Ever tried walking a tightrope while blindfolded? That’s what it feels like navigating DeFi platforms without a clue about what they offer. Especially when you’re looking at something as power-packed and buzzworthy as GMX — the decentralized perpetual exchange that’s giving centralized trading platforms a serious run for their money.

If you’re an entrepreneur, a DeFi product builder, or a curious creator plotting your next crypto venture, GMX probably has your attention. And rightly so. With rising demand for derivatives, decentralized leverage trading, and non-custodial protocols, GMX checks off several boxes on the future-of-finance bingo card. But before you jump in headfirst or sketch out your own “GMX clone”, let’s break down what’s actually under the hood.

Whether you’re exploring clone development, looking to integrate GMX-like features into your dApp, or simply geeking out on next-gen crypto platforms — this blog’s got your back. And hey, Miracuves has helped launch dozens of scalable crypto clones before… but more on that in a bit.

What is GMX, Anyway?

Before we dissect its features, let’s get some context.

GMX is a decentralized, permissionless exchange that allows users to trade perpetual futures with up to 50x leverage — all while keeping custody of their assets. Built primarily on Arbitrum and Avalanche, it combines the speed of Layer 2 with the security of decentralized protocols. Unlike centralized giants like Binance or Bybit, GMX prioritizes transparency, self-custody, and on-chain trading.

Think of it as:

- A hybrid between Uniswap and BitMEX

- A DEX tailored for leverage junkies

- A solid blueprint for anyone building a decentralized trading app

Now, let’s get into what makes GMX tick.

Read more: What is a GMX App and How Does It Work?

