Otto’s projected €10–11 billion revenue in 2025 highlights a key shift in e-commerce: the strongest players don’t rely only on buying inventory and reselling it. Otto has expanded into a hybrid model where retail sales bring volume, the marketplace adds scale with lower risk, and services improve margins.

For founders, the big takeaway is stability. A marketplace layer reduces dependence on inventory-heavy growth, while service revenue (ads, fulfillment, financing, seller tools) creates recurring income that’s less seasonal and more predictable.

Understanding Otto’s model helps entrepreneurs build platforms that stay profitable even when product margins tighten—because the business earns not just from sales, but from the ecosystem built around those sales.

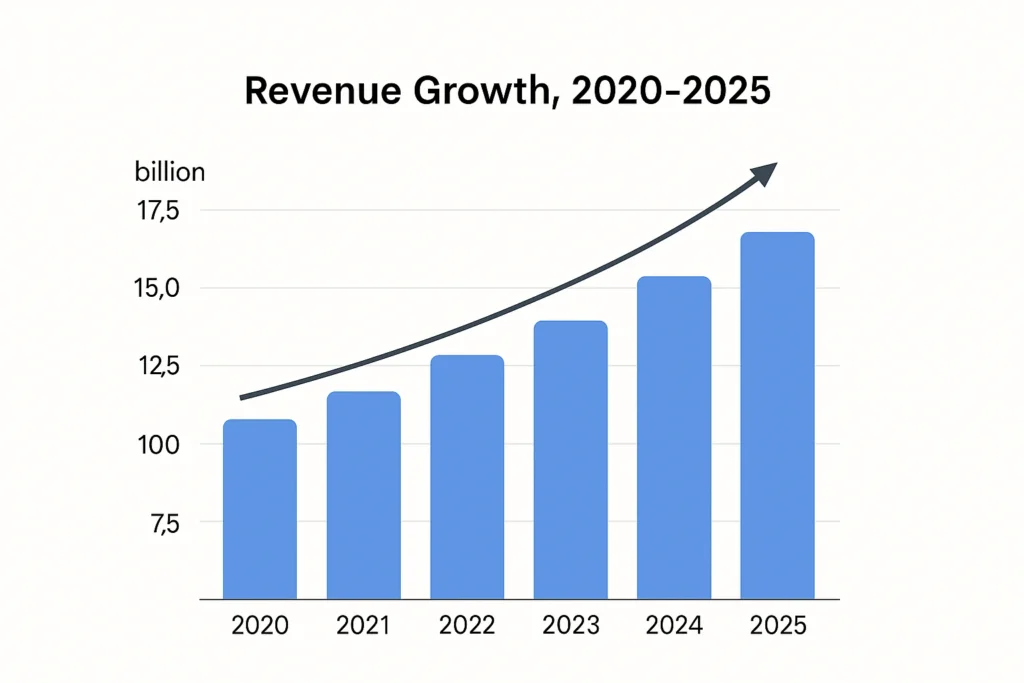

Otto Revenue Overview – The Big Picture

Otto’s 2025 revenue is estimated between €10 and €11 billion, driven by marketplace expansion, logistics services, and higher-margin digital monetization.

- Valuation: Estimated €18–20 billion at group level

- YoY Growth: 5%–8% driven by marketplace GMV growth

- Revenue by Region:

- Germany: ~75%

- Rest of Europe: ~20%

- International & services: ~5%

- Profit Margins: EBIT margin around 3.5%–4.5%

- Competition Benchmark: Competes with Amazon, Zalando, Wayfair, and regional marketplaces

Read More: What is OTTO and How Does It Work?

Primary Revenue Streams Deep Dive

Revenue Stream #1: Direct Retail Sales

Otto sells products directly to consumers from its own inventory, earning margins on goods across categories such as fashion, furniture, electronics, and home essentials.

- Share of revenue: ~40%

- Strength: Control over pricing and assortment

Revenue Stream #2: Marketplace Commissions

Third-party sellers list products on Otto’s marketplace and pay commissions per transaction.

- Share of revenue: ~30%

- Commission range: 7%–25% depending on category

Revenue Stream #3: Advertising & Sponsored Listings

Brands pay to promote products through sponsored placements, search boosts, and homepage exposure.

- Share of revenue: ~12%

- High-margin, scalable monetization

Revenue Stream #4: Logistics & Fulfillment Services

Otto offers warehousing, delivery, and returns management services to sellers.

- Share of revenue: ~10%

- Strong recurring B2B income

Revenue Stream #5: Financial & Value-Added Services

Includes installment payments, buyer financing, seller tools, and analytics services.

- Share of revenue: ~8%

Revenue Streams Percentage Breakdown

| Revenue Stream | Share |

|---|---|

| Direct Retail Sales | 40% |

| Marketplace Commissions | 30% |

| Advertising | 12% |

| Fulfillment Services | 10% |

| Fintech & Other | 8% |

The Fee Structure Explained

User-Side Fees

- No platform access fees

- Product pricing only

- Optional financing and installment payment fees

Provider-Side Fees

- Sales commissions per order

- Fulfillment and warehousing fees

- Advertising and promotion fees

Hidden Revenue Layers

- Sponsored visibility

- Premium seller tools

- Data insights and analytics

Regional Pricing Variation

Fees vary based on product category, delivery complexity, and return rates.

Complete Fee Structure by User Type

| User Type | Fee Type | Description |

|---|---|---|

| Consumers | Product price | No joining fee |

| Consumers | Financing fee | Optional installment charges |

| Sellers | Commission | Percentage per sale |

| Sellers | Fulfillment | Storage and delivery |

| Sellers | Advertising | Sponsored placements |

How Otto Maximizes Revenue Per User

Otto focuses on long-term customer value rather than one-time transactions.

- Segmentation: Differentiates casual buyers and high-frequency shoppers

- Upselling: Encourages premium brands and higher-ticket items

- Cross-selling: Home, furniture, electronics, and lifestyle bundles

- Dynamic Pricing: Seasonal and demand-based pricing strategies

- Retention Monetization: Loyalty programs and financing options

- LTV Optimization: Personalization and recommendation engines

- Psychological Pricing: Monthly installment framing boosts conversion

These strategies significantly increase average order value and repeat purchase rates.

Cost Structure & Profit Margins

Infrastructure Costs

Warehouses, logistics centers, cloud infrastructure, and returns handling.

Customer Acquisition & Marketing

Search ads, TV campaigns, brand partnerships, and performance marketing.

Operations

Customer support, seller onboarding, fraud prevention, returns processing.

R&D

AI recommendations, seller tools, logistics optimization, fintech products.

Unit Economics

- Lower margins on retail inventory

- Higher margins on ads, commissions, and services

Profitability Path

Otto improves margins by shifting revenue from inventory-heavy retail toward platform services.

Read More: Best Otto Clone Script 2025 | Launch Your E-commerce Marketplace

Future Revenue Opportunities & Innovations

- Expansion of marketplace seller ecosystem

- AI-driven personalization and pricing engines

- Growth of retail media advertising

- Fintech-led buyer and seller financing

- Cross-border marketplace expansion

Risks & Threats

- High return rates

- Intense competition from Amazon

- Logistics cost inflation

Opportunities for Founders

- Vertical-specific marketplaces

- Regional commerce platforms

- Marketplace + logistics hybrid models

Lessons for Entrepreneurs & Your Opportunity

What Works

- Hybrid retail + marketplace model

- Strong logistics infrastructure

- Multiple monetization layers

What to Replicate

- Commission-based marketplace

- Advertising revenue

- Fulfillment services

Market Gaps

- Niche product verticals

- Faster seller onboarding

- Local-first marketplaces

Founder Improvements

- Leaner operations

- Category focus

- Faster go-to-market execution

Want to build a platform with Otto’s proven revenue model?

Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Otto-style marketplace solutions come with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Otto clearly shows that modern e-commerce success goes far beyond selling products. The strongest advantage comes from building a platform where services, data, logistics, and seller enablement work together to create consistent revenue.

For founders working with Miracuves, the Otto model serves as a practical blueprint for launching scalable marketplaces with multiple monetization layers. By combining marketplace commissions, advertising, fulfillment, and value-added services, entrepreneurs can reduce risk, improve margins, and build long-term, resilient digital businesses.

FAQs

1. How much does Otto make per transaction?

Through product margins, commissions, and service fees.

2. What’s Otto’s most profitable revenue stream?

Advertising and marketplace commissions.

3. How does Otto’s pricing compare to competitors?

Competitive on products, stronger on backend monetization.

4. What percentage does Otto take from sellers?

Typically between 7% and 25% depending on category.

5. How has Otto’s revenue model evolved?

From catalog retail to a full-scale digital marketplace.

6. Can small platforms use similar models?

Yes, especially in niche or regional markets.

7. What’s the minimum scale for profitability?

Thousands of monthly transactions with service revenue.

8. How to implement similar revenue models?

Combine commissions, ads, and fulfillment services.

9. What are alternatives to Otto’s model?

Subscription commerce or direct-to-consumer platforms.

10. How quickly can similar platforms monetize?

With the right setup, monetization can begin within weeks of launch.