In India, Policybazaar didn’t win because it “sold insurance.” It won because it made insurance feel like e-commerce: compare, understand, buy, and manage—without endless calls, paperwork, or confusion. That shift is now measurable in business outcomes. In Q4 FY25, PB Fintech (Policybazaar’s parent) reported revenue from operations of ₹1,508 crore and net profit of ₹171 crore—proof that an insurance marketplace model can scale with strong unit economics when trust and distribution click.

For entrepreneurs planning an InsurTech launch in 2026, the lesson is simple: people don’t want “more policies,” they want better decisions. That’s why Policybazaar Clone Script are expanding beyond just comparison into renewals, claims assistance, personalization, and cross-sell. PB Fintech’s FY25 net profit reportedly rose to ₹353 crore with margin improvement—signals of a maturing, profitability-focused phase for this category.

At Miracuves, we approach Policybazaar Clone Development as a startup build, not a template sale: performance-first architecture, compliance-aware workflows, and revenue-ready modules—so you can ship faster, learn faster, and scale confidently with Miracuves Clone Solutions.

What Makes a Great Policybazaar Clone?

Building a Policybazaar clone in 2026 is not about copying an insurance comparison website. It is about designing a high-trust, high-performance InsurTech marketplace that removes friction from decision-making while handling sensitive data at scale. Entrepreneurs who succeed in this space understand that insurance buyers expect the same speed, clarity, and personalization they get from fintech and e-commerce apps.

A great Policybazaar clone starts with performance and reliability. Insurance comparisons happen in real time, often pulling data from multiple insurers, underwriting engines, and pricing APIs. In 2026, users expect pages to load instantly, quotes to refresh dynamically, and transactions to complete without delays. From a technical perspective, this means an average response time under 300ms, API failover handling, and 99.9% uptime to ensure credibility during peak traffic like renewal seasons.

Equally important is trust-driven UI/UX. Insurance is complex by nature, so the interface must simplify rather than overwhelm. Clear benefit breakdowns, premium transparency, comparison sliders, and AI-assisted recommendations are no longer optional. A great clone educates users subtly while guiding them toward confident purchases. Miracuves focuses heavily on conversion-optimized UX flows that reduce drop-offs at quote, KYC, and payment stages.

From a business lens, monetization readiness defines greatness. The most successful Policybazaar-style platforms earn through commissions, lead referrals, renewal incentives, cross-sell of add-ons, and white-label B2B integrations. Your clone must support flexible revenue logic from day one, not as an afterthought. Miracuves Clone Solutions are built with modular monetization layers that adapt as your partnerships grow.

What Defines a Great Policybazaar Clone in 2026

After understanding the fundamentals, these are the non-negotiables that separate high-performing platforms from average ones:

- Scalable cloud architecture capable of handling sudden traffic spikes during policy renewal windows

- AI-powered comparison engines that rank policies based on user intent, not just price

- Regulatory-aware workflows for KYC, data storage, and consent management

- Cross-platform compatibility across web, Android, and iOS with a single backend

- Advanced analytics dashboards for tracking CAC, LTV, and insurer conversion rates

Must-Have Technology Layers in Modern Policybazaar Clones

A future-ready clone integrates emerging technologies that increase efficiency and transparency:

- AI automation for lead scoring, policy recommendations, renewal reminders, and upsell logic

- Blockchain transparency for tamper-proof policy records and claims verification logs

- Cross-platform API integration with insurers, payment gateways, CRM tools, and compliance services

- Data security layers including AES-256 encryption, tokenized payments, and role-based access control

Modern Policybazaar Clone Comparison

| Capability Area | Standard Clone | Advanced 2026 Clone (Miracuves) |

|---|---|---|

| Quote Response Time | 700–900ms | Under 300ms |

| Uptime SLA | 98% | 99.9% |

| Personalization | Rule-based | AI-driven recommendations |

| Compliance Handling | Manual | Automated & audit-ready |

| Monetization Flexibility | Limited | Multi-channel & modular |

| Scalability | Regional | Global multi-tenant |

In short, a great Policybazaar clone behaves less like a comparison site and more like a decision-intelligence platform. This is where Miracuves stands apart. Our Policybazaar Clone Development approach blends technical depth, compliance awareness, and revenue strategy so founders don’t just launch fast—they launch strong.

