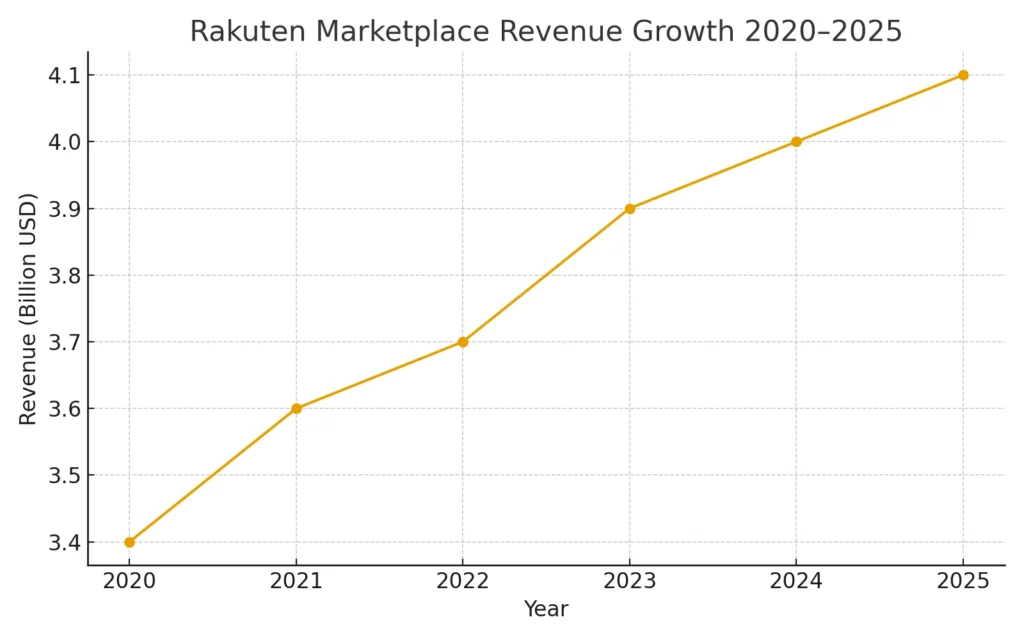

Rakuten Marketplace remains one of Japan’s most profitable e-commerce ecosystems, crossing $4.1 billion in marketplace-driven revenue in 2025. Known for its loyalty-based approach, Rakuten differentiates itself with a merchant-first, point-reward, multi-layered monetization model.

Understanding how Rakuten structures its income streams is crucial for entrepreneurs designing competitive marketplace platforms in 2025.

Its hybrid revenue architecture shows how loyalty ecosystems can multiply revenue far beyond simple commissions.

Rakuten Revenue Overview – The Big Picture

2025 Revenue (Marketplace-only): ~$4.1B

GMV (Marketplace 2025): ~$43B

Valuation (Rakuten Group): ~$10–12B

YoY Growth: ~3.4%

Region Breakdown:

- Japan: 89%

- Southeast Asia: 7%

- Other regions: 4%

Profit Margins (Net, Marketplace): ~19–22%

Competition Benchmark (2025):

- Amazon Japan: ~35% market share

- Rakuten: ~25%

- Yahoo Shopping: ~10%

- Mercari: Rising rapidly in C2C

Primary Revenue Streams Deep Dive

1. Commission Fees (Take Rate) – ~47% Share

Rakuten earns 4–15% depending on the product category.

High-margin categories like beauty, apparel, and lifestyle contribute most.

2025 estimated commission earnings: ~$1.9B.

2. Advertising (Rakuten Ichiba Ads) – ~26% Share

Rakuten’s internal ad network allows merchants to promote listings.

Both CPC and CPA models.

2025 ad revenue: ~$1.06B.

3. Subscription & Merchant Tools – ~12% Share

Monthly merchant subscription fees range from $50–$1,000.

Includes dashboards, analytics, CRM tools, and store customization.

4. Logistics, Fulfillment, and Shipping Fees – ~9% Share

Rakuten Super Logistics earns from warehousing, packing, and delivery.

Cross-border commerce is a growing revenue driver.

5. Loyalty Ecosystem Monetization – ~6% Share

Rakuten Points incentivize buyers and create repeat purchase cycles.

Merchants co-fund the loyalty payouts.

2025 revenue contribution: ~$250M.

Read More: Business Model of Rakuten : Strategy Breakdown 2025 Guide

Revenue Streams Percentage Breakdown

| Revenue Stream | % Share | 2025 Revenue |

|---|---|---|

| Commissions | 47% | $1.9B |

| Advertising | 26% | $1.06B |

| Subscriptions | 12% | $0.49B |

| Logistics & Fulfillment | 9% | $0.36B |

| Loyalty Monetization | 6% | $0.25B |

The Fee Structure Explained

User-Side Fees

Buyers rarely pay fees.

Shipping charges vary by merchant.

International buyers may pay customs handling fees.

Provider-Side (Merchant) Fees

- Commission: 4–15%

- Monthly Membership: $50–$1,000

- Payment Processing: ~2.7%

- Advertising: CPC/CPA-based

- Logistics Fees: Variable

Hidden Revenue Layers

- Escrow & payment handling fees

- Currency conversion markup

- Rakuten Points merchant contribution

- Service upgrades (analytics, CRM, premium dashboard themes)

Regional Pricing Variation

Japan has the highest take rate due to strong market loyalty and repeat purchase behavior.

Complete Fee Structure By User Type

| User Type | Fee Type | Range |

|---|---|---|

| Buyers | Shipping, Intl service | Variable |

| Merchants | Commission | 4–15% |

| Merchants | Payment Fee | ~2.7% |

| Merchants | Subscription | $50–$1000/mo |

| Merchants | Ad Spend | CPC/CPA |

| Merchants | Logistics | Variable |

How Rakuten Maximizes Revenue Per User

Segmentation

Rakuten segments into small merchants, large brands, global sellers, repeat buyers, and loyalty-driven customers.

Upselling

Premium merchant packages, analytics suites, ad slots, and extended catalog programs.

Cross-Selling

Rakuten Card, Rakuten Pay, Rakuten Travel integration, insurance bundles.

Dynamic Pricing

Personalized pricing influenced by loyalty behavior and purchase history.

Retention Monetization

The Rakuten Points economy increases purchase frequency by ~22%.

LTV Optimization

Merchants spend more on ads and tools once early ROI is proven.

Psychological Pricing

Reward-driven purchasing boosts conversions significantly.

Real Data Examples

Rakuten merchants using ads + points reported 18–25% higher GMV in 2025.

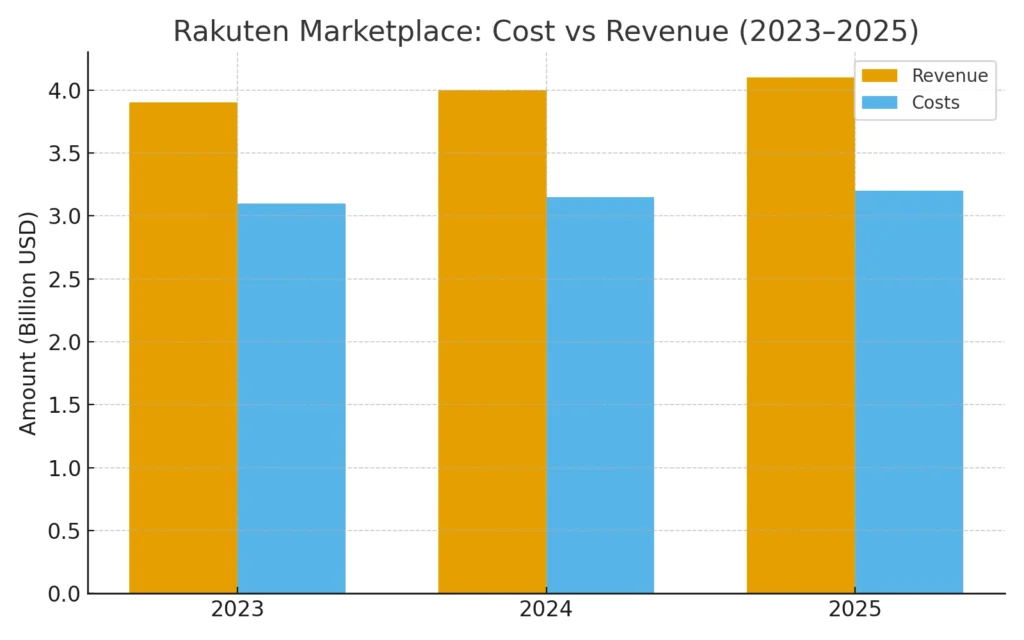

Cost Structure & Profit Margins

Infrastructure

E-commerce hosting, search, fraud prevention, loyalty computation frameworks.

CAC & Marketing

Large budgets spent on loyalty points and cross-platform branding.

Operations

Logistics, merchant support, marketplace compliance.

R&D

AI-driven product recommendations, merchant tools, and payment architecture.

Unit Economics

Marketplace operations enjoy 70–85% gross margins, similar to eBay and Etsy.

Margin Optimization

Higher ad revenue improves margins annually.

Profitability Path

Rakuten Marketplace remains solidly profitable, unlike Rakuten Mobile.

Read More: Best Rakuten Clone Script 2025 | Build an E-Commerce Marketplace

Future Revenue Opportunities & Innovations

New Streams

AI-powered merchant automation, BNPL integrations, subscription commerce.

AI/ML Monetization

Predictive ads, smart pricing, real-time product discovery improvements.

Market Expansion

Southeast Asia cross-border commerce and luxury segments.

Predictions 2025–2027

- Ad revenue becomes the largest stream

- Points-based incentive innovation

- Deeper fintech–commerce integration

Risks

Amazon Japan, Mercari growth, logistics cost increases.

Opportunities for Founders

Rakuten’s model shows the power of combining loyalty + marketplace + merchant monetization.

Lessons for Entrepreneurs & Your Opportunity

What Works

- Strong merchant community

- Loyalty ecosystem

- Subscription-driven tools

- Multi-revenue-layer strategy

What to Replicate

- Points-based user retention

- Premium merchant packages

- Hybrid monetization structure

Market Gaps

- Hyper-niche vertical markets

- AI-native commerce

- SME-focused analytics

Improvements Founders Can Use

- Integrate loyalty rewards

- Add AI product discovery

- Build merchant growth tools

Want to build a platform with Rakuten’s proven revenue model? Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization systems. Our Rakuten clone scripts come with flexible revenue models you can customize. Some clients see revenue within 30 days of launch. we may arrange and deliver it in 30–90 days.

If you want advanced language-level scripts or enhanced versions, Miracuves provides those too.

Final Thought

Rakuten proves that a marketplace can grow faster when loyalty, merchant tools, and advertising fuel its revenue ecosystem. Its differentiated approach makes it more stable than traditional commission-only platforms.

Founders can learn that building long-term buyer incentives creates compounding revenue benefits. Merchants spend more, buyers return more often, and the marketplace thrives.

With modern technology and rapid deployment tools from Miracuves, replicating Rakuten’s success is more achievable than ever.

FAQs

1. How much does Rakuten make per transaction?

Typically 4–15% depending on category.

2. What’s the most profitable revenue stream for Rakuten?

Advertising and merchant subscriptions.

3. How does Rakuten’s pricing compare to competitors?

Lower than Amazon Japan, similar or slightly higher than Yahoo Shopping.

4. What percentage does Rakuten take from merchants?

4–15% commission plus optional ad spend.

5. How has Rakuten’s revenue model evolved?

From pure e-commerce to loyalty-driven monetization with heavy ad layers.

6. Can small platforms use similar models?

Yes, loyalty + marketplace is extremely effective.

7. What’s the minimum scale for profitability?

Typically, marketplaces become sustainable around $5–8M annual GMV.

8. How to implement similar monetization?

Add commissions, ads, subscriptions, loyalty, and merchant tools.

9. What are alternatives to Rakuten’s model?

Zero-commission loyalty models, pure-subscription marketplaces.

10. How quickly can similar platforms monetize?

Many monetize instantly if commission and ad modules are integrated.