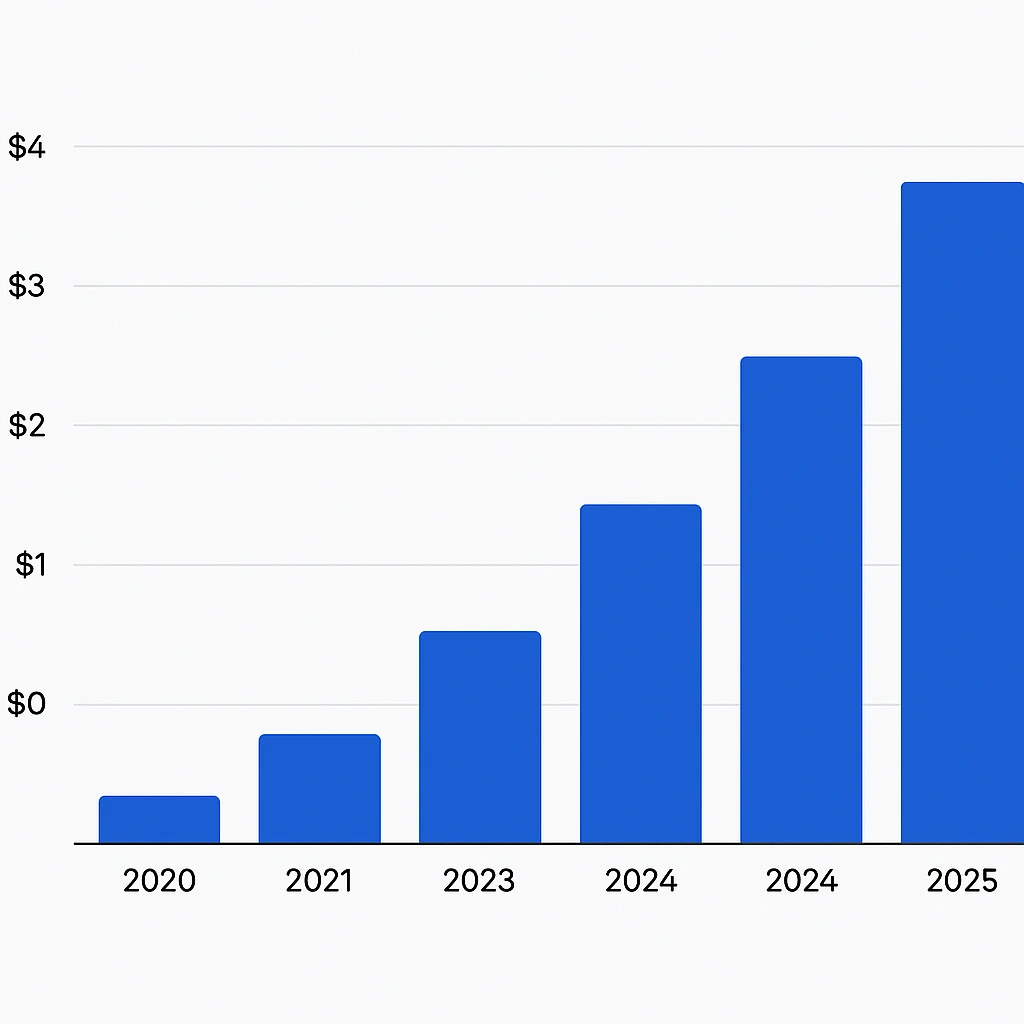

P2P exchange platforms earned $3.8 billion in revenue in 2025, largely by monetizing every completed trade — without owning or storing any crypto themselves. Instead of acting as a custodian, the platform simply facilitates direct peer-to-peer transactions, using escrow logic, fee mechanisms and tier-based seller models to generate profit instantly.

Why It Matters

Entrepreneurs are choosing the P2P exchange model because it scales quickly, works in regions with weak banking infrastructure, and doesn’t require liquidity pools or token reserves. With the right fee structure and escrow system, a P2P platform can start earning from Day 1, even with a small user base. This makes it one of the most accessible and resilient business models in the Web3 ecosystem — ideal for first-time founders and niche-market platforms.

P2P Exchange – Revenue Overview (2025)

The P2P exchange model exploded due to rising crypto adoption & stricter regulations on centralized exchanges. Platforms like Binance P2P, OKX P2P, Paxful, LocalBitcoins processed millions of trades via escrow-backed peer-to-peer logic.

2025 Financial Overview

- Total estimated revenue: $3.8B+

- Average profit margin: 40–58%

- Global valuation: $14B+

- Most active regions: Asia, Africa & Latin America

- Year-over-year growth: 62%

Revenue Share by Region (2025)

| Region | Share |

|---|---|

| Asia | 38% |

| North America | 22% |

| Europe | 19% |

| Africa | 15% |

| Others | 6% |

The model works because platforms charge fees per trade + premium seller tiers + escrow release charges while keeping cost structure relatively stable.

Read More: The Future of P2P Crypto Exchange Apps: Trends to Watch in 2025 and Beyond

Deep Dive – Main Revenue Streams

| Revenue Stream | % Share (Avg 2025) | Explanation |

|---|---|---|

| Trading Fees | 30% | 0.5%–2% per trade |

| Escrow Release Fee | 20% | Charged when trade is completed |

| Spread Profit | 15% | Difference between buy/sell rates |

| Premium Seller Accounts | 12% | Monthly subscription tiers |

| Ads & Promotions | 10% | Listing boost, sponsored sellers |

| KYC/Verification Fee | 7% | Document processing fees |

| Additional Services | 6% | API access, brokerage services |

Detailed Breakdown

1. Trading Fees – Core Revenue Source

Every trade triggers percentage-based charges on either seller or both parties.

2. Escrow Release Fee

A fixed % charged when escrow is unlocked — $3–$30 per transaction average.

3. Tier-Based Seller Accounts

Top sellers pay monthly subscriptions for faster visibility & higher buyer trust.

4. Spread Earnings

Platforms profit from subtle buy/sell price differences — especially for fiat trades.

5. Ad & Promotional Fees

Featured seller placement + search boost visibility generates steady recurring income.

The Fee Structure Explained

| User Type | Fee Type | Avg. Charge |

|---|---|---|

| Buyers | Minimal or zero | Incentivized onboarding |

| Sellers | Trading fee + escrow release | 0.5%–2.5% |

| VIP Sellers | Monthly subscription | $49–$299 |

| International Traders | Higher KYC/AML fee | $30–$150 |

| Brokerage Firms | API usage fee | $200–$700/month |

Hidden Fees

- KYC acceleration fee

- Fraud protection package

- Cross-border transaction fee

- Premium dispute resolution

Regional Pricing Reality

Africa & Latin America see highest profit margins due to inflation-based pricing patterns.

How P2P Exchanges Boost Revenue Per User

P2P exchanges use strong LTV optimization strategies:

- AI-based trader categorization

- Dynamic fee charging

- Frequent trader subscription packs

- Verified seller badge upselling

- Fiat → crypto conversion fee

- Loyalty reward systems

- Behavior-based upselling

- Escrow-based lock-in strategies

Retention + trust = higher transaction volume → automatically higher revenue.

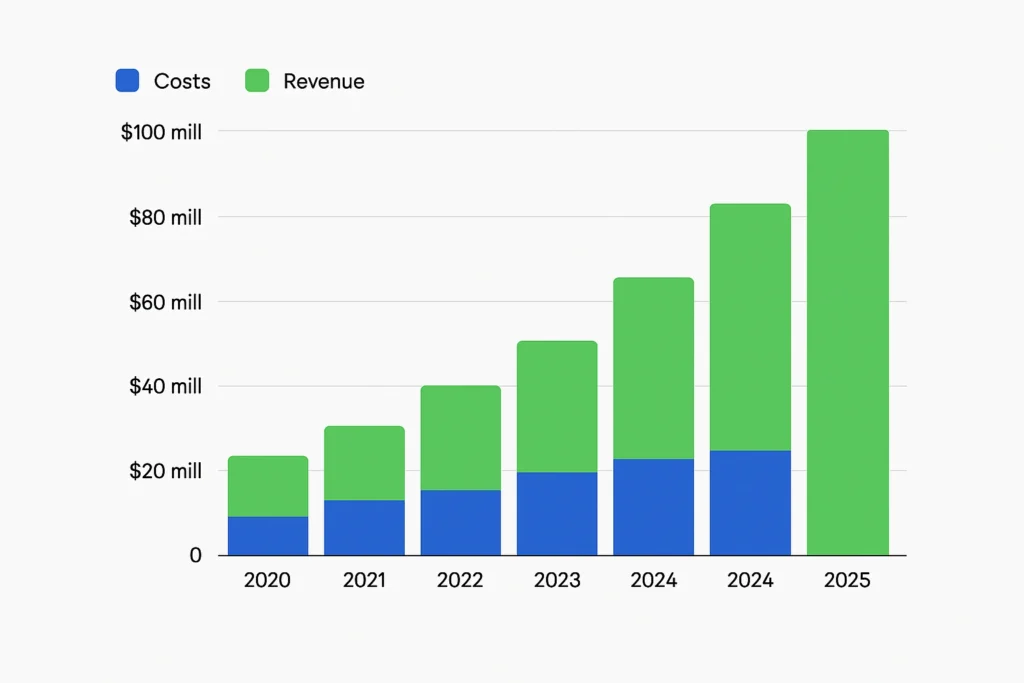

Cost Structure & Profit Margins

| Cost Component | Avg. Cost Share |

|---|---|

| Tech infra & ops | 30% |

| Legal compliance | 15% |

| User acquisition | 25% |

| Escrow security | 10% |

| R&D | 8% |

| Others | 12% |

Unit Economics (2025)

- Avg. CAC: $40–$65

- Avg. LTV: $450–$820

- Profit margins rise after 12,000+ monthly active users

As KYC tech becomes cheaper, profit margins are projected to rise 8–12% by 2027.

Read More: LocalBitcoins Features List: Key Tools That Built Trust

Future Revenue Opportunities (2025–2027)

Emerging Monetization Paths

- AI-based escrow decision engine

- Blockchain identity verification APIs

- Regulated P2P platforms for banks & fintechs

- Tokenized fiat assets

- Launch of P2P as a Service (P2PaaS)

- Biometric ID-based escrow models

- Lending & credit services for traders

Major Threats

- Regulation & taxation

- Lack of dispute mechanisms

- API vulnerabilities

- AI-based scams

Opportunity exists for region-specific & compliance-first P2P platforms.

Entrepreneur Lessons & Your Opportunity

What Works

- Every trade is revenue

- No liquidity pool required

- Viral community marketing

- Marketplace-style expansion

Gaps You Can Capture

- Local-language P2P exchanges

- Women-focused crypto markets

- Crypto ⇆ fiat lending systems

- Government-compliant KYC hubs

Want to build a P2P exchange with a proven revenue model? Miracuves helps entrepreneurs launch scalable P2P platforms with built-in escrow systems, AI verification tools & powerful monetization layers. Our P2P Exchange Script Clone comes with flexible fee controls, dynamic pricing & multi-chain support. Some clients generate revenue in under 30 days — and Miracuves delivers ready-to-launch solutions in 3–9 days guaranteed. If you want advanced AI-driven fee engines or region-based pricing logic, Miracuves will provide that too. Book a free consultation to map your revenue model today.

Final Thought

P2P Clone Script exchanges are among the few business models where revenue grows alongside user activity — the more people trade, the more the platform earns. With dynamic fee models, tier-based seller systems and strong compliance frameworks, scaling becomes systematic and predictable. As regulatory frameworks tighten in 2025 and beyond, platforms that combine trust, security and localized positioning will dominate niche markets and build sustainable revenue faster than traditional exchanges.

FAQs

1. How much does a P2P exchange earn per trade?

Around 0.5%–2.5% of the total transaction.

2. What is the most profitable revenue stream?

Escrow fee + premium seller subscriptions.

3. What percentage is taken from providers?

1% on average + tier-based fees.

4. Can this be started in small regions?

Yes — regional exchanges are trending in 2025.

5. How quickly can it turn profitable?

Break-even can happen with 12–15k active users.

6. Do small platforms benefit from this model?

Absolutely — success depends on niche positioning.

7. How to implement similar models?

Use escrow logic + dynamic fee structures + KYC flow.

8. What are alternatives to this model?

Hybrid exchanges, DeFi P2P, NFT marketplaces.

9. How much can sellers earn?

Verified sellers see 3× higher conversion rates.

10. Can Miracuves help with launching one?

Yes — ready-to-launch P2P exchange scripts with customizable revenue engines are available from Miracuves, and you can launch in just 3–9 days with guaranteed delivery.