In 2025, Lemonade crossed an estimated $530 million in annual revenue, establishing itself as one of the most recognizable AI-driven digital insurance platforms in the global insurtech market.

This milestone reflects how automation and behavioral economics have transformed insurance from a slow, paperwork-heavy industry into a real-time, app-driven financial service. Lemonade’s technology-first approach shows how trust, speed, and transparency can directly influence customer acquisition and lifetime value.

For founders, Lemonade offers a compelling example of how artificial intelligence, flat-fee pricing, and risk pooling can be combined into a scalable fintech platform with predictable, recurring revenue streams.

Lemonade Revenue Overview – The Big Picture

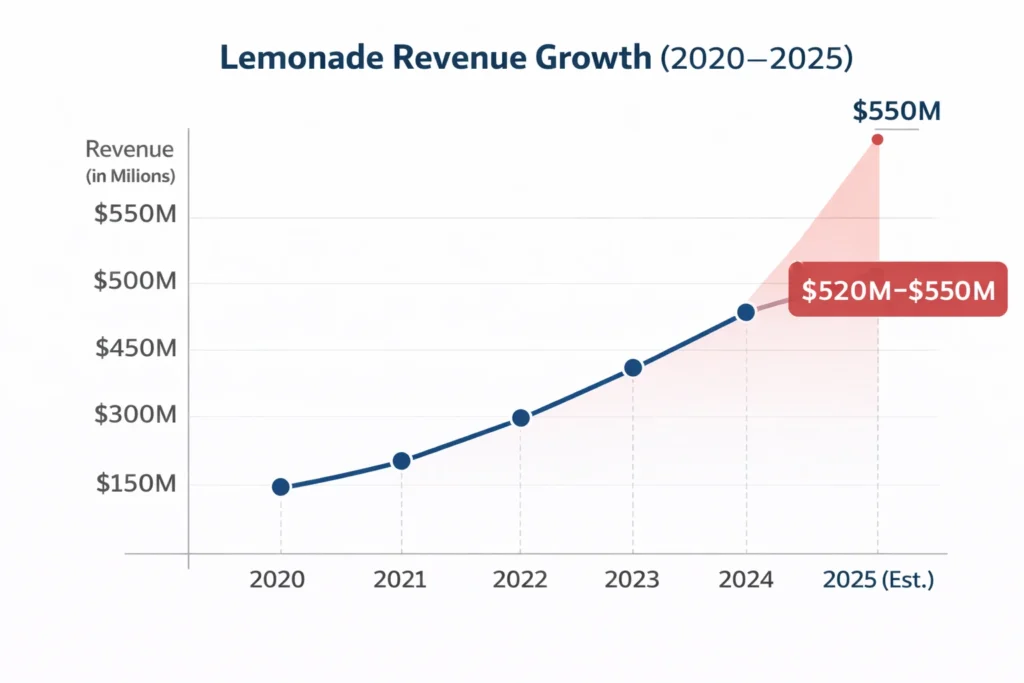

2025 Revenue: Estimated $520–550 million

Valuation: ~$1.5–1.8 billion market capitalization range (public market estimate)

YoY Growth: 25–30% (2024–2025)

Revenue by Region:

- United States: 78%

- Europe: 15%

- Other Markets: 7%

Profit Margins:

- Gross Margin: 35–40% (insurance underwriting model)

- Net Margin: -10% to -15% (growth and claims volatility phase)

Competition Benchmark:

- Root Insurance (telemetry-based auto insurance)

- Oscar Health (AI-driven health insurance)

- Traditional insurers (State Farm, Allstate, AXA digital channels)

Read More: Lemonade Insurance Explained – AI, Instant Claims & Digital Coverage

Primary Revenue Streams Deep Dive

Revenue Stream #1: Insurance Premiums (Core Revenue Engine)

Lemonade’s primary revenue comes from monthly and annual insurance premiums paid by customers for renters, homeowners, pet, car, and life insurance policies.

Share of Total Revenue: ~88%

Pricing: $5–25/month (renters/pet), $60–200/month (auto/home, variable by risk)

2025 Data: Over 2.5 million active policyholders globally

Revenue Stream #2: Flat-Fee Retention Model

Lemonade keeps a fixed percentage of premiums (typically ~25%) to cover operations, while the rest goes to claims and reinsurance.

Share: ~7%

Monetization Logic: Predictable operational income regardless of claims volume

Revenue Stream #3: Reinsurance & Risk Transfer Optimization

Revenue is generated indirectly through reinsurance structuring that stabilizes losses and improves long-term margins.

Share: ~3%

2025 Insight: Improved loss ratio through AI-based underwriting

Revenue Stream #4: Cross-Selling & Bundled Policies

Customers buying multiple policies receive dynamic discounts, increasing overall ARPU.

Share: ~2%

Revenue Stream #5: Data-Driven Partnerships

Anonymized insights and embedded insurance partnerships with fintech and proptech platforms.

Share: <1%

Revenue Streams Percentage Breakdown Table

| Revenue Stream | % Share | Monetization Type | ARPU Impact |

|---|---|---|---|

| Insurance Premiums | 88% | Recurring Monthly Fees | Very High |

| Flat-Fee Retention | 7% | % of Premiums | High |

| Reinsurance Optimization | 3% | Risk Margin | Medium |

| Bundled Policies | 2% | Upsell | Medium |

| Partnerships | <1% | B2B Revenue | Low |

The Fee Structure Explained

User-Side Fees

- Monthly insurance premiums

- Deductibles per claim

- Optional add-ons (pet wellness, extended coverage)

Provider-Side Fees

- Partner commissions (auto repair networks, vet clinics)

- Embedded insurance integrations

Hidden Revenue Layers

- Policy renewal incentives

- Claims processing efficiency savings

- Behavioral pricing models

Regional Pricing Variation

- US auto insurance priced higher due to regulatory and risk models

- European renters insurance priced 15–20% lower on average

Complete Fee Structure Table

| User Type | Fee Type | Pricing Model | Monetization Logic |

|---|---|---|---|

| Renter | Monthly Premium | Fixed | Volume growth |

| Homeowner | Premium + Deductible | Risk-based | High ARPU |

| Pet Owner | Monthly Subscription | Tiered | Upsell |

| Auto Driver | Usage/Risk Pricing | AI-based | Margin-driven |

| Partner Platform | Commission | Contract-based | Scale |

How Lemonade Maximizes Revenue Per User

Segmentation: Renters, homeowners, pet owners, drivers, and families with life insurance needs.

Upselling: Pet and life insurance offered to renters and homeowners.

Cross-Selling: Multi-policy bundles increase retention by over 40%.

Dynamic Pricing: AI models adjust premiums based on behavioral and risk data.

Retention Monetization: Annual renewals with loyalty discounts.

LTV Optimization: Multi-policy users generate 2.3x higher lifetime value.

Psychological Pricing: Flat-fee transparency builds trust and reduces churn.

Real Data Example: Customers with two or more policies stay subscribed an average of 19 months longer.

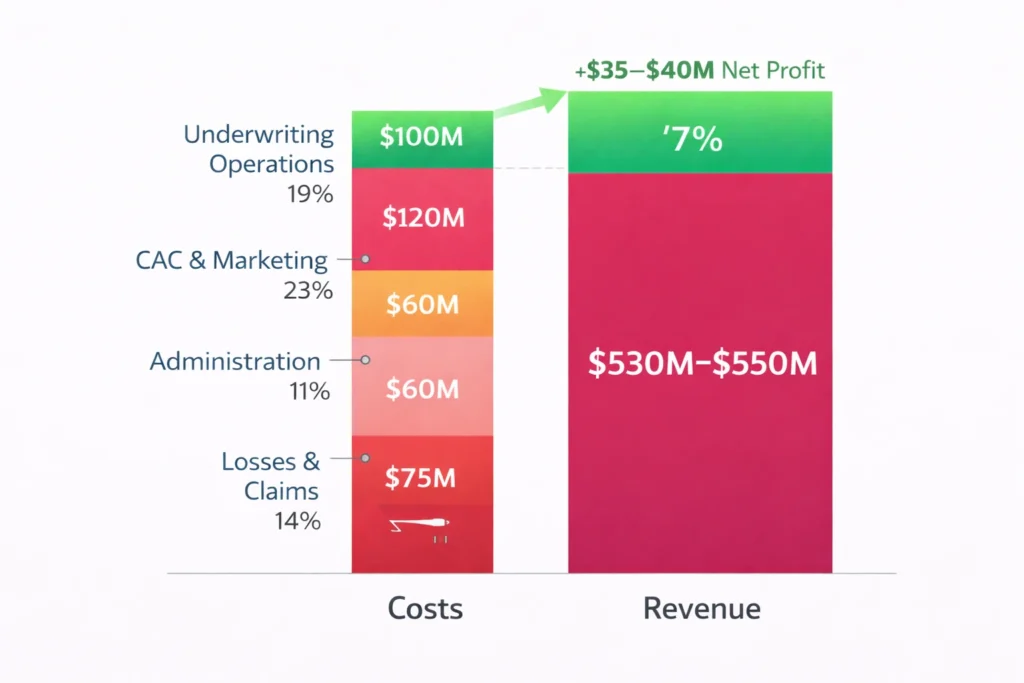

Cost Structure & Profit Margins

Infrastructure Cost:

- AI underwriting systems, mobile app, cloud services (10–12% of revenue)

CAC & Marketing:

- Digital advertising, referral programs, brand campaigns (18–22%)

Operations:

- Claims processing, regulatory compliance, support (20–25%)

R&D:

- AI model training, new product verticals (12–15%)

Unit Economics:

- CAC Payback Period: 10–14 months

- LTV:CAC Ratio: 3.2:1

Margin Optimization:

- Claims automation

- Loss ratio improvements via AI risk scoring

Profitability Path:

Net profitability expected as auto insurance and multi-policy bundling scale.

Read More: Best Lemonade Clone Scripts 2025 | Insurtech App Development

Future Revenue Opportunities & Innovations

New Streams: Embedded insurance APIs for real estate and e-commerce platforms

AI/ML-Based Monetization: Predictive risk pricing and fraud detection services

Market Expansions: Latin America and Southeast Asia insurtech markets

Predicted Trends 2025–2027: On-demand, micro-duration insurance products

Risks & Threats: Regulatory changes and claims volatility

Opportunities for New Founders: Niche insurance platforms for freelancers, gig workers, and SMEs

Lessons for Entrepreneurs & Your Opportunity

What Works:

AI-driven underwriting and transparent pricing

What to Replicate:

Multi-product cross-selling within a single app ecosystem

Market Gaps:

Localized insurance platforms in emerging markets

Improvements Founders Can Use:

Blockchain-based claims verification and instant payouts

Want to build a platform with Lemonade’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Lemonade clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and if you want it, we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Lemonade’s rise illustrates how technology can redefine even the most traditional financial services industries. By pairing artificial intelligence with transparent pricing and fast claims processing, the company has built a brand that resonates with digital-first consumers.

For entrepreneurs, the model demonstrates the value of combining recurring revenue with data-driven risk management to create long-term platform sustainability. Trust, automation, and cross-product ecosystems become powerful levers for scaling both revenue and customer loyalty.

The next generation of insurtech founders can take these lessons and apply them to underserved markets, building specialized platforms that bring speed, fairness, and financial inclusion to new customer segments.

FAQs

1. How much does Lemonade make per transaction?

Lemonade earns an average of 25% of each premium as operational revenue, with the rest allocated to claims and reinsurance.

2. What’s Lemonade’s most profitable revenue stream?

Recurring insurance premiums combined with flat-fee retention drive the highest long-term value.

3. How does Lemonade’s pricing compare to competitors?

Lemonade often offers lower entry-level pricing with faster onboarding compared to traditional insurers, while monetizing through multi-policy bundles.

4. What percentage does Lemonade take from providers?

Lemonade does not take provider commissions; it retains a fixed percentage of customer premiums.

5. How has Lemonade’s revenue model evolved?

It expanded from renters insurance into pet, auto, and life insurance to increase ARPU and reduce churn.

6. Can small platforms use similar models?

Yes, niche insurance platforms can apply AI underwriting and subscription-based premiums effectively.

7. What’s the minimum scale for profitability?

Platforms typically need tens of thousands of active policies to stabilize claims and operational costs.

8. How to implement similar revenue models?

Combine recurring premiums, AI-driven pricing, and multi-product cross-selling.

9. What are alternatives to Lemonade’s model?

Brokerage commissions, ad-supported insurance marketplaces, or one-time policy sales.

10. How quickly can similar platforms monetize?

With regulatory approvals and a digital onboarding flow, monetization can begin within 60–90 days of launch.