Key GMX Features That Set It Apart

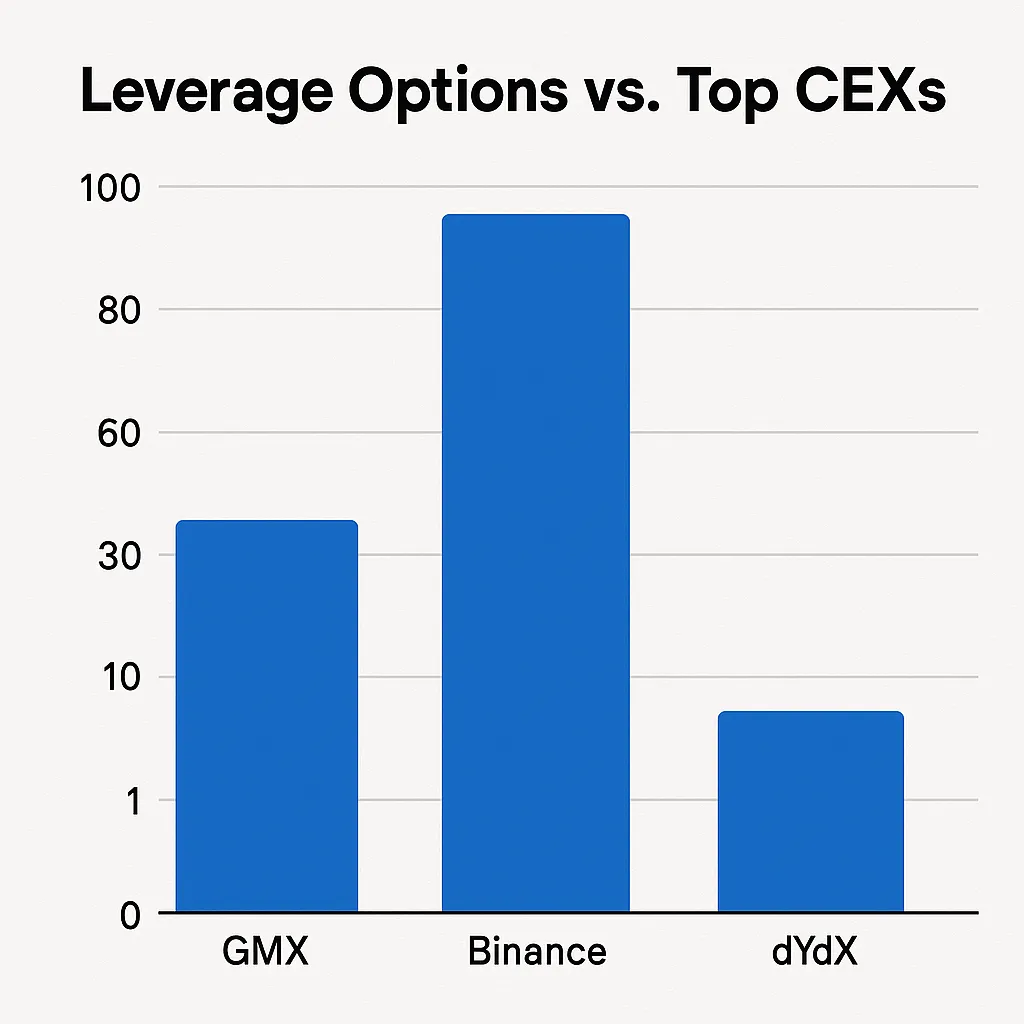

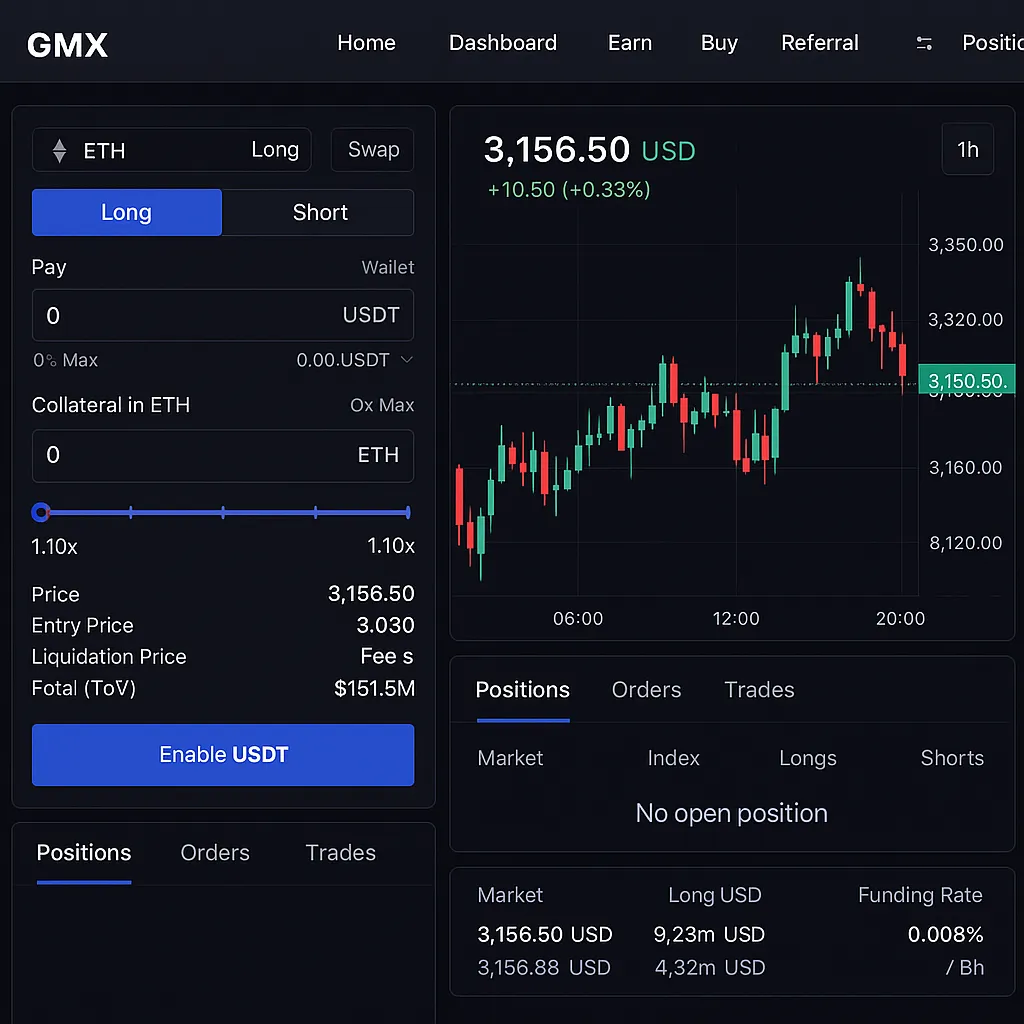

1. Perpetual Futures with High Leverage

Trade BTC, ETH, and more with up to 50x leverage — all from your Web3 wallet.

- No KYC. No third-party holds. No funny business.

- Traders can go long or short using a simple interface.

- Price feeds are aggregated from top centralized exchanges for accuracy.

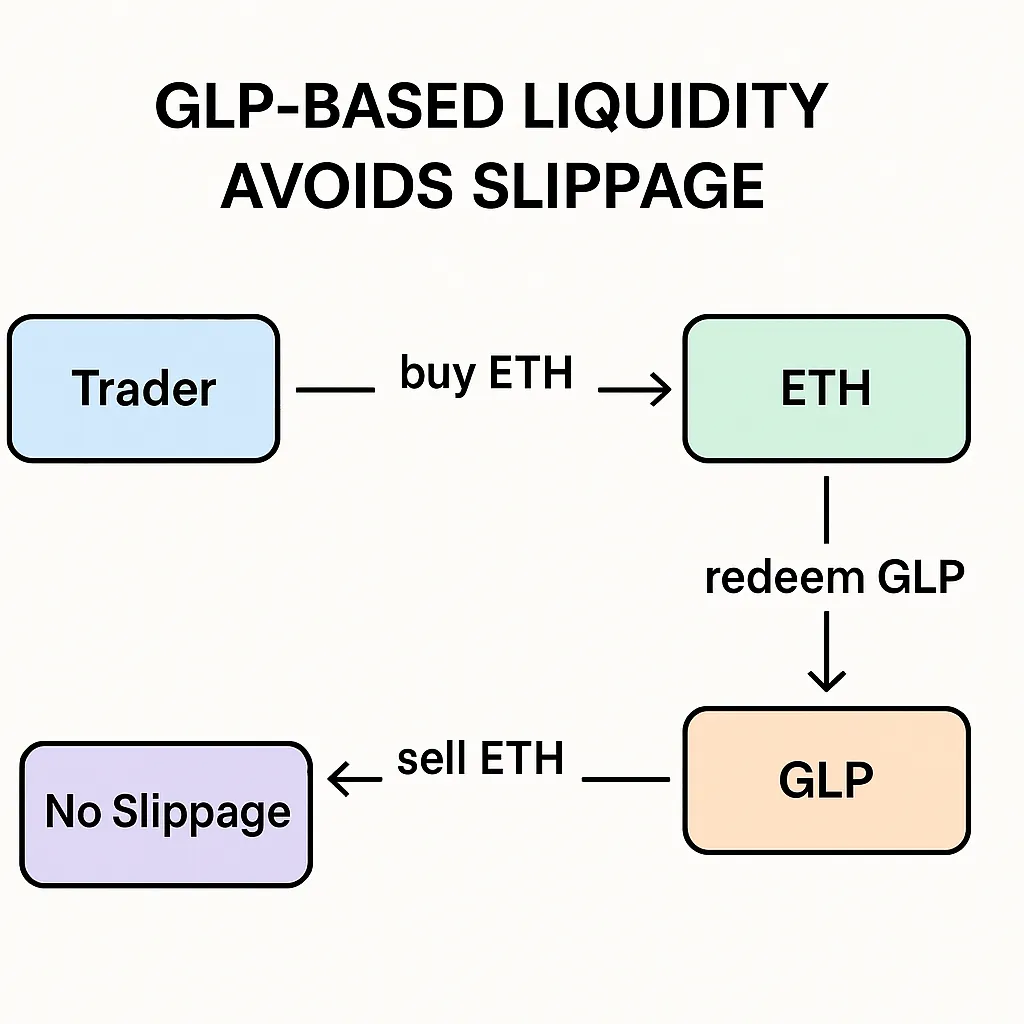

2. Zero Slippage Trading

GMX uses a multi-asset pool model ($GLP) that offers deep liquidity, enabling zero slippage on most trades.

This isn’t just a UX win — it’s a trader’s dream. Say goodbye to order books and price swings.

Bonus:

- Zero price impact

- No front-running bots eating your lunch

3. $GLP Token Mechanics

Here’s where things get spicy.

- $GLP is the liquidity provider token, backed by a basket of assets (BTC, ETH, USDC, etc.)

- LPs earn yield from trading fees and funding fees

- GLP stakers benefit when traders lose, creating an anti-correlation dynamic

Polysemy moment: GLP = Good Liquidity Play? Depends who you ask.

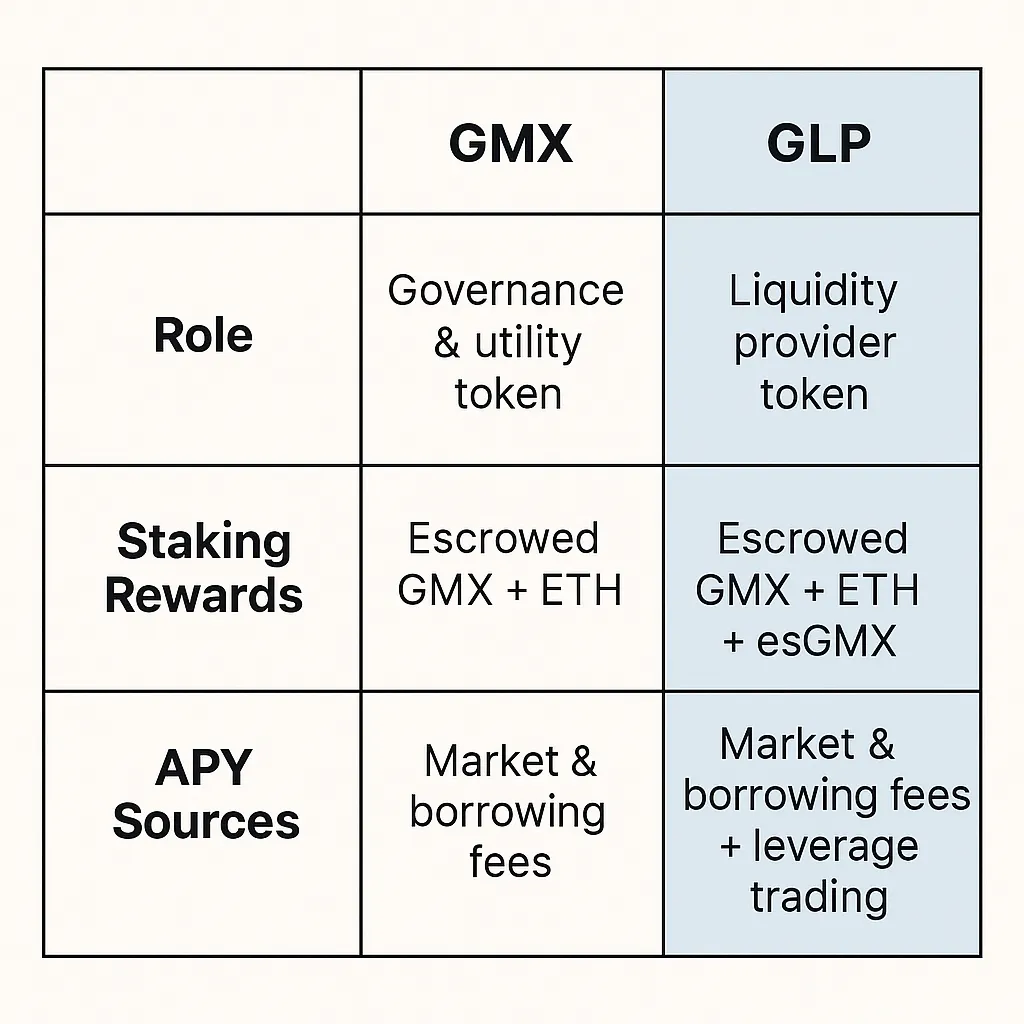

4. Dual Token Ecosystem ($GMX & $GLP)

GMX isn’t your average single-token protocol. It smartly separates:

- $GMX – the governance and revenue-sharing token

- $GLP – the liquidity provision and yield token

This modular architecture makes it easier to scale and fork independently — especially handy if you’re planning a GMX clone with your own twist.

5. Dynamic Fee Structure

GMX dynamically adjusts fees based on utilization — not some rigid static model.

- Swapping fees: 0.1% to 0.6%

- Open/close position fees: 0.1%

- Funding fees update every hour

This ensures liquidity stays healthy, rewards LPs, and discourages reckless over-leverage.

6. No Oracle Manipulation (Chainlink Integrated)

Price manipulation is the Achilles’ heel of DeFi trading. GMX integrates Chainlink oracles + time-weighted average prices (TWAP) from top exchanges to neutralize this.

- Safer liquidation logic

- More trust in PnL calculations

- Less room for foul play

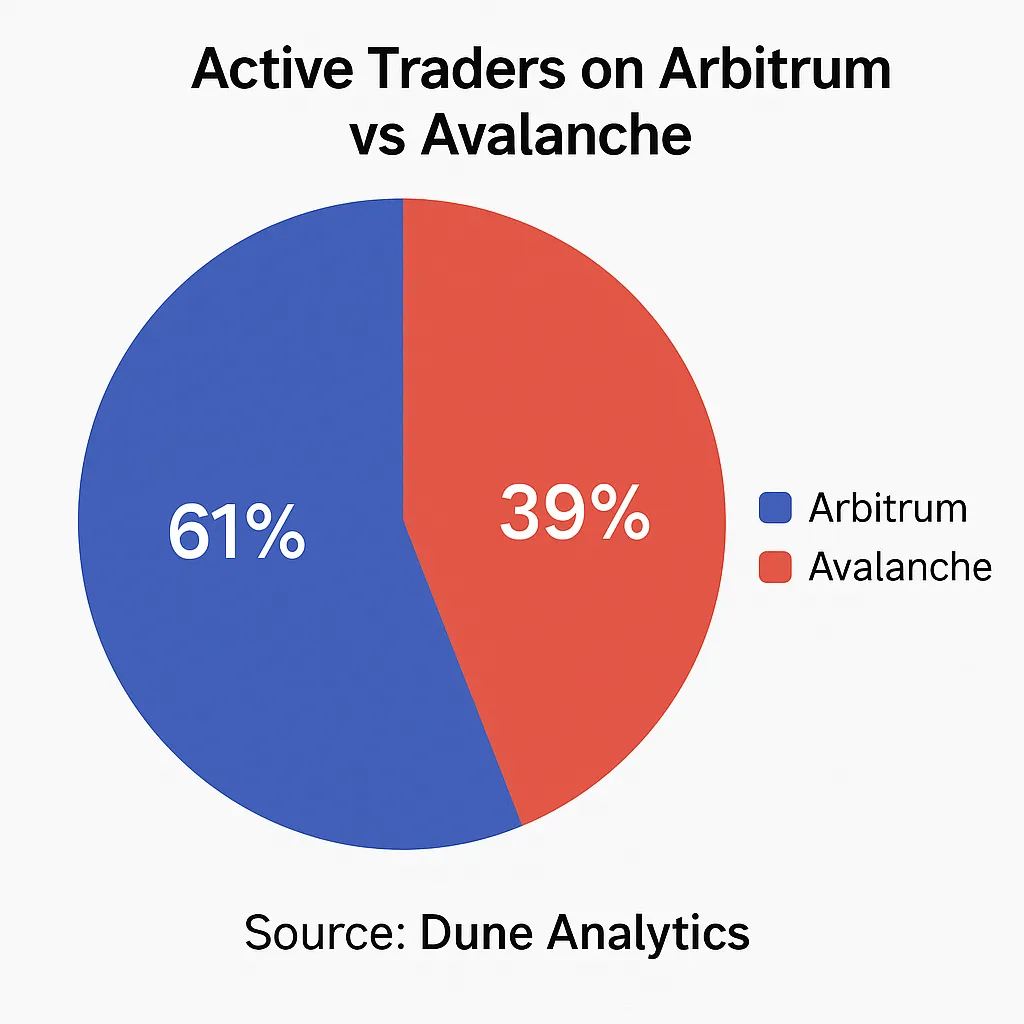

7. Arbitrum & Avalanche Compatibility

Why settle for one blockchain when you can dominate two?

- GMX was born on Arbitrum (Ethereum Layer 2)

- Later expanded to Avalanche for greater reach and speed

You get low gas, fast confirmation, and access to dual user bases.

8. Intuitive UI & Analytics Dashboard

Even with all that tech under the hood, GMX keeps the user experience smooth:

- Clean charting interface (via TradingView)

- Real-time funding rates and open interest data

- PnL visualization and trading history exports

9. Built-in Referral & Affiliate System

Looking to incentivize growth? GMX lets users:

- Create custom referral links

- Earn a % of trading fees from referees

- On-chain tracking = zero disputes

A dream for crypto influencers and communities.

10. Community-Governed Treasury

With $GMX holders at the helm, the protocol evolves via governance votes:

- Treasury allocations

- New asset listings

- Risk parameters

This makes GMX feel more like a public good than a black-box protocol.

Read more: Best GMX Clone Scripts in 2025: Features & Pricing Compared

Why Entrepreneurs Are Cloning GMX (and Why You Should Care)

The rise of GMX clones isn’t surprising. Startups are eager to replicate its formula while adding niche improvements — think multi-chain support, mobile-first UX, or altcoin focus.

If you’re building your own decentralized derivatives exchange, GMX’s feature set gives you a perfect springboard. But cloning code isn’t enough. You need smart integration, killer design, and airtight security — and that’s where Miracuves comes in.

Final Thoughts

GMX isn’t just a DeFi platform — it’s a movement. It proves that decentralized trading can be powerful, user-friendly, and sustainable. Whether you’re a trader, a builder, or an idea-stage dreamer, understanding GMX’s feature set gives you a serious edge.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q:1 What assets can you trade on GMX?

You can trade BTC, ETH, and a selection of top stablecoins and altcoins, depending on the network (Arbitrum or Avalanche).

Q:2 How does GLP make money for liquidity providers?

Liquidity providers earn fees from leverage traders — including spreads, funding fees, and liquidation penalties.

Q:3 What makes GMX different from dYdX?

GMX uses pooled liquidity (GLP) and offers zero-slippage trades, while dYdX uses an order book model with its own pros/cons.

Q:4 Is GMX safe to use?

Yes. It integrates Chainlink oracles, time-weighted pricing, and non-custodial smart contracts. But as with any DeFi protocol, smart contract risks exist.

Q:5 Can I build a GMX clone for my crypto startup?

Absolutely. Many startups are building niche GMX-style platforms. Miracuves can help you develop and launch your custom version fast.

Q:6 What’s the main advantage of building on Arbitrum or Avalanche?

Both offer fast, cheap transactions with high network activity — perfect for trading apps. Arbitrum benefits from Ethereum security, while Avalanche offers sub-second finality.

Related Articles: