Back in the early DeFi days, launching your own exchange meant wrestling with liquidity pools, smart contract audits, and constant front-end failures. And then came GMX — a decentralized perpetual exchange that didn’t just work, it worked beautifully. Low fees, high leverage, no sign-ups. The kind of no-nonsense crypto tool that developers and traders both fell in love with.

If you’re looking to build your own decentralized trading platform, chances are you’ve studied GMX closely — maybe even used it religiously. But building a similar product from scratch? That’s months (or years) of work. Fortunately, 2026 is the golden age of clone scripts — especially in crypto.

Whether you’re launching a community-focused DEX, a derivatives trading hub, or a DAO tool, this guide will help you choose the best GMX clone scripts available today. From features to pricing, we’ll compare it all — and show you how Miracuves helps builders like you launch faster without compromising performance or decentralization.

Why a GMX Clone is a Smart Move in 2026

Let’s get something out of the way — this isn’t about copy-pasting code. It’s about capturing GMX’s proven user experience and liquidity model and applying it to your niche, your audience, your chain.

GMX broke ground by offering:

- On-chain perpetual futures

- Zero price impact trades

- Dynamic pricing via Chainlink + TWAP

- Community-owned liquidity (GLP)

It operates on Arbitrum and Avalanche, supports leverage up to 50x, and has one of the cleanest interfaces in DeFi. According to DeFiLlama, GMX consistently ranks among the top 10 protocols by TVL, with over $500M locked.

Cloning that model for your own ecosystem — whether you’re on BNB Chain, Polygon, or a custom rollup — opens doors to:

- Institutional-grade DeFi tools for local communities

- DAO-run trading protocols

- Niche trading assets (e.g., commodities, tokens, NFTs)

- Platform-native tokens with real yield

Read More : GMX Features List: Everything You Need to Know Before You Dive In

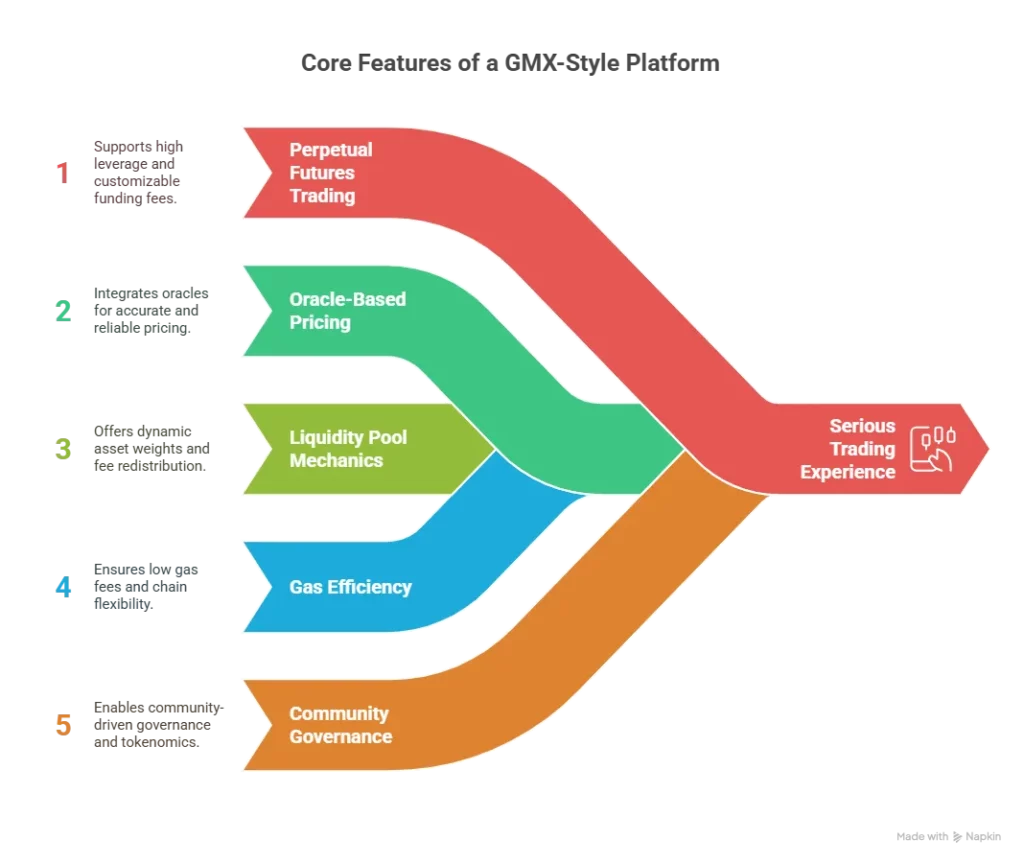

Core Features Every GMX Clone Script Should Offer

A real GMX-style platform goes far beyond token swaps. These are the key features your clone must include to deliver a serious trading experience:

1. Perpetual Futures Trading

The heart of GMX is perpetuals. Your clone script should support:

- Leverage up to 50x

- Long & short positions

- Customizable funding fees

- Liquidation mechanisms

2. Oracle-Based Pricing

GMX uses Chainlink + time-weighted average price (TWAP). Your clone should offer:

- Oracle integrations (Chainlink, Band, Pyth)

- Fallback price feeds

- On-chain + off-chain hybrid models

3. Liquidity Pool Mechanics

GMX’s GLP (GMX Liquidity Pool) is brilliant. Look for:

- Single asset or basket LP support

- Dynamic asset weights

- Fee redistribution to LP holders

- Rebalancing tools

4. Gas Efficiency + Chain Flexibility

No one likes high gas. A good clone should support:

- L2 deployment (Arbitrum, Optimism)

- EVM compatibility

- Token bridges or rollup integrations

5. Community Governance & Tokenomics

If you’re launching a DEX without a token, you’re leaving money on the table. Your script should support:

- Dual token models (GMX/GLP style)

- Fee staking

- DAO governance voting

- Airdrop or LP incentives

Read More : GMX App Marketing Strategy: How to Make Your DeFi Exchange Stand Out

Top GMX Clone Scripts in 2026 – Features & Pricing Compared

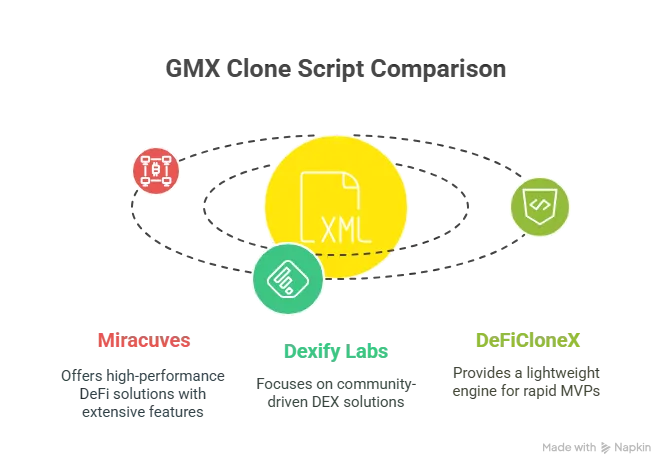

1. Miracuves – GMX Clone Script

Best for: Teams building high-performance, fully-custom DeFi exchanges

Key Features:

- Smart contract suite for perpetuals, vaults, and fee distribution

- EVM-ready deployment on Arbitrum, Avalanche, or custom chains

- Real-time price feed module (Chainlink + fallback)

- Liquidity engine with LP share tracking

- Token staking, governance, and vault analytics dashboard

Add-ons:

- Mobile-first trading UI

- DAO governance module

- Multi-chain bridge integration

Enterprise: Quote-based with audit support

Why Choose: Miracuves balances DeFi-grade performance with startup-ready flexibility — plus ongoing support for tokenomics, incentives, and UI upgrades.

2. Dexify Labs

Best for: Web3 DAOs launching a community-owned DEX

Key Features:

- Simplified perpetual trading contract

- DAO treasury and fee vault setup

- Snapshot voting integration

Why Choose: Community-focused, ideal for DAOs or ecosystem-based exchanges. Lacks deep analytics or advanced LP rebalancing.

3. DeFiCloneX

Best for: Rapid MVPs on testnets or hackathons

Key Features:

- Lightweight perpetual engine

- Basic front end with trading view

- Faucet-based demo tokens

Why Choose: Great for proof-of-concept. Not intended for production or real capital deployment.

