So, picture this: you’re a bootstrapped founder in 2012. Bitcoin is this underground digital whisper, and there’s no easy way to buy or sell it without navigating sketchy forums and trusting usernames with pixelated avatars. Enter LocalBitcoins—the rebel disruptor that brought P2P Bitcoin trading to the masses. No banks, no middlemen. Just you, the buyer/seller, and a world of decentralized possibility.

Fast-forward to today, and while LocalBitcoins shut its doors in 2023, its legacy still inspires P2P crypto startups worldwide. If you’re a builder dreaming about launching your own crypto marketplace app or looking to clone a proven model, understanding what made LocalBitcoins tick is like getting your hands on the secret recipe. Think escrow magic, chat systems, multi-layer security—and yes, that startup grit that refused to quit.

Let’s deep dive into the features that made LocalBitcoins a legend, why they mattered to users, and how you can recreate (or improve on) them. And if you’re itching to build your own LocalBitcoins-style platform? Spoiler alert: Miracuves has your back.

Read more: What is a LocalBitcoins App and How Does It Work?

Key Features of LocalBitcoins

1. User-to-User Trading Marketplace

At its core, LocalBitcoins was a decentralized marketplace where users could trade Bitcoin directly with each other. No centralized order books. Just humans dealing with other humans. This made it uniquely flexible, personal, and resistant to geographical and financial barriers.

What made it work:

- Buyers could browse seller listings based on payment method, price, and user reputation.

- Sellers could create offers with custom rules, pricing models, and limits.

Why it matters:

Startups targeting emerging markets love this model because it removes the dependency on banking infrastructure. It’s crypto for the people, not for the institutions.

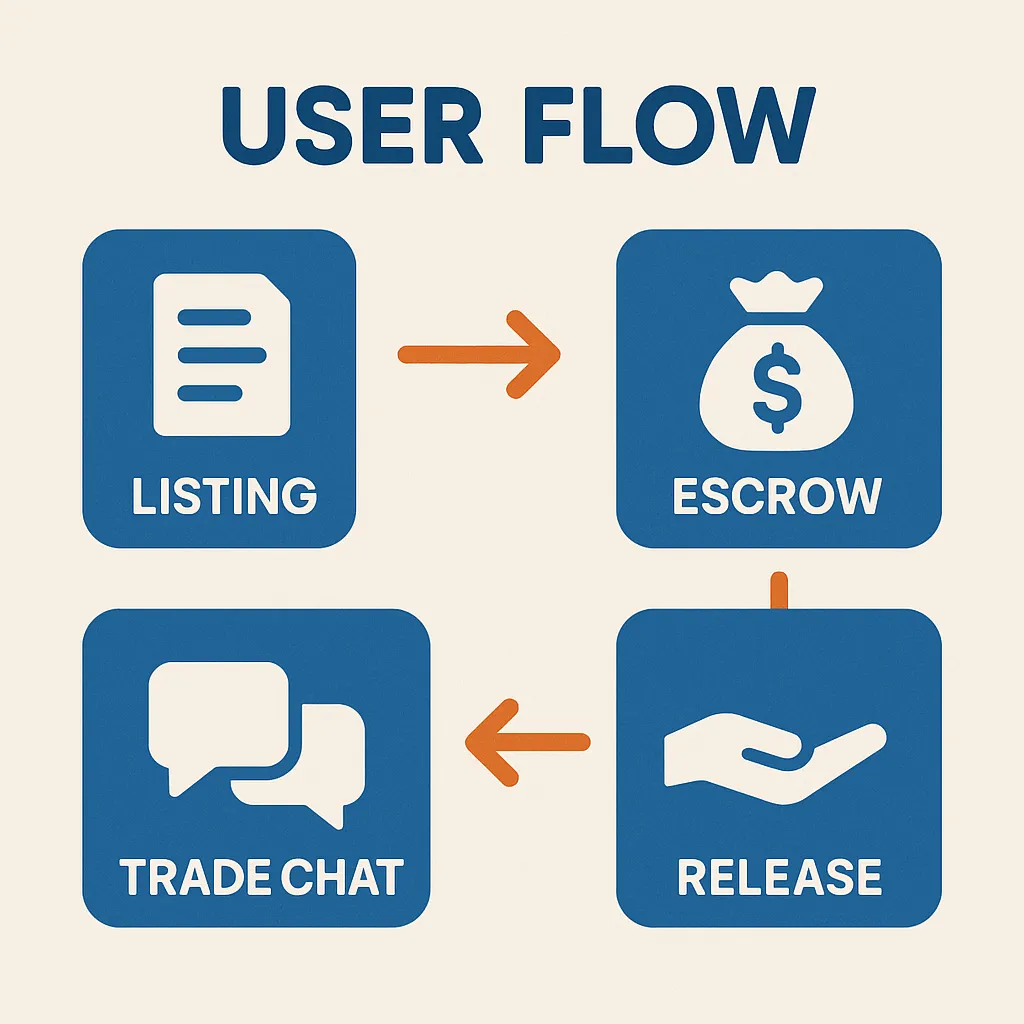

2. Escrow Protection for Secure Trades

Probably the crown jewel of LocalBitcoins. When a buyer initiated a trade, the seller’s Bitcoin was locked in an automated escrow wallet. Only once the seller confirmed receipt of payment would the Bitcoin be released.

Why it’s a game-changer:

- It solved the trust problem without needing intermediaries.

- Reduced scam rates significantly in P2P environments.

Pro tip:

If you’re cloning this model, your escrow logic has to be airtight. Think smart contracts, automated release triggers, and dispute workflows.

3. Inbuilt Trade Chat System

LocalBitcoins featured an internal messaging system that allowed buyers and sellers to chat in real-time after a trade was initiated. Sounds simple? It was a lifesaver.

Key reasons it worked:

- Kept all communications centralized and documented.

- Helped resolve disputes faster since moderators had chat logs.

- Prevented off-platform conversations (and potential scams).

Startups take note:

Integrating secure, encrypted in-app chat is essential in any marketplace dealing with money, whether it’s crypto or catsitting.

4. Reputation & Feedback Mechanism

You’d think this is obvious, but in the early days of crypto? Reputation systems were rare.

LocalBitcoins nailed it by:

- Assigning trust scores to users based on trade history.

- Displaying the number of completed trades, trade volume, and positive/negative reviews.

- Allowing custom notes like “This user is fast” or “Delayed once.”

Why it builds trust:

New users could spot reliable traders in seconds, reducing onboarding anxiety—a major bottleneck in high-risk fintech apps.

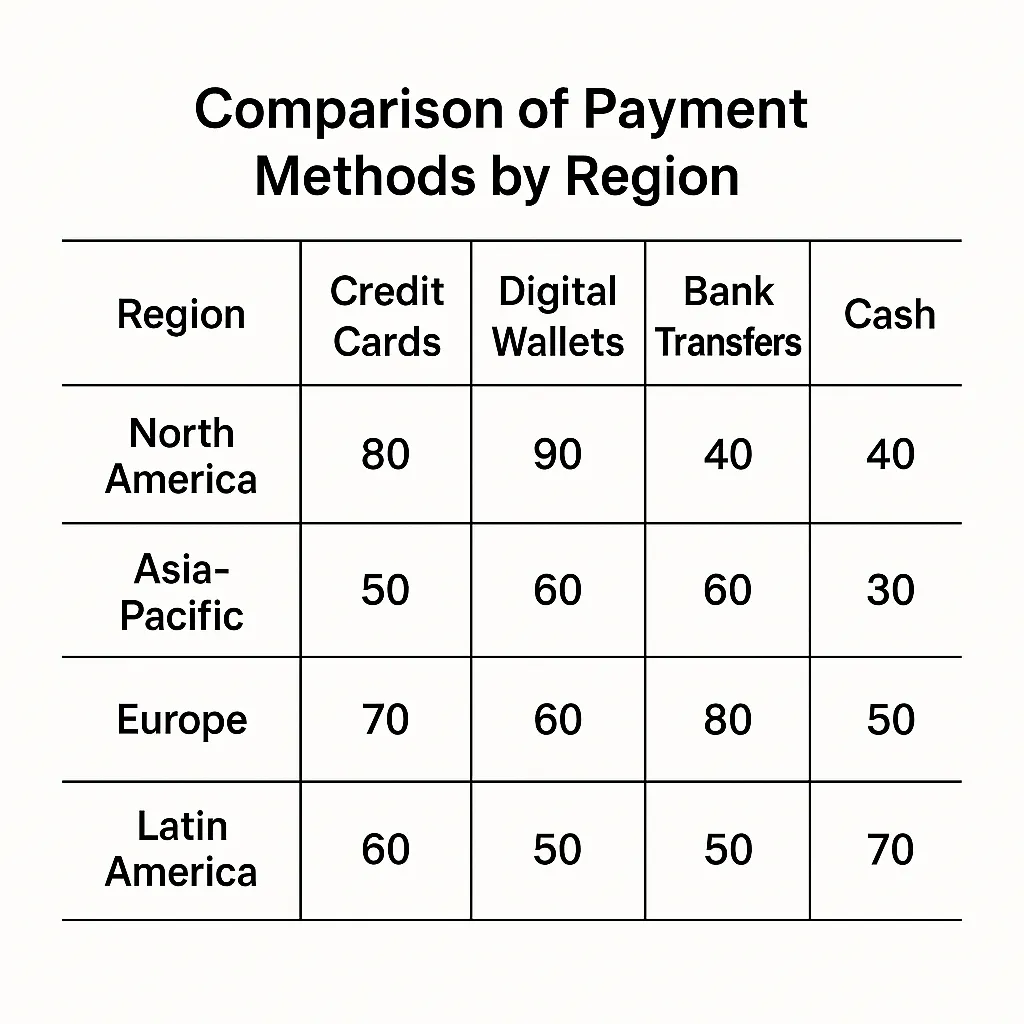

5. Multi-Currency & Multi-Payment Method Support

LocalBitcoins supported virtually every fiat currency and payment method under the sun. From PayPal to bank transfers, gift cards to cash-in-person—it didn’t matter where you lived or what you used.

This feature was huge for:

- Increasing liquidity and trade volume.

- Penetrating underserved, unbanked, or financially restricted regions.

6. Two-Factor Authentication (2FA) & KYC Verification

Let’s be real. Crypto’s wild west reputation needed some taming.

LocalBitcoins added:

- 2FA for logins and withdrawals.

- Tiered KYC verification for larger trades.

- Optional ID upload and phone/email verification.

Why it mattered:

As regulations tightened globally, having a flexible compliance framework allowed LocalBitcoins to stay ahead while retaining user trust.

7. Dispute Resolution & Moderation System

Even with escrow and chat, disputes happen. LocalBitcoins had a full-time moderation team that could:

- Intervene when trades went sideways.

- Access chat history and transaction logs.

- Manually release escrow based on evidence.

Feature breakdown:

- Dispute buttons became clickable after a certain timeout.

- Resolution times averaged under 24 hours in most cases.

- Moderators acted like decentralized judges.

Lesson for builders:

Human-in-the-loop dispute workflows still outperform AI in high-stakes financial apps.

8. Mobile Optimization & Light Apps

Even before everyone was screaming “mobile-first,” LocalBitcoins quietly optimized their web interface for smartphones and low-bandwidth areas.

Why it mattered:

- Africa, Asia, and Latin America were mobile-only for many users.

- Minimalist UI meant fast loading, even on 3G.

Today’s equivalent?

Progressive Web Apps (PWA) + React Native builds + offline fallback caching.

9. APIs for Power Users

While not everyone knew this, LocalBitcoins offered RESTful APIs for power users and vendors to:

- Automate offer posting

- Track trades

- Manage wallets

Read more: Cost vs Features: Striking the Right Balance in P2P Crypto App Development

Final Thoughts

LocalBitcoins didn’t just build features—they built freedom tech for millions. Whether you want to recreate its magic or upgrade it for 2025’s Web3 world, the formula is clear: trust, speed, simplicity, and control in the user’s hands.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q:1 What is LocalBitcoins used for?

It was a peer-to-peer crypto marketplace where users could buy and sell Bitcoin using hundreds of payment methods—directly and securely.

Q:2 How did LocalBitcoins’ escrow system work?

When a trade started, the seller’s BTC was held in escrow until they confirmed payment receipt. It protected both parties from scams.

Q:3 Was LocalBitcoins safe to use?

Yes, with 2FA, in-platform messaging, a reputation system, and dispute resolution, it was one of the safest P2P trading platforms.

Q:4 Did LocalBitcoins require KYC?

Yes, especially for higher-volume trades. Users had to verify their identity with ID and phone number based on the trade tier.

Q:5 What payment methods did it support?

Almost all: bank transfers, PayPal, cash in person, gift cards, mobile wallets—you name it. That’s what made it globally popular.

Q:6 Is there an alternative to LocalBitcoins now?

Yes, platforms like Paxful and HodlHodl offer similar services. Or, you can build your own version tailored to your market with Miracuves.

Related Articles:

- How Much Does It Cost to Build a Peer-to-Peer Cryptocurrency Marketplace in 2025

- Best BSCPad Clone Scripts in 2025: Features & Pricing Compared

- Paxful Features List: The Power Tools Behind a Peer-to-Peer Crypto Empire

- Best Ramitano Clone Scripts in 2025: Features & Pricing Compared

- The Future of P2P Crypto Exchange Apps: Trends to Watch in 2025 and Beyond