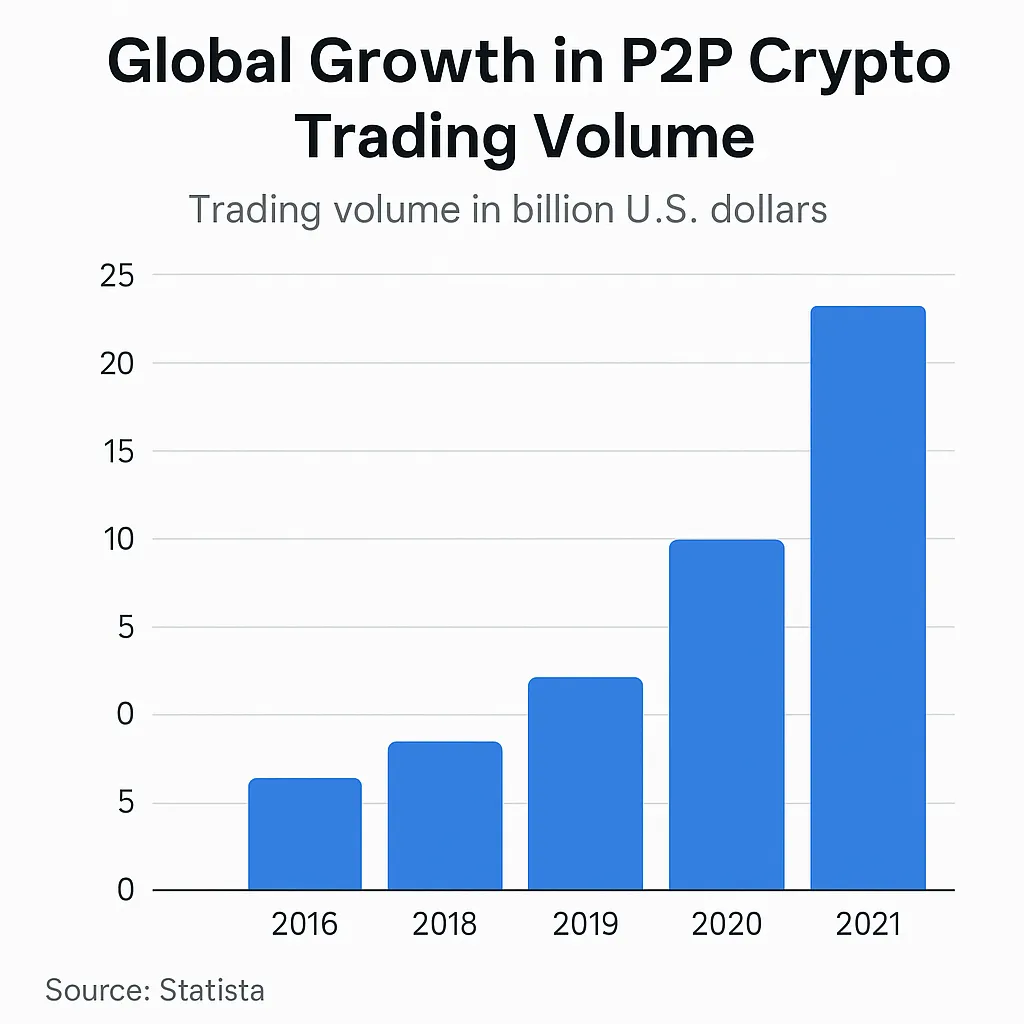

Let’s be real—building a peer-to-peer crypto app isn’t just another walk in the dev park. One minute you’re dreaming of being the next Binance or LocalBitcoins, the next you’re knee-deep in budget spreadsheets, trying to figure out whether a secure KYC module is worth skipping your next coffee machine upgrade. Entrepreneurs and startup founders know this feeling all too well: the itch to launch fast, cheap, and loaded with features… until reality taps you on the shoulder with a budgetary slap.

Just last week, a creator buddy of mine asked me, “Should I splurge on advanced wallet integration or go lean and launch early?” That, right there, is the million-dollar question. P2P crypto marketplace apps are like Teslas—cool, futuristic, and expensive if you’re not careful. What you need is clarity—what’s essential, what’s nice-to-have, and what’ll burn your pocket for no real gain.

