Remitano-style peer-to-peer (P2P) crypto exchanges are expected to generate over $1.8 billion in 2025, driven by rising demand for secure, user-led digital trading across emerging markets. Unlike centralized exchanges, P2P platforms don’t rely on order books or liquidity pools — instead, they connect real buyers and sellers directly, making transaction speed, trust and transparency the core business drivers.

Why it matters:

This model is ideal for entrepreneurs because it doesn’t require massive liquidity or heavy infrastructure. With the right escrow mechanism, KYC management, and mobile-first trading flow, even regional startups can launch P2P exchanges that turn profitable fast. Users prefer platforms that allow own-payment methods, local currency supports, lower fees, chat-based negotiation, and instant settlements — which is exactly why Remitano-like exchanges are on the rise.

In 2025, the biggest opportunity lies in niche, localized, and specialized P2P exchanges —Remitano rather than competing with Binance or Coinbase. A well-positioned exchange with just 50K active users can achieve sustainable revenue if the model is built correctly. That’s what this revenue breakdown reveals — how to launch a P2P exchange that monetizes from day one.

Remitano Revenue Overview – The Big Picture

• Global revenue (2025 estimate): $1.8B+

• Active users: 5M+

• Year-over-year growth: 21%

• Dominant regions: Southeast Asia, Nigeria, India

• Profit margins: 30%–55% depending on fee structure

• Top competitors: Paxful, LocalBitcoins, Binance P2P

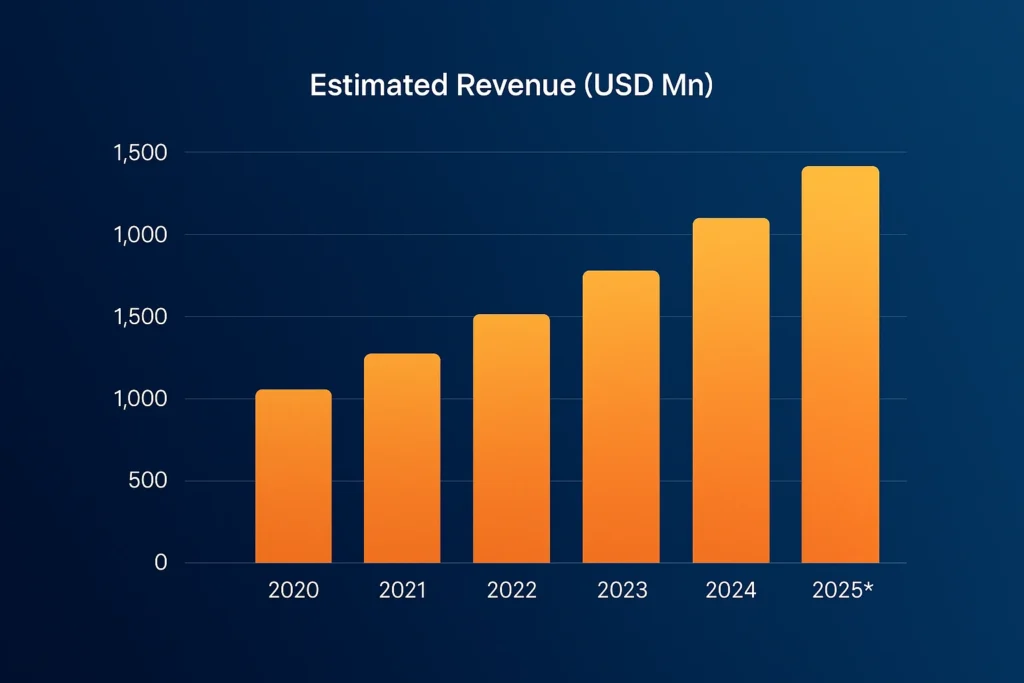

| Year | Estimated Revenue (USD Mn) |

|---|---|

| 2020 | 520 |

| 2021 | 780 |

| 2022 | 1,050 |

| 2023 | 1,250 |

| 2024 | 1,470 |

| 2025* | 1,800+ |

Primary Revenue Streams Deep Dive

1. Trading Commission (45% share)

Charge 0.5%–1% per trade. Remitano generates over $2M per month just from trading commissions.

2. Ads & Featured Listings (10%–18%)

Token projects pay for visibility and top position on trade screens.

3. Escrow Service Fees (15%–20%)

Users pay a fee for secure fund holding during P2P trades.

4. Withdrawal Fees (10%–12%)

Applies to both fiat and crypto withdrawals with fixed/dynamic structures.

5. Premium Services (5%–10%)

KYC priority, instant swaps, trading insights, API-based trading tools.

| Revenue Source | Share (%) | Avg 2025 Revenue |

|---|---|---|

| Trading Fees | 40–45% | $800M+ |

| Escrow Fees | 15–20% | $350M+ |

| Ads & Listings | 10–18% | $250M+ |

| Withdrawal Fees | 10–12% | $200M+ |

| Premium Tools | 5–10% | $150M+ |

The Fee Structure Explained

| User Type | Fee Type | Typical Rate |

|---|---|---|

| Trader | Trade commission | 0.5% – 1% |

| Seller | Escrow fee | % of transaction |

| Token Provider | Listing fee | Up to $100K/project |

| VIP User | Premium subscription | $15 – $150 monthly |

| API Trader | API access | $500+ monthly |

Hidden Revenue Layers:

• Maker/taker fee difference

• Conversion spread

• Referral profit-sharing

• Regional KYC fast-track fee

• Auto-transaction fee during peak times

How Remitano Maximizes Revenue Per User

• Tier-based fees

• VIP verification programs

• Trade limits based on KYC level

• Mobile-first trading optimization

• Regionalized offers (e.g., festival bonuses in Asia)

• Subscription trading bots

• Higher limits for premium users

• Referral-based fee deduction programs

• LTV-focused retention programs

Real example: Paxful increased LTV per user to $1,900+ using VIP & referral monetization layers.

Cost Structure & Profit Margins

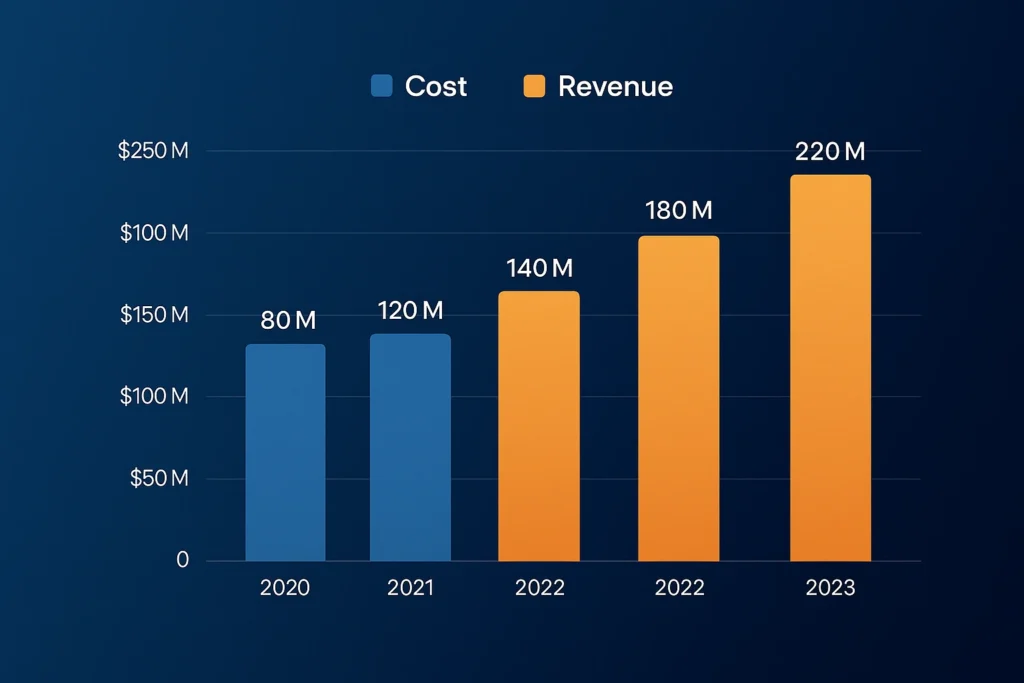

| Cost Type | Avg Share of Revenue |

|---|---|

| Tech Infrastructure | 22% |

| Customer Acquisition | 25% |

| Legal & Compliance | 20% |

| Staff & Operations | 15% |

| R&D | 8% |

| Other | 10% |

Unit Economics & Profitability Path

• Target profitability threshold: 100K+ active users

• Cloud-native structure improves margin by 20%

• KYC automation reduces staffing cost significantly

Read More: Best Remitano Clone Scripts in 2025 | P2P Crypto Exchange Guide

Future Revenue Opportunities & Innovations

• AI-based trading bots for P2P

• Liquidity pool staking

• Cross-chain swaps

• Sector-wise micro-exchanges (e.g., gaming & AI coins)

• Mobile-first lightweight P2P models

• Africa & LATAM-focused localized platforms

• P2P lending services via escrow

2025–2027 forecast:

• Emerging markets to drive adoption

• Revenue expected to touch $2.5B+

• Gov-regulated KYC-backed P2P exchanges will dominate

Lessons for Entrepreneurs & Your Opportunity

What works: Fast onboarding + trust-based escrow trading

What to copy: Multi-fee layers + referral systems

What to improve: UX, lower fees, local payment methods

Gap in the market: Niche P2P trading for industry-based tokens

Want to build a platform with Remitano’s proven P2P revenue model?Miracuves helps entrepreneurs launch revenue-generating platforms with built-in monetization features. Our Remitano Clone Script comes with flexible revenue models you can customize. In fact, some clients see revenue within 30 days of launch, and Miracuves delivers ready-to-launch solutions in 3–6 days guaranteed. Get a free consultation to map out your revenue strategy — and if you want it in advanced language script, Miracuves will provide that also.

Final Thought

P2P exchanges win not by scale, but by trust, speed, and smart monetization. That’s why Remitano-style platforms are becoming the preferred gateway to crypto for millions of first-time users across Asia, Africa, and LATAM. The opportunity is no longer limited to dominant players — niche, localized, and purpose-built P2P exchanges are positioned to grow fastest in 2025.

The key is building a platform that is secure, flexible, compliant, and revenue-ready from day one. With the right tech stack and escrow-based architecture, even a small-scale exchange can scale quickly — especially with strong retention hooks, referral models, and tier-based fee structures.

This is exactly where Miracuves helps entrepreneurs win.

Miracuves doesn’t just develop apps — we create P2P exchange systems built to earn, with embedded monetization, multi-layer fee structures, KYC automation, liquidity logic, and scalable architecture. Our Remitano Clone Script gives you a ready-to-launch platform in just 3–6 days, so you can enter the market early and move ahead of bigger competitors.

FAQs

How much does Remitano earn per trade?

Between 0.5% and 1% depending on region and user tier.

What’s the most profitable revenue stream?

Trading fees and escrow-based service charges.

How does Remitano’s pricing compare to competitors?

Low-fee exchanges focus on attracting mass users, while premium platforms charge more for advanced tools and analytics. With Miracuves, you still get premium features at an accessible starting price of $2,899.

What percentage does Remitano take from providers?

Listing fees can reach $100K per campaign.

How has its revenue model evolved?

It moved from basic fees to layered subscription & referral models.

Can small platforms use this revenue model?

Yes — regional P2P exchanges can operate lean and still be profitable.

What’s the minimum scale for profitability?

Around 100K active users with daily trade volume.

How to implement similar revenue streams?

Start with escrow + trading fees and later introduce premium plans.

What’s an alternative to this model?

Subscription-based trading tools and AI-based signal marketplaces.

How fast can a P2P exchange monetize?

With Miracuves clone scripts, revenue can start within 30 days, backed by our 3–6 days guaranteed delivery for full launch readiness.