In the ever-evolving world of fintech, crypto exchange apps are quickly emerging as one of the most profitable and future-forward opportunities for startup founders, entrepreneurs, and digital agencies. With crypto adoption gaining traction across both developed and emerging markets, 2025 is shaping up to be a milestone year for blockchain-backed innovation.

From mainstream investors seeking user-friendly platforms to niche traders looking for advanced tools, the demand for efficient, secure, and scalable crypto exchange solutions has skyrocketed. Moreover, with regulatory clarity improving and tech infrastructure becoming more accessible, launching a profitable crypto exchange app is no longer reserved for the Silicon Valley elite.

Read more: How to Start a P2P Crypto Exchange Platform Business

Why Crypto Exchange Apps Are a Hot Opportunity in 2025

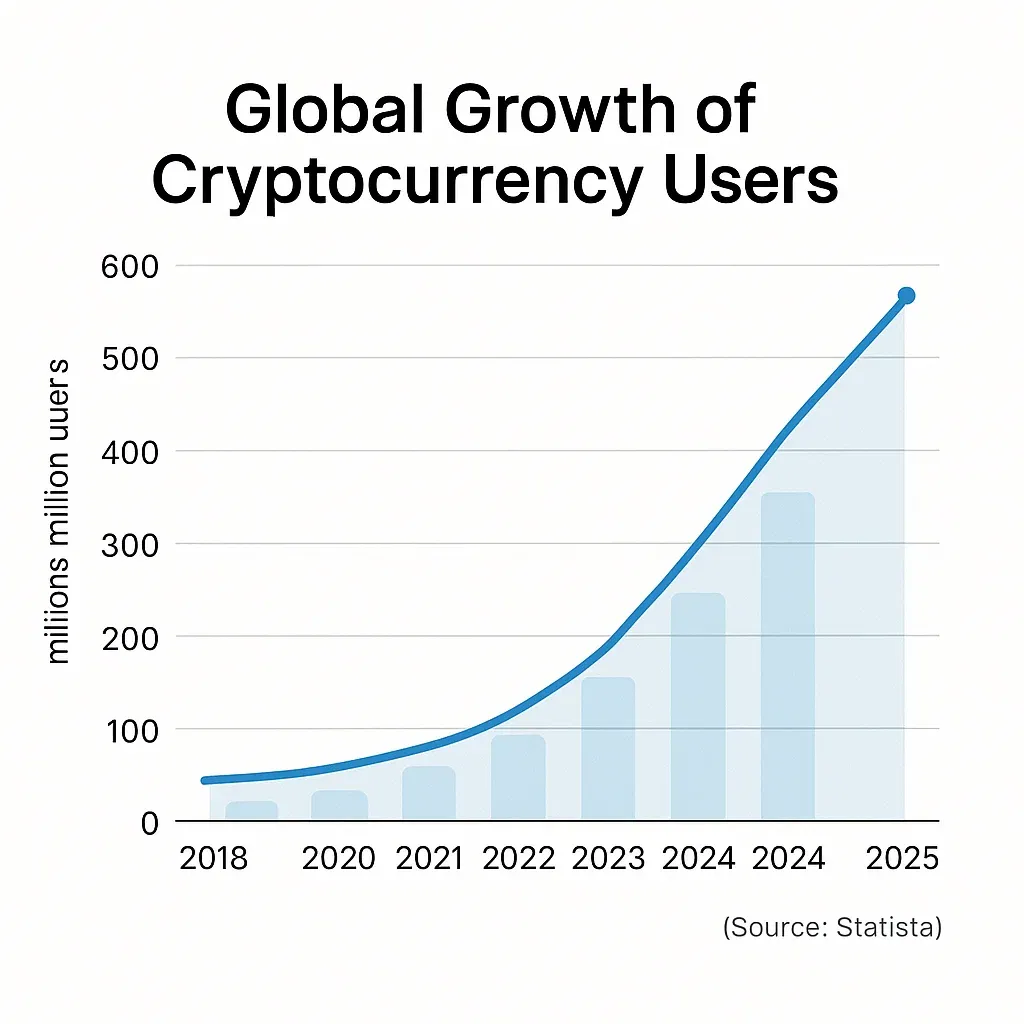

The numbers speak volumes. According to a 2024 report by Statista, the number of crypto users worldwide surpassed 500 million and is projected to grow by another 200 million by the end of 2025. In parallel, CB Insights reveals that global VC funding in the crypto and blockchain space rebounded to over $30 billion in 2024—up 40% from the previous year.

Consumer behavior is evolving as well. People are no longer just buying Bitcoin. They’re staking, swapping, yield-farming, and diversifying across assets. This shift opens up doors for varied app models beyond the standard exchange platform.

Additionally, tech enablers such as Web3 wallets, smart contract automation, and blockchain APIs are lowering the barrier to entry for developers and founders alike. Despite major players like Binance and Coinbase dominating headlines, gaps remain—especially in local fiat-crypto integrations, compliance-first platforms, and mobile-first user experiences.

Top Profitable Crypto Exchange App Ideas to Launch in 2025

1. Peer-to-Peer (P2P) Crypto Marketplace

A decentralized trading platform that connects crypto buyers and sellers directly, eliminating intermediaries. These marketplaces offer escrow protection and flexible pricing. P2P models thrive in regions with limited banking access or regulatory uncertainty. In 2025, rising privacy concerns make them an ideal choice for global users.

- Monetization Strategy: Transaction fees, escrow fees, premium ad listings

- Why it Works in 2025: With users seeking more privacy and control, P2P platforms are poised for mainstream adoption, especially in regions with unstable banking systems.

2. Crypto-Fiat Hybrid Exchange

This model blends traditional banking with crypto, allowing users to buy and sell digital assets using local currencies. With seamless on-ramp and off-ramp support, these apps appeal to both new investors and experienced traders. As regulations improve, fiat integration becomes a must-have. It’s a smart entry point for mass-market adoption in 2025.

- Monetization Strategy: Currency conversion fees, withdrawal charges, VIP tiers

- Why it Works in 2025: As crypto gets regulated, legal fiat integration becomes a competitive advantage for onboarding mainstream users.

3. Decentralized Exchange (DEX) Platform

DEX apps allow trustless crypto trading via smart contracts, giving users full control of their assets. With no central authority, these platforms are censorship-resistant and secure. Web3 growth and user demand for privacy are pushing DEX adoption sky-high in 2025. It’s the future of permissionless finance.

- Monetization Strategy: Liquidity provider fees, governance token launches

- Why it Works in 2025: Web3-savvy users are shifting to non-custodial, transparent systems—DEXs meet this demand.

4. White-Label Crypto Exchange for Institutions

A customizable solution for banks, fintechs, and agencies to launch branded crypto exchanges. These B2B platforms come pre-built with essential features and compliance support. As institutions enter the crypto space, white-label solutions offer speed, scalability, and cost-efficiency. Ideal for monetizing enterprise demand in 2025.

- Monetization Strategy: Setup fee, monthly license, revenue sharing

- Why it Works in 2025: The demand for branded crypto solutions is rising among traditional finance players looking to modernize.

5. Crypto Derivatives & Futures Exchange

These platforms cater to pro traders seeking leveraged tools like options, futures, and perpetual contracts. With volatility-based income models, they generate high margins from every transaction. As regulatory clarity expands in 2025, derivatives will be legal in more jurisdictions—making this a high-potential niche.

- Monetization Strategy: Margin fees, liquidation penalties, subscription tools

- Why it Works in 2025: As regulation matures, derivatives will be legal in more countries, unlocking a huge untapped segment.

6. Mobile-First Micro-Investing Exchange

Targeting younger users, these apps enable small, recurring crypto investments with features like round-ups and auto-invest. The focus is on simplicity, automation, and gamified saving. With Gen Z leaning toward mobile-first financial habits, this model is perfect for building sticky user engagement in 2025.

- Monetization Strategy: Subscription models, spread margins, cross-sells

- Why it Works in 2025: Younger Gen Z users prefer mobile-first financial tools with gamified investment experiences.

7. Crypto Gift Cards & Voucher Platform

Users can convert crypto into redeemable gift cards for brands like Amazon, Uber, or Apple. It’s a practical off-ramp for people in unbanked regions or those who want to spend crypto easily. This niche combines convenience, utility, and cross-border reach—an appealing model for 2025’s growing retail crypto user base.

- Monetization Strategy: Partner commissions, processing fees

- Why it Works in 2025: Offers a simple crypto off-ramp option for users without bank accounts or in regions with cash-based economies.

What Makes an App Profitable in the Crypto Exchange Niche?

Profitable crypto exchange apps in 2025 typically share a few key traits:

- Recurring Revenue Streams: Whether through transaction fees, subscriptions, or premium features, profitability scales with user activity.

- High User Retention: Offering ease of use, low fees, and ongoing incentives (like staking rewards) keeps users coming back.

- Low Operational Overhead: DEXs and smart contract platforms reduce the need for manual oversight.

- Scalable Acquisition Models: From influencer marketing to affiliate programs, successful apps build viral traction early.

One major enabler here? Ready-made clone apps. These white-label solutions drastically reduce development timelines and overhead. Companies like Miracuves offer scalable, customizable crypto exchange clones that can cut go-to-market time by 70%.

Cost to Build a Crypto Exchange App in 2025

Developing a crypto exchange app in 2025 can cost anywhere from $25,000 to $200,000+, depending on the complexity, feature set, and level of customization. Here’s how it breaks down:

- Basic P2P Crypto App (minimal UI, core trading, wallet integration): $25,000 – $45,000

- Mid-Range Exchange (with KYC, fiat support, liquidity integration): $50,000 – $90,000

- Advanced Exchange (real-time charts, staking, futures trading, admin panel): $100,000 – $200,000+

Ready to trade like a pro? Miracuves brings your Crypto Exchange App to life — all within a range of $2500–$3500 Go Live in 3-6 Days

Several factors influence the final cost:

- Platform Choice: Web + mobile (iOS/Android) support increases cost

- Tech Stack: Blockchain protocols, custom wallets, and security layers

- Backend Architecture: Matching engines, liquidity integrations, and scalability

- UI/UX Complexity: Custom dashboards, animation, multi-role panels, etc.

But here’s the game-changer: opting for a clone app solution from trusted providers like Miracuves can significantly reduce this cost—sometimes by as much as 60%—without compromising on performance or scalability. Plus, clones get you to market in weeks, not months.

Read more: What Drives the Cost of Developing a Crypto Exchange Platform?

Tips for Founders to Launch a Successful Crypto Exchange App

1. Start with an MVP

Don’t fall into the trap of trying to build a full-scale Binance on Day One. Focus on a lean MVP with just the core features: user auth, wallet integration, trade engine, and basic UI. Scale as feedback rolls in.

2. Prioritize UI/UX Design

Crypto can be intimidating. Your app needs to feel simple, clean, and trustworthy. A good UI reduces bounce rates and helps new users feel at ease while investing.

3. Validate Before You Launch

Before committing to full-scale development, run surveys, pre-launch waitlists, or even no-code prototypes to validate demand. Let real user interest guide the roadmap.

4. Build for Scale

Ensure your backend is designed for growth. Use microservices, cloud-based storage, and security-first architecture. You should be able to handle thousands of transactions without crashing.

5. Don’t Ignore Marketing

Even the best app will fail without the right launch plan. Invest early in SEO, influencer campaigns, crypto communities, and app store optimization to drive traction from Day One.

Read more: The Future of P2P Crypto Exchange Apps: Trends to Watch in 2025 and Beyond

Conclusion

As crypto adoption accelerates and users seek better platforms to trade, invest, and interact with digital currencies, crypto exchange apps present one of the most profitable startup opportunities in 2025. Whether you build a peer-to-peer platform, a fiat hybrid exchange, or a white-label solution for institutions, there’s room to thrive—if you execute smartly.

Don’t waste months reinventing the wheel. Ready to launch your own crypto exchange app? Miracuves offers scalable, white-label clone solutions to help you go live faster and smarter. Get in touch today and take the leap toward your crypto venture.

FAQs

Q1: How much does it cost to build a crypto exchange app?

It typically ranges from $25,000 to $200,000+, depending on features and tech complexity.

Q2: What features should a successful crypto exchange app include?

Core features include KYC, wallet integration, trading engine, real-time charts, and strong security protocols.

Q3: Is it better to build from scratch or use a clone solution?

For most startups, using a clone solution is faster, more cost-effective, and lowers the risk of launch delays.

Q4: How long does it take to launch a crypto exchange app?

From scratch, 6–9 months. With a clone solution like Miracuves’, you can launch in as little as 4–6 weeks.

Q5: Are crypto exchange apps still profitable in 2025?

Yes—especially niche models like P2P, mobile-first exchanges, and institutional white-label platforms.

Q6: What makes crypto apps successful long-term?

Strong user retention, low fees, advanced tools, and regulatory compliance are key to long-term growth.

Related Articles: