Ever tried pitching a digital bank idea to investors with just a slide deck and a dream? It’s rough. You walk in thinking you’re building the next Revolut, and walk out realizing you might not even afford a custom dev team. Sound familiar?

For early-stage founders in the fintech space, custom development often feels like a mountain—expensive, slow, and riddled with gotchas. And while you’re still waiting on designs, someone else just launched a sleek neobank. Timing isn’t just important; it’s your make-or-break moment.

That’s where smart go-to-Market Strategies for NeoBank Clone come into play. With a NeoBank Clone, you’re not starting from zero—you’re starting from ready. Leverage pre-built UX flows, tested onboarding funnels, and integrate with leading CRM and analytics platforms from day one. Run targeted pre-launch campaigns using waitlists and referral incentives. Use influencer-led content on platforms like LinkedIn and YouTube to drive credibility. And don’t forget strategic partnerships—with fintech APIs, affiliate networks, and even niche media outlets—to generate buzz and conversions. The clone gets you to market faster; smart marketing makes sure you own that market.

That’s why startups are increasingly swapping custom builds for our NeoBank Clone. Built by Miracuves with real-world scalability in mind, it’s not just a shortcut—it’s a game plan.

That means more funds for regulatory compliance, user acquisition, or even hiring that growth hacker your investor won’t stop recommending, Statista – Fintech Development Costs Breakdown

Why Going Clone is a Power Move in Fintech for Neo Bank Clone

The fintech revolution is reshaping the way people interact with money. Neo banks—100% digital banking platforms—are leading this shift. But launching a fully functional neo bank from the ground up is no small feat. That’s where cloning becomes a strategic advantage, not a compromise.

Here’s why building a Neo Bank Clone is a power move for fintech startups:

1. Rapid Entry into a Competitive Market

Fintech is fast-moving. Every day spent on custom development is a day lost to potential competitors. A clone solution helps you skip the lengthy R&D phase and go live faster with a market-ready product, capturing users early and building brand recognition.

2. Reduced Development Costs

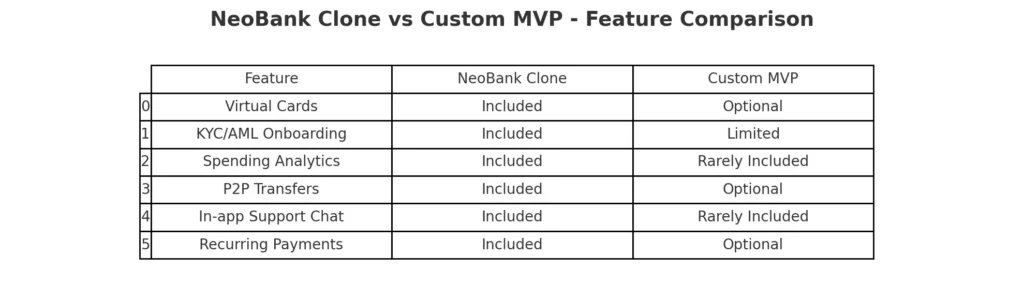

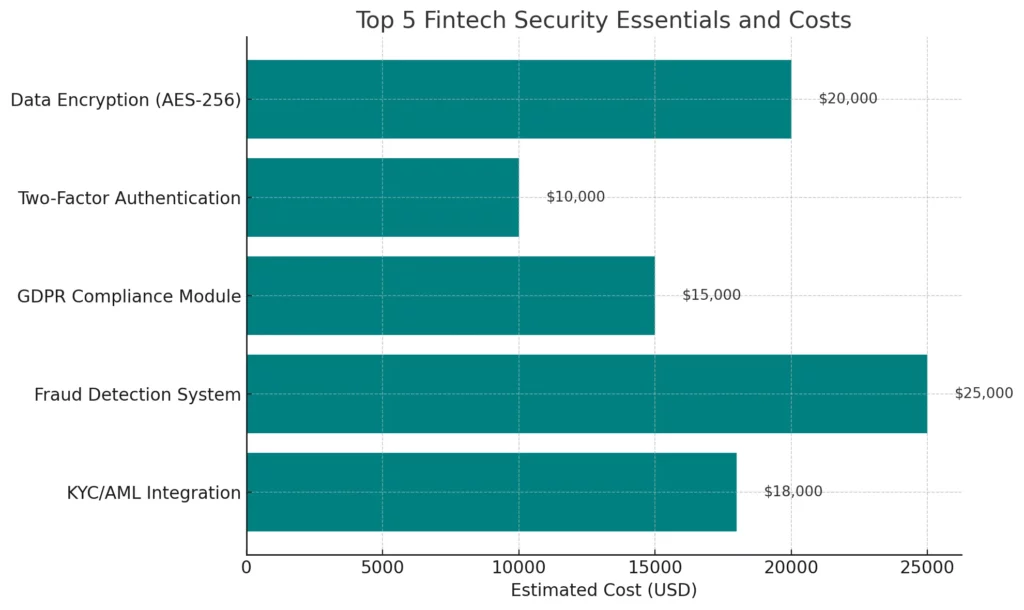

Building a banking platform involves high backend complexity—KYC, fraud detection, encryption, compliance, transaction tracking, and more. Clone scripts come with these critical systems pre-built, allowing startups to launch with lower financial risk and better resource allocation.

3. Compliance-Ready Infrastructure

Top neo bank clones are built with regulatory standards in mind—like GDPR, PCI DSS, and AML protocols. This makes it easier to tailor your app for local compliance, reducing legal hurdles and saving valuable time on audits.

4. Tried-and-Tested User Flows

Neo banking is all about frictionless user experience. Clone platforms replicate interfaces and workflows already proven to delight users—like digital onboarding, real-time balances, card management, and instant transfers—so you start off on a strong UX foundation.

5. Room for Innovation

Using a clone doesn’t mean you’re stuck with a cookie-cutter app. Think of it as a launchpad—you get the essentials built-in, and from there, you can innovate. Integrate crypto wallets, add budgeting AI, or build localized financial tools. The base is ready, the rest is yours to enhance.

6. Banking-Grade Security

Security is non-negotiable in fintech. Clone solutions often include features like:

- End-to-end encryption

- Biometric authentication

- Two-factor verification

- Secure transaction protocols

All of which would take months to build and test from scratch. With a clone, enterprise-level security is already baked in.

7. Scalable & Modular Architecture

Need to support millions of transactions? Planning to roll out across countries? Clone platforms are built to scale, with cloud-based architecture, modular services, and API-driven integration. You’re not boxed in—you’re built for growth.

Scaling with a clone doesn’t mean limitations. It means you start smart and grow with confidence.

Learn More: Neobank Clone App Explained: Features, Flow & Monetization

Why Miracuves? Because We Don’t Just Clone. We Collaborate.

You’re not buying a script. You’re partnering with a fintech-focused dev team that understands the nuances of digital banking. Need integration with local tax systems? Want to gamify budgeting tools? Planning a launch in multiple languages? We’re already on it.

Launch Your Digital Banking App Development with Miracuves

We go beyond setup. With ongoing support, roadmap planning, and upgrades, Miracuves is in your corner long after the launch.

Conclusion: NeoBank Dreams Made Achievable

Startups don’t have to choose between time, budget, and quality. With Miracuves’ NeoBank Clone, you get all three. Build faster. Spend smarter. Launch bolder.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

1) What is a NeoBank Clone?

A NeoBank Clone is a ready-made digital banking app framework modeled after successful neobanks but fully customizable for new brands.

2) Is it safe to use a clone for digital banking?

Absolutely. Our NeoBank Clone comes with bank-level encryption, authentication, and regulatory compliance modules.

3) How quickly can I launch my neobank with this clone?

With Miracuves, you can launch your neobank clone in just 3–6 days with guaranteed delivery, even with essential customizations and integrations.

4) Will I be able to customize the design and features?

Yes. The clone is modular, so branding, features, and third-party integrations are fully flexible.

5) What about compliance and legal regulations?

We include baseline KYC, AML, GDPR, and data privacy support, and can help tailor to local regulatory needs.

6) Does Miracuves offer post-launch support?

Yes, we provide long-term support, feature upgrades, and scaling services post-launch.