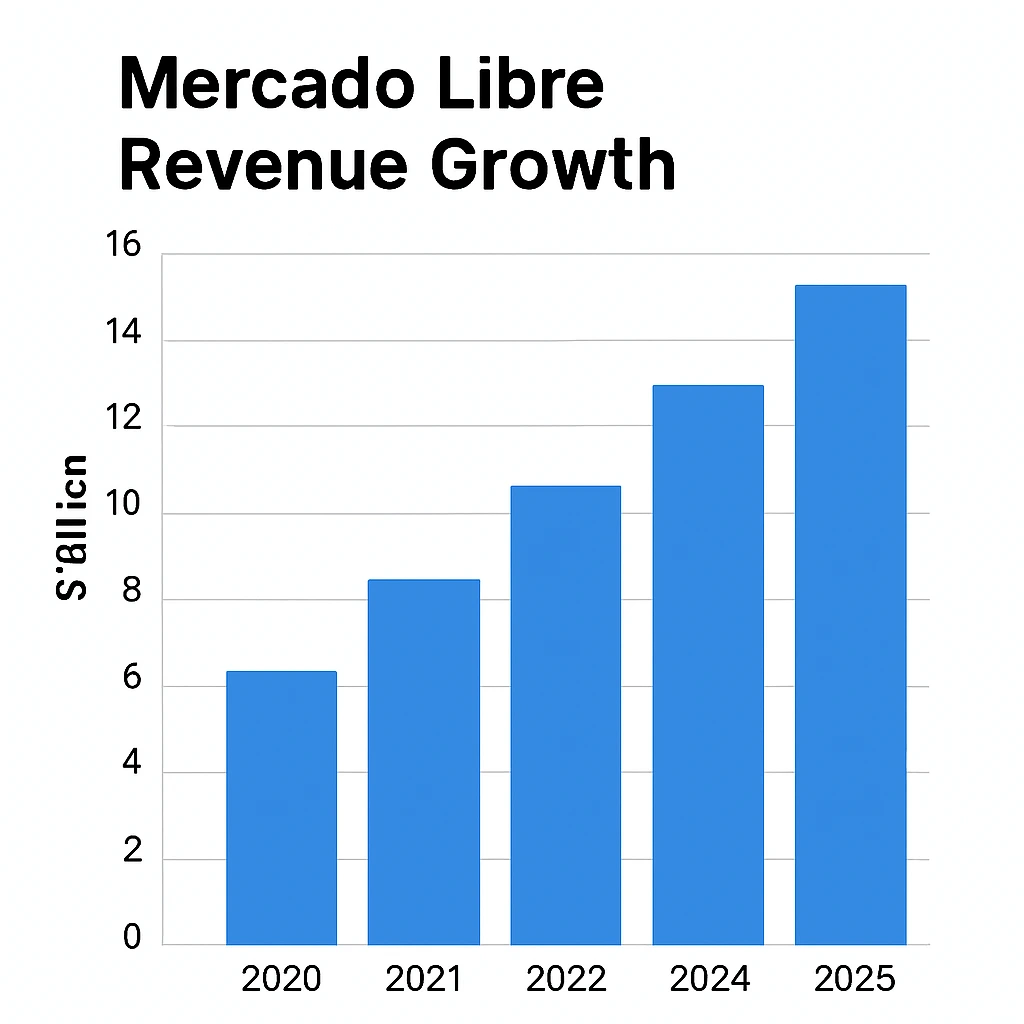

Mercado Libre has become the undisputed e-commerce and fintech powerhouse of Latin America, crossing $15.1 billion in revenue in 2025 and expanding faster than most global platforms. What began as a simple online marketplace now functions as the region’s equivalent of Amazon + PayPal + Shopify + FedEx + Ads all bundled into one ecosystem.

For founders, understanding Mercado Libre’s revenue architecture is a masterclass in multi-stream monetization and ecosystem design.

If you’re planning to build a marketplace or fintech-led commerce platform, this breakdown gives you the exact financial blueprint Mercado Libre uses to dominate LATAM.

Mercado Libre Revenue Overview – The Big Picture

2025 Revenue: ~$15.1B (Marketplace + Fintech + Logistics + Ads)

Valuation: ~$90B market cap (2025 Q3 estimates)

YoY Growth: 2024–2025 revenue growth ~33%

Revenue by Region:

- Brazil – 55%

- Argentina – 25%

- Mexico – 15%

- Rest of LATAM – 5%

Profit Margins:

- Operating margin: ~12–14%

- Net margin: ~7–9%

Competition Benchmark:

- Amazon LATAM trails Mercado Libre in GMV

- Shopee competes heavily in Mexico but lacks MELI’s fintech strength

- Rappi competes in delivery but not in marketplace scale

Read More: What is Mercado Libre and How Does It Work?

Primary Revenue Streams Deep Dive

1. Marketplace Transaction Fees (38%)

Mercado Libre earns a percentage of every sale depending on category, seller type, and country.

- Typical commission: 11%–18%

- Higher-priced items incur fixed fees

- 2025 marketplace GMV surpassed $40B

This is MELI’s foundational revenue engine.

2. Mercado Pago (Fintech) – Payment Processing, Wallets & Credit (32%)

The fastest-growing revenue unit.

Includes:

- Merchant payment processing fees

- Consumer financing

- Credit interest

- Wallet transactions

- QR payments

Fintech revenue exceeded $5B in 2025 alone.

3. Mercado Envíos (Logistics & Fulfillment) – (14%)

Revenue from:

- Fulfillment fees

- Shipping charges

- Last-mile delivery

- Storage

Mercado Envíos handled 1.2B+ packages in 2025.

4. Advertising – Sponsored Listings & Display Ads (10%)

Sellers pay to rank higher in search or run display ads.

Ad revenue has grown over 50% YoY.

5. Subscriptions & SaaS for Sellers (6%)

Includes:

- Store subscriptions

- B2B APIs

- Inventory tools

- Loyalty programs

Revenue streams percentage breakdown

| Revenue Stream | % Contribution (2025) |

|---|---|

| Marketplace Fees | 38% |

| Fintech (Mercado Pago) | 32% |

| Logistics (Mercado Envíos) | 14% |

| Advertising | 10% |

| Subscriptions/SaaS | 6% |

The Fee Structure Explained

User-Side Fees

- Buyers pay shipping (unless eligible for free tiers)

- Interest on credit installments

- Wallet transaction fees in some regions

Provider/Seller Fees

- 11%–18% commission per sale

- Fixed closing fee per item

- Fulfillment fees

- Ad fees for visibility

- Subscription fees for storefronts

Hidden Revenue Layers

- Float income from Mercado Pago balances

- Lending & credit interest

- Currency exchange spreads

Regional Pricing Variation

Brazil has the highest commission brackets; Mexico slightly lower; Argentina varies based on inflation-adjusted structures.

Complete fee structure by user type

| Fee Type | Buyer | Seller |

|---|---|---|

| Commission | No | 11–18% |

| Shipping | Yes | Depending on program |

| Installment/Credit | Yes | Sometimes |

| Ads | No | Yes |

| Subscription | Optional | Yes |

| FX Fees | Yes | Sometimes |

SECTION 5: How Mercado Libre Maximizes Revenue Per User

Segmentation: Different pricing tiers for casual sellers vs professional stores.

Upselling: Promoting premium visibility and paid ads.

Cross-selling:

- Marketplace → Fintech

- Fintech → Logistics

- Logistics → Marketplace loyalty

Dynamic Pricing: Data-backed commission and ad bidding adjustments.

Retention Monetization:

- Loyalty programs

- Faster delivery through Mercado Envíos Flex

- Wallet cashback

LTV Optimization:

- High usage of Mercado Pago boosts ecosystem lock-in

- Credit issuance increases per-user monetization

Psychological Pricing:

- Installment payments reduce perceived cost

- Ad bids work on competitive psychology

Real Data Example (2025):

Average revenue per active user (ARPU) exceeded $72/year, up 26% YoY.

Cost Structure & Profit Margins

Infrastructure

Servers, payment infrastructure, and fulfillment centers.

CAC & Marketing

Customer acquisition lower than global competitors due to organic dominance.

Operational Costs

Logistics, call centers, seller support, returns cycle.

R&D Cost

AI-based fraud detection, recommendation engines, credit scoring.

Unit Economics

- Take rate rose to 17% in 2025

- Contribution margin strong in Brazil and Mexico

Path to Profitability

Fintech + ads are the highest-margin units pushing company profitability upward.

Read More: Best Mercado Libre Clone Script 2025 | A Scalable Marketplace

Future Revenue Opportunities & Innovations

New Streams:

- AI-powered seller tools

- Embedded finance

- BNPL expansion across LATAM

- High-margin subscription loyalty tiers

AI/ML Monetization:

- Fraud scoring

- Inventory prediction

- Personalized ad bidding

Market Expansions:

- Mexico logistics strengthening

- Cross-border commerce from the U.S.

Predicted Trends 2025–2027:

- 25–30% annual fintech growth

- Increase in ARPU from ads and credit

Risks:

- Regional inflation

- Logistics costs

- Competitive pressure from Amazon & Shopee

Opportunities for Founders:

- LATAM-focused fintech + marketplace ecosystems

- Hyperlocal logistics + SME commerce platforms

Lessons for Entrepreneurs & Your Opportunity

What Works in Mercado Libre’s Model:

- Multi-stream monetization

- Deep seller ecosystem

- Fintech + commerce synergy

- Strong logistics backbone

What Founders Can Replicate:

- Integrating payments with marketplace

- Ads as a high-margin booster

- Loyalty and installment-based growth

Market Gaps to Leverage:

- Niche vertical marketplaces

- Specialized logistics networks

- Credit products for SMEs

Want to build a platform with Mercado Libre’s proven revenue model?Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Mercado Libre clone scripts come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch. If you want it we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Mercado Libre’s rise is no accident — it is the natural result of building an ecosystem where every user action flows into revenue. Its strength lies in connecting marketplace, fintech, ads, and logistics into a seamless engine.

For founders, this model proves that diversification is the real advantage in modern commerce. You don’t need millions of users to start; you need the right revenue levers.

If you’re inspired to build a LATAM-style commerce ecosystem or a similar multi-stream platform, now is the perfect time to launch. Miracuves gives you the infrastructure to make it possible.

FAQs

1. How much does Mercado Libre make per transaction?

Typically 11–18% of the item cost, plus fixed fees.

2. What’s Mercado Libre’s most profitable revenue stream?

Fintech (Mercado Pago) and advertising.

3. How does Mercado Libre’s pricing compare to competitors?

Higher than Shopee, similar to Amazon in premium categories.

4. What percentage does Mercado Libre take from sellers?

11–18% depending on category and region.

5. How has Mercado Libre’s revenue model evolved?

Shift from pure marketplace to fintech, logistics, and ads ecosystem.

6. Can small platforms use similar models?

Yes — marketplace + payments + ads is highly adaptable.

7. What’s the minimum scale for profitability?

Typically 8–12k monthly transactions with balanced CAC.

8. How to implement similar revenue models?

Start with marketplace → add payments → add ads → add credit.

9. What are alternatives to Mercado Libre’s model?

Subscription-led, commission-free + ads, vertical-focused marketplaces.

10. How quickly can similar platforms monetize?

With strong seller onboarding, revenue can start within 30–60 days.