With an estimated $50–$55 million in annual revenue in 2025, Leonardo AI has rapidly risen from a niche startup into a globally recognized generative AI content platform powering millions of digital creators worldwide. Its growth is fueled by a powerful combination of freemium onboarding, creator-centric design tools, and a scalable cloud infrastructure that allows artists, developers, and agencies to produce high-quality visual assets at speed and at scale. By embedding monetization directly into the creative workflow, Leonardo AI has transformed AI generation from a utility into a repeatable, revenue-generating ecosystem.

For entrepreneurs, understanding Leonardo AI’s marketplace-driven monetization strategy offers a blueprint for building scalable AI services and creative marketplaces that balance user value with platform profitability. The platform demonstrates how combining subscription tiers, usage-based credits, and creator-to-creator transactions can unlock multiple revenue layers from a single user base. More importantly, it highlights how community growth, asset liquidity, and trust systems can turn a product into a self-reinforcing marketplace where both creators and platform operators benefit from long-term network effects.

Leonardo AI Revenue Overview – The Big Picture

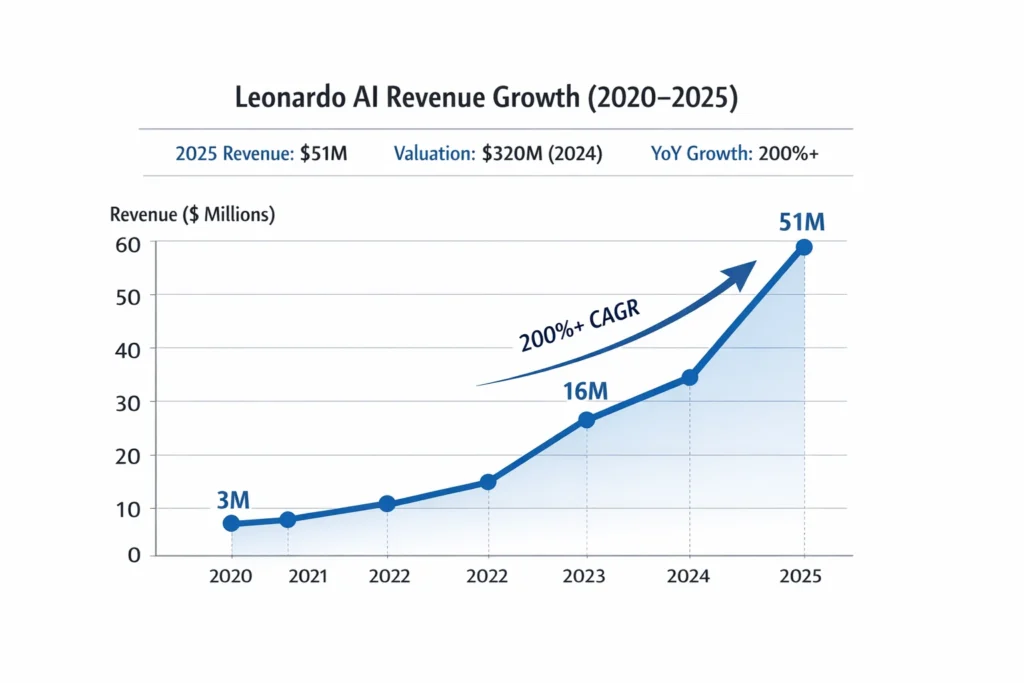

In 2025, Leonardo AI’s estimated annual revenue is around $51.1 million, driven by subscription sales and premium usage features that unlock creative assets and marketplace transactions.

Valuation: After acquisition by Canva in 2024 for an estimated $320 million, Leonardo AI now operates within a larger creative ecosystem, increasing strategic value but creating op-co integration complexity.

Year-over-Year Growth: From roughly $16 million in 2024 revenue to over $50 million in 2025, YoY growth exceeds 200 percent as demand for generative content exploded.

Revenue by Region: North America and Europe dominate revenue share through paid subscriptions and enterprise marketplace licensing, while APAC shows accelerating adoption among digital creators.

Profit Margins: While exact margins aren’t public, high gross margins are typical for SaaS/AI platforms once GPU and cloud costs scale efficiently.

Competition Benchmark: Leonardo AI competes with Midjourney, Runway, and Adobe generative tools — with its marketplace model distinguishing Leonardo by enabling community monetization and custom asset exchange.

Read More: What Is Leonardo AI? A Simple Guide to Advanced AI Art

Primary Revenue Streams Deep Dive

Revenue Stream #1: Subscription Plans

Leonardo AI operates a tiered subscription model — from free users to pro creators and enterprise teams. Paid plans unlock higher generation limits, faster throughput, and advanced styles.

2025 share: ~40%

Revenue Stream #2: Marketplace Commissions

In a marketplace scenario, Leonardo AI takes a percentage of transactions when creators sell assets (images, templates, 3D assets, presets) to other users. Estimated share: ~25%

Revenue Stream #3: Credit/Token Sales

Users buy credits/usage tokens for high-volume generation or video renderings — a direct usage monetization layer. Estimated share: ~20%

Revenue Stream #4: API / Integration Fees

Paid API access enables developers and agencies to integrate Leonardo’s generative features into their apps or pipelines. Estimated share: ~10%

Revenue Stream #5: Enterprise Licensing

Studio and corporate teams pay premium fees for secure workspace features, on-brand model training, and enhanced SLA support. Estimated share: ~5%

Table: Revenue Streams Percentage Breakdown

| Revenue Stream | Estimated % Share |

|---|---|

| Subscriptions | 40% |

| Marketplace Commissions | 25% |

| Token/Credit Sales | 20% |

| API Access & Integrations | 10% |

| Enterprise Licensing | 5% |

The Fee Structure Explained

User-Side Fees

Users pay monthly or annual fees for premium plans. Higher tiers offer increased quotas and creative controls.

Provider-Side Fees

In the marketplace, creators who sell digital assets pay a commission (e.g., 15 – 30 percent) on each sale.

Hidden Revenue Layers

Token top-ups, priority compute queues, and accelerator packs create indirect revenue beyond upfront plans.

Regional Pricing Variation

Pricing varies by region to match purchasing power — e.g., lower rate plans in APAC vs. premium pricing in North America and Europe.

Complete Fee Structure by User Type

| User Type | Subscription Fee | Marketplace Commission | Token Cost |

|---|---|---|---|

| Individual Creator | $15/month+ | 25% | Varies |

| Professional Artist | $49/month+ | 20% | Varies |

| Business Team | $199/month+ | 15% | Bulk Packs |

| API Developer | Usage-based | N/A | Included |

How Leonardo AI Maximizes Revenue Per User

Segmentation: Offers distinct tiers for hobbyists, professionals, and enterprises.

Upselling: Users start free, upgrade to paid when limits constrain creative output.

Cross-selling: AI tools for images, videos, 3D assets and marketplace asset packs.

Dynamic Pricing: Seasonal promotions and token bundles adjust willingness to pay.

Retention Monetization: Monthly credits encourage ongoing subscriptions rather than one-off purchases.

LTV Optimization: Long-term licenses and add-ons increase lifetime revenue.

Real Data Examples: A top creator selling marketplace assets can earn significant revenue, with Leonardo AI commissions stacking with subscription income.

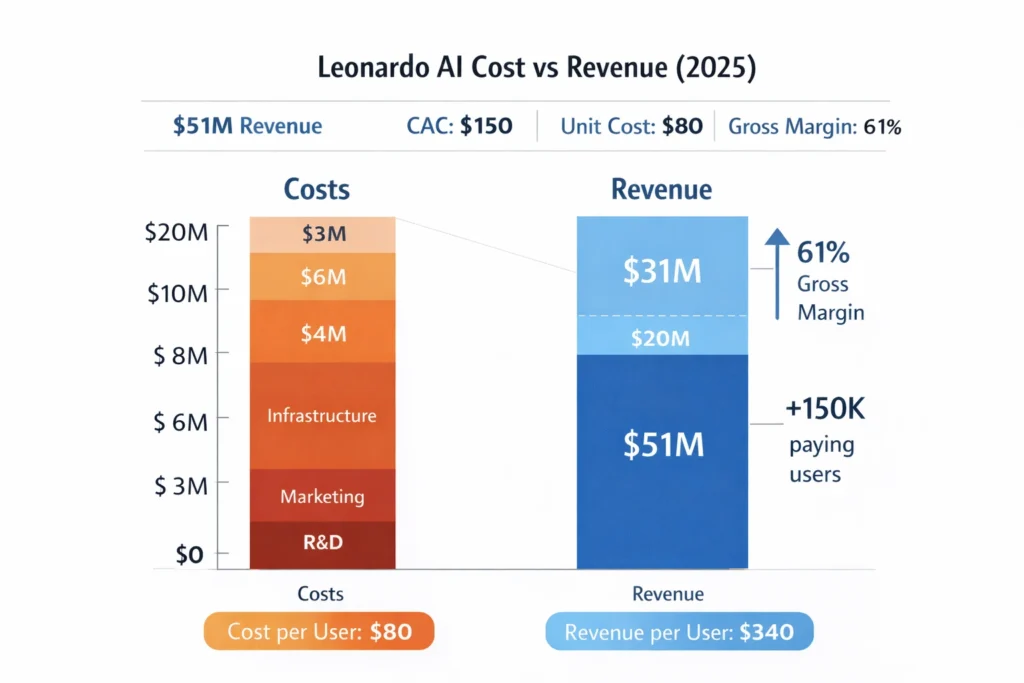

Cost Structure & Profit Margins

Infrastructure Cost: GPU cloud compute is a major operating expense.

CAC & Marketing: VR samples, tutorials, and influencer campaigns drive acquisition.

Operations: Support, moderation, and model updates form recurring overhead.

R&D: Heavy investment in model improvement and feature expansion.

Unit Economics: Once a user is paying, incremental profit margin rises as compute cost per user decreases with scale.

Margin Optimization: Optimizing GPU batch sizes, caching, and artifact reuse improves margins.

Profitability Path: As adoption scales, subscription and marketplace revenue can outpace scaling costs.

Future Revenue Opportunities & Innovations

New Streams: AI plug-ins, mobile apps, and design templates marketplaces.

AI/ML-Based Monetization: Personalized creative suggestions, neural style packs sold on demand.

Market Expansion: Localization for emerging creative markets.

Predicted Trends 2025–2027: AI content creation demand to grow double-digit annually.

Risks & Threats: AI regulation, content misuse, compute cost inflation.

Opportunities for New Founders: Build niche marketplaces (e.g., game asset exchanges) leveraging Leonardo-style backend.

Lessons for Entrepreneurs & Your Opportunity

What Works: Freemium hook, diverse revenue streams, scalable cloud infrastructure.

What to Replicate: Credit systems, marketplace commissions, enterprise tiers.

Market Gaps: Specialized vertical marketplaces — e.g., architectural textures, NFT art packs.

Improvements Founders Can Use: On-chain asset rights, creator royalties, enhanced discovery algorithms.

Want to build a platform with Leonardo AI’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Leonardo AI clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, if you want it, Miracuves can arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Leonardo AI’s marketplace model demonstrates how AI platforms can combine subscription SaaS with creator economies to unlock scalable revenue streams. By understanding its diversified monetization stack — from credits and subscriptions to marketplace commissions — founders can craft competitive platforms that reward both users and creators.

As the generative AI market expands, platforms modeled after Leonardo AI’s strategy can capture niche segments and drive new revenue opportunities.

For entrepreneurs, the key is balancing user value with sustainable monetization, ensuring experiences remain engaging while building recurring revenue.

FAQs

1. How much does Leonardo AI make per transaction?

Marketplace commission typically ranges from 15 % to 30 % per asset sale.

2. What’s Leonardo AI’s most profitable revenue stream?

Subscriptions remain the largest revenue driver, followed by marketplace commissions.

3. How does Leonardo AI’s pricing compare to competitors?

Pricing is competitive with Midjourney and Runway, with a stronger focus on marketplace earnings.

4. What percentage does Leonardo AI take from providers?

Around 20 % on average, varying by tier and asset type.

5. How has Leonardo AI’s revenue model evolved?

From pure freemium model into diversified marketplace and enterprise monetization.

6. Can small platforms use similar models?

Yes — credit systems and tiered subscriptions are scalable for startups.

7. What’s the minimum scale for profitability?

Typically several thousand paying users with moderate content churn.

8. How to implement similar revenue models?

Use credit-based monetization, tiered plans, and marketplace infrastructure.

9. What are alternatives to Leonardo AI’s model?

Pure API-only models or flat-fee enterprise licensing.

10. How quickly can similar platforms monetize?

Many platforms see revenue within the first 30 to 60 days with effective pricing and marketing.