Lazada has become one of Southeast Asia’s most dominant eCommerce ecosystems, backed by Alibaba and powered by a highly diversified monetization engine. With billions in GMV flowing through the platform each year, Lazada’s business model has become a benchmark for founders launching marketplace platforms in 2025.

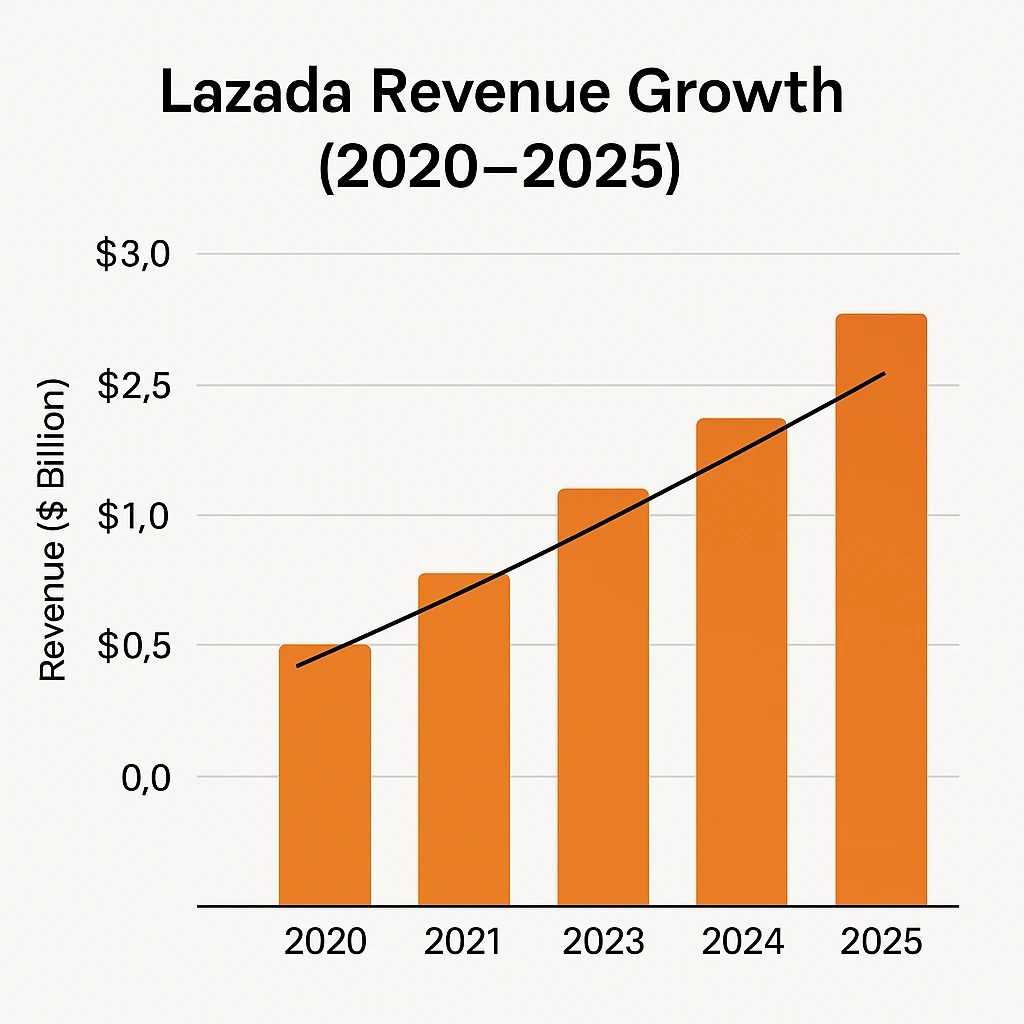

The numbers themselves tell a compelling story—Lazada surpassed $22.4B in GMV and crossed $2.7B in revenue in 2025, with strong growth across Indonesia, Philippines, Vietnam, Thailand, and Malaysia. Understanding how Lazada makes money gives founders a blueprint for building platforms that monetise from day one.

For entrepreneurs, Lazada’s model is a masterclass in multi-layer monetization, efficiency, user trust, and ecosystem expansion—crucial insights for anyone building a next-gen marketplace.

Lazada Revenue Overview – The Big Picture

2025 Estimated Revenue: ~$2.7 Billion

Valuation: Estimated at ~$20–23 Billion (based on Alibaba reporting + SEA market projections)

YoY Growth: ~14% annualized across SEA

GMV: ~$22.4 Billion

Revenue by Region:

- Indonesia: 34%

- Philippines: 18%

- Vietnam: 17%

- Thailand: 16%

- Malaysia: 10%

- Singapore: 5%

Profit Margins:

Adjusted EBITDA margins improving to ~6–9% due to logistics optimization and ads scaling.

Competition Benchmark (2025):

- Shopee (SEA leader) – higher marketing burn

- Tokopedia – strong Indonesia presence

- Amazon SG – limited but rising

- TikTok Shop – fastest-growing threat

Read More: What is Lazada and How Does It Work?

Primary Revenue Streams Deep Dive

1. Commissions on Sales (28–35% of revenue)

Lazada charges sellers a commission based on product category, ranging from 1% to 10%. High-margin categories like electronics pay lower commission, while fashion and beauty sit higher. With millions of sellers, this forms Lazada’s foundation revenue layer.

2. Advertising & Sponsored Listings (25–30%)

Lazada’s fastest-growing revenue stream. Sellers bid for:

- Sponsored Products

- Homepage visibility

- Display ads

This auction-based model mirrors Alibaba’s ad engine and is becoming Lazada’s top profit driver.

3. Logistics & Fulfillment (Lazada eLogistics) (20–25%)

Lazada earns from:

- Fulfillment fees

- Storage fees

- Pick-pack fees

- Last-mile delivery margins

- Cross-border logistics (Cainiao integration)

4. Payment Fees (Lazada Wallet, LazPayLater) (10–12%)

Revenue comes from:

- Payment processing

- Credit interest (BNPL)

- Merchant settlement fees

5. Subscription & Value-Added Services (5–8%)

Including:

- LazMall seller subscriptions

- Premium analytics

- Additional storefront services

The Fee Structure Explained

User-Side Fees

- Delivery fees

- LazPayLater interest

- Premium packaging upgrades

- Cross-border import duties

Provider/Seller Fees

- Commission (1–10%)

- Transaction fees

- Advertising spend

- Fulfillment fees

- Storage penalties

Hidden Revenue Layers

- Ad bid inflation

- Priority seller programs

- Logistics arbitrage

- Affiliate commissions

Regional Pricing Variation

Southeast Asia has different willingness-to-pay levels, so Lazada tailors its commission and logistics pricing per country.

Read More: Best Lazada Clone Script 2025 | Build a Multi-Vendor Marketplace

How Lazada Maximizes Revenue Per User

Segmentation

Different user tiers receive curated discounts, BNPL options, and targeted product categories.

Upselling

Lazada pushes:

- LazMall (authenticated brands)

- Premium delivery

- Bundled offers

Cross-selling

Payments, wallet cashbacks, and BNPL repayment incentives drive repeat purchases.

Dynamic Pricing

Based on demand, festival seasons, seller competition, and inventory data.

Retention Monetization

Voucher gamification, personalized recommendations, and app-only rewards.

LTV Optimization

AI-driven lifetime value scoring helps assign high-value user segments more aggressive reactivation strategies.

Real Data Example

Indonesia and Vietnam users show 19–23% higher basket values when LazPayLater is enabled.

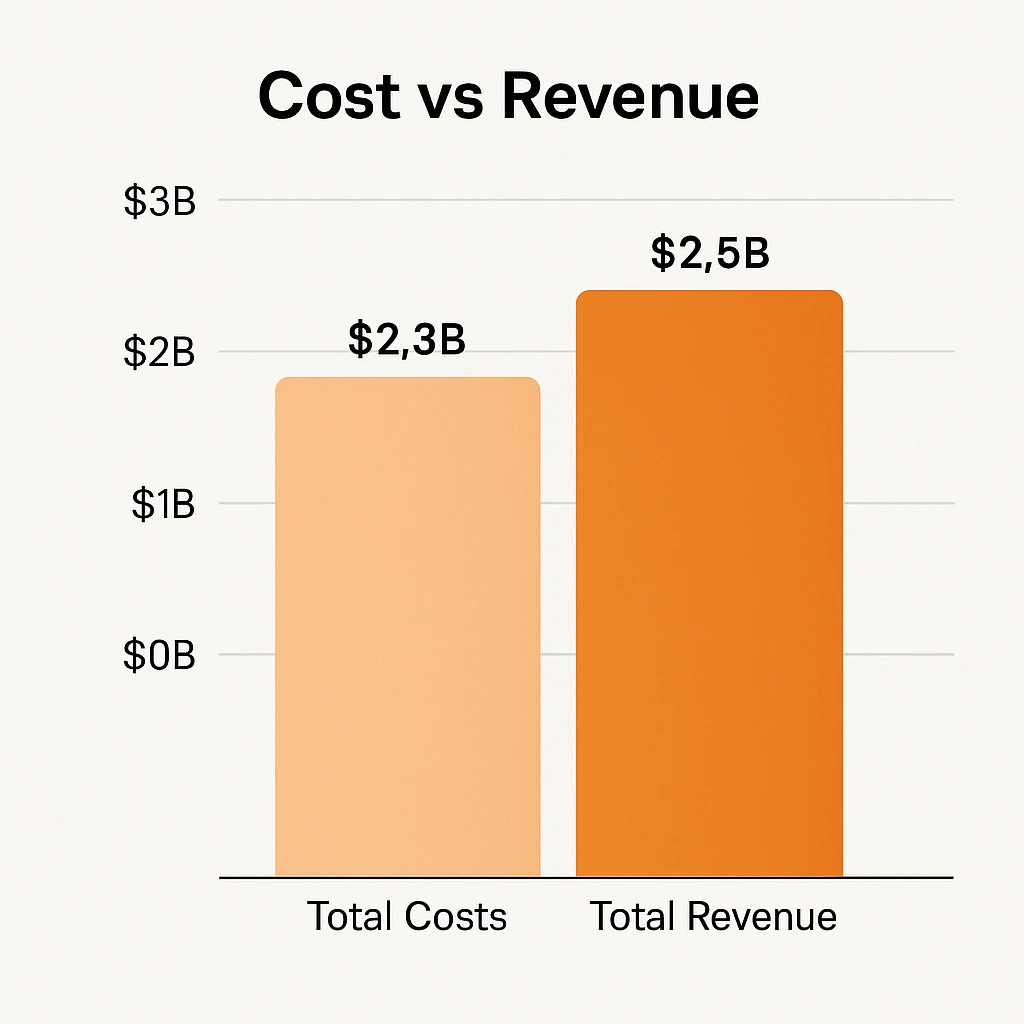

Cost Structure & Profit Margins

Infrastructure Cost

Cloud hosting, distributed warehousing, and real-time recommendation engines.

Customer Acquisition Cost (CAC)

Marketing, influencer partnerships, and seasonal campaigns (11.11, 12.12 sales).

Operations

Logistics workforce, warehouse staff, seller onboarding, customer service.

R&D

AI search algorithms, fraud detection, personalization systems.

Unit Economics

Improved through:

- Higher ad revenue

- Optimized delivery routes

- Seller-funded promo models

Profitability Path

Logistics automation + ad revenue scale is steadily pushing margins upward.

Future Revenue Opportunities & Innovations

New Streams

- Video commerce

- Livestream seller monetization

- Wholesale B2B marketplace expansion

AI/ML-Based Monetization

- Predictive inventory tools

- AI storefronts for sellers

- Intelligent pricing engines

Market Expansions

Greater penetration into rural Indonesia & Philippines.

Predicted Trends (2025–2027)

- BNPL expansion

- Logistics robotics

- Integrated retail media networks

Risks & Threats

- TikTok Shop dominance

- High logistics costs

- Changing SEA regulations

Opportunities for Founders

- Hyper-local marketplaces

- Niche product verticals

- Private-label DTC via marketplace infrastructure

Lessons for Entrepreneurs & Your Opportunity

What Works

- Multi-layer monetization

- Strong logistics backbone

- Aggressive ad-tech ecosystem

What to Replicate

- Dynamic seller fees

- Cross-border product sourcing

- Gamified user retention

Market Gaps

- Hyper-local delivery

- Niche fashion and beauty segments

- Social commerce with AI creators

Improvements Founders Can Use

- Transparent pricing

- Seller-focused toolkits

- Lightweight delivery models

Want to build a platform with Lazada’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Lazada clone scripts come with flexible revenue models you can customize. Some clients even see revenue within 30 days of launchand if you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Lazada’s revenue engine is a perfect blueprint for how modern eCommerce marketplaces scale sustainably in 2025. With diversified revenue streams, strong logistics, and deep ad monetization, the model is both resilient and highly profitable.

For founders, the takeaway is simple—success requires ecosystem thinking, not just a marketplace. Every part of Lazada’s model reinforces another.

If you can replicate even 60% of Lazada’s system with innovation layered on top, your platform can become a powerful revenue generator in your region.

FAQs

1. How much does Lazada make per transaction?

Approximately 1–10% via commissions + additional revenue from transaction fees and logistics.

2. What’s Lazada’s most profitable revenue stream?

Advertising—Lazada’s retail media revenue has the highest margins.

3. How does Lazada’s pricing compare to competitors?

Slightly lower commissions than Shopee but higher logistics fees in some regions.

4. What percentage does Lazada take from providers?

Commissions range from 1–10%, depending on product category and country.

5. How has Lazada’s revenue model evolved?

Shifted from pure commissions to heavy ads monetization and fintech revenue.

6. Can small platforms use similar models?

Yes—commission + ads + fulfillment is a proven structure for marketplaces.

7. What’s the minimum scale for profitability?

Generally after 10,000+ monthly active transactions with efficient logistics.

8. How to implement similar revenue models?

Use layered monetization: commissions, ads, logistics, subscription services.

9. What are alternatives to Lazada’s model?

Subscription-only marketplaces, social commerce models, or zero-commission models.

10. How quickly can similar platforms monetize?

With the right tech stack and marketing, revenue can begin within 30–60 days.