Ever had that lightbulb moment while sipping coffee, thinking, “What if there was a better way to swap crypto without getting robbed by exchange fees or caught in red tape?” If yes, congrats—you’re already halfway into the wild world of P2P cryptocurrency marketplaces. These aren’t your average trading platforms. They’re more like crypto farmers markets: no middlemen, just people dealing directly with each other, swapping Bitcoin for USDT, or maybe even Dogecoin for a pizza (again). If you’re ready to launch a P2P crypto exchange, understanding how these platforms make money is your next step.

Now, before you go slapping a domain on a fancy idea and pitching to angel investors, let’s get real: how does a P2P crypto marketplace actually make money? It’s not enough to be cool; it has to be cash-flow positive. Your platform can’t run on vibes alone. It needs structure, strategy, and sustainable streams of income.

And that’s where Miracuves steps in. As a top-tier app clone development partner, we’ve built scalable crypto exchange clones and fintech platforms that are user-obsessed and revenue-smart. So, ready to monetize your crypto matchmaking idea? In this guide on Revenue Models for P2P Cryptocurrency Marketplace, let’s dig in and explore how to turn your platform into a profitable venture.

What Is a P2P Cryptocurrency Marketplace, Really?

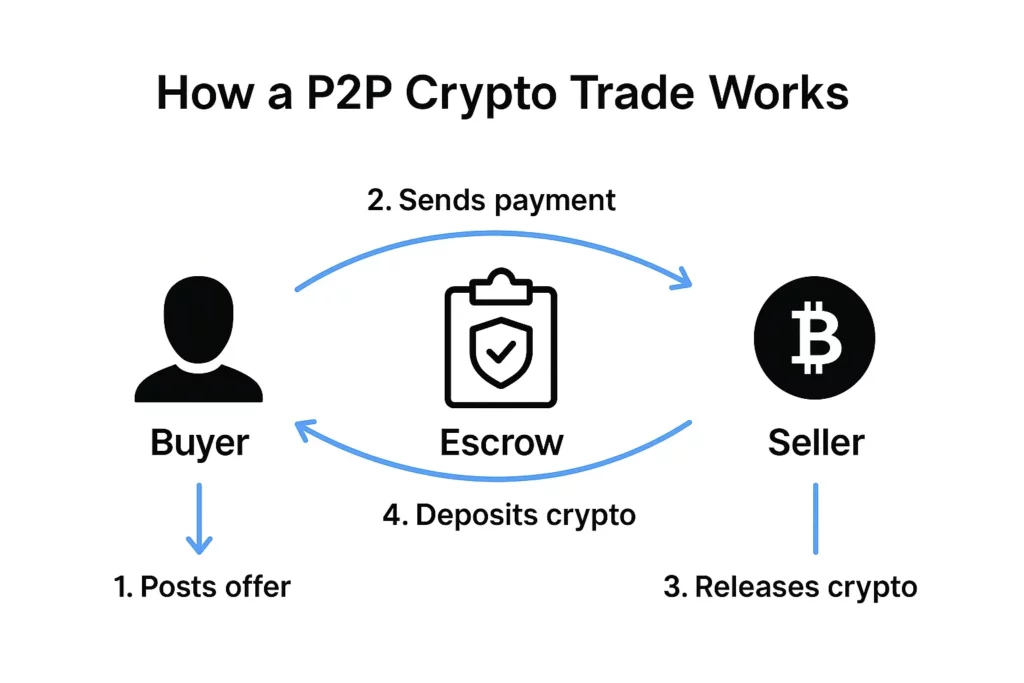

Think of it like Craigslist for crypto. Instead of buying Bitcoin from a centralized exchange (like Binance or Coinbase), users post buy/sell offers and negotiate terms directly. These platforms simply play the role of an escrow and referee.

Examples?

These platforms cater to users in countries with strict banking rules or volatile fiat currencies. They’re smartphone-first, often relying on low-bandwidth networks, and are big in regions like Latin America, Africa, and Southeast Asia.

Read more: How to Develop a P2P Cryptocurrency Marketplace App

Primary Revenue Streams to Bank On

1. Transaction Fees

Ah, the classic. Take a small cut from each successful trade—usually 0.5% to 1%. It’s like charging entry to a party that you didn’t have to stock with snacks.

- Pros: Predictable, scales with volume

- Cons: Low volume = low revenue

Pro tip: Offer tiered fees based on trade size or loyalty programs to keep users coming back.

2. Escrow Premiums

Escrow is the beating heart of any P2P platform. Users trust you to hold their funds until both parties are satisfied.

- Add a micro-fee (say 0.25%) for using escrow

- Upsell faster verification for a higher fee

This turns a trust mechanism into a cash cow.

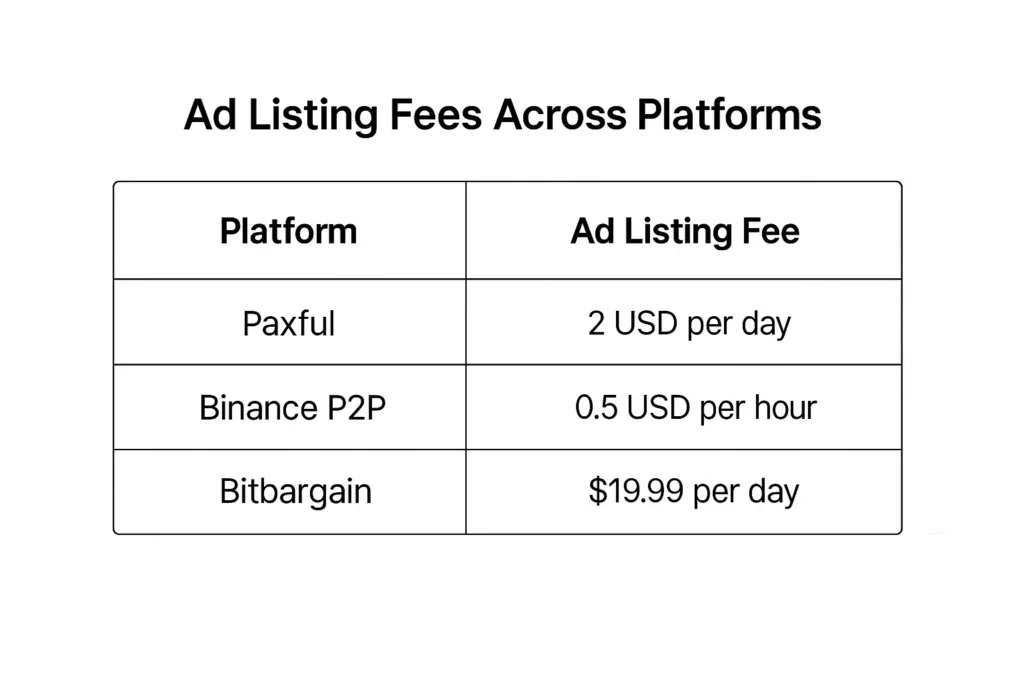

3. Ad Listings and Featured Offers

Give users a chance to promote their listings to the top.

- Sell “premium ad spots” like Google Ads

- Daily or hourly rates

- Push notifications as upsells

4. Currency Conversion Margins

If your platform supports multi-crypto or fiat conversions, mark up the rates slightly.

- Hidden but effective

- Works best with real-time exchange APIs

5. Membership or Subscription Plans

This one’s for your power users—traders who move high volumes or run arbitrage gigs.

- Monthly fees for perks: lower commissions, advanced analytics, priority dispute resolution

Secondary Monetization Tactics

Affiliate Marketing & Referrals

Turn users into marketers:

- Invite friends, earn crypto

- Partner with wallets or DeFi tools for cross-promos

Data Analytics as a Service

Offer anonymized trading data to researchers or hedge funds.

- Purely optional, requires clear opt-in

- Think “Google Trends” but for crypto

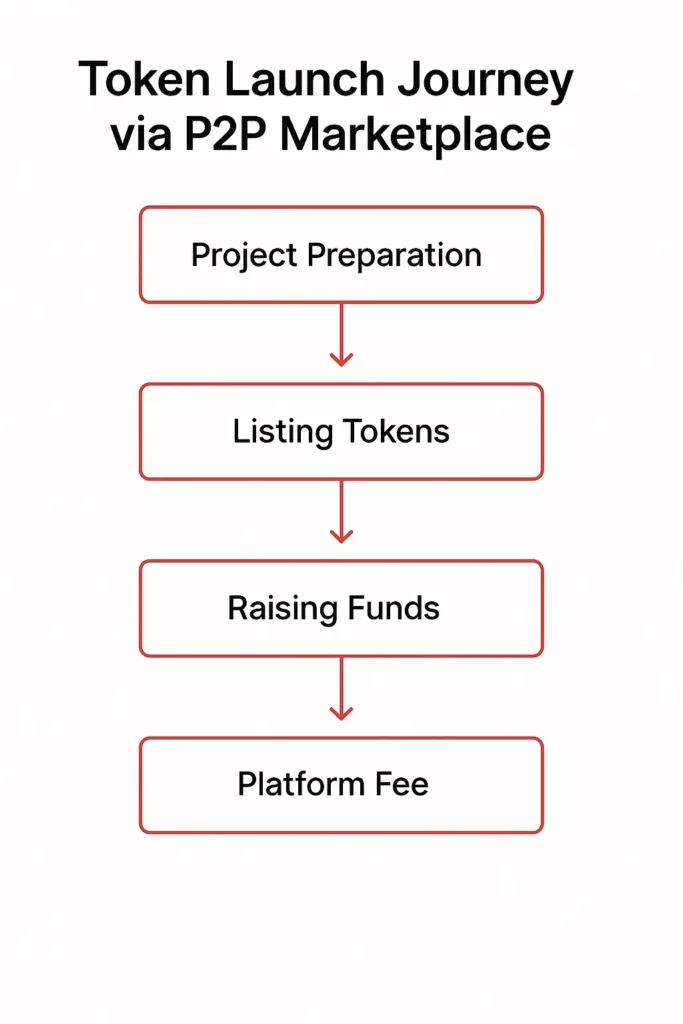

Token Launchpad Services

Got liquidity? Help new projects list tokens or raise funds via your platform. Take a slice of the pie.

Read more: How Much Does It Cost to Build a Peer-to-Peer Cryptocurrency Marketplace in 2025

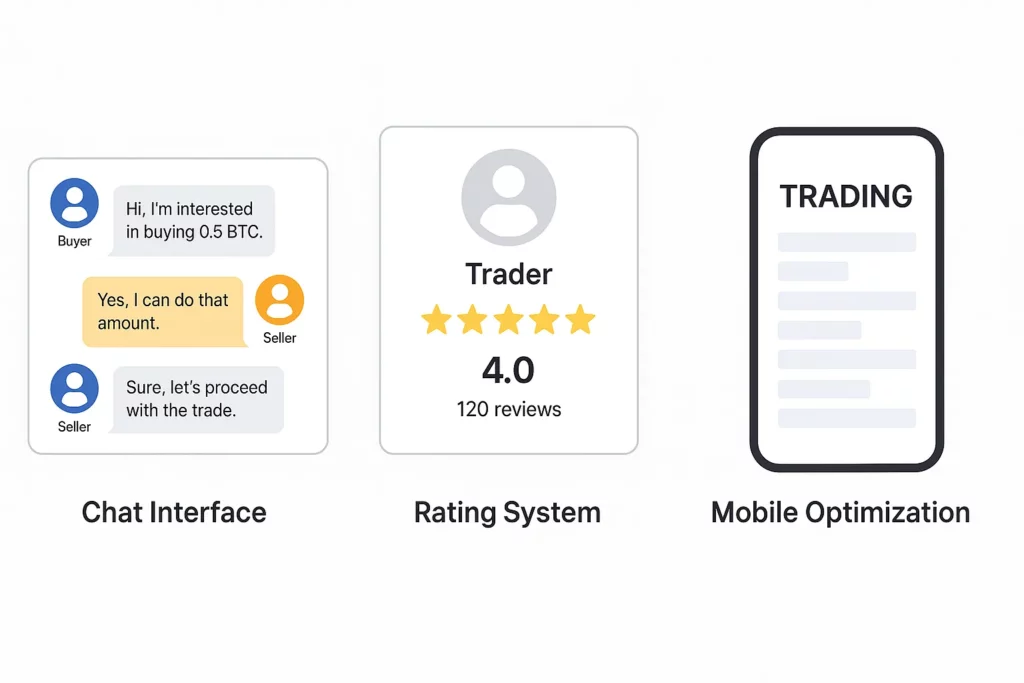

Key UX Features That Drive Retention (and Revenue)

- Trust Scores: Build credibility with trader ratings

- Chat & Negotiation Tools: Make it human

- Dispute Resolution: Quick and transparent

- Mobile Optimization: Must work seamlessly on smartphones

- Multi-language Support: Crypto is global, your UX should be too

Read more: Cost vs Features: Striking the Right Balance in P2P Crypto App Development

Conclusion

A P2P crypto marketplace isn’t just about slapping up a platform and hoping for magic—it’s about designing a system rooted in trust, transparency, and usability. Traders need more than just a place to transact; they need secure tools, reliable dispute management, smooth UX, and incentives that keep them coming back. By implementing the right revenue strategies, from transaction fees to value-added services, you can build a platform that’s not only lean and profitable but also scalable and globally competitive in the ever-evolving crypto landscape.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

Q1: What makes a P2P marketplace different from a traditional crypto exchange?

Traditional exchanges hold your funds and act as the trading party. P2P platforms connect traders directly and just provide the infrastructure.

Q2: Can a small startup compete with big names like Binance P2P?

Absolutely—niche targeting, lower fees, and unique features can carve out space for newcomers.

Q3: How do I ensure safety on my platform?

Use multi-sig wallets, KYC protocols, and a robust dispute resolution system.

Q4: What crypto should my platform support?

Start with the basics: BTC, ETH, USDT. Then expand based on demand and regional preferences.

Q5: Do I need to build from scratch?

Not at all. At Miracuves, we offer crypto exchange clone scripts that cut dev time and cost.

Q6: How do I attract users initially?

Referral bonuses, lower fees, regional partnerships, and killer UI can get the ball rolling.

Realted Articles: