Launching a DeFi exchange app like GMX isn’t just about forking some code and flipping a landing page live. It’s about earning trust in a trustless world. When GMX made waves with its decentralized perpetuals model, many founders thought, “We can do that too.” But here’s the kicker: tech is half the battle. The other half? Getting people to actually use your app.

Let’s be honest — in the sea of crypto platforms, if your app isn’t sticky, it’s sunk. You need early adopters, volume, liquidity providers, influencers tweeting you into virality… and that doesn’t happen with just a sleek UI and gasless swaps.

This blog dives deep into the nuts and bolts of building a marketing strategy for your GMX-style app — what works, what flops, and where to double-down. If you’re planning to launch a GMX clone or already have one out in the wild, keep reading. And yep, Miracuves can help bring that strategy to life when you’re ready to scale smart.

Understanding GMX: What Made It Click?

Before you market like GMX, you’ve gotta think like GMX.

Key Features of GMX That Define Its Appeal

- Perpetual Futures with No Liquidation Woes: GMX uses a unique GLP (GMX Liquidity Pool) model — traders trade against a multi-asset pool, minimizing counterparty risks.

- Low Fees + Real Yield: Users love that GMX pays stakers actual revenue from fees. That’s DeFi 2.0 vibes.

- On Arbitrum & Avalanche: Fast, cheap, L2 chains = win for usability.

Learn More: Top 10 GMX Features Every Crypto Builder Must Know

Marketing Takeaway:

Leverage innovation narrative — show how your GMX-style app solves old DeFi problems in new ways. If your fork adds improvements (e.g., higher leverage, better tokenomics, a referral model), highlight them as evolutionary upgrades, not just re-skins.

Building Buzz Before Launch: The Pre-Marketing Playbook

Marketing your GMX clone app starts before the code is complete. Here’s what to line up:

1. Narrative Crafting

You need a story that resonates with crypto natives — something like:

“Trade perpetuals like a pro. No KYC. No counterparty risk. Just DeFi, simplified.”

Use memetic hooks. Position it as a response to CEX chaos, leverage degeneracy, or yield farming fatigue.

2. Community First, App Second

- Open a Telegram and Discord early. Invite alpha testers.

- Offer testnet competitions: leaderboard, mock trades, rewards in points/NFTs.

- Let the community co-own the roadmap. Make them feel heard.

3. Influencer Whisper Campaign

- Seed crypto Twitter threads from niche KOLs (Key Opinion Leaders)

- Run spaces on “The Future of DeFi Trading”

- DM active GMX users to try your beta — offer perks for feedback

Post-Launch Power Moves: Driving Retention, Not Just Hype

1. Onboarding That Doesn’t Suck

Let’s face it — most DeFi onboarding is trash. You need:

- A simple walkthrough, maybe with gamified quests

- UI/UX that mimics Web2 (but flexes Web3 power)

- No surprise gas fees, ever

2. Token Utility > Just a Sticker

Your token can’t just be a pump vehicle. Make it:

- Stakeable for fee rewards (like GMX does)

- Upgradeable for LP boosts or governance

- Paired with fee rebates or VIP access

3. Growth Hacking With Incentives

- Referral bonuses (tiered rewards work best)

- Volume-based trading contests

- GMX-style dual yield farming for early LPs

Learn More: Pre-launch vs Post-launch Marketing for GMX Clone Startups

Smart Channels for Growth: What Works in DeFi?

Let’s talk tactical.

Twitter/X is King

GMX built clout through threads, stats, and alpha drops. Do the same.

- Drop “Weekly TVL & Fee Stats”

- Meme about macro trends

- Engage influencers in threads

Mirror/Paragraph/Medium for Deep Dives

Educational content builds credibility. Think:

- “How Our Perpetual Engine Works”

- “Why We Built on Base/Scroll Instead of Arbitrum”

Reference: GMX usage stats from Dune Analytics

Email Isn’t Dead (But It’s Gated)

Collect emails via airdrop announcements or waitlists. Send alpha, governance proposals, and trader tips.

Keeping the Community Hooked

Host Regular AMAs

Even if no one shows up the first time — consistency builds trust.

Transparency Dashboards

GMX earned love by showing everything on-chain. You should too.

- Public fees dashboard

- Real-time pool stats

- Monthly dev diaries

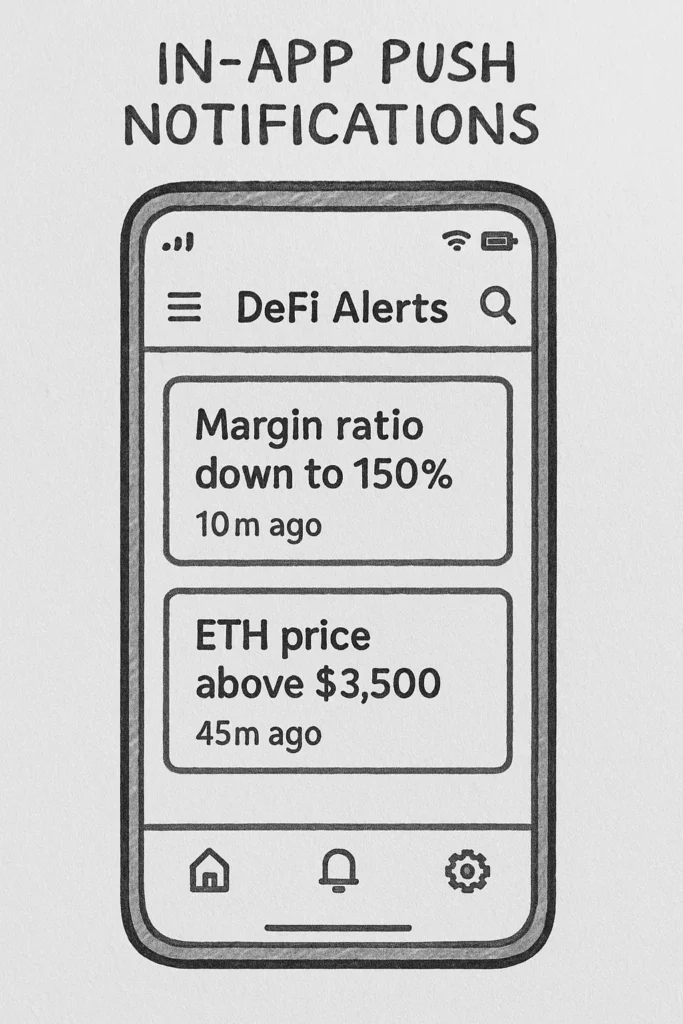

Re-target Users via Web3 Tools

Tools like Notifi or Push Protocol let you ping wallets, not inboxes.

Common Mistakes You Should Absolutely Avoid

- Copy-pasting tokenomics from GMX — without matching their model

- Ghosting your community post-launch

- Not educating users on risk — perpetuals ≠ no risk

- Overpromising rewards and failing to sustain them

Want to get started with your own decentralized trading platform? Check out our GMX App Development page.

Conclusion

Marketing a GMX clone isn’t about flashy banners or Discord mods spamming “LFG”. It’s about authenticity, transparency, and building a DeFi app that people actually trust — and love using.

Whether you’re in stealth mode or ready to launch tomorrow, remember: hype fades, but community sticks. And the right strategy makes all the difference.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

What makes GMX different from other DEXs?

GMX offers decentralized perpetual trading with no order books — it uses a multi-asset liquidity pool and rewards real yield to stakers.

Do I need a big budget to market a GMX clone?

Not necessarily. You can start with community-building, smart referrals, and organic influencer engagement. Budget helps, but creativity matters more.

Can I use the same model on other chains?

Yes! GMX started on Arbitrum and expanded to Avalanche. You can tailor your clone for chains like Base, Optimism, or even zkSync.

How do I get liquidity for my GMX clone?

Offer LP incentives early — dual rewards, staking bonuses, and transparency on returns help attract capital.

Should I launch with a native token?

A native token helps bootstrap incentives, but make sure it has actual utility. Avoid launching one without clear use-cases.

How can Miracuves help me?

We build scalable, fully customizable GMX clone solutions — including smart contracts, UI, token integration, and go-to-market strategy support.