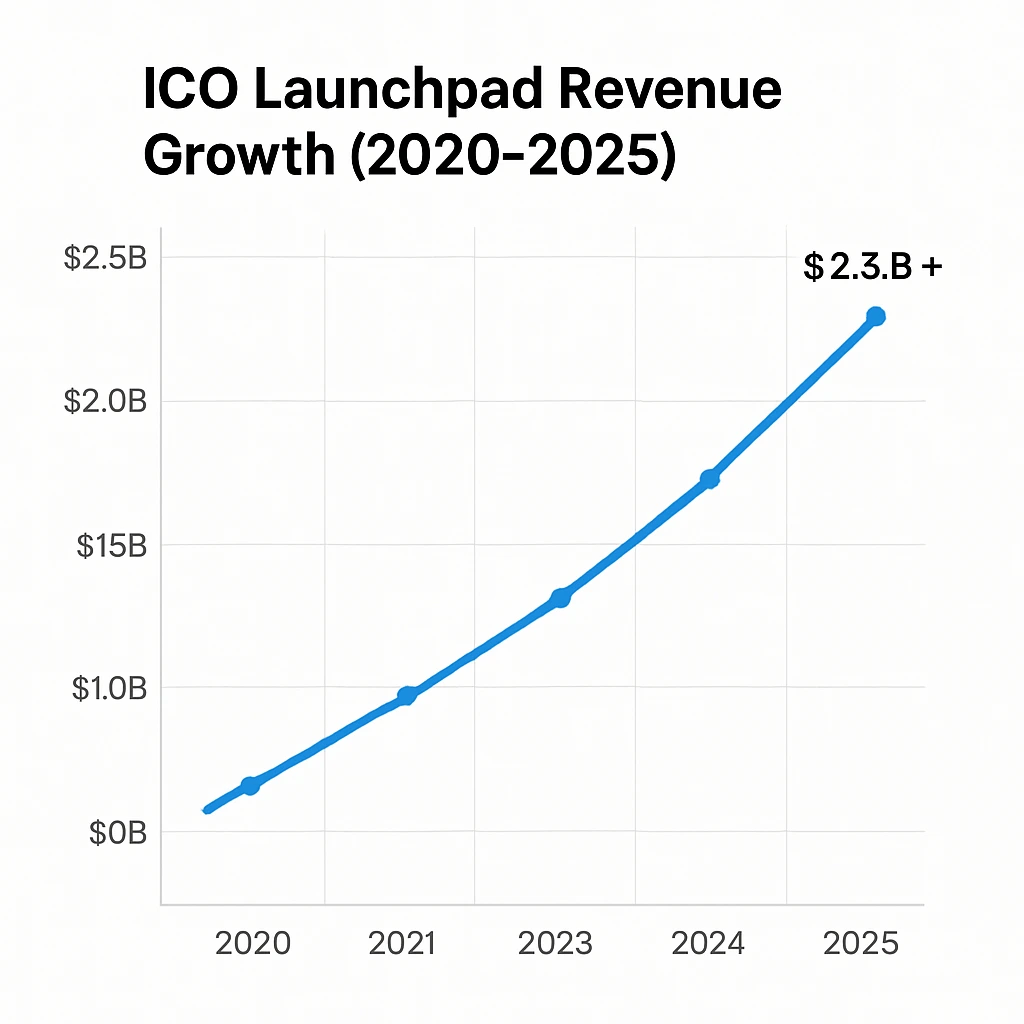

In 2025, ICO launchpad platforms crossed $2.3 billion in revenue globally — without launching any tokens of their own.

This is one of the few business models where platforms earn before a project even goes live, making it one of the most scalable and capital-efficient models in Web3.

Why It Matters

For entrepreneurs, understanding how launchpads earn through tokenomics, listing fees, staking, advisory services and allocation tiers can unlock a profitable entry into the crypto market — without needing liquidity pools or large engineering teams. The launchpad model proves that in Web3, control over project discovery and fundraising is often more valuable than owning the token itself.

ICO Launchpad Revenue Overview – The Big Picture

The global ICO launchpad market grew 65% YoY in 2025, driven by the rise in crypto startups and decentralized crowdfunding platforms. Top ICO launchpads like Binance Launchpad, TrustSwap, and DAOMaker collectively onboarded over 1,200 projects in just one year.

2025 Estimates

- Estimated total revenue: $2.3B+

- Current market valuation: $9.5B

- Average platform profit margin: 38–52%

- Annual project listings: 70–120 per platform

Read More: Everything You Need to Know About an ICO Launchpad App

Revenue Breakdown by Region (2025)

| Region | Share |

|---|---|

| North America | 32% |

| Europe | 27% |

| Asia-Pacific | 34% |

| Others | 7% |

Market Position

Binance Launchpad still dominates, but micro-niche launchpads (gaming, DeFi, real estate, AI) are seeing faster adoption and higher token success rates.

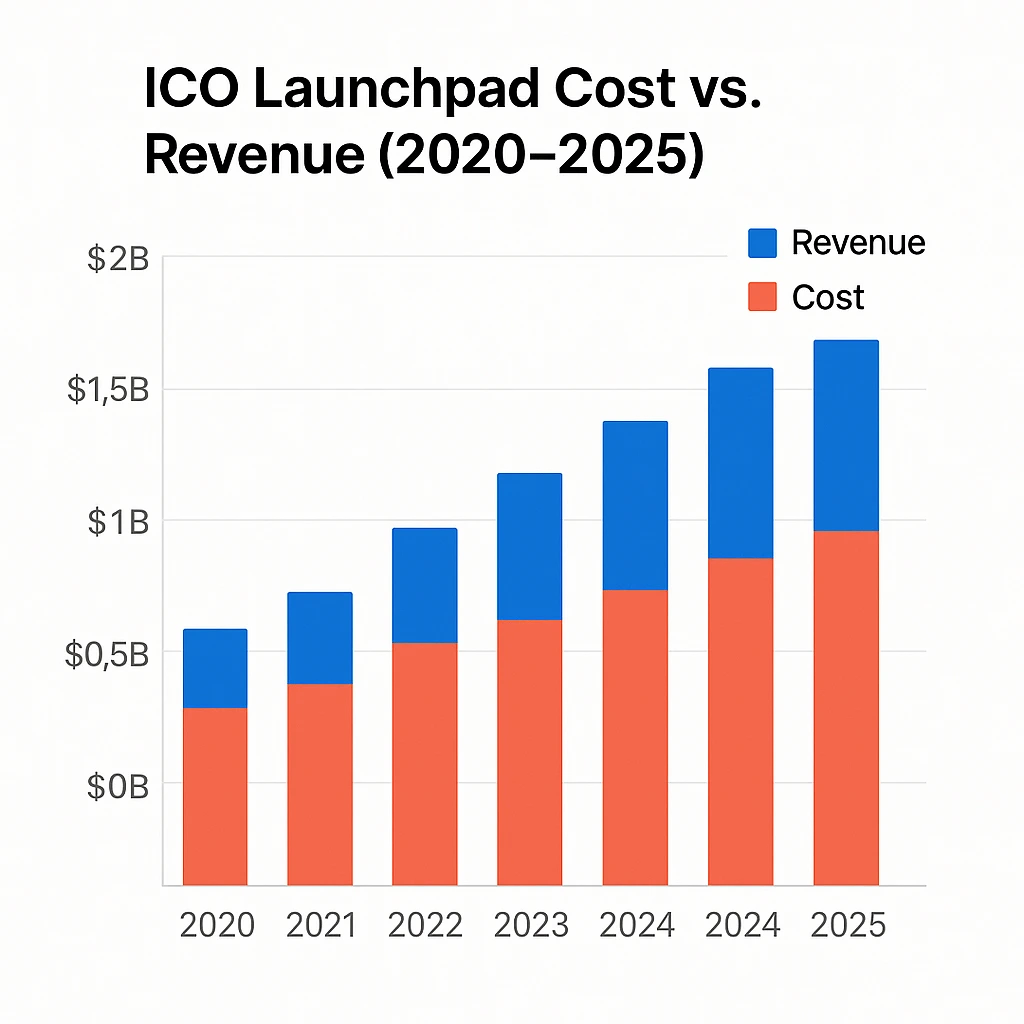

Profitability Analysis

Low operational cost + high token sale fees = strong margins, especially for niche-focused platforms.

Primary Revenue Streams – Deep Dive

| Revenue Stream | % Share (Avg 2025) | Explanation |

|---|---|---|

| Token Sale Commissions | 35% | % cut from total funds raised |

| IDO/IEO Launch Fees | 25% | One-time project onboarding fee |

| Staking & Yield Pools | 15% | Token-locking for rewards |

| Token Allocation via Tier System | 12% | Paid investor access tiers |

| Marketing & Advisory Services | 8% | Paid listing promotions |

| Additional Revenue | 5% | Liquidity pool fees, audits |

Detailed Breakdown

1. Token Sale Fee (Main Revenue Source)

Platforms take 5–12% of the total capital raised during token sale. For projects raising $5M, platforms make $250K–600K instantly.

2. Launch + Listing Fee

Fixed fee charged before token goes live: $40K–$120K average per project.

3. Investor Access Tier System

Staking-based tiers give users priority access — subscription pricing between $199–$999/month.

4. Staking & Liquidity Pools

Platform-controlled staking — APR between 8–18% where platform keeps a % of rewards.

5. Advisory & Marketing Packages

Tokenomics planning, whitepaper writing & influencer outreach — priced between $5K–$50K per project.

Read More: Business Model of ICO Launchpad: Strategy Breakdown 2025

The Fee Structure Explained

| User Type | Charges Applied |

|---|---|

| Project Owners | Listing fee + % revenue cut + advisory cost |

| Investors | Tier subscription + staking fees |

| Token Holders | Trading fee + withdrawal fee |

| Launchpad Admins | Earn via all channels |

Hidden Revenue Layers

- Token vesting management

- Liquidity pool validation

- Audit partnerships

- Smart contract hosting

- Early staking penalties

Regional Pricing Variations

Europe and Singapore have higher compliance fees, while Dubai & Hong Kong are emerging tax-friendly zones.

How ICO Launchpads Maximize Revenue Per User

To increase LTV (Lifetime Value), launchpads use:

- Segmentation of investors by tier

- Dynamic pricing for allocations

- VIP access and gamified rewards

- Cross-selling: audit + marketing packages

- Retention via staking lock-ins (30-180 days)

- AI-based risk scoring

- Psychological pricing ($999 VIP Access instead of $1000)

Platforms now use AI-powered investor profiling, predicting who will invest more — helping platforms push targeted high-fee offers.

Cost Structure & Profit Margins

| Cost Area | Avg. Cost Share |

|---|---|

| Tech Infrastructure | 22% |

| Marketing & Investor Acquisition | 28% |

| Legal & Compliance | 16% |

| Operations & Support | 9% |

| R&D | 12% |

| Others | 13% |

Unit Economics (2025)

- CAC per investor: $45–$80

- LTV per investor: $450–$700

- Avg. payback period: 10–15 days

Profit margin reaches 50%+ when tokenomics strategy is managed in-house.

Future Revenue Opportunities (2025–2027)

Growth areas:

- AI-led token rating system

- NFT-based allocations

- Multi-chain project listings

- Token vesting marketplace

- Subscription-based launchpad SaaS

- Debt-token launchpads (DeFi lending)

- Insurance-backed crypto IPOs

Key Threats

Regulation, scams, low token performance, API security, legal cross-border issues.

Opportunity for New Players

Niche + Compliance-first + Transparent = High investor trust & faster adoption.

Lessons for Entrepreneurs & Your Opportunity

What works

- High fees per token launch

- Guaranteed liquidity model

- Tier-based recurring revenue

- Tokenomics control = high leverage

Gaps entrepreneurs can target

- Region-specific launchpads

- Industry-specific launchpads (AI, gaming, health)

- KYC-compliant global IDO platforms

Want to build a platform with the ICO Launchpad revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization features. Our ICO Launchpad clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and Miracuves delivers ready-to-launch solutions in 3–9 days guaranteed. If you want an advanced token vesting system, staking engine or AI-led tier mechanism — Miracuves will provide that too. Get a free consultation to map out your revenue strategy.

Final Thought

The ICO launchpad Clone model is powerful because it earns before the token even lists — meaning revenue begins at the fundraising stage itself. With the right positioning, entrepreneurs can dominate micro-niches such as AI, gaming, DeFi, real estate or regional Web3 markets without launching any tokens of their own. As regulation increases, trust, compliance and strong launch mechanics will decide who wins. Those who adapt early can build highly scalable platforms with predictable revenue — especially when powered by pre-built frameworks and revenue engines.

FAQs

1. How much does an ICO launchpad earn per transaction?

Around 5–12% of funds raised.

2. What is the most profitable revenue stream?

Token launch commission and advisory packages.

3. How do prices compare to competitors?

It’s important to note that big players often charge 30–40% more due to brand trust — but with Miracuves, you can build a similar platform starting at just $2499, delivered in 3–9 days with guaranteed delivery.

4. What percentage is taken from project providers?

$40K–$120K fixed + % of raised capital.

5. How has the model evolved over time?

2024–2025 saw advanced staking and AI-backed tier systems.

6. Can small startups use this model?

Yes — niche launchpads are trending in 2025.

7. What’s the minimum scale for profitability?

20 successful projects per year.

8. How to implement this revenue model?

Use a tokenomics engine + staking + tiered access.

9. What are alternatives?

DeFi launchpads, NFT launchpads, STO platforms.

10. How quickly can similar platforms monetize?

With proven scripts, platforms earn from Day 1 — especially with Miracuves’ ready-to-launch solutions.