Remember when banking meant standing in long queues, filling out endless forms, and dealing with that one grumpy cashier who always seemed to hate Fridays? Yeah, same. Fast forward to today, and we’re living in a world where neobanks have made financial services feel more like scrolling Spotify than dealing with spreadsheets. No branches. No bureaucracy. Just tap, swipe, done.

But here’s the thing—building a cool neobank app isn’t enough anymore. Users are spoiled with options. If your app doesn’t connect emotionally and solve real money pain, it’ll get lost in the sea of fintech noise. That’s where marketing strategies comes in—not the boring kind, but the kind that speaks millennial, breathes digital-first, and knows a thing or two about memes and trust.

In this post, we’re pulling back the curtain on what makes successful neobank app marketing strategies tick. From viral growth loops to retention hacks, we’re digging into what works—and how you can replicate it. At Miracuves, we don’t just help you build high-performance neobank apps—we help you grow them too. Let’s roll.

What is Neobank and Why Neobank Marketing So Unique?

Digital-Only = Trust-First

Unlike traditional banks, neobanks don’t have physical branches to back up their credibility. Which means—yep, trust has to be earned online. This affects every pixel of your marketing: the design, the tone, the testimonials, the transparency.

Action Tip: Use simple, jargon-free language. Highlight security (biometrics, FDIC-like backing), and spotlight real customer stories in your ads.

Targeting Gen Z & Millennials

This isn’t your grandpa’s bank. Neobanks market to a generation that grew up with Venmo, not vaults. They want financial literacy, control, and cool perks. Not brochures.

Keyword insight: Embed terms like “save smarter,” “budget like a boss,” “zero hidden fees,” and “instant transfers.”

Learn More: Neobank App Explained: Features, Flow & Monetization

Growth Loops That Actually Work for Neobank Apps

1. Referral Programs that Feel Like a Win-Win

Think about how Revolut and N26 exploded in Europe. They gave users €10 to refer friends—and it worked. But it wasn’t just the money—it was how easy and rewarding it felt.

Your move:

- Add social-friendly referral codes

- Make it visual: “You + 1 = ₹500 each”

- Track referrals inside the app (gamify it with badges)

2. In-App Challenges & Financial Goals

Want to increase user retention? Turn money management into a mini-game. Give users badges for saving, budgeting streaks, and investment milestones.

Example: “Save ₹5,000 in 30 days. Get a free debit card skin.”

Content Marketing That Builds Financial Confidence

1. Social Media = Education + Personality

Neobanks like Chime, Monzo, and Step kill it on Instagram and TikTok. They teach money tips in 15 seconds, roast bad financial advice, and celebrate user wins.

Tips for your clone:

- Use memes to explain credit scores

- Create a hashtag campaign like #MyMoneyMoves

- Run polls: “What’s worse: overdraft fees or late rent?”

2. Blogging for SEO & Value

People Google before they download. Rank for things like:

- “How to start saving in my 20s”

- “Best digital bank for students”

- “Is XYZ neobank safe?”

Miracuves Hack: Build your own content hub with FAQs, savings tips, and how-to guides.

Paid Marketing Tactics (Without Burning Through Budget)

1. Targeted Google & Meta Ads

Instead of generic “Open a bank account today” ads, go micro:

- “Get a virtual card for your next trip to Goa”

- “Neobank with zero ATM fees for freelancers”

Focus on intent-based keywords and Facebook Lookalike Audiences based on fintech users.

2. Influencer Collabs (But Make It Real)

Partner with finance influencers who actually use digital banking tools. Think Instagram reels, YouTube explainers, or even reaction videos to the app’s onboarding.

Pro Tip: Micro-influencers (5K–50K followers) often outperform big celebs in trust and engagement.

Retention Is the New Growth

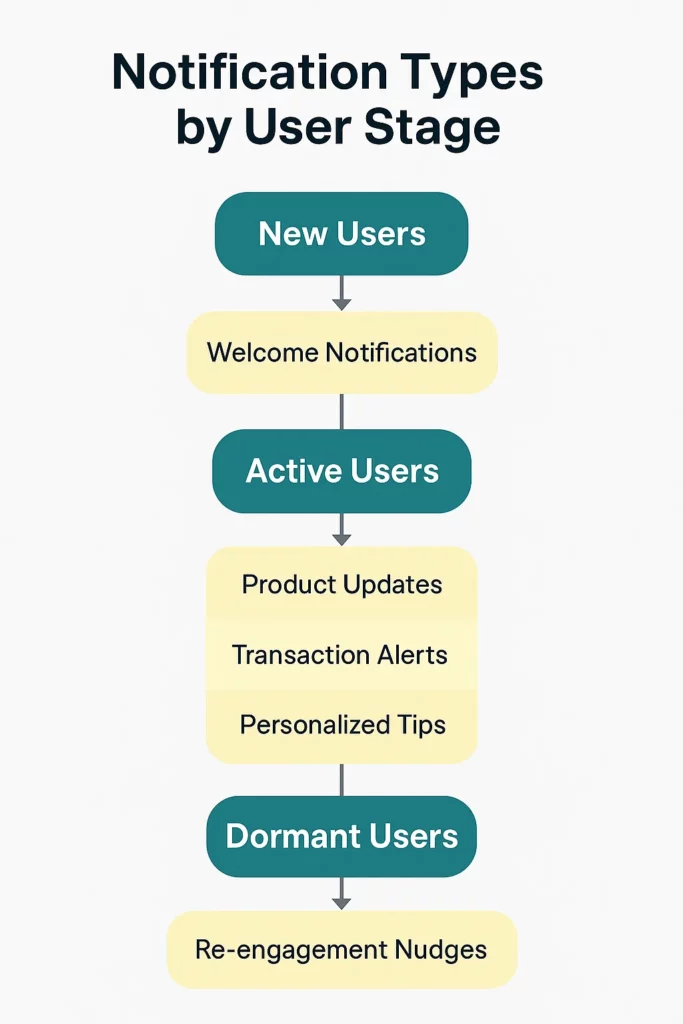

1. Push Notifications With Purpose

Don’t just shout “Your balance is low.” Make it personal:

- “Hey, you’ve saved ₹1,000 this week. Want to round up for your goal?”

- “You skipped a budget check-in. Want to catch up now?”

2. UX-Driven Personal Finance Tools

Retention = value. Give users:

- Spending analytics (like color-coded categories)

- Weekly digest emails

- Auto-budgeting nudges

Learn More: How to Build an App Like Neobank – Developer Guide for Node.js & PHP Stacks

Conclusion

You don’t need a billion-dollar budget to market like a pro. Neobank success is all about relatability, smart referrals, content that educates, and a brand that feels human. It’s time to stop looking at old banks and start acting like a fintech rebel.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQ’s

What’s the most important first step in neobank marketing?

Start with building trust. A clean UX, security signals, and transparent language go a long way.

Are influencer campaigns effective for neobank apps?

Yes—especially when paired with authentic creators who teach financial literacy or share money tips.

How can I boost app downloads quickly?

Use referral programs, Google/Meta ads targeting freelance, student, and traveler personas.

Should I focus on Gen Z or Millennials?

Both—but tailor your message. Gen Z wants financial tools and lifestyle perks; Millennials want control and long-term savings.

How do I keep users engaged after sign-up?

Offer gamified challenges, weekly insights, and useful push notifications tied to financial behavior.

Can I legally clone a neobank app?

You can build a similar app legally with original branding, design, and compliance. Miracuves specializes in clone solutions built for scale.