Picture this: You’ve got a killer idea for a blockchain project. Maybe it’s a DeFi platform, a next-gen NFT marketplace, or even a decentralized TikTok alternative. But here’s the kicker—without funding, your brilliant idea is just that… an idea. That’s where ICO launchpads step in, offering a gateway to crypto-backed crowdfunding.

But building a launchpad? It ain’t as simple as spinning up a landing page and shouting “Token Sale Starts Now!” from the Twitter rooftops. Nope. The competition is fierce, the audience is crypto-savvy, and the tech? Oh boy, it better be airtight. You’re not just building a platform—you’re crafting a launch vehicle for dreams.

Whether you’re a founder itching to bootstrap Your Own ICO Launchpad or a startup eyeing the Web3 space, understanding what makes a high-converting, secure, and scalable ICO launchpad is essential. That’s exactly what we’re diving into today. And yep, if you’re looking for a battle-tested development partner? Miracuves has your back.

Read more: How to Build an App Like ICO Launchpad: A Full-Stack Developer’s Guide

What Is an ICO Launchpad and Why Are They Popping Up Everywhere?

An ICO (Initial Coin Offering) Launchpad is essentially a platform that helps crypto startups raise capital by selling their tokens to early adopters. Think of it as Kickstarter, but for blockchain projects—and instead of T-shirts and mugs, you get tokens that might 10x.

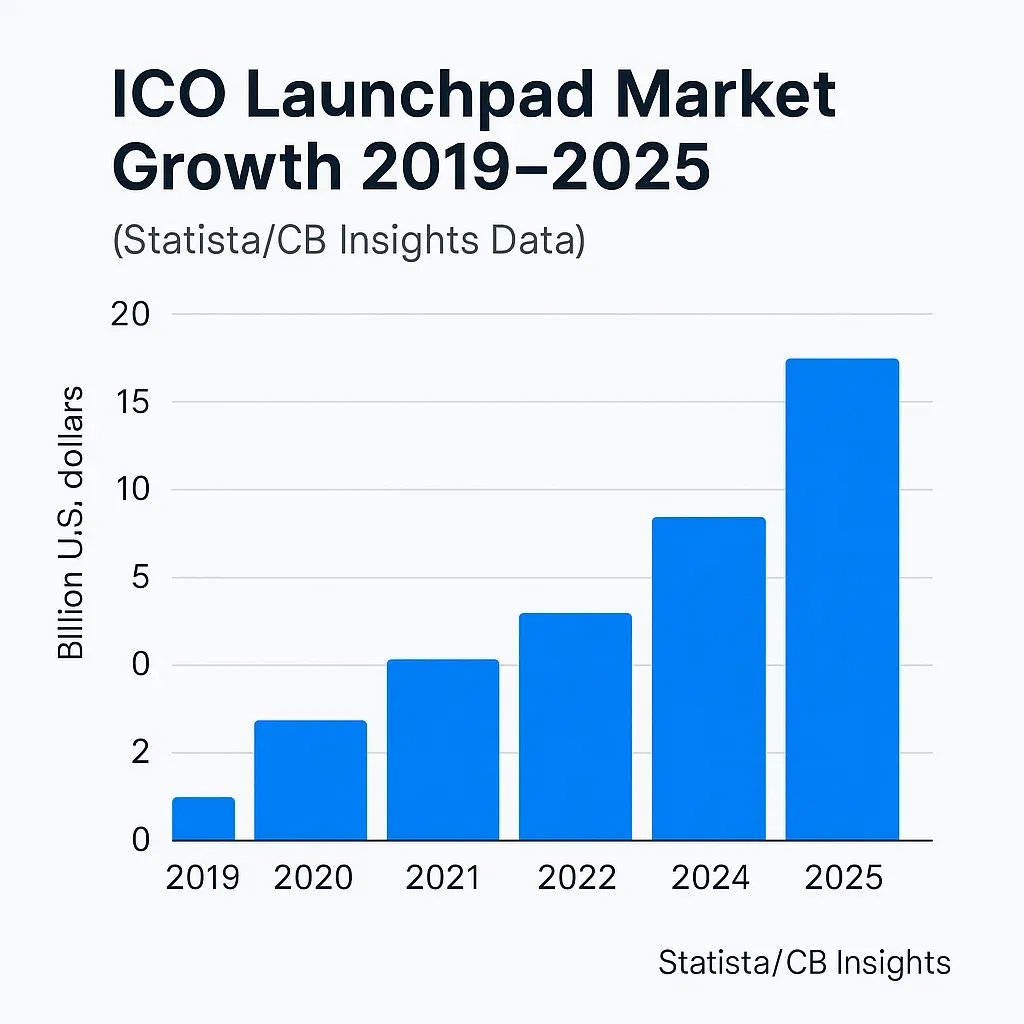

We’ve seen the rise of heavyweights like Binance Launchpad, Polkastarter, and TrustPad. They’ve helped launch dozens of crypto startups, raising millions. And with retail investors looking to get in early, the demand for secure, feature-rich launchpads is only climbing.

Must-Have Features in a Modern ICO Launchpad

1. Multi-Tier Staking Mechanism

This isn’t just about locking tokens—it’s about building hype and community engagement. Users stake tokens to get allocation rights. Tiered systems (Bronze, Silver, Gold, etc.) gamify participation and give people that FOMO boost.

Why it matters:

Encourages long-term commitment and helps weed out whales trying to dump post-IDO.

2. KYC/AML Integration

As much as we love decentralization, compliance isn’t optional anymore—especially if you want to attract institutional interest.

Must-have integrations:

- Blockpass

- SumSub

- IdentityMind

This protects both your users and your project’s legal future.

3. Multi-Chain Support

Let’s face it—Web3 is fragmented. Some users are diehard Ethereum fans, others swear by BNB Chain, Solana, or Avalanche. The more networks you support, the more projects (and users) you can attract.

4. Robust Smart Contract Audits

Security in the crypto space is like seatbelts in a race car—non-negotiable. Your ICO launchpad needs rock-solid, audited contracts for staking, token sales, and vesting.

Integrate with audit firms like:

- CertiK

- Hacken

- SolidProof

One exploit can tank your platform’s credibility overnight.

5. Token Vesting Dashboard

Your investors don’t want spreadsheets. They want clarity. A sleek, interactive vesting dashboard shows real-time unlock schedules, claimable balances, and lock periods.

Add automated reminders or wallet push alerts for vesting dates.

6. Admin & Project Dashboard

For you and your project creators, dashboards are the cockpit. You need oversight on every campaign, every wallet, every milestone.

Essential features include:

- Project approval workflows

- Whitelist management

- Contribution caps

- Refund control

Control + transparency = confidence.

7. In-Built Wallet Integration

The fewer the clicks, the better the conversions. Supporting MetaMask, Trust Wallet, WalletConnect, and Ledger is just the start.

Want to go pro? Enable seamless fiat-to-crypto onboarding (MoonPay, Ramp, Transak).

8. Analytics & Conversion Tracking

No more flying blind. Your platform should offer real-time analytics for token sale performance, user behavior, and referral effectiveness.

9. Referral & Affiliate Programs

Growth hack your way to virality. Let early supporters bring in more users with unique referral links. Add bonuses like extra allocation or commission.

10. Community Integrations (Discord, Telegram Bots)

Web3 lives on Telegram, breathes on Discord, and debates on Twitter/X. Enable automated alerts, project updates, and AMA events right from your platform.

Bonus Features That Add the Wow Factor

- NFT Airdrops for Early Investors

- Launch Calendar View

- Live Chat Support via AI Bot

- Dark/Light UI Toggle

- Real-Time Gas Fee Estimations

These aren’t essential, but they do elevate your platform and keep users coming back.

Real-World Inspiration: Features from Top Players

- Binance Launchpad: Insanely intuitive UI, fixed staking model

- Polkastarter: Decentralized vetting via community governance

- TrustPad: KYC partnership with Blockpass, great mobile experience

Use these as benchmarks—but don’t clone blindly. Instead, build smarter.

