Let’s be real—jumping into the crypto exchange business in 2026 isn’t just a moonshot anymore. It’s a well-calculated play, especially with platforms like MEXC proving there’s still space for innovative players beyond Binance and Coinbase. But if you’re looking to build a trading platform with high liquidity, tight security, and multi-asset support, you don’t need to start from zero. That’s where MEXC clone scripts come in.

I’ve seen founders drown in regulatory paperwork, hire expensive blockchain teams, and spend a year coding only to realize their product is already outdated. But the smart ones? They launch fast with clone scripts that come fully loaded—then focus on growth and compliance.

At Miracuves, we empower crypto visionaries with ready-to-deploy MEXC clones that are secure, scalable, and built for serious trading volume. If you’re ready to enter the crypto ring, this blog will help you pick the right clone script that won’t leave your wallet or your users hanging.

What is a MEXC Clone Script?

A MEXC clone script is a pre-developed cryptocurrency exchange software inspired by the features and interface of the original MEXC platform. It allows startups and fintech entrepreneurs to launch their own digital asset exchange without building every block from scratch.

It typically includes:

- Spot and margin trading modules

- Crypto wallet integration

- Trading engine with high TPS (transactions per second)

- Admin panel for user and trade management

- Support for tokens, stablecoins, and even NFTs

It’s like getting the MEXC trading brain—customized with your branding, security layers, and token pairs.

Read More : MEXC App Features List: What Makes This Crypto Exchange Tick?

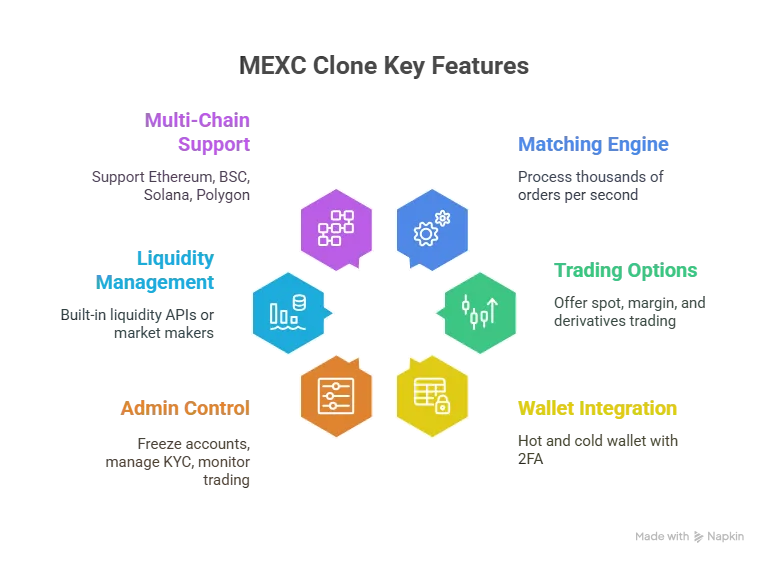

Key Features You Need in 2026

With crypto evolving at lightning speed, your MEXC clone needs to be more than a trading site. It must be a comprehensive fintech engine that supports user trust, regulatory compliance, and future innovation.

1. High-Performance Matching Engine

Your exchange should process thousands of orders per second. Anything less is a deal-breaker for serious traders.

2. Spot, Margin & Derivatives Trading

Offer the full spectrum—from beginner-friendly spot markets to advanced options and leverage tools.

3. Crypto Wallet Integration

Hot and cold wallet integration with multi-signature support and two-factor authentication (2FA) are now baseline.

4. Admin Control Center

You need granular control—freeze accounts, manage KYC, monitor trading patterns, and generate compliance reports.

5. Liquidity Management

Use built-in liquidity APIs or third-party market makers to ensure users never face thin order books.

6. Support for Multi-Chain Tokens

Cross-chain compatibility is the future. Your clone should support Ethereum, BSC, Solana, Polygon, and more.

Read More : Mexc App Marketing Strategy: How to Break Through in the Crypto Exchange Game

Cost Factors & Pricing Breakdown

MEXC-Style Crypto Exchange — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Centralized Exchange MVP | User registration, KYC, spot trading engine, order book, deposits/withdrawals, trading fees, basic wallet, simple admin panel | $70,000 |

| 2. Full-Feature MEXC-Like Exchange | Advanced matching engine, maker–taker fees, multi-coin wallets, market/limit/stop orders, referral & fee discounts, futures-ready architecture, robust admin & compliance dashboards, basic AML monitoring | $150,000 |

| 3. Enterprise-Grade Trading Ecosystem | Margin & futures (architecturally ready), multi-region setup, advanced risk engine, market-making tools, API trading, audit logs, deep analytics, high-availability infra, DDoS protection, compliance tooling | $300,000+ |

These prices reflect the global development cost of building a MEXC-style centralized crypto exchange — including a high-performance matching engine, secure wallet infrastructure, and compliance-ready back office.

Miracuves Pricing for a MEXC-Style Exchange

Miracuves Price: Starts at $3,299

Miracuves provides a ready-to-launch MEXC-style spot trading exchange featuring user KYC onboarding, multi-coin wallets, order book trading (limit/market), fee engine, deposit/withdrawal flows, promotions/referrals, and a powerful admin dashboard — all built on a stable, battle-tested PHP architecture.

Note

This package includes full non-encrypted source code, backend/API setup, admin panel configuration, deployment assistance, and web front-end — giving you a complete MEXC-style exchange ready to go live.

Launch your MEXC-style crypto exchange with Miracuves and go live in days instead of months.

Delivery Timeline for a MEXC-Like Platform with Miracuves

Estimated deployment timeline: 3–9 days, depending on:

- Number of trading pairs and listed assets

- KYC / verification flow and compliance depth

- Fee structures, commissions, and promo logic

- Required admin, support, and reporting modules

- Branding, UI customization, and integrations (emails, SMS, etc.)

Tech Stack

Built using PHP, MySQL, and modular APIs, optionally connected with crypto node / gateway services — enabling reliable order execution, secure wallet operations, and scalable performance for high-traffic centralized crypto exchanges.

Clone Script vs. Building From Scratch – What’s the Smarter Move?

If you’re an early-stage founder, here’s what you’re really choosing between:

| Decision Point | Build from Scratch | Clone Script (Miracuves) |

|---|---|---|

| Time to Market | 8–12 months | 3–9 days |

| Cost | $100,000+ | $3,299 |

| Security Testing | Needs full audit | Pre-hardened |

| Compliance Tools | Build your own | Built-in modules |

| Token Launch Speed | Delayed | Instant |

Think of it like DeFi farming: do you want to start with a whole new yield protocol, or deploy a fork and start generating returns? The smart money optimizes for speed and security.

Read More : Revenue Model of MEXC and How This Crypto Exchange Makes Money

Trends Shaping Crypto Exchanges in 2026

- Decentralized KYC (zk-KYC) is being tested to combine compliance with anonymity.

- Regulatory sandboxes are opening in markets like UAE and Singapore.

- Mobile-first exchanges are capturing Gen-Z traders with simplified UX.

- Tokenized stocks and RWA (real-world asset) trading are coming to alt exchanges.

The MEXC clone you pick must evolve with these trends—or risk being irrelevant within the year.

Source:

CB Insights – Future of Crypto Exchanges

Conclusion & Final Thoughts

Crypto moves fast—and so should your product. If you’re serious about launching a MEXC-style exchange that can handle real-world volume and regulatory scrutiny, clone scripts are the path of least resistance and highest return. Just make sure your base isn’t a security liability or an unscalable experiment.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Still have questions about MEXC clone scripts? Let’s clear them up.

What tech stack is used in the MEXC clone?

At Miracuves, the backend is built using Node.js and GoLang, while the frontend uses React/Vue. It’s optimized for high-frequency trading.

Can I launch my own token with the exchange?

Absolutely. You can list your native token and allow staking, farming, or pairing with other assets.

Does the script support mobile apps?

Yes. You’ll get Android and iOS apps with real-time market data, KYC flow, and portfolio management.

What compliance features are included?

Miracuves includes modules for KYC, AML, audit logs, and GDPR-ready user data handling.

Can I integrate with third-party liquidity providers?

Yes. You can plug in external APIs or use Miracuves’ built-in liquidity solutions.

What’s the post-launch support like?

We offer technical maintenance, security patches, and feature enhancements as part of our SLA.

Related Articles