*In 2025, IKEA continues to generate approximately €45 billion ($48–49B) in annual revenue, making it the world’s largest home-furnishing retailer. This scale is powered by high inventory turnover, standardized global sourcing, vertically integrated supply chains, and a cost-first product design philosophy that allows IKEA to maintain strong margins while keeping prices accessible across markets.

What makes IKEA remarkable isn’t luxury pricing or premium positioning—it’s radical cost efficiency, operational discipline, and logistics mastery. From flat-pack engineering that slashes shipping volume, to warehouse-style stores that reduce staffing costs, to long-term supplier contracts that lock in production economics, every part of the system is designed to maximize profit per square foot and per shipment.

For founders, IKEA’s revenue model is a masterclass in building a defensible, high-volume business engine. The real lesson lies in modular product design, service-based upselling, loyalty-driven repeat purchases, and psychological pricing strategies that increase lifetime value while keeping customer acquisition costs low—principles that can be replicated in both digital and physical marketplaces.

IKEA Revenue Overview – The Big Picture

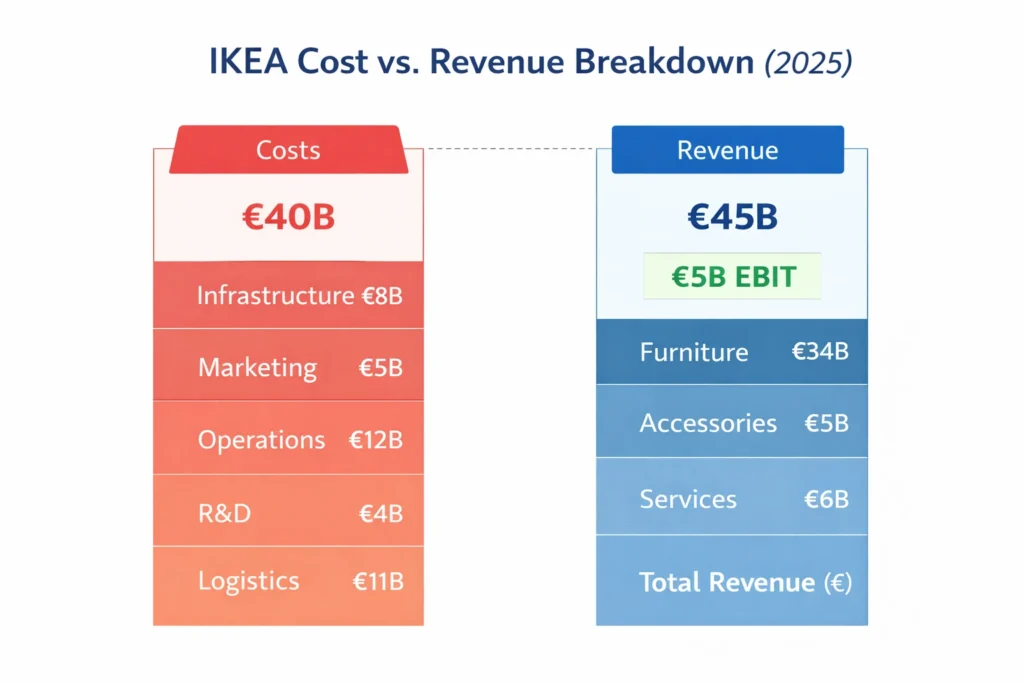

- 2025 Revenue: ~€45B

- Valuation (Private est.): €80–90B

- YoY Growth: ~2–3% (stable, mature market)

- Revenue by Region:

- Europe: ~65%

- North America: ~20%

- Asia-Pacific & others: ~15%

- Average Gross Margin: 36–38%

- Net Profit Margin: ~10%

- Competition Benchmark:

- Wayfair: Lower margins, higher logistics costs

- Home Depot: Higher ticket size, less vertical integration

Primary Revenue Streams Deep Dive

Revenue Stream #1: Furniture Sales (≈75%)

Core revenue comes from self-assembled furniture—beds, sofas, wardrobes, tables.

- How it works: Mass-produced, modular designs

- Pricing: Low unit price, high volume

- 2025 contribution: ~€34B

Revenue Stream #2: Home Accessories & Décor (≈12%)

Lighting, kitchenware, storage, textiles.

- Higher impulse buying

- Strong cross-sell with furniture

Revenue Stream #3: In-Store & Online Services (≈5%)

Delivery, installation, assembly, extended warranties.

- High-margin add-ons

- Growing faster than core furniture sales

Revenue Stream #4: Food & Restaurants (≈4%)

IKEA food courts and packaged food retail.

- Loss leader + brand engagement

- Drives longer store visits

Revenue Stream #5: B2B, Licensing & Real Estate (≈4%)

Office furniture, franchise licensing, and shopping-center assets.

Revenue Streams Percentage Breakdown

| Revenue Source | % Share |

|---|---|

| Furniture | 75% |

| Home Accessories | 12% |

| Services | 5% |

| Food & Beverage | 4% |

| B2B & Licensing | 4% |

The Fee Structure Explained

User-Side Costs

- Product price

- Delivery fee

- Assembly & installation fee

Provider-Side Costs

- Suppliers operate on long-term, volume-based contracts

- Strict cost targets set by IKEA

Hidden Revenue Layers

- Packaging optimization

- Shelf-ready logistics

- Store-owned real estate value

Regional Pricing Variation

- Local sourcing adjusts cost

- Purchasing power parity pricing by country

Complete Fee Structure by User Type

| User Type | Fees Paid |

|---|---|

| Retail customer | Product + delivery + service |

| Business client | Contract pricing + logistics |

| Franchise partner | Licensing & supply chain fees |

How IKEA Maximizes Revenue Per User

- Segmentation: Students, families, renters, businesses

- Upselling: Accessories bundled with furniture

- Cross-selling: Room-based layouts increase cart size

- Dynamic pricing: Seasonal promotions & regional pricing

- Retention monetization: IKEA Family loyalty program

- LTV optimization: Repeat purchases across life stages

- Psychological pricing: “Under €99” anchor strategy

Example: A €199 sofa often leads to €80–120 in accessory add-ons.

Cost Structure & Profit Margins

- Infrastructure: Warehousing, mega-stores, IT systems

- Customer acquisition: Very low CAC due to brand dominance

- Operations: Self-service stores reduce staffing costs

- R&D: Product design, materials, sustainability

- Unit economics: Flat-pack reduces shipping volume by ~60%

- Margin optimization: Design-to-cost discipline

- Profitability path: High volume offsets low unit margins

Read More: Best IKEA Clone Scripts 2025 | A Furniture E-Commerce Platform

Future Revenue Opportunities & Innovations

- Subscription-based furniture leasing

- AI-driven home planning tools

- Smart furniture integrations

- Urban micro-stores & faster delivery

- Asia & Middle East expansion

Risks:

- Logistics disruptions

- Sustainability compliance costs

- DTC competition

Opportunities for founders:

- Vertical niche furniture platforms

- Localized fast-delivery models

- AR/AI-powered home commerce

Lessons for Entrepreneurs & Your Opportunity

What works

- Vertical integration

- Cost-first design

- High inventory turnover

What to replicate

- Modular products

- Add-on services

- Experience-driven commerce

Market gaps

- Faster customization

- Premium assembly services

- AI-assisted buying journeys

Want to build a platform with IKEA’s proven revenue model?

Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our IKEA-style furniture marketplace clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it we may arrange and deliver it in 3–9 days.

if you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

IKEA proves that profitability doesn’t require premium pricing—it requires operational excellence, cost-engineered product design, and relentless process optimization. By focusing on high inventory velocity, supplier consolidation, and standardized global workflows, IKEA turns thin margins into massive cumulative profits through sheer scale and efficiency.

Its revenue model is a blend of logistics intelligence, psychological pricing, and platform-like scale effects. Flat-pack shipping reduces freight costs, room-based merchandising increases average order value, and add-on services like delivery, assembly, and accessories create high-margin revenue layers on top of low-cost core products.

For founders, the lesson is clear: design the business system before the product. Build pricing frameworks, upsell paths, retention loops, and operational moats into your platform from day one—because when the system is engineered for efficiency and growth, revenue becomes a predictable outcome rather than a hopeful target.

FAQs

1. How much does IKEA make per transaction?

On average, €70–90 per retail transaction globally.

2. What’s IKEA’s most profitable revenue stream?

Furniture accessories and add-on services.

3. How does IKEA’s pricing compare to competitors?

Lower base price with higher volume and lower logistics cost.

4. What percentage margin does IKEA earn?

Gross margins average around 36–38%.

5. How has IKEA’s revenue model evolved?

From pure retail to services, food, B2B, and digital tools.

6. Can small platforms use similar models?

Yes, at niche or regional scale.

7. What’s the minimum scale for profitability?

Usually after consistent monthly inventory turnover.

8. How to implement similar revenue models?

Combine modular products, services, and logistics control.

9. What are alternatives to IKEA’s model?

DTC premium furniture or rental-based platforms.

10. How quickly can similar platforms monetize?

With the right setup, within the first 30–90 days.