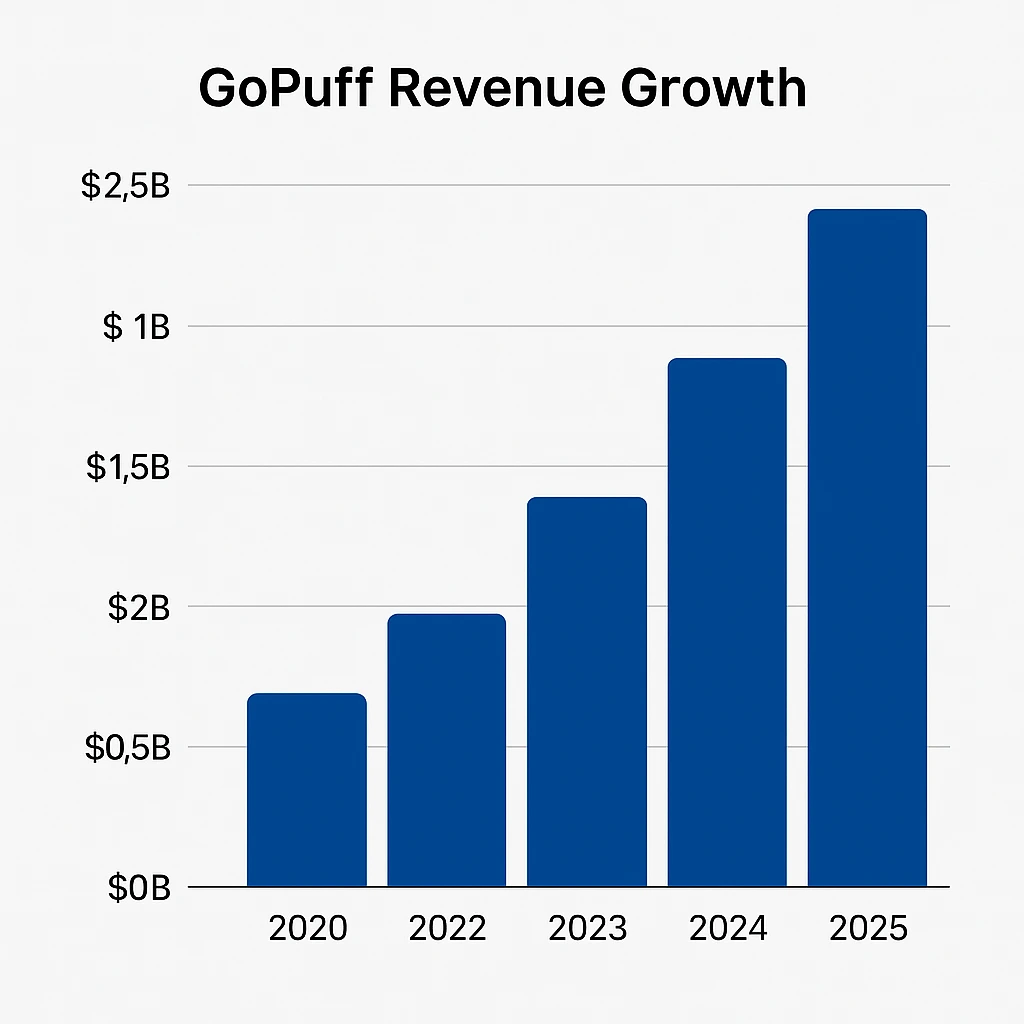

GoPuff generated approximately $2.2–$2.4 billion in revenue in 2025, establishing itself as one of the most successful instant-commerce platforms globally. Its rapid growth shows that ultra-fast delivery can scale into a multi-billion-dollar business when backed by the right monetization strategy.

Unlike traditional food delivery marketplaces, GoPuff follows an inventory-owned, dark-store model, giving it full control over pricing, fulfillment, and customer experience. This structure enables stronger gross margins, predictable revenue, and faster optimization of unit economics across regions.

For founders building quick-commerce or hyperlocal delivery platforms, GoPuff offers a proven, scalable revenue framework. Its blend of product margins, delivery fees, subscriptions, and advertising provides a clear blueprint for building sustainable on-demand businesses.

GoPuff Revenue Overview – The Big Picture

2025 Estimated Revenue: $2.2–$2.4 billion

Valuation: ~$15 billion (private market estimates)

YoY Growth: ~8–12% (post-pandemic normalization)

Revenue by Region:

- USA: ~78%

- UK & Europe: ~15%

- Others: ~7%

Average Gross Margin: 28–34%

Primary Competitors: DoorDash DashMart, Uber Eats Essentials, Instacart, Getir

Benchmark Position: Higher margins than food delivery, lower CAC than marketplaces

| Metric | 2025 Data |

|---|---|

| Estimated Revenue | $2.2–$2.4 Billion |

| Valuation | ~$15 Billion |

| YoY Growth | 8–12% |

| Gross Margin | 28–34% |

| Core Market | United States |

| Main Competitors | Instacart, DoorDash DashMart, Uber Eats Essentials |

| Profit Status | Unit-economics positive in mature markets |

Revenue by Region

| Region | Revenue Share |

|---|---|

| United States | ~78% |

| UK & Europe | ~15% |

| Other Regions | ~7% |

Read More: What is GoPuff and How Does It Work?

Primary Revenue Streams Deep Dive

Revenue Stream #1: Product Markup (Core Revenue)

GoPuff operates owned dark stores, not a marketplace. This allows it to buy inventory wholesale and sell at retail prices.

- Share of revenue: ~55–60%

- Markup range: 20–40% depending on category

- 2025 insight: Private-label snacks and beverages deliver the highest margins

Revenue Stream #2: Delivery & Service Fees

Every order includes a flat delivery or service fee.

- Share of revenue: ~15–18%

- Typical fee: $1.95–$3.95 per order

- Dynamic pricing: Higher fees during late night or peak demand

Revenue Stream #3: GoPuff Fam Subscription

A subscription that removes delivery fees.

- Price: ~$7.99/month

- Share of revenue: ~8–10%

- Strategic value: Boosts order frequency and LTV

Revenue Stream #4: Alcohol & Regulated Products

Alcohol, tobacco, and vapes generate premium margins.

- Share of revenue: ~10–12%

- Margin advantage: 2–3× compared to snacks

- Regulatory moat: High entry barrier for competitors

Revenue Stream #5: Brand Advertising & Sponsored Listings

Brands pay for product placement inside the app.

- Share of revenue: ~5–7%

- Pricing model: CPC + featured placements

- Fastest-growing stream in 2025

GoPuff Revenue Streams Breakdown (2025)

The Fee Structure Explained

User-Side Fees

| Fee Type | Typical Range |

|---|---|

| Delivery Fee | $1.95 – $3.95 |

| Small Basket Fee | $2–$4 |

| Surge Pricing | Time & demand based |

Provider-Side Fees

| Entity | Fee |

|---|---|

| Merchants | None (GoPuff owns inventory) |

| Brands (Ads) | CPC / placement based |

Hidden & Indirect Revenue

| Source | Purpose |

|---|---|

| Private-Label Products | Higher margins |

| Brand Data Insights | CPG partnerships |

| Sponsored Campaigns | Seasonal promotions |

How GoPuff Maximizes Revenue Per User (ARPU)

| Strategy | Execution |

|---|---|

| User Segmentation | Students, late-night users, families |

| Upselling | Checkout add-ons |

| Cross-Selling | Snacks + alcohol bundles |

| Dynamic Pricing | Peak hours & demand |

| Retention Monetization | Subscription-first UX |

| Psychological Pricing | $9.99 bundles |

| LTV Growth | Fam users order ~2.4× more |

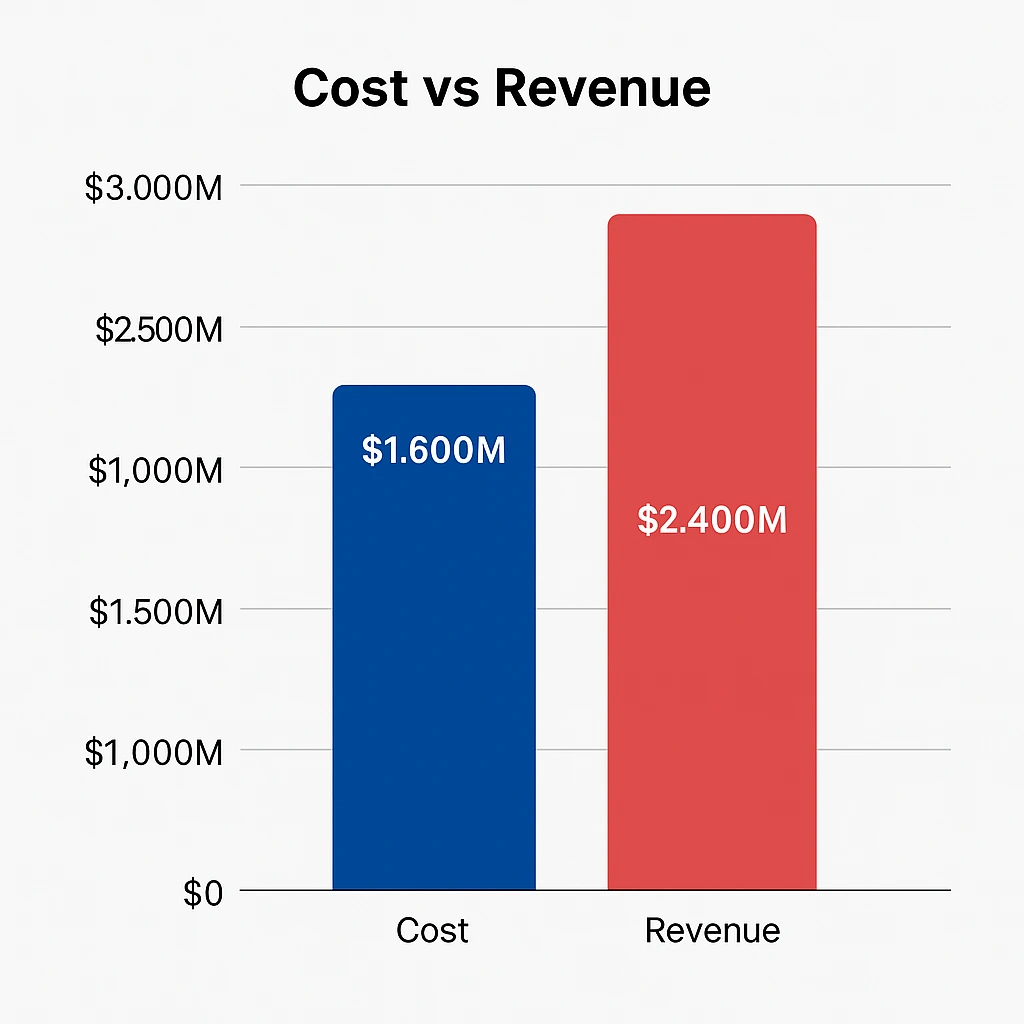

Cost Structure & Profit Margins

GoPuff Cost Breakdown

| Cost Category | % of Revenue |

|---|---|

| Dark Stores & Warehousing | ~25% |

| Logistics & Delivery | ~30% |

| Marketing & CAC | 12–15% |

| Operations & Admin | ~10% |

| R&D & Technology | 6–8% |

- Infrastructure: Dark stores, warehousing (~25%)

- Logistics & Drivers: ~30%

- Marketing & CAC: ~12–15%

- Operations: ~10%

- R&D & Tech: ~6–8%

Unit Economics Insight:

Orders above $28 basket value generate positive contribution margins within 12–15 months.

Read More: Best GoPuff Clone Script 2025 | Launch On-Demand Delivery App

Future Revenue Opportunities & Innovations

- AI-driven demand forecasting

- Automated micro-fulfillment centers

- White-label logistics for local brands

- Retail media networks for CPGs

- Expansion into Tier-2 cities

2025–2027 risks:

- Margin pressure

- Regulatory changes

- Labor costs

Founder opportunity:

Niche-focused instant commerce (pharmacy, campus delivery, B2B supplies)

Lessons for Entrepreneurs & Your Opportunity

What works:

- Inventory ownership

- Subscription-first monetization

- High-margin private labels

What to replicate:

- Dark-store density model

- Bundled pricing

- Data-backed upselling

Market gaps:

- Regional quick commerce

- B2B instant delivery

- Specialized vertical delivery

Risks: Margin compression, labor costs, regulation

Founder Opportunity: Vertical-specific instant commerce platforms

Lessons for Entrepreneurs & Your Opportunity

| Insight | Founder Takeaway |

|---|---|

| Inventory Ownership | Higher margin control |

| Subscription Revenue | Predictable cash flow |

| Dark Store Density | Faster break-even |

| Bundled Pricing | Higher AOV |

| Data Monetization | Long-term growth lever |

Want to build a platform with GoPuff’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our GoPuff-style clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

GoPuff’s success highlights that instant delivery alone is not enough to build a durable business. True scalability comes from owning the entire monetization stack, from inventory and pricing to fulfillment and customer experience.

By combining strong product margins with subscriptions and in-app advertising, GoPuff creates multiple, reinforcing revenue streams. This layered approach helps stabilize income, improve unit economics, and reduce reliance on pure order volume.

For founders, GoPuff’s model offers a clear path to profitable quick commerce. It shows how controlling operations and monetization can turn convenience-driven demand into a sustainable, long-term business.

FAQs

1. How much does GoPuff make per transaction?

Around $6–$9 gross margin per order.

2. What’s GoPuff’s most profitable revenue stream?

Private-label and alcohol products.

3. How does GoPuff’s pricing compare to competitors?

Slightly higher product pricing but fewer delivery charges.

4. What percentage does GoPuff take from providers?

None—it owns inventory.

5. How has GoPuff’s revenue model evolved?

From delivery-centric to margin- and ads-driven.

6. Can small platforms use similar models?

Yes, especially in niche markets.

7. What’s the minimum scale for profitability?

~2,000–3,000 monthly orders per dark store.

8. How to implement similar revenue models?

Combine owned inventory, subscriptions, and upsells.

9. What are alternatives to GoPuff’s model?

Marketplace or hybrid inventory models.

10. How quickly can similar platforms monetize?

With efficient logistics and a well-structured monetization setup, similar platforms can begin generating revenue quickly after launch.