Picture this: It’s 2010, and you’re stuck in a never-ending queue at a traditional bank just to transfer money. Fast forward to today—boom! You’ve got a whole bank in your pocket, with slick UI, zero paperwork, and instant everything. That, my friend, is the magic of a neobank. These mobile-first banks are rewriting the rules, and everyone—from Gen Z freelancers to seasoned digital nomads—is here for it.

But here’s the kicker: Not every neobank app is created equal. Some are smooth as butter, while others? Clunky as a Windows 98 pop-up. Whether you’re an ambitious startup founder or a digital product junkie, you’ve probably asked yourself—what actually makes a neobank app work like a charm? Spoiler alert: It’s not just fancy colors and minimalistic logos. That’s why many entrepreneurs are exploring Neobank clone app development to build platforms that combine sleek design with flawless functionality.

In this guide, we’re breaking down the must-have features of a top-performing neobank app. So if you’re thinking of building the next N26, Chime, or even a local star like Jupiter, stick around. And hey—Miracuves helps startups like yours launch smart, scalable app clones that rival the big players. Let’s dive in.

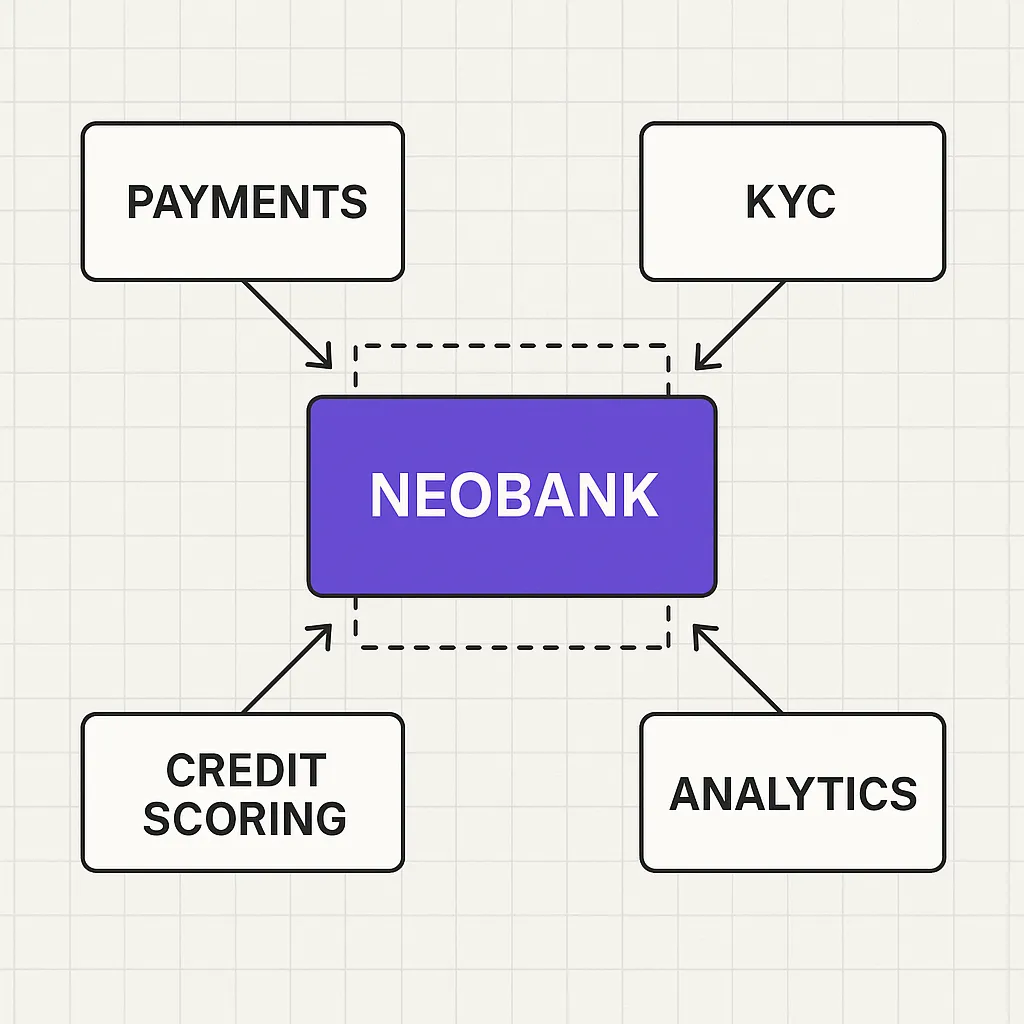

What Is a Neobank App, Anyway?

A neobank is a fully digital bank that operates without physical branches. It lives entirely inside smartphones and web apps, focusing on seamless UX and customer-first features. Neobanks aren’t just “apps with banking features”—they are the bank.

Popular names like Revolut, Chime, N26, and Jupiter have become powerhouses by serving niche audiences—freelancers, students, digital-savvy millennials—with tailored experiences. No paperwork. No hidden fees. Just clean, modern banking that fits into your life.

Read more: What is a Neobank App and How Does It Work?

Core Features Every Neobank App Must Include

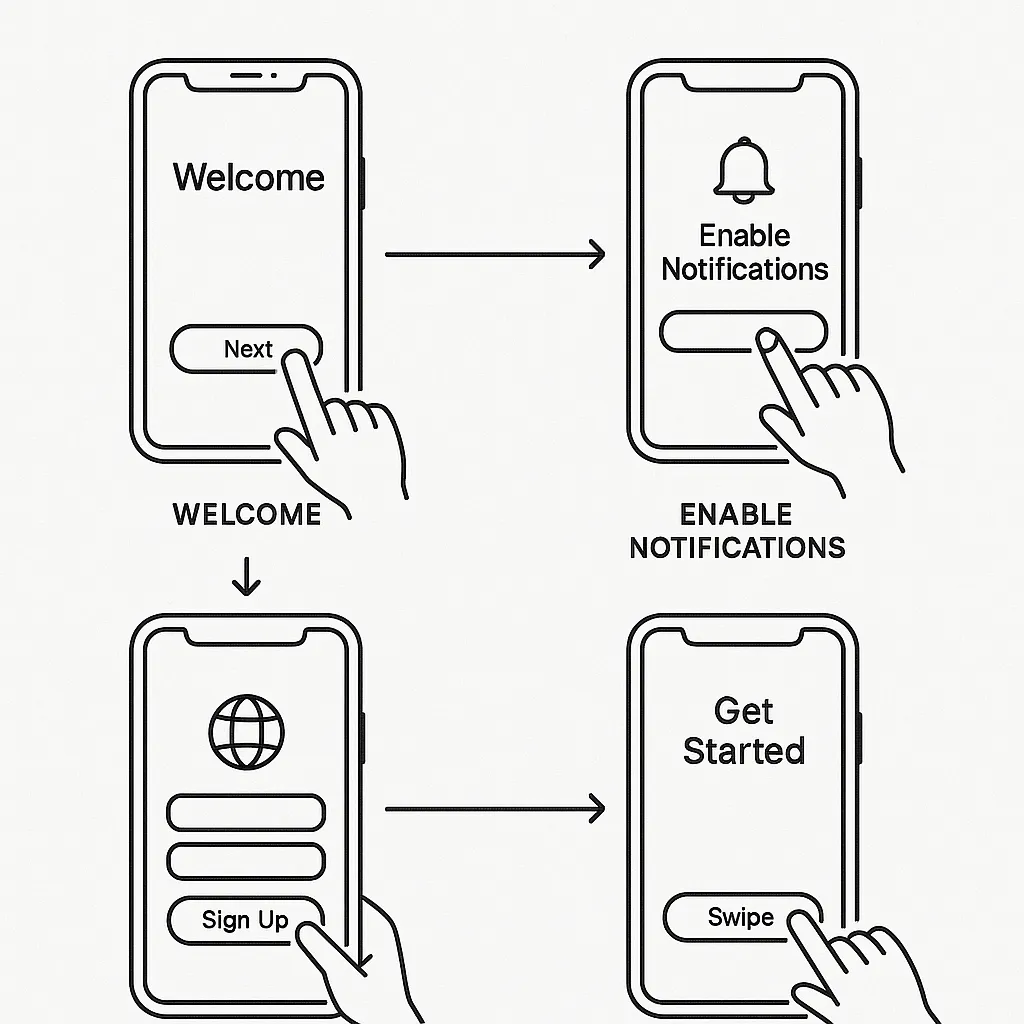

1. Intuitive Onboarding

Forget 45-minute form-filling marathons. A good neobank app gets users onboarded in under 5 minutes.

- eKYC with OCR + selfie verification

- Instant card issuance (virtual)

- Simple document uploads

- Referral code integration

2. Smart Account Management

Users want full control over their money—without needing a helpdesk ticket.

- Real-time balance updates

- Spend categorization (groceries, rent, dining)

- Freeze/unfreeze cards

- Custom nicknames for savings pots

Gamified savings goals and “round-up” features add serious stickiness.

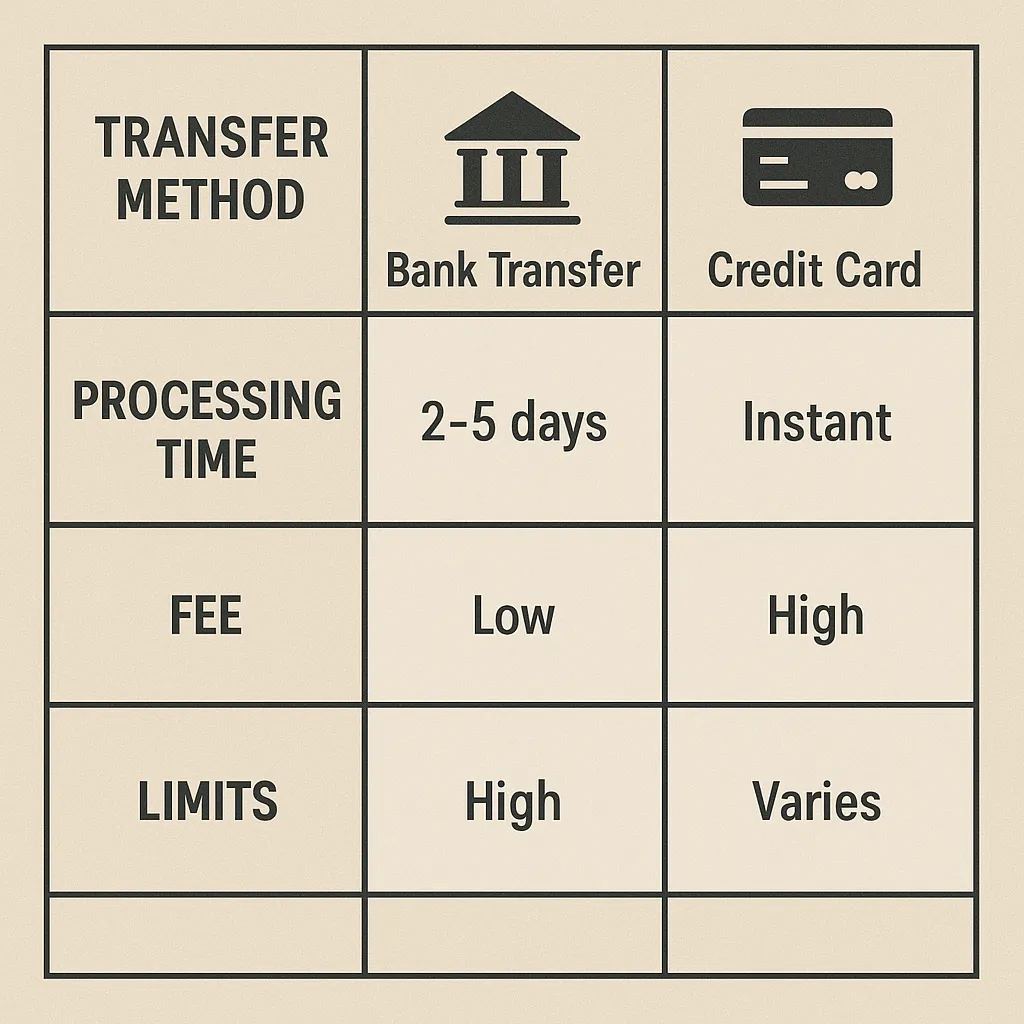

3. Seamless Payments & Transfers

A neobank without slick payments is just a fancy wallet. Speed and simplicity are non-negotiable.

- UPI, IMPS, NEFT integration (for Indian neobanks)

- Peer-to-peer transfers (a la Venmo)

- Bill payments & recharge

- QR code scanning

4. Virtual & Physical Card Integration

From Apple Pay to contactless swipes, card flexibility is a baseline feature.

- Instantly generate virtual cards

- Freeze/mute card in-app

- Control international use

- Single-use cards for online purchases

Add customizable card skins for visual appeal

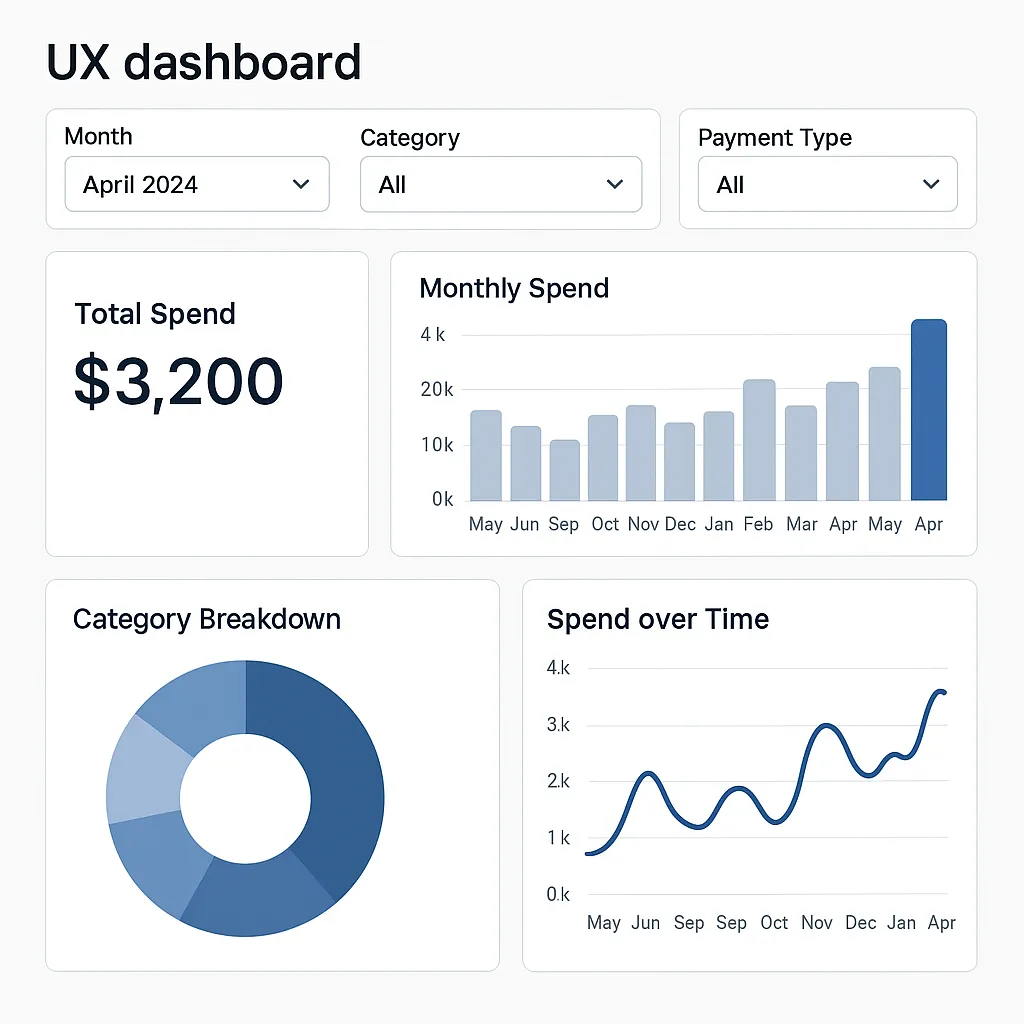

5. Budgeting & Personal Finance Tools

Modern users aren’t just looking to spend—they want to plan. Help them stay financially fit.

- Expense tracking with pie charts

- Weekly/monthly insights

- Bill reminders

- Credit score monitoring

6. Security That Doesn’t Feel Obnoxious

Banking is serious business—but no one wants to jump through hoops every time they log in.

- Biometric login (Face ID, fingerprint)

- Two-factor authentication

- Device recognition alerts

- Transactional OTP + push notifications

Use invisible security layers for smooth UX with solid protection.

7. Support That Actually Supports

When things go sideways, users need answers fast—not a generic chatbot loop.

- 24/7 in-app chat support

- Contextual support suggestions

- Ticketing system with status tracking

- Human fallback after X failed bot interactions

8. Rewards, Offers & Cashbacks

People love perks—especially if they’re relevant and real-time.

- Partner merchant offers

- Cashback on spends

- Goal-based rewards

- Gamified spin-the-wheel bonuses

Keep the rewards engine dynamic to maintain excitement and engagement.

9. Multi-Currency & International Support

Neobanks with global ambitions need borderless capabilities baked in.

- Forex wallet with live conversion rates

- International wire transfers

- Travel spending analytics

- Geo-specific compliance features

10. APIs & Integrations

Want to open up your ecosystem? APIs are your golden ticket.

- Open banking compliance

- Integration with accounting apps like QuickBooks or Zoho

- Webhooks for custom automations

- IFTTT/Zapier-style rule builders

Read more: Best Neobank Clone Scripts in 2025: Features & Pricing Compared

Emerging Features to Watch Out For

Neobanking isn’t static. If you want to stay relevant in 2025 and beyond, keep an eye on:

- AI-powered financial advisors

- Voice-based transaction commands

- Crypto wallets & token-based loyalty

- ESG score-based spend tracking

- BNPL (Buy Now Pay Later) functionality

Think of these as the cherry on top that could make your app the next breakout fintech star.

Conclusion

Neobanks are no longer “the future”—they’re very much the now. Whether you’re solving problems for gig workers or small businesses, a winning neobank app is all about smooth flows, actionable insights, and real-world convenience.

And if you’re building your own? Don’t reinvent the wheel. At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