This is where Miracuves quietly enters the chat. We’ve been helping innovators like you avoid money pits and focus on performance-first crypto platforms that scale. Let’s break down how to strike that oh-so-tricky balance between costs and killer features.

Why P2P Crypto Apps Aren’t Your Average Marketplace

Peer-to-peer crypto exchange apps operate in a volatile, high-stakes arena. Unlike traditional eCommerce or ride-sharing platforms, these apps require military-grade security, instant data processing, and airtight compliance.

The Stakes Are Higher Than You Think

- Real-time transactions: Crypto doesn’t sleep. Your platform needs to be 24/7 reliable—think WhatsApp reliability with PayPal-level security.

- Security expectations: Between SIM-swaps and phishing attacks, your app must outsmart hackers constantly.

- Regulatory heat: From KYC (Know Your Customer) to AML (Anti-Money Laundering), regulations vary across countries. Compliance is non-negotiable.

Read more: How to Develop a P2P Cryptocurrency Marketplace App

Core Features That You Can’t Afford to Skip

Before we talk numbers, let’s align on essentials. These are your “non-negotiables” if you want to build user trust and avoid a Reddit scandal.

1. Secure Wallet Integration

Think of it as the heartbeat of your app. Whether you’re working with hot wallets, cold wallets, or both—your users need easy access, airtight encryption, and fast transaction capability.

2. KYC & AML Compliance Module

You might want to skip this to save cash, but spoiler alert: it’ll cost you more in fines and trust later. Automating ID verification and transaction tracking is an investment, not an expense.

3. Smart Contract-Based Escrow

Escrow systems reduce fraud by ensuring both parties hold up their end of the bargain before funds are released. Smart contracts make this transparent, immutable, and fast.

4. Multi-Currency Support

Bitcoin, Ethereum, USDT, Solana—users love options. Your system should allow for flexibility, both for deposits and withdrawals.

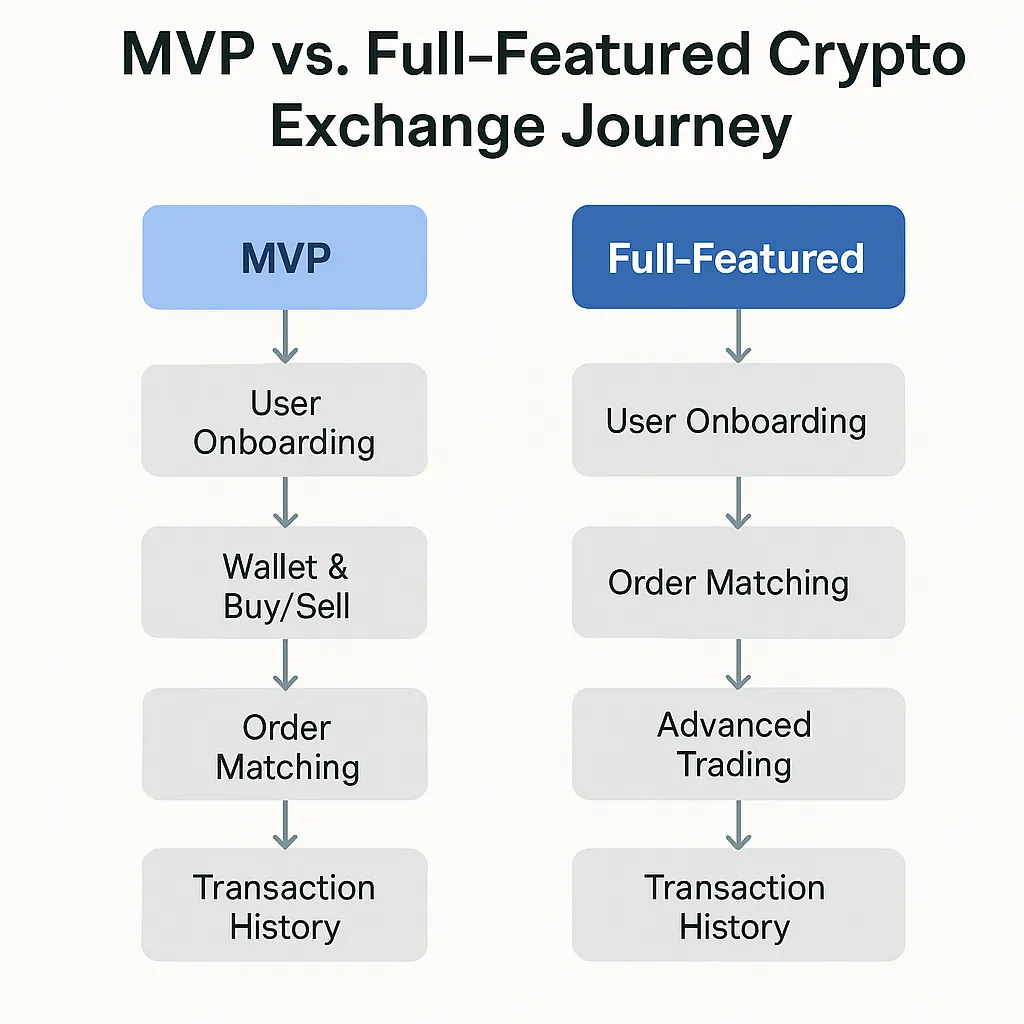

The “Nice-to-Haves” That Can Wait… For Now

When your MVP (Minimum Viable Product) is taking shape, you don’t need to go full Web3 wizard right away. Here’s what you can postpone:

1. Custom Avatars & User Themes

While fun, these don’t impact functionality. Focus on performance and clean UX instead.

2. In-App Chat with Emojis & Stickers

Basic messaging? Yes. GIF wars? Maybe later.

3. Gamification Modules

Leaderboards and referral bonuses can be bolted on later. First, win trust, then add flair.

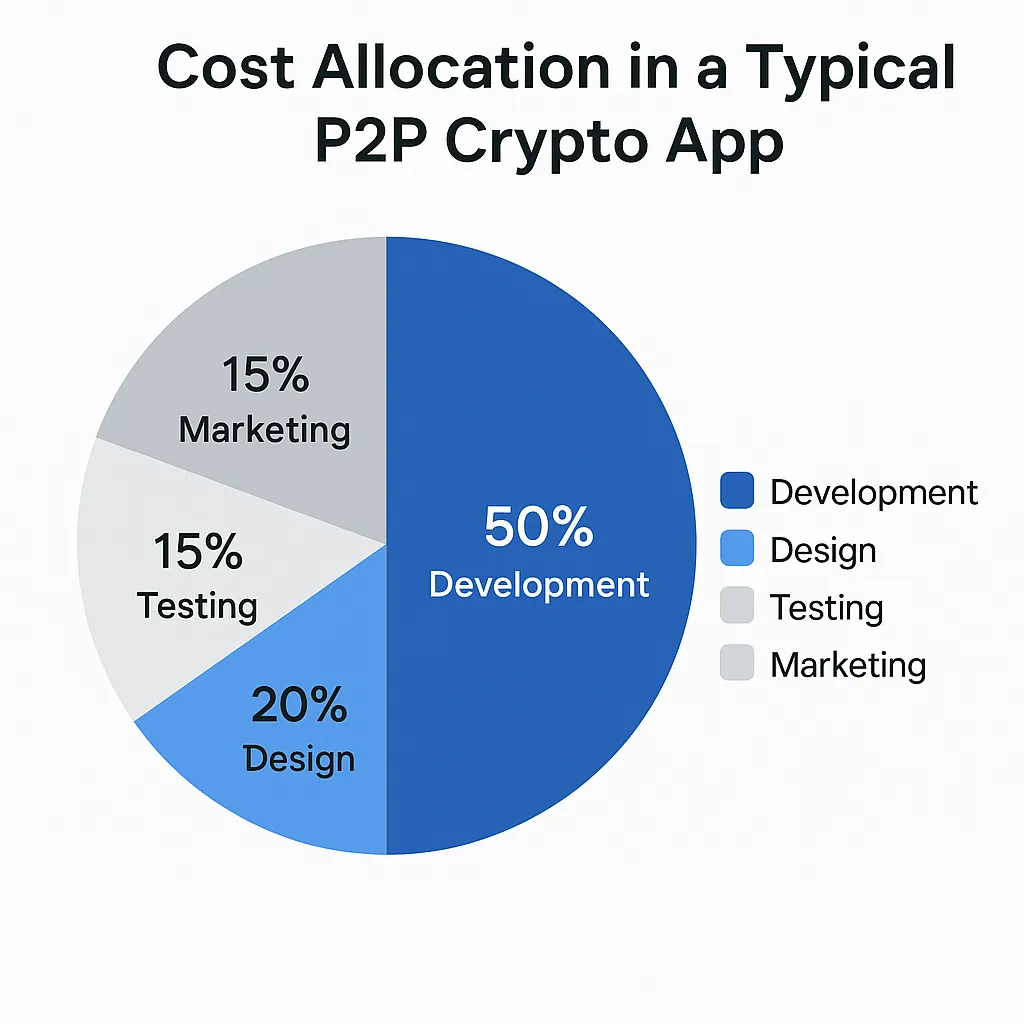

Cost Breakdown: What You’re Really Paying For

Here’s a ballpark estimate of where your development budget goes when building a P2P crypto exchange app:

| Feature/Functionality | Estimated Cost (USD) |

| Wallet Integration | $8,000 – $20,000 |

| KYC/AML Compliance | $5,000 – $12,000 |

| Escrow via Smart Contracts | $6,000 – $15,000 |

| Admin Panel | $4,000 – $8,000 |

| UI/UX Design | $3,000 – $7,000 |

| Basic P2P Trading Engine | $10,000 – $25,000 |

| Testing & QA | $2,000 – $5,000 |

| Deployment & Support | $3,000 – $6,000 |

Read more: Developing Revenue Model for P2P Bitcoin Trading Marketplace App

Cost-Saving Tips Without Sacrificing Functionality

Use Clone Scripts Wisely

Not all clone scripts are created equal. Opt for ones built with scalability and modularity in mind. For example, a Paxful clone by Miracuves can slash development time in half and still offer room for customization.

Go Open Source (With Caution)

Integrating open-source blockchain libraries like Web3.js or Ethers.js can help reduce dev time. But beware—community support doesn’t replace professional security audits.

Modular Build Approach

Instead of building one massive app, build it in chunks:

- Phase 1: MVP with core trading & wallet

- Phase 2: Compliance add-ons

- Phase 3: UX goodies & gamification

Feature Creep: The Silent Budget Killer

It’s tempting to keep saying “just one more feature,” especially when investors are watching or FOMO kicks in. But every “small” addition could mean weeks of dev time and mountains of bugs.

Stick to what makes your app usable, not “cool.”

The Future-Proofing Play: Scale When You’re Ready

Your first version doesn’t need to support 10M users. But it should be designed with scalability in mind:

- Use containerization (Docker, Kubernetes)

- Modular codebase (Laravel, Node.js with microservices)

- Cloud deployment (AWS, GCP, Azure)

CB Insights reports that 70% of startups fail due to premature scaling. Don’t be a statistic.

Looking to enter the decentralized trading space? Explore our customizable P2P exchange script solutions to launch your own secure crypto platform.

Conclusion

So, where do you draw the line? Between your wallet and your wishlist. Prioritize security, user trust, and essential functionality. Add the glitter once the foundation’s rock solid.

The crypto market waits for no one—but that doesn’t mean you rush in blind. Start smart, iterate wisely.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q:1 What’s the average cost to develop a P2P crypto app?

You’re looking at anywhere from $30,000 to $100,000 depending on complexity, features, and region of your development team.

Q:2 Is it better to build from scratch or use a clone script?

If speed, cost-efficiency, and a proven model appeal to you, go with a clone. Custom builds offer more flexibility but come at a higher price.

Q:3 How do I ensure my app stays compliant across countries?

Use modular compliance systems and integrate third-party KYC/AML providers like Jumio or ShuftiPro. Laws change—modularity is your friend.

Q:4 Which blockchain is best for a P2P crypto marketplace?

Ethereum is popular due to its mature ecosystem, but BNB Chain and Polygon offer lower fees and faster transactions. Choose based on your app’s use case.

Q:5 Can I start with just Bitcoin support and expand later?

Absolutely. Start lean with top coins and expand based on user demand. Multi-coin support can be integrated later.

Q:6 How long does it take to launch a functional MVP?

With the right tech partner (ahem, Miracuves), you could go live in 6–10 weeks with an MVP focused on core trading and wallet functionality.

Related Articles: