NeoBanks are the fintech darlings of the digital age. With flashy UIs, instant account setups, and fee-free banking, they’re winning hearts and market share. So naturally, startups want in. The idea of launching a neobank clone—a sleek digital-only bank like Chime, Revolut, or N26—is thrilling. But make no mistake: building a neobank is no plug-and-play side hustle.

If you think slapping on a minimalist design and offering a virtual debit card is enough, you’re setting yourself up for a fintech facepalm. We’ve seen startups underestimate everything from compliance to transaction flows, and the costs of those mistakes? Steep.

At Miracuves, we’ve helped build neobank clones that are fast, secure, and scale-ready. Here are the five most common mistakes we see when startups venture into digital banking—and how you can skip the pain and go straight to launch.

Mistake 1: Ignoring Banking Regulations and Compliance like NeoBanks

Fintech isn’t like building an e-commerce app is like TechCrunch’s NeoBanks . You’re dealing with money. Real people’s money. Which means there are rules. Lots of them. Startups often assume they can “sort out licensing later,” but that’s like selling food and ignoring health codes.

Different regions have different licensing, data protection, KYC (Know Your Customer), and AML (Anti-Money Laundering) laws. Non-compliance can get your app banned, fined, or worse—shut down.

Avoid it by:

- Partnering with licensed banking-as-a-service (BaaS) providers

- Integrating modular compliance frameworks

- Building region-based policy toggles into your admin panel

Learn More: What Is a Neobank App? How It Works & Why It’s Disrupting Traditional Banking

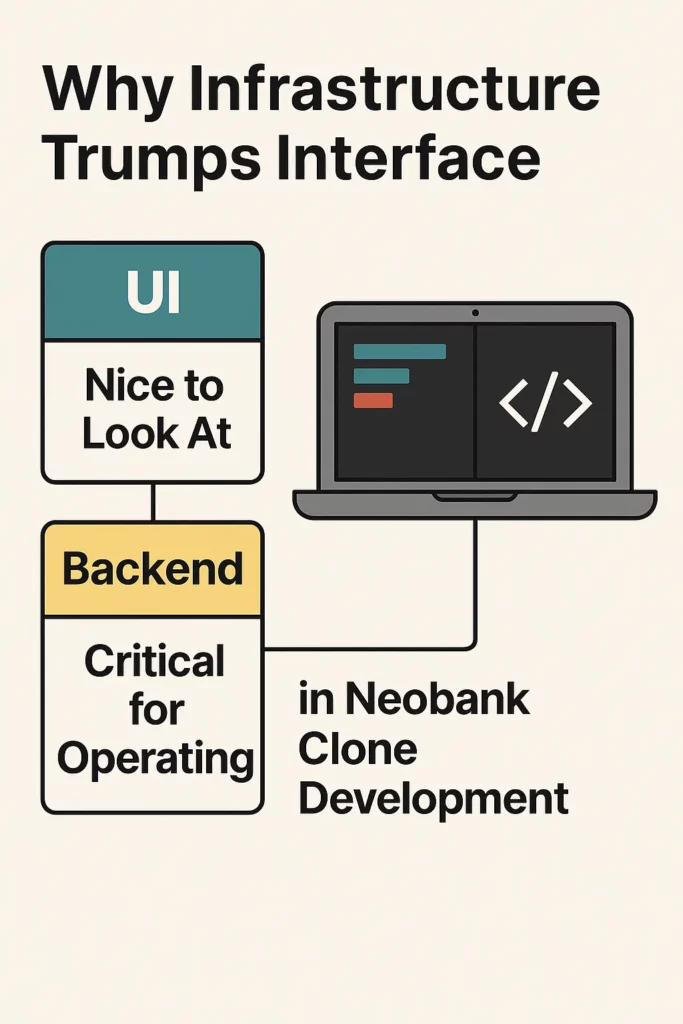

Mistake 2: Prioritizing Features Over Financial Infrastructure

Everyone wants to launch with flashy dashboards, colorful pie charts, and real-time notifications. But if your transaction layer fails or your API limits choke under traffic, the glitter won’t save you.

Neobanks need solid infrastructure to:

- Support ACH, SEPA, UPI, and wire transfers

- Manage account reconciliation

- Integrate with multiple payment gateways and core banking APIs

Mistake 3: Offering a One-Size-Fits-All User Experience

Banking habits aren’t universal. A freelancer in Berlin, a student in Mumbai, and a retiree in Sydney need different flows. Most startups clone neobank apps with a generic UX that doesn’t cater to diverse financial needs.

Neobanks win because they personalize:

- Spending insights for freelancers

- Budgeting tools for students

- Retirement tracking for older users

Fix it by:

- Building modular UX flows

- A/B testing with real user personas

- Including accessibility features for different age groups and abilities

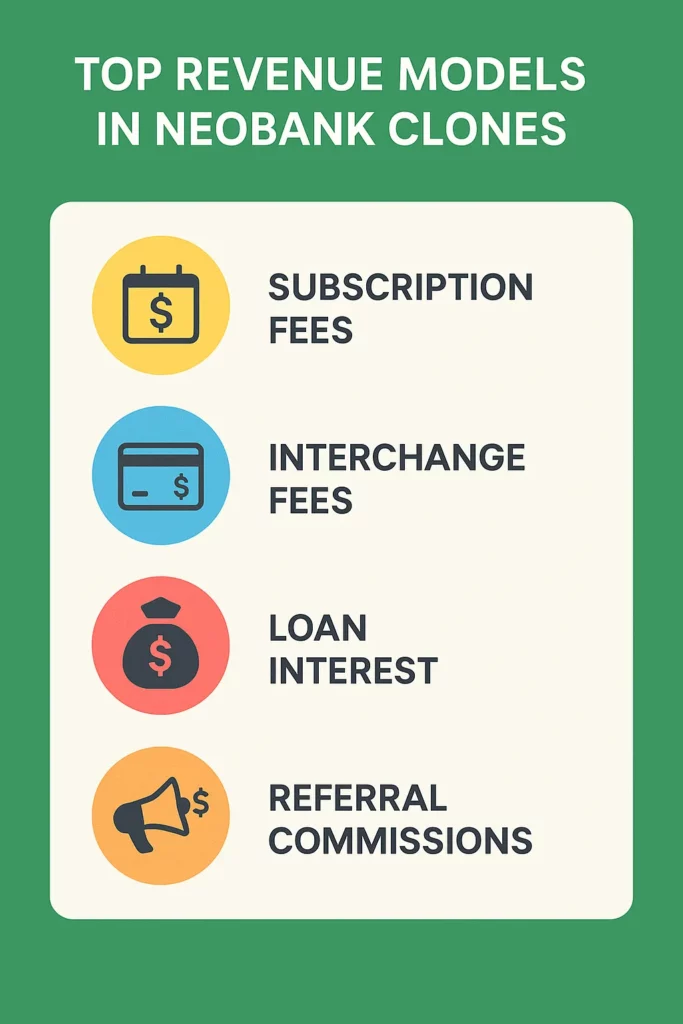

Mistake 4: Forgetting About Monetization

You’re not just building a neobank; you’re building a business. Free banking sounds great, until server bills and partner fees hit. Many startups focus on user acquisition but leave revenue generation as an afterthought.

Successful neobanks monetize via:

- Premium plans (e.g., metal cards, cashback perks)

- Interchange fees on card swipes

- Lending and overdraft interest

- Insurance and financial product referrals

Plan ahead:

- Integrate subscription tiers into the core product

- Launch financial marketplaces inside the app

- Enable referral rewards and upsell flows

Build Your Own Neobank Clone with Miracuves

Mistake 5: Skipping Scalability and Security Planning Features

It’s not just about launch day. What happens when you hit 100K users? Or a coordinated fraud attempt? Many neobank clones are built for MVP demos, not real-world scale.

Security and scalability must be baked in:

- End-to-end encryption for all transactions

- PCI-DSS and SOC 2 compliance

- Scalable microservices architecture

Learn More: Top Features Every Neobank App Must Have in 2025

Conclusion

Building a neobank clone is like walking a tightrope across a fintech canyon. Ambition is great—but without foresight, you’re just one misstep away from disaster. Get the infrastructure, compliance, and personalization right, and the rest will follow.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQ’s

1) Is it legal to clone a neobank like Chime or Revolut?

Yes, if you create a unique solution inspired by their models and comply with licensing and branding laws.

2) How long does it take to launch a neobank clone?

With Miracuves, you can launch a fully functional neobank clone in just 3–9 days with guaranteed delivery, including all essential features and compliance setup.

3) What tech stack is best for digital banking?

Node.js backend, Flutter/React Native frontend, PostgreSQL, and cloud platforms like AWS or Azure.

4) Can I offer debit cards and account numbers?

Yes, if you partner with a licensed BaaS or fintech enabler offering virtual/physical cards and banking rails.

5) How do neobanks make money?

Via interchange fees, premium plans, lending services, and referrals for insurance or investments.

6) What should I budget to build a neobank clone?

Expect to invest $40K–$100K+ depending on features, integrations, and compliance requirements.