Cost Factors & Pricing Breakdown

GMX-Style Perpetual DEX & Crypto Trading Platform — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic GMX-Style DEX MVP | Core on-chain swap & simple perpetual trading, wallet connect (MetaMask etc.), basic liquidity pool setup, order execution with price feeds, PnL calculation, simple dashboard, basic admin for markets & fees. | $70,000 |

| 2. Full-Feature GMX-Like Perp DEX | Advanced perpetuals (multi-pair support), dynamic funding rates, multi-asset liquidity pools, trading history, positions dashboard, oracle integrations, fee tiers, referral system, analytics, risk controls, and full admin backend. | $160,000 |

| 3. Enterprise-Grade Perp DEX Ecosystem | Multi-chain deployment, advanced risk engine, cross-margin & isolated-margin models, custom oracle/risk feeds, institutional accounts, compliance tooling, audit logs, deep analytics, API for pro traders/bots, and highly scalable infra. | $320,000+ |

These prices reflect the global custom development cost of building a GMX-style perpetual DEX from scratch — including smart contracts, trading engine logic, liquidity architecture, oracle integration, security, and scalable blockchain infrastructure.

Miracuves Pricing for a GMX-Like Platform

Miracuves Price: Starts at $3,299

According to the Miracuves solutions pricing sheet, the GMX Clone is a PHP-based, ready-made perpetual DEX solution. It includes core trading modules, liquidity pool logic, user & admin panels, fee configuration, and integration-ready structures for oracles and wallets — packaged as a complete white-label product instead of a long, risky custom build.

Note

This package includes full non-encrypted source code, backend/API setup, web front-end, admin configuration, and deployment assistance — so you can host, customize, and scale your GMX-style DEX under your own brand. Launch your GMX-like perpetual DEX with Miracuves and go live in just 3–9 days with a fully branded, revenue-ready crypto trading platform.

Delivery Timeline for a GMX-Like Platform with Miracuves

Estimated deployment timeline: 3–9 days, depending on:

- Number of markets/pairs and leverage configurations

- Liquidity pool design and tokenomics setup

- Required referral, rewards, and fee structures

- Branding, UI customization, and localization needs

- Chosen blockchain/network and deployment environment

Tech Stack

Built using PHP + MySQL with modular APIs — enabling secure user management, integration with blockchain nodes/oracles, real-time position & PnL updates, and scalable performance for high-concurrency derivatives trading use cases.

Choosing the Right Clone Based on Use Case

Here’s a simple breakdown to help match the script to your goals:

| Use Case | Recommended Script |

|---|---|

| Production-ready DEX on L2 | Miracuves |

| DAO-run trading platform | Dexify Labs |

| Hackathon MVP or demo | DeFiCloneX |

| Token + liquidity farming integration | Miracuves |

| Low-code, fast-launch solution | Dexify Labs |

Smart Contract Audits: Non-Negotiable in 2026

Let’s be real — launching a DEX without an audit is asking for trouble. Clone script or not, your platform handles real assets. Make sure your provider:

- Offers access to audited contracts

- Supports integrations with audit firms (CertiK, Hacken, SlowMist)

- Provides test coverage and stress test data

Read More : MEXC vs GMX Business Model | Guide for Crypto Startups

Conclusion

Building a GMX-style decentralized exchange isn’t just for the elite anymore. In 2026, the tools exist — clone scripts are powerful, flexible, and surprisingly affordable. The real win lies in customizing the platform to fit your niche, your tokenomics, and your vision.

Whether you’re targeting a local Web3 community, launching a DAO-run exchange, or just want to bring leverage trading to a new chain, your path forward starts with the right script — and the right partner.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Still have questions about GMX Clone Scripts in 2026? Let’s clear them up.

Is it legal to launch a GMX clone?

Yes, as long as you build your own smart contracts and avoid copying protected brand elements. Functionality isn’t trademarked.

Can I launch this on my own blockchain?

If your chain is EVM-compatible, yes. Scripts like Miracuves’ GMX clone support cross-chain deployment.

Do I need a token to launch?

Technically, no. But for community growth, staking, and governance, a token is strongly recommended.

How are liquidations handled?

Your clone should include logic for margin calls, funding rates, and automated liquidation based on real-time price oracles.

What’s the best chain to launch on?

Popular choices include Arbitrum, Base, and Optimism for low fees and high throughput. Polygon and BNB Chain are also viable.

Can I earn from LP fees?

Absolutely. Your protocol can distribute fees to liquidity providers, stakers, and your treasury via customizable split ratios.

Related Articles