Ever felt like you’re the last one to hear about a new crypto project that just “mooned”? Yeah, same. But here’s the thing — while most of us are chasing the next 100x token, smart entrepreneurs are building the decentralized crypto launchpads that birth these tokens. And they’re not just launching tokens — they’re printing serious revenue.

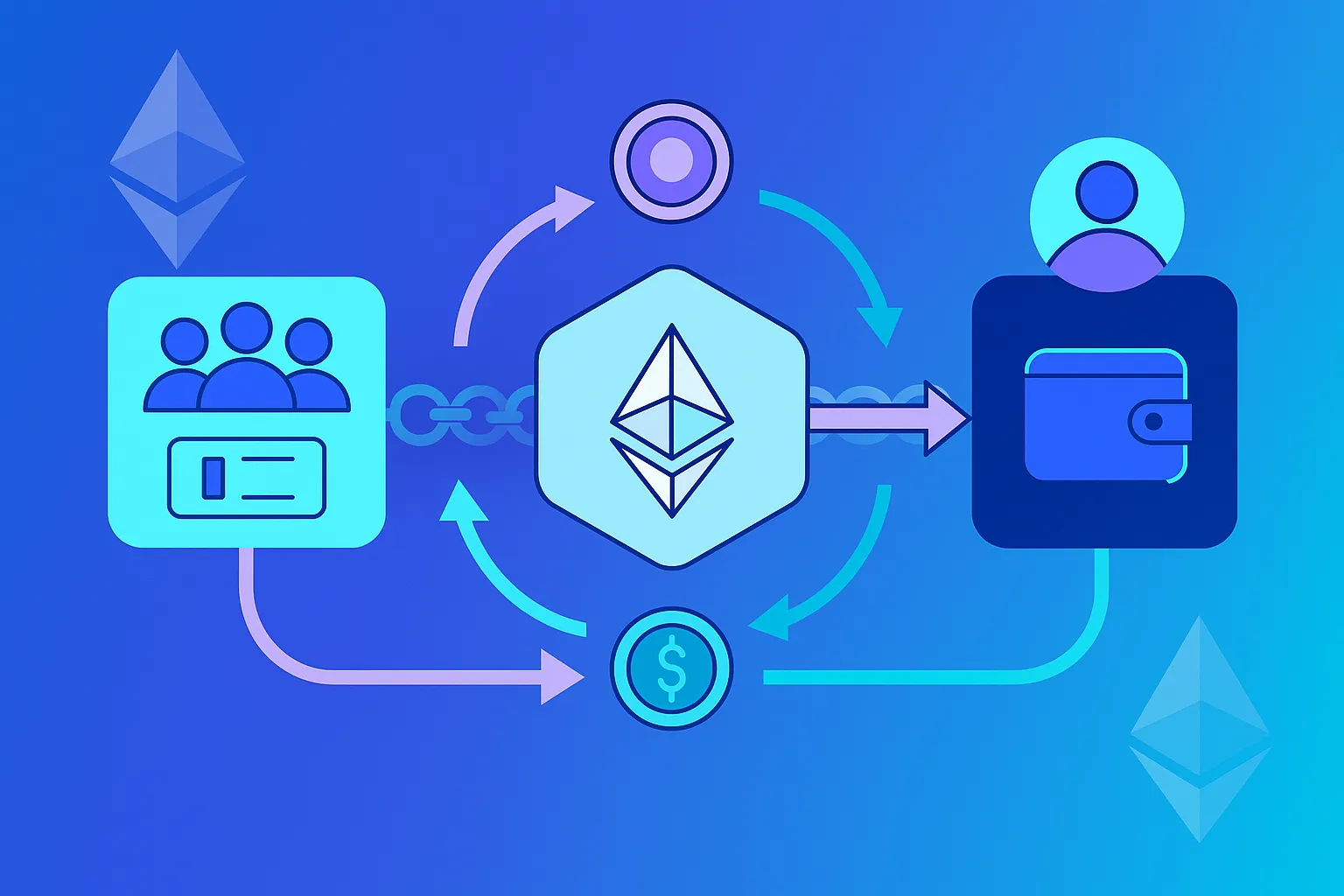

Picture this: a creator in Lisbon or a startup in Bangalore wants to launch their crypto project. But they don’t have the tech muscle or liquidity to pull off a successful IDO. Enter — decentralized launchpads, the matchmakers of the Web3 world. They connect hungry projects with eager investors. It’s like Kickstarter met Ethereum… and had a baby on the blockchain .And if you’re wondering “How do these platforms actually make money?” — you’re in for a wild ride. Let’s peel back the curtain and explore the juicy revenue streams behind decentralized crypto launchpad apps. And hey, if you’re dreaming about launching your own, Miracuves can help make that dream App-ready. Let’s dive in.

What Is a Decentralized Crypto Launchpad ?

Before we talk dollars and tokens, let’s break it down.

A decentralized crypto launchpad is a platform that helps blockchain-based projects raise capital via token launches (IDOs, IGOs, IEOs). But unlike centralized exchanges, there’s no gatekeeping. These platforms run on smart contracts — which means no CEOs, no middlemen, just code and community.

Some heavy-hitters in this space include:

- Polkastarter

- TrustSwap

- DAO Maker

- BSCPad

They cater to DeFi, NFTs, GameFi, and more. Launchpads help in vetting projects, whitelisting users, and automating token distribution. And yes — they’re doing it with a pretty lean team. Now that’s what we call smart leverage.

Revenue Streams: How Launchpads Rake in Crypto & Fiat

1. Token Sale Commissions

This is the bread and butter. Most launchpads take a percentage cut from every successful token launch — typically 5–10% of the total raise, either in project tokens, stablecoins, or native platform tokens.

Real-world Example: Polkastarter charges both fixed fees and token commissions. In booming markets, a single launch can generate six figures.

2. Staking & Tiered Access Models

To participate in token sales, users often have to stake the launchpad’s native token. Decentralized Crypto Launchpad The more you stake, the higher your allocation.

- Staking = Lock-in liquidity

- Tiered system = Gamifies loyalty

Launchpads earn through: - Staking fees

- Token appreciation

- Penalty fees for early unstaking

3. Subscription & Whitelisting Fees

Some platforms offer guaranteed access to IDOs for a monthly fee. Decentralized Crypto Launchpad Others charge projects for priority listings or exposure.

- Whitelisting fee for users: Priority allocation

- Listing fee for projects: Marketing boost, credibility

Think of it like the VIP fast-pass at Disneyland — only this one gets you early access to GameFi unicorns.

4. Yield Farming Integration

Many launchpads double as DeFi protocols, offering farming opportunities post-IDO. They take a slice of the farming pool, platform fees, or liquidity mining rewards.

For instance:

- Launchpad partners with a DEX (like PancakeSwap)

- Users add liquidity to project-token pools

Launchpad earns from LP tokens or protocol fees

5. Token Appreciation (HODL Strategy)

When launchpads accept project tokens as payment — and those tokens go up — it’s pure passive gain. This is a “venture capital with benefits” model.

Also, if the platform has its own token (and most do), they benefit when:

- Demand for IDOs increases

- Users buy & stake more tokens

- Token price rises

In bull markets, this revenue source can eclipse all others.

6. Governance & DAO Participation

Decentralized doesn’t mean directionless.

Projects often incentivize DAOs to vote on launches or ecosystem grants. Launchpads that participate in multiple ecosystems can earn from governance tokens, DAO rewards, or staking-as-a-service offerings.

Read more : Business Model of MEXC : Crypto Platform Earns Revenue

Market Trends Fueling These Revenue Models

- Surge in Web3 projects: Over 2,000 new tokens launched .

- Growing retail interest in early-stage investing

- Shift from centralized exchanges to DeFi rails

- Increased mobile access to launchpads via dApps

And here’s the kicker: most of these platforms are monetizing with fewer than 10 full-time employees. Decentralized Crypto Launchpad Now that’s operational efficiency.

Read more : Revenue Model For Decentralized Crypto Launchpad

Monetization-Ready From Day 1 (With Miracuves)

Let’s face it: building a launchpad from scratch is tough. You need:

- Smart contract devs

- Wallet integrations

- KYC/AML compliance layers

- Tokenomics modeling

- Frontend + backend + dashboards

That’s where Miracuves comes in. We build high-performance launchpad clone apps — fast, secure, scalable, and yes, monetization-ready out of the box.

Conclusion

Crypto launchpads are quietly making bank — not just through token launches, but by stacking multiple streams of on-chain revenue. From staking tiers to farming fees, it’s a buffet of monetization opportunities.

And the best part? You don’t need to reinvent the wheel. With the right tech stack (and the right dev team), you can launch your own crypto launchpad and tap into the next Web3 gold rush.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

How do launchpads make money if the token fails?

Most charge upfront fees in stablecoins or take tokens during the raise, minimizing post-launch risk.

Is staking mandatory for users?

Usually yes — staking determines your tier and access level for token sales.

Can a launchpad earn passively?

Yes! Through farming, token appreciation, and auto-staking mechanisms.

What’s the average commission a launchpad charges per project?

Typically between 5–10% of the raised amount, plus token allocations.

Do all launchpads need a native token?

Not always, but it helps with community building, staking incentives, and internal economics.

Is it safe to invest in IDOs via launchpads?

There’s always risk. Top-tier launchpads conduct project audits and community votes, but DYOR (Do Your Own Research) is still key.

Related Article :