Don’t Forget: UX and Mobile-First Design

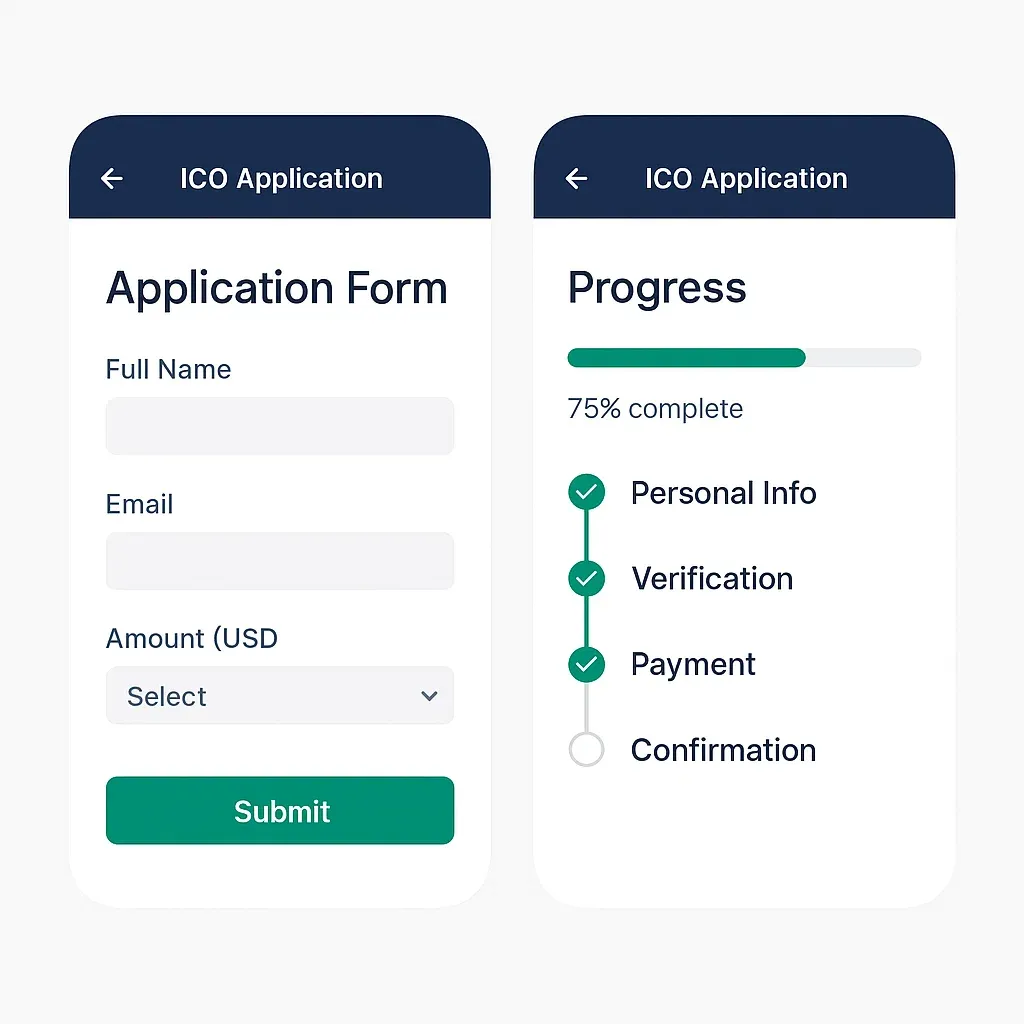

A clunky launchpad UI is the fastest way to kill conversions. Users should glide through staking, applying, and investing—especially on mobile.

UX gestures to consider:

- Swipe to stake

- Tap to view vesting

- Push alerts for token claims

Read more: Best ICO Launch Platforms in 2025: Features & Pricing Compared

Conclusion

Building an ICO launchpad isn’t just about coding—it’s about creating a bridge between bold blockchain ideas and the community that funds them. From KYC to smart vesting dashboards, the features you bake in today will determine whether users stay or stray.

In 2025 and beyond, we’re going to see more multi-chain platforms, integrated social virality tools, and fiat onramps redefining how crypto fundraising works.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q:1 What is the main role of an ICO launchpad?

An ICO launchpad helps crypto startups raise funds by offering tokens to early investors. It provides the tech, legal, and marketing support needed for a successful token launch.

Q:2 How do investors participate in a launchpad sale?

Typically, investors stake a certain number of native tokens to gain tiered access to new projects. After KYC, they can invest based on their tier level.

Q:3 Are launchpads only for Ethereum-based projects?

Nope! Modern launchpads support multiple blockchains like BNB Chain, Solana, Polygon, and even Avalanche. Multi-chain compatibility is a huge value-add.

Q:4 How do launchpads make money?

Revenue comes from token listing fees, staking commissions, featured project promotions, and even referral systems.

Q:5 Is it necessary to integrate KYC in a launchpad?

Yes, especially if you’re operating in jurisdictions with AML regulations. KYC also builds trust among investors and reduces fraudulent activity.

Q:6 Can I build a white-label ICO launchpad?

Absolutely. In fact, companies like Miracuves offer fully customizable white-label ICO launchpads that are plug-and-play.

Related Articles: