So, you’ve got this idea for a decentralized crypto exchange — no middlemen, no gatekeepers, just pure peer-to-peer trading power. It’s the kind of vision that makes every crypto-native’s eyes light up. But then comes the real question — how the heck do you make money with it?

Let’s be real. It’s easy to get swept up in the Web3 hype, the promise of “financial freedom,” and Discord-fueled launches. But if your DEX (Decentralized Exchange) isn’t monetized smartly, it might just end up another ghost chain in the graveyard of broken tokenomics.

This blog is your go-to playbook — breaking down revenue models that actually work for decentralized crypto exchanges. Whether you’re building the next Uniswap clone or pioneering a DeFi-first marketplace, Miracuves is here to help you build fast, build secure, and yep — build monetizable.

Why Monetizing a DEX Is a Different Beast

Traditional exchanges like Coinbase or Binance rake in billions — but they do it through centralized control. DEXes? They’re the rebels. No signups, no central custody, just wallet-to-wallet wizardry. So how do you generate revenue without turning into the thing you’re trying to replace?

The answer lies in smart contracts, protocol-level fees, and tokenomics that aren’t just pretty whitepaper fluff. You need models that align with decentralization and sustain developer efforts, liquidity incentives, and platform security.

Proven Revenue Models for Decentralized Crypto Exchanges

1. Swap Fees (a.k.a. Trading Fees)

This is the OG revenue model in DeFi. Every time a user swaps one token for another, the protocol takes a tiny cut — typically 0.2% to 0.3%. That adds up real fast with high trading volume.

The twist? You can split this fee between:

- Liquidity providers (LPs)

- Token holders (via staking)

- Treasury or dev fund (you)

Example: Uniswap charges 0.3% per swap — 100% goes to LPs. SushiSwap splits it with stakers.

Also Read :-How to Market a Decentralized crypto exchange App Successfully After Launch

2. Yield Farming and Liquidity Mining

If you want users to lock up tokens and provide liquidity, you better give them a reason. That’s where farming comes in. You reward them with native tokens (your $DEXCOIN or whatever catchy ticker you’ve got in mind).

Then you:

- Allocate a portion of tokens as incentives

- Build in vesting or burn mechanics

- Offer bonus rewards for early adopters

But beware of inflationary death spirals — design tokenomics with care.

Learn More :-Business Models That Power Decentralized Crypto Exchanges (DEXs)

3. Protocol-Owned Liquidity (POL)

Instead of relying on users to bring liquidity, you own it. The protocol provides the trading pairs and keeps 100% of the fees.

How? Via mechanisms like:

- Bonding (Olympus DAO style)

- Token swaps with LP tokens

- Strategic acquisitions of LP positions

It’s DeFi vertical integration at its finest.

4. Staking & Validator Commissions

If your DEX runs on a proof-of-stake chain (or you spin up your own sidechain), you can charge commission on staking rewards.

Think of it like taking a tiny tip from validators or delegators for helping secure the network.

5. Launchpad / IDO Fees

Initial DEX Offerings (IDOs) are the new crypto Kickstarter. You host token launches and charge a listing or success fee. Plus, you can:

- Require LP lockups

- Take allocation in the launched token

- Upsell marketing services (DeFi influencers are their own breed!)

Example: PancakeSwap Launchpad

6. Bridge Fees & Cross-Chain Swaps

Multi-chain is the name of the game. If your exchange supports swaps across Ethereum, BNB Chain, Solana, etc., you can charge bridge fees for:

