenting with AI-based fleet optimization to maximize utilization and predict maintenance needs. It’s also testing subscription models allowing members to book multiple voyages annually for a flat fee. Expansion into Asia-Pacific and eco-tourism markets is a key growth vector for 2025-2027.

Potential future streams include sustainability surcharges, NFT-based ownership shares, and green fleet upgrades funded via tokenized investment platforms. Threats include fuel price fluctuations and new digital-only aggregators disrupting traditional fleet operators.

For entrepreneurs, these shifts open space to launch niche platforms focusing on specific destinations, boat types, or subscription models using a Miracuves clone framework.

Lessons for Entrepreneurs & Your Opportunity

Key Takeaways: Dream Yacht Charter proves how asset optimization and multi-stream monetization can drive strong returns in a seasonal luxury market. Replicate its scalable commission system and diversified product tiers. Explore fractional ownership as a recurring revenue model.

Market Gaps: Regional operators lack digital automation and real-time pricing. This is where new startups can dominate with technology-first charter apps.

Want to build a platform with Dream Yacht Charter’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization features. Our Dream Yacht Charter Clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch. Get a free consultation to map out your revenue strategy.

Final Thought

Dream Yacht Charter’s success comes from monetizing every stage of the marine vacation journey—from bookings to ownership to premium services. With Miracuves, you can replicate this entire ecosystem through an automated, customizable clone platform designed for fast ROI and scalable growth.

Revenue Model FAQs

How much does Dream Yacht Charter make per transaction?

Around 15 – 20 % commission from each booking.

What’s Dream Yacht Charter’s most profitable revenue stream?

Crewed and luxury charters deliver the highest margins.

How does Dream Yacht Charter’s pricing compare to competitors?

The pricing is typically 5–10% higher than competitors due to global coverage and premium services — and with Miracuves, you can build a similar high-end platform starting at just $2899.

What percentage does Dream Yacht Charter take from providers?

Between 15 % and 20 % of booking value.

How has Dream Yacht Charter’s revenue model evolved?

Shifted from asset-heavy fleet ownership to asset-light partner programs and fractional ownership.

Can small platforms use similar models?

Yes — Miracuves Clone solutions let startups apply the same multi-stream approach at smaller scale.

What’s the minimum scale for profitability?

Around 15 – 20 yachts with 75 % annual utilization rate.

How to implement similar revenue models?

Adopt tiered pricing, commission structures, and automated booking logic within your platform.

What are alternatives to Dream Yacht Charter’s model?

Peer-to-peer boat-sharing or subscription-based nautical clubs.

How quickly can similar platforms monetize?

With Miracuves clones, entrepreneurs can start earning in just 3–9 days with guaranteed delivery, ensuring a rapid launch and instant monetization.