Essential Features Every Policybazaar Clone Script Must Have

A successful Policybazaar clone in 2026 is built around one core idea: making complex insurance decisions feel simple, secure, and personalized. Entrepreneurs often underestimate how many functional layers are required to deliver this experience at scale. The strongest platforms balance user convenience with backend intelligence and partner enablement.

At Miracuves, Policybazaar Clone Development starts by mapping the full insurance lifecycle—from discovery and comparison to purchase, renewal, and claims assistance. Each user type interacts with the platform differently, and your feature stack must reflect that reality.

User-Side Features: Experience, Convenience, Retention

From the customer’s perspective, the platform must reduce confusion and friction at every step. In 2026, users expect more than just price comparison; they expect guidance.

Core user-side capabilities include smart onboarding with minimal data input, real-time policy comparison across multiple insurers, AI-based recommendations tailored to age, location, income, and risk profile, and seamless digital KYC. Advanced clones also offer policy wallets, renewal alerts, claims status tracking, and personalized cross-sell suggestions. These features directly improve retention and lifetime value while building long-term trust.

Admin Panel Features: Control, Analytics, Automation

For founders and operations teams, the admin dashboard is the command center. A great Policybazaar clone provides full visibility into platform performance, insurer partnerships, user behavior, and revenue flows.

Admins need tools for insurer onboarding, commission configuration, policy approval workflows, lead distribution rules, and real-time analytics. Automation plays a big role in 2026—AI-assisted fraud detection, smart lead routing, and automated compliance checks reduce manual effort and operational risk. Miracuves integrates advanced reporting that tracks conversion funnels, CAC, LTV, and renewal ratios in one unified view.

Insurer / Agent Side Features: Enablement & Performance

Insurance providers, agents, or brokers using your platform need tools that help them close deals faster and manage customers efficiently.

Key features include real-time lead notifications, quote management dashboards, earnings and commission reports, AI recommendations on high-intent leads, and communication tools. For enterprise-grade clones, blockchain-based policy verification and digital document management add another layer of transparency and trust.

Advanced 2026 Features That Drive Competitive Advantage

To stand out in crowded InsurTech markets, modern Policybazaar clones increasingly rely on next-gen capabilities:

- AI-based personalization for smarter comparisons and upselling

- AR-assisted onboarding to explain policy benefits visually

- Blockchain verification for immutable policy and claim records

- Predictive analytics for renewal likelihood and churn prevention

- Voice and chat AI for instant insurance support

Technical Architecture Requirements

Behind the scenes, the platform must be engineered for scale and security. A robust Policybazaar clone uses microservices architecture, auto-scaling cloud infrastructure, secure API gateways, and load balancers capable of handling millions of quote requests. Data security is enforced through multi-layer authentication, encrypted storage, and compliance-ready audit logs. Third-party integrations typically include insurers, payment gateways, KYC providers, CRM tools, and analytics platforms.

Feature Comparison: Basic vs Professional vs Enterprise Policybazaar Clone

| Feature Layer | Basic | Professional | Enterprise |

|---|---|---|---|

| User Comparison Engine | Basic filters | AI-powered | AI + predictive |

| Admin Analytics | Limited | Advanced dashboards | Real-time BI |

| Insurer Integrations | 5–10 | 20+ | Unlimited |

| Security & Compliance | Standard | Enhanced | Enterprise-grade |

| Scalability | Regional | Multi-region | Global |

| Customization | Minimal | Moderate | Full white-label |

How Miracuves Implements These Features

Miracuves Clone Solutions are built with modular architecture, allowing entrepreneurs to start lean and scale fast within 30–90 days. Every Policybazaar clone we deliver includes performance optimization, security best practices, and future-ready extensibility. Whether you are targeting a regional market or planning a global InsurTech rollout in 2026, Miracuves ensures your platform is ready for growth from day one.

Cost Factors & Pricing Breakdown

Policybazaar-Like Insurance Aggregator Development — Market Price

| Development Level | Inclusions | Estimated Market Price (USD) |

|---|---|---|

| 1. Basic Insurance Comparison MVP | User onboarding, insurance product listings, premium comparison, lead capture forms, admin dashboard, basic analytics | $40,000 – $60,000 |

| 2. Mid-Level Insurance Aggregator Platform | Multi-insurer onboarding, quote engine, policy comparison logic, CRM integration, analytics dashboard, payment gateway, email/SMS automation | $100,000 – $150,000 |

| 3. Advanced Policybazaar-Level Platform | Real-time insurer APIs, dynamic pricing engine, underwriting workflows, claims management, AI-based recommendations, compliance modules, scalable cloud infrastructure | $250,000+ |

Policybazaar-Style Platform Development

The prices above reflect the global market cost of building an insurance aggregation and comparison platform like Policybazaar.

Such platforms typically require deep integrations with insurers, complex pricing logic, regulatory compliance, and scalable backend systems — resulting in development cycles of 6–12 months and six-figure budgets.

Miracuves Pricing for a Policybazaar-Like Platform

Miracuves Price: Starts at $15,999

This solution is developed as a custom JavaScript-based insurance aggregation platform, designed for scalability, security, and high-performance quote comparison. It includes customer onboarding, insurer management, comparison logic, admin controls, analytics, and extensible architecture for future integrations.

Note:

This includes full non-encrypted source code, complete deployment support, backend setup, API integrations, admin panel configuration, and publishing support for Google Play Store and Apple App Store — ensuring you receive a fully operational ecosystem ready for launch and future expansion.

Delivery Timeline for a Policybazaar-Like Platform with Miracuves

A typical delivery timeline is 30–90 days, depending on:

- Number of insurance categories (health, life, motor, travel, etc.)

- Complexity of quote & comparison logic

- Third-party insurer API integrations

- Compliance & data security requirements

- UI/UX customization level

- CRM, analytics, and automation workflows

Tech Stack

We preferably use JavaScript for building the entire solution — leveraging Node.js / Next.js, PostgreSQL, and Flutter or React Native for mobile apps.

This ensures speed, scalability, and a unified codebase across platforms. Other tech stacks can be discussed and arranged upon request.

Read More : What is Policybazaar and How Does It Work?

Customization & White-Label Options

Launching a Policybazaar-style insurance marketplace requires far more than a basic lead-capture website. Insurance buyers expect instant quotes, clean comparisons, trusted checkout, secure document handling, and clear policy issuance—meaning your platform must reflect strong branding, optimized UI/UX, and compliance-ready operational logic. Customization is essential to stand out in a competitive digital insurance landscape.

Our fully white-label Policybazaar-style solution can be tailored to your brand identity, insurance product mix, underwriting flows, partner insurer integrations, and scalability goals. Whether you’re building a direct-to-consumer aggregator, an agent-led distribution platform, or an embedded insurance layer for fintech/ecommerce, the system can be customized to match your exact operating model.

Why Customization Matters

Insurance marketplaces depend on accuracy, compliance, trust, and conversion. Businesses often need:

- Mobile-first UI/UX optimized for fast plan discovery & comparison

- Rule-based quote generation, eligibility checks & smart sorting

- Multi-insurer integrations for quote, proposal, issuance & policy PDFs

- KYC/CKYC flows, document capture, and e-sign / consent journeys

- Product-specific questionnaires (Health/Motor/Life/Travel) and add-on logic

- Premium breakdowns (taxes, discounts, riders) with transparent pricing

- Renewal, endorsement, and claims-assistance workflows

- Role-based admin controls for commissions, agents/partners, and reporting

Customization ensures your Policybazaar-style platform delivers a smooth, trustworthy, and high-conversion customer experience.

What You Can Customize

UI/UX & Branding

Custom themes, color palettes, comparison tables, filters, product cards, trust blocks, and landing pages built for insurance conversion.

Operational Workflow Enhancements

Lead routing, assisted buying flows, call-center/agent assignment logic, document verification pipelines, and SLA-based follow-ups.

Feature-Level Upgrades

Smart recommendations, plan shortlisting, quote caching, renewal automation, claims initiation flows, and advanced search & filtering.

Product Structure Adaptation

Support for Health, Motor, Term Life, Travel, SME/commercial lines—each with unique underwriting questions, add-ons, and exclusions.

Full White-Label Branding

Custom domain, logo, fonts, email/SMS templates, policy templates, and fully white-labeled web + app interfaces (consumer + partner).

Backend Integrations

Insurer APIs, payment gateways, KYC/CKYC, e-sign providers, CRM systems, analytics dashboards, WhatsApp/SMS, and marketing automation.

Monetization Add-Ons

Commission management, partner slabs, featured plan placements, lead marketplace options, referral programs, cross-sell bundles, and campaign tools.

How We Handle Customization

- Requirement Analysis

Understanding your product mix, distribution model (D2C/agent/embedded), compliance needs, and insurer integration roadmap. - Sprint Planning

Every customization request is structured into predictable micro-sprints with milestone-based delivery. - Design & Development

UI/UX improvements, quote logic, underwriting flows, insurer API integrations, and partner/admin modules built to match your blueprint. - Testing & QA

Ensuring quote accuracy, integration reliability, data security, performance, and stable policy issuance workflows. - Deployment

Your fully branded, white-label platform goes live with consumer app/web + partner/agent portal + admin dashboards + reporting.

Real Examples for a Policybazaar-Style Platform

Typical rollouts and configurations include:

- Health insurance comparison + assisted buying with agent/call-center workflows

- Motor insurance quotes with RC upload, add-ons, and instant policy issuance

- Term life marketplace with underwriting questionnaire + eKYC + e-sign checkout

- Partner/PoSP portal with commission slabs, lead distribution, and performance dashboards

- Embedded insurance journeys for fintech/ecommerce checkouts (API-first flows)

Launch Strategy & Market Entry

Launching a Policybazaar clone in 2026 is less about code and more about execution. Even the most feature-rich InsurTech platform will struggle without a clear go-to-market plan. Successful founders approach launch like a mentor-guided rollout, balancing speed, compliance, and early traction.

At Miracuves, we help entrepreneurs think beyond deployment and focus on sustainable market entry.

Pre-Launch Checklist for Policybazaar Clones

Before going live, every detail matters:

- End-to-end testing across user, admin, and insurer flows

- Compliance validation for KYC, data storage, and consent

- App store setup for Android and iOS with optimized descriptions

- Load testing to handle peak quote requests

- Marketing asset preparation including landing pages and onboarding content

This structured preparation minimizes post-launch surprises and builds credibility from day one.

Regional Market Entry Strategies

Insurance behavior varies by geography, and your Policybazaar clone must adapt accordingly.

In Asia, price sensitivity and mobile-first usage dominate, making localized language support and lightweight onboarding essential. MENA markets value trust and assisted buying, so agent enablement and call-back features perform well. Europe requires strict GDPR compliance and transparent data handling. In the U.S., niche focus—such as SMB insurance or usage-based policies—often outperforms broad aggregation.

Miracuves designs region-aware workflows so your platform feels native, not imported.

User Acquisition Frameworks That Work in 2026

Paid ads alone are no longer enough. High-performing Policybazaar clones combine:

- Influencer-led education campaigns that explain insurance benefits

- Referral loops rewarding renewals and policy upgrades

- Content-driven funnels focused on calculators and comparison tools

- Retention flows using AI-powered reminders and cross-sell prompts

These strategies reduce CAC while increasing lifetime value.

Proven Monetization Models

In 2026, the strongest revenue comes from diversified streams:

- Commission per policy sold

- Renewal and loyalty incentives

- Lead distribution fees from insurers and agents

- Premium listings for insurers

- Value-added services like claims assistance

Miracuves Clone Solutions are built to support all these models from launch.

Miracuves End-to-End Launch Support

Miracuves does not stop at development. Our team assists with server setup, security hardening, third-party integrations, and a structured first 90-day growth roadmap. Founders gain clarity on metrics to track, features to iterate, and partnerships to prioritize.

The result is a smoother launch, faster learning cycle, and stronger early momentum.

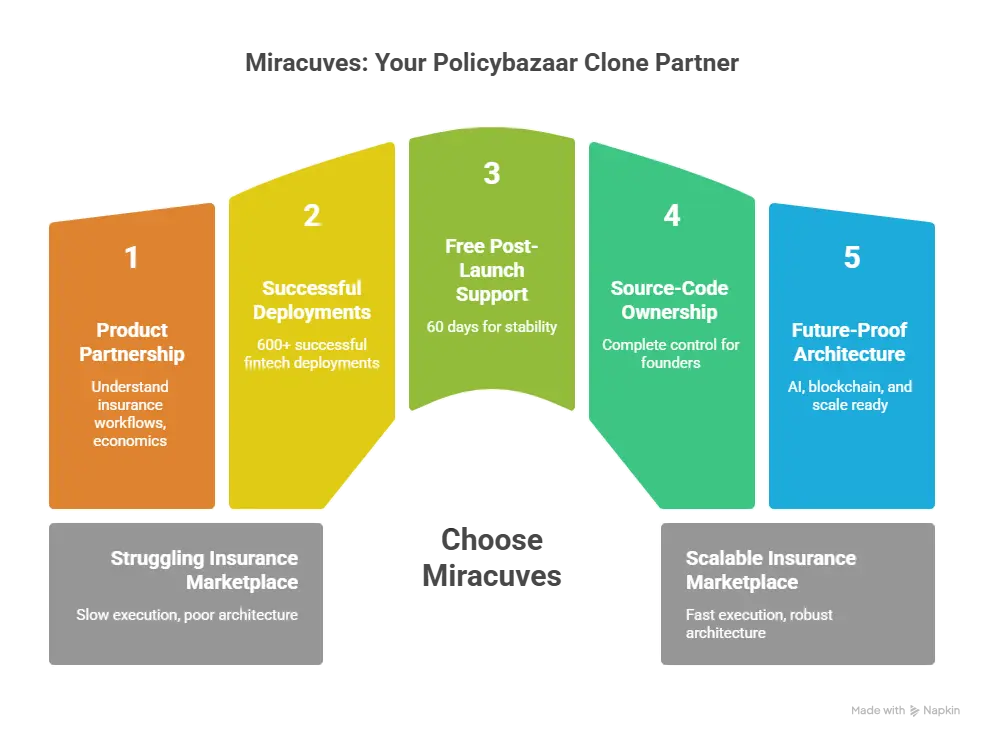

Why Choose Miracuves for Your Policybazaar Clone

Every successful InsurTech platform has a story behind it—usually one where founders chose the right technology partner early. In 2026, the difference between a struggling insurance marketplace and a scalable one often comes down to execution speed, architectural foresight, and post-launch support. This is where Miracuves consistently proves its value.

Miracuves is not just a development company. It is a product partner that understands insurance workflows, regulatory realities, and startup economics.

What Sets Miracuves Apart

Miracuves’ track record speaks directly to founder confidence:

- 600+ successful deployments across fintech, healthcare, and marketplace platforms

- 60 days of free post-launch support for stability and optimization

- 100% source-code ownership, giving founders complete control

- Future-proof architecture designed for AI, blockchain, and scale

These are not marketing promises; they are operational advantages that reduce risk.

Real Founder Transformations

One regional insurance startup in Southeast Asia launched a Miracuves-powered Policybazaar clone focused on motor and micro-health insurance. Within six months, the platform onboarded over 25 insurers and crossed its first $180K in annualized commissions.

Another fintech-led broker in the Middle East used Miracuves Clone Solutions to white-label an insurance aggregator for SMEs. By integrating renewal automation and AI lead scoring, the company reduced sales cycle time by 32% while improving conversion rates.

A third client in Africa entered the market with a niche gig-worker insurance platform. Thanks to Miracuves’ scalable architecture, they expanded into three new countries within a year without rebuilding the core system.

Why Founders Trust Miracuves

Founders choose Miracuves because the platform is built for reality, not demos. Compliance-aware flows, scalable infrastructure, and monetization-ready modules mean fewer surprises after launch. Combined with transparent pricing and hands-on guidance, Miracuves becomes an extension of the founding team.

Final Thought

Building a Policybazaar-style platform in 2026 is not about chasing a trend—it is about understanding how trust, technology, and timing intersect in insurance distribution. Policybazaar proved that when complex products are simplified, comparison becomes empowerment, and empowerment drives scale.

For entrepreneurs, the real advantage lies in decoding this business logic and applying it to focused markets where large players move slowly. With the right niche, a clear value proposition, and a scalable foundation, a Policybazaar clone can grow from MVP to a category leader within 30–90 days of launch momentum.

Miracuves Clone Solutions exist to shorten this journey. By combining proven architecture, deep customization, and launch-ready infrastructure, Miracuves enables founders to move faster, learn smarter, and scale with confidence. In a world where speed and trust define winners, the right technology partner makes all the difference.

Ready to launch your Policybazaar clone? Get a free consultation and a detailed project roadmap from Miracuves—trusted by 200+ entrepreneurs worldwide to build, scale, and win in competitive InsurTech markets.

FAQs

How quickly can Miracuves deploy my Policybazaar clone?

Miracuves can deploy and launch a fully functional Policybazaar clone within 30–90 days, including customization, integrations, compliance setup, and market-ready deployment based on your business requirements.

What’s included in the Miracuves clone package?

The package includes a complete user platform, admin dashboard, insurer or agent panel, core comparison engine, payment integration, analytics, and security layers, all optimized for 2026 InsurTech standards.

Can I get full source-code access?

Yes. Miracuves provides 100% source-code ownership, ensuring you have full control over customization, scaling, and future development without vendor lock-in.

How does Miracuves ensure scalability?

Miracuves uses cloud-native microservices architecture, auto-scaling infrastructure, and load-balanced APIs designed to handle high traffic and insurer data volumes with 99.9% uptime.

Does Miracuves assist with app store approval?

Yes. Our team supports app store and Play Store submission, compliance documentation, and technical validation to ensure smooth approval.

Is post-launch maintenance included?

Miracuves offers 60 days of free post-launch support covering bug fixes, performance tuning, and minor adjustments to ensure stability after launch.

Can Miracuves integrate custom payment gateways?

Absolutely. Miracuves Clone Solutions support global and regional payment gateways, including custom and insurer-preferred integrations.

What’s the upgrade and update policy?

The platform is built modularly, allowing seamless upgrades and feature additions without disrupting live operations. Long-term update plans are available based on your growth roadmap.

How does white-labeling work?

White-labeling includes complete branding control—logo, UI, domain, and app identity—allowing you to launch the platform as your own independent product.

What kind of ongoing support can I expect?

Beyond free support, Miracuves provides optional long-term maintenance, feature expansion, and scaling assistance, acting as a continuous technology partner as your InsurTech grows in 2026 and beyond.

Related Articles

- Best Plaid Clone Scripts 2026 – Launch a High-Compliance Open Banking API Platform with Miracuves

- Best Brex Clone Scripts 2026: Launch a Next-Gen & Expense Platform

- Best Wealthfront Clone Scripts 2025: Launch Your Automated Investing Platform Faster

- Best Afterpay Clone Scripts 2026: Launch a Powerful BNPL App for Your Fintech Startup

- Best Monzo Clone Scripts 2026: Build a Digital Banking App That Scales Globally

- Best Groww Clone Scripts 2026: Launch a Powerful Investment & Trading Platform Fast

- Best Acorns Clone Scripts 2025 – Launch Your Micro-Investing App Fast

- Best Root Insurance Clone Scripts 2025: Build a Usage-Based Insurtech Platform That Scales