- Token wrapping

- Liquidity transfer

- Gas optimizations

Example: Multichain, Wormhole

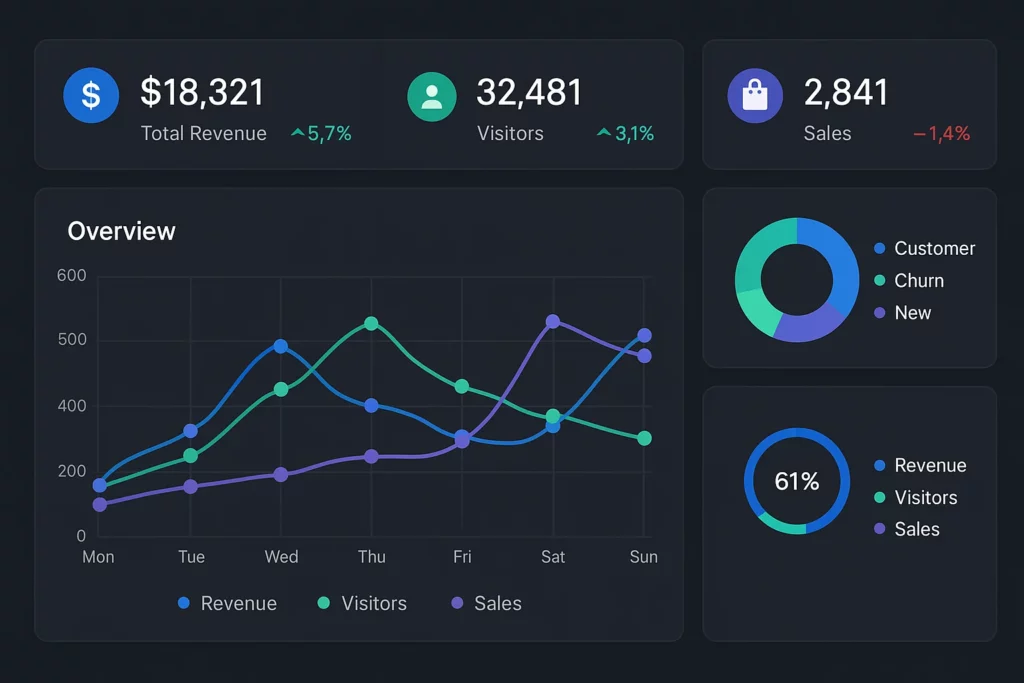

7. Premium Analytics & Pro Tools

DeFi whales love data. Give them insights like:

- Token volatility

- Historical APYs

- Whale activity

- Front-running protection tools

Offer these as paid features or unlockables via staking.

8. NFT Marketplace Integration

Okay, hear us out — NFTs aren’t dead, they’re just… chilling. If your DEX expands into NFT trading, you unlock:

- Creator royalties

- Listing fees

- Marketplace commissions

Bonus: NFTs can double as loyalty passes or governance tokens. Who said JPEGs can’t pull double duty?

Hybrid Tokenomics = Revenue Rocket Fuel

Want the big brains play? Combine 3 or 4 of these into a hybrid model.

Example:

- Take swap fees

- Distribute to stakers

- Boost rewards for governance voters

- Use POL to stabilize liquidity

This creates a flywheel where users, LPs, and devs all win — sustainably.

Build a Monetizable DEX with Miracuves

Whether you’re cloning PancakeSwap, launching the next cross-chain wizard, or building your own DeFi empire — you need infrastructure that’s fast, secure, and built to make money. That’s where Miracuves shines.

From smart contract development to UI dashboards, tokenomics to validator setup — we help launch scalable, revenue-ready DEX clones that don’t just work — they win.

Read More :-How to Develop a Decentralized Crypto Exchange App

Conclusion

Monetizing your DEX doesn’t mean betraying decentralization — it means fueling it. With the right revenue models, you can fund devs, reward the community, and grow like crazy.

Keep it transparent, keep it fair — and keep the gas fees low while you’re at it.

At Miracuves, we help innovators launch high-performance app clones that are fast, scalable, and monetization-ready. Ready to turn your idea into reality? Let’s build together.

FAQs

What’s the safest revenue model for a new DEX?

Swap fees and staking rewards are safe bets — they’re familiar to users and easy to implement.

Can I monetize without launching a token?

Yes — through bridge fees, analytics, IDO launchpads, and pro features. But tokens do open more doors.

Are DEX revenues taxable?

Generally yes. It depends on jurisdiction and whether you’re a DAO, company, or individual. Always consult a crypto-savvy CPA.

How do I avoid token inflation killing my revenue?

Cap supply, design halving events, and incentivize token burning to stabilize your economy.

How do I fund development before revenue kicks in?

Raise via private token sales, angel rounds, or grants. Lean MVPs with low gas fees help too.

Can I clone a DEX legally?

Yes, open-source protocols like Uniswap are free to fork. Just be sure to modify, rebrand, and comply with local laws.