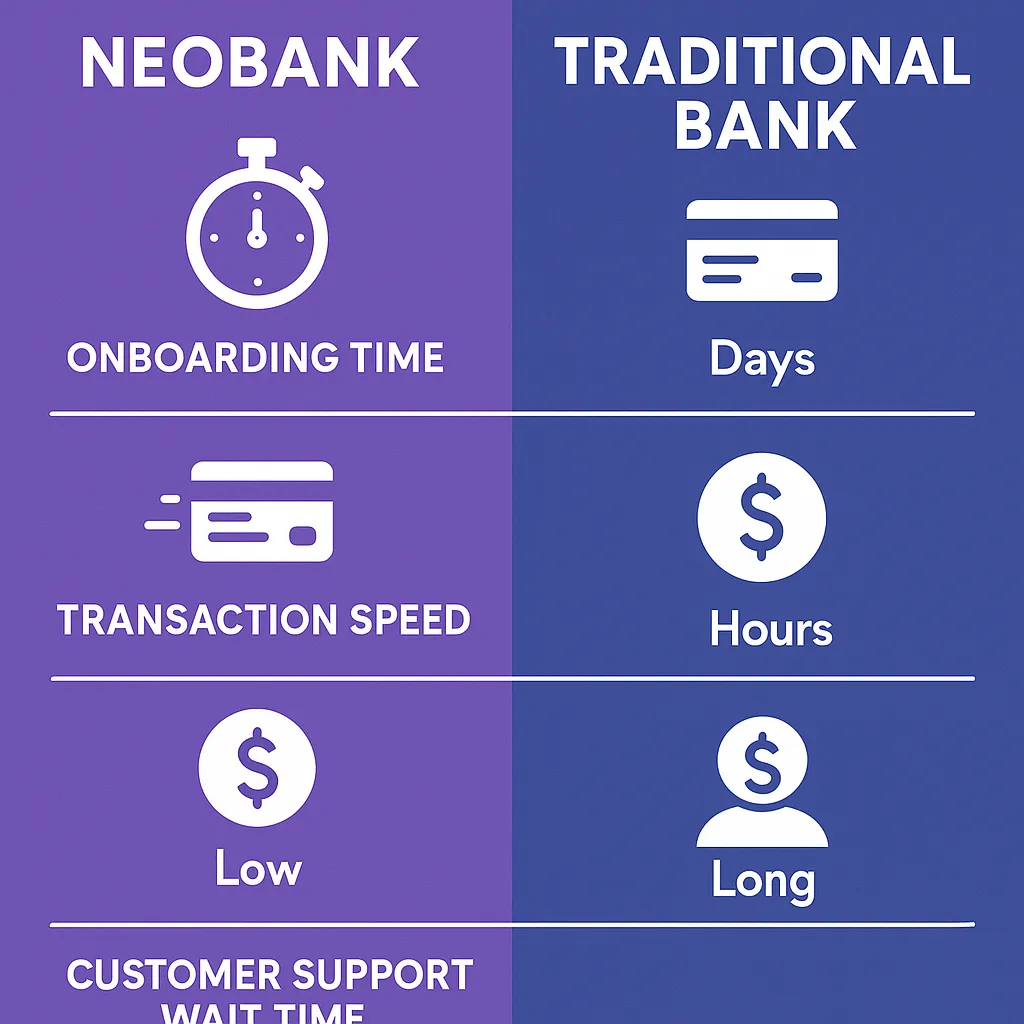

Q:1 What’s the difference between a neobank and a traditional bank?

Neobanks are fully digital, with no physical branches. Everything is managed through an app, making them faster, cheaper, and more user-friendly.

Q:2 Can neobank apps issue debit or credit cards?

Absolutely. Most neobanks offer both virtual and physical debit cards. Some even partner with banks to offer credit lines or BNPL options.

Q:3 How do neobanks make money?

Common revenue streams include interchange fees, premium subscriptions, partner offers, and financial product upsells.

Q:4 Are neobank apps safe to use?

Yes, provided they follow security best practices like data encryption, biometric logins, and 2FA. Always check if they’re regulated by financial authorities.

Q:5 What tech stack is best for building a neobank app?

Popular choices include React Native or Flutter for the frontend, Node.js or Python for backend, and cloud-native infrastructure on AWS or GCP.

Q:6 Can Miracuves build a custom neobank app for my startup?

You bet. Whether you’re cloning Chime or creating something fresh, Miracuves offers end-to-end development to get you from idea to launch.

